Before Bitcoin, peer-to-peer (P2P) meant sharing music files. Napster let you grab songs from strangers’ hard drives, but it crashed when the law came knocking-because it still needed a central server to find who had what. That was the problem: P2P technology wasn’t truly decentralized. It looked like it, but it wasn’t. Blockchain changed all that.

The First Real Decentralized Network

The real breakthrough didn’t come from a startup or a tech giant. It came from a person-or group-named Satoshi Nakamoto. In 2008, they published a paper that solved a problem computer scientists had struggled with for decades: how do you get a group of strangers to agree on something without a middleman? This is called the Byzantine Generals Problem. Bitcoin’s answer? A blockchain built on P2P architecture. No central authority. No bank. No PayPal. Just a network of computers, each holding a copy of the same ledger. Every transaction is checked by multiple nodes, signed with cryptography, and added to a chain of blocks. The first block, mined on January 3, 2009, contained a message referencing a headline from The Times: "Chancellor on brink of second bailout for banks." It was a quiet protest-and the start of something massive.How P2P Changed from File Sharing to Financial Infrastructure

Early P2P systems like BitTorrent were smarter than Napster. They broke files into pieces and distributed them across thousands of machines. But they still relied on trackers or seeders to coordinate. If the tracker went down, the system slowed or broke. Blockchain P2P networks are different. They don’t need trackers. Every node is equal. If one goes offline, the rest keep running. Bitcoin’s network has over 15,000 public nodes as of 2023. These aren’t servers in data centers-they’re laptops, Raspberry Pis, and dedicated rigs run by individuals from Reykjavik to Rio. That’s resilience. The magic isn’t just in the structure. It’s in the rules. Bitcoin uses proof-of-work to validate blocks. Miners compete to solve a cryptographic puzzle. The first to solve it gets to add the next block and earns new bitcoins. Other nodes verify the solution instantly. It’s not fast, but it’s trustless. You don’t need to know who the miner is. You just need to know the math checks out.Storage, Speed, and the Hidden Costs

Running a full Bitcoin node isn’t easy. You need at least 500GB of SSD storage, 2GB of RAM, and a stable internet connection. The blockchain itself is over 700GB as of early 2026. Syncing it for the first time takes two to three days. Most people don’t run full nodes-they use lightweight wallets that trust third parties. That’s a trade-off. Speed is another issue. Bitcoin handles about 7 transactions per second. Visa does 24,000. For everyday payments, that’s not enough. That’s why the Lightning Network was created. It’s a second-layer solution that lets users open payment channels off-chain. Transactions happen instantly, and only the final balance gets settled on the main blockchain. It’s like using a debit card instead of writing a check every time you buy coffee. Then there’s energy. Bitcoin mining used to consume more electricity than Norway. In 2022, it hit 121 terawatt-hours annually. That sparked global criticism. Ethereum’s shift to proof-of-stake in September 2022 cut its energy use by 99.95%. Now, instead of miners solving puzzles, validators lock up ETH as collateral. If they cheat, they lose it. It’s faster, cheaper, and greener. Other chains followed.

Where It Works-and Where It Doesn’t

Blockchain P2P excels where trust is scarce. Cross-border remittances are a perfect example. Sending $500 from the U.S. to Nigeria used to cost $35 and take three days. Now, with a crypto wallet and a P2P exchange, it takes 15 minutes for $2.50. People in countries with unstable banks or capital controls rely on this daily. Supply chains use it too. Walmart tracks food shipments on blockchain. If a batch of mangoes is contaminated, they can trace it back to the farm in minutes-not weeks. That’s real value. But it fails where speed and low cost matter most. Paying for a $2 coffee with Bitcoin during peak hours? You might pay $5 in fees. That’s why most users don’t transact directly on the main chain. They use exchanges, custodial wallets, or layer-2 solutions. The blockchain is the backbone, not the front door.Upgrades That Changed Everything

Bitcoin didn’t stand still. The Taproot upgrade in November 2021 introduced Schnorr signatures and MAST (Merkelized Abstract Syntax Trees). This made transactions more private and efficient. Fees dropped by 2.7% on average. More importantly, it paved the way for smart contracts on Bitcoin-something many thought impossible. Ethereum’s Shanghai upgrade in March 2023 let users withdraw their staked ETH for the first time. That unlocked billions in locked capital and boosted participation in proof-of-stake networks. Now, over 40% of all ETH is staked. That’s not just a technical upgrade-it’s a shift in economic incentives.

