Category: Cryptocurrency - Page 3

BITEXBOOK Crypto Exchange Review: Is It Safe to Trade Here in 2026?

BITEXBOOK crypto exchange shows critical security flaws, zero trustworthy reviews, and no regulatory oversight. Avoid this platform in 2026-your funds are at serious risk.

View MoreAmpleSwap Crypto Exchange Review: Is This DEX Still Active in 2026?

AmpleSwap was once promoted as a top BSC DEX, but in 2026, it has zero trading volume, no user reviews, and no active development. This review shows why you should avoid it and where to trade safely instead.

View MoreSTEX Crypto Exchange Review: Fees, Altcoins, and Security in 2026

STEX is a regulated crypto exchange with 500+ altcoins, 0.10% trading fees, and strong security. Ideal for experienced traders seeking obscure tokens, but not for beginners or those needing fast support.

View MoreHow Blockchain Tracks Charity Funds with Total Transparency

Blockchain lets you track every dollar you donate to charity in real time - from your wallet to the final impact. See how smart contracts, public ledgers, and verified receipts are transforming philanthropy with unmatched transparency.

View MorePhilippines Crypto Exchange Blacklist by SEC: What You Need to Know in 2026

The Philippines SEC blacklisted 15 major crypto exchanges in 2025 for operating without licenses. Learn which platforms are banned, why the crackdown happened, and what legal options Filipinos have now.

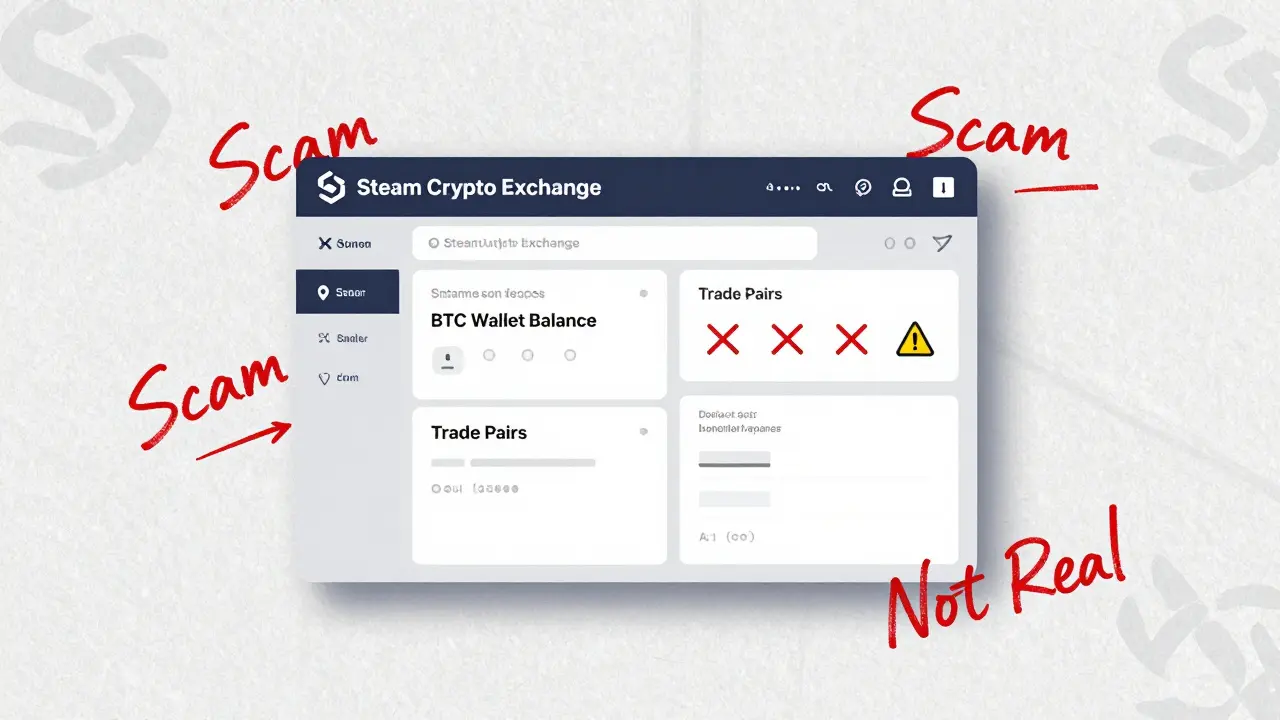

View MoreSteamm Crypto Exchange Review: Why It Doesn't Exist and What You Should Know

There is no Steam crypto exchange. Steam briefly accepted Bitcoin payments in 2016-2017 but never offered trading or storage. Today, all claims of a Steam crypto platform are scams. Learn the truth and how to safely buy Steam games with crypto.

View MoreWhat Is Market Cap in Cryptocurrency? A Simple Guide to Understanding Crypto Value

Market cap in cryptocurrency is the total value of all coins in circulation, calculated by multiplying price by circulating supply. It's the best way to compare crypto projects, not price per coin.

View MoreWhat is NORMIE (NORMIE) crypto coin? The truth about this meme token

NORMIE is a meme crypto coin with no real value, low liquidity, and no utility. Despite marketing claims, it's a high-risk token with minimal trading volume and no future. Don't invest - it's entertainment only.

View MoreCoinsBank Crypto Exchange Review: High Fees, Poor Support, and Withdrawal Woes

CoinsBank crypto exchange has high fees, poor support, and widespread reports of locked funds and account deletions. With a 1.3/5 Trustpilot rating and no reliable customer service, it's not safe to use.

View MoreChainGPT x CoinMarketCap Airdrop: How to Qualify for the $50,000 CGPT Token Giveaway

ChainGPT's $50,000 airdrop with CoinMarketCap in 2023 offered up to 10,000 participants free CGPT tokens. Learn how it worked, who won, and why most airdrops fail to create long-term users.

View MoreEvolution of P2P Technology in Blockchain: From Napster to Decentralized Trust

P2P technology in blockchain evolved from file-sharing networks into a trustless system for global transactions. Bitcoin’s decentralized ledger changed everything-no banks, no intermediaries, just code and consensus.

View MoreACMD X CMC Airdrop by Archimedes: How It Worked and What Happened After

The ACMD X CMC airdrop by Archimedes Protocol offered $20,000 in tokens in 2024, but now ACMD trades at $0 on major sites despite fake $309 prices elsewhere. Here's what happened after the launch.

View More