Regulation, Adoption, and the Real Users

Governments are no longer ignoring blockchain. The EU’s MiCA regulation, effective in 2024, requires companies offering P2P crypto services to register, disclose risks, and protect user funds. Nigeria’s eNaira processes over a million P2P transactions monthly. El Salvador made Bitcoin legal tender. China is testing digital yuan on P2P networks. But adoption isn’t uniform. A 2023 CryptoCompare survey found 68% of active users are male, with a median age of 34. Most have a bachelor’s degree or higher. That’s not a coincidence. Understanding private keys, gas fees, and wallet security requires learning. Chainalysis reports 20% of cryptocurrency losses come from lost or mismanaged keys. That’s not a bug-it’s a user problem. Reddit users give mixed reviews. One person says they sold their car for Bitcoin and bypassed PayPal’s $3,000 limit. Another paid $50 in fees to send $20. Trustpilot ratings average 3.8/5. The complaints? Delays during congestion and wallet complexity. The praises? No chargebacks and global access.The Future: Interoperability and Beyond

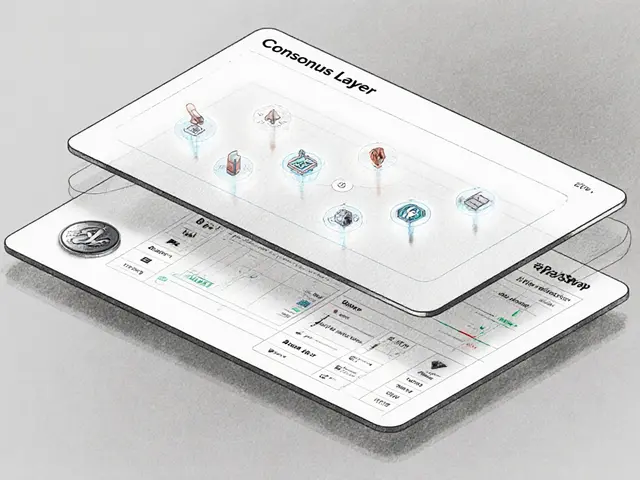

The next frontier isn’t just one blockchain. It’s many blockchains talking to each other. Protocols like Cosmos IBC and Polkadot’s XCM let assets move between chains securely. Imagine sending ETH to a Bitcoin-based DeFi app without a bridge. That’s the goal. Gartner predicts that by 2026, 10% of government interactions will happen via blockchain P2P systems. That’s up from 0.5% in 2023. ARK Invest thinks blockchain could store 10% of global assets by 2030. The Bank for International Settlements warns that scalability and energy remain existential risks. The truth? P2P in blockchain isn’t about replacing banks. It’s about giving people control. It’s about building systems that work when trust breaks down. From a single message in a genesis block to a global network of nodes, it’s the most radical experiment in digital trust since the internet itself.What is the main difference between early P2P networks and blockchain P2P?

Early P2P networks like Napster and BitTorrent relied on central trackers or seeders to coordinate file sharing. If those failed, the system broke. Blockchain P2P has no central point of control. Every node holds a full copy of the ledger and validates transactions independently. If one node goes offline, the network keeps running. That’s true decentralization.

Why does Bitcoin use so much energy?

Bitcoin uses proof-of-work, which requires miners to solve complex math puzzles using powerful computers. The more miners join, the harder the puzzles get to keep block times steady. This competition drives up electricity use. In 2022, Bitcoin’s annual consumption peaked at 121.49 TWh-similar to Norway’s entire national usage. Ethereum switched to proof-of-stake in 2022 and cut energy use by 99.95%, proving it’s not necessary.

Can I run a Bitcoin node on my home computer?

Yes, but it’s not simple. You need at least 500GB of SSD storage, 2GB of RAM, and a reliable internet connection with 50GB monthly upload. The initial sync takes 2-3 days. Most users don’t run full nodes because of the technical load. Lightweight wallets are easier but require trusting third parties. Running a node supports network security and gives you full control over your transactions.

What’s the difference between proof-of-work and proof-of-stake?

Proof-of-work (PoW) requires miners to solve cryptographic puzzles using computational power. The first to solve it adds the block and gets rewarded. It’s secure but energy-heavy. Proof-of-stake (PoS) selects validators based on how much cryptocurrency they lock up (stake). If they act dishonestly, they lose their stake. PoS is faster, cheaper, and uses 99.95% less energy than PoW, as proven by Ethereum’s 2022 upgrade.

Is blockchain P2P technology secure?

The core blockchain protocol is extremely secure-it’s never been hacked. But the surrounding systems have. Wallets get stolen, exchanges get breached, and smart contracts have bugs. The $600 million Poly Network hack in 2021 exploited a flaw in a cross-chain bridge, not the blockchain itself. Security isn’t in the code alone-it’s in how you manage keys, choose platforms, and understand risks.

What are the biggest challenges facing blockchain P2P today?

The top three are scalability, energy use (for PoW chains), and user experience. Bitcoin and Ethereum can’t handle millions of transactions per second like Visa. High fees during congestion make small payments impractical. Wallets are confusing for newcomers. Regulatory uncertainty also holds back mainstream adoption. Solutions like layer-2 networks, sharding, and better UI design are being built-but they’re still works in progress.

Who uses blockchain P2P technology the most?

The biggest users are in emerging markets with unstable banking systems. Nigeria, Vietnam, Argentina, and Kenya see high adoption for remittances and local commerce. In the U.S. and Europe, users are mostly tech-savvy individuals, freelancers, and small businesses avoiding payment processors. Enterprises use it for supply chain tracking and secure record-keeping. The median user is a 34-year-old male with a college degree, but that’s changing fast as tools get simpler.

Andy Simms

20 January, 2026 . 13:01 PM

Early P2P was like borrowing a CD from a friend who lived across town. Blockchain is like every single person in the city having an identical, constantly updated copy of every CD ever made-and no one can delete or alter it without everyone else knowing. That’s the real magic.

It’s not about speed or cost. It’s about trust without a middleman. You don’t need to believe in me. You just need to believe in the math.

Harshal Parmar

20 January, 2026 . 14:43 PM

Man I remember when I used to download entire albums on Napster at 2 a.m. with my dial-up, and half the files were just 10-second clips or some guy’s voicemail. But now? I can send crypto to my cousin in Mumbai and he gets it before his chai cools down. No bank fees, no paperwork, no ‘we’re reviewing your transaction for compliance.’ It’s wild how far we’ve come from those sketchy MP3s.

And don’t even get me started on how Bitcoin’s blockchain is basically a global public ledger that’s impossible to fake. Even if the entire US power grid went down, the network would still run on solar-powered Raspberry Pis in someone’s garage in Nairobi. That’s not tech-that’s a revolution.

Darrell Cole

21 January, 2026 . 05:31 AM

The notion that blockchain is decentralized is a marketing myth propagated by crypto bros who dont understand distributed systems. Most nodes are hosted by institutional players. The so-called 'individuals running nodes' are mostly miners with ASICs and data center contracts. And proof of work? A colossal waste of energy that benefits no one but hardware manufacturers.

Bitcoin is not money. It is a speculative asset with a cult following and an outdated consensus mechanism that should have been retired after 2015.

Linda Prehn

22 January, 2026 . 15:43 PM

So let me get this straight-you’re telling me we built an entire global financial system on top of a protocol that can’t process more than 7 transactions a second and requires a 700GB download just to verify your own wallet?

And we call this innovation?

Meanwhile my bank lets me pay my rent with a tap and I don’t have to run a supercomputer in my closet to do it.

Clark Dilworth

22 January, 2026 . 22:27 PM

The architectural paradigm shift from tracker-based P2P to Byzantine fault-tolerant consensus mechanisms represents a foundational evolution in distributed systems theory. The elimination of single points of coordination via cryptographic verifiability and immutable ledgering enables trust minimization at scale-a concept previously theoretical until Nakamoto’s synthesis of hash chains, proof-of-work, and incentive alignment.

This isn't merely a technological upgrade. It's a socio-economic re-architecting of value transmission.

Brenda Platt

23 January, 2026 . 04:59 AM

Y’all are overcomplicating this. Blockchain is just a way for regular people to take power back from banks and big tech.

I sent $200 to my sister in Lagos last week. Took 8 minutes. Cost $1.50. No one asked for my ID, my tax number, or why I was sending money to ‘Africa.’

That’s freedom. And if you’re still stuck on ‘but it’s slow’ or ‘it uses too much energy,’ you’re missing the point. We’re building a new system. It’s messy. It’s imperfect. But it’s ours.

And honestly? I’d rather have a system that’s slow but fair than one that’s fast but controlled.

Paru Somashekar

24 January, 2026 . 21:11 PM

It is imperative to acknowledge that the foundational principle of decentralization in blockchain technology fundamentally alters the traditional paradigm of centralized trust authorities. Unlike Napster, wherein metadata coordination was reliant upon a singular server infrastructure, blockchain implements a distributed consensus protocol wherein each participating node independently validates transactions through cryptographic means.

This structural innovation ensures resilience against single-point failures and mitigates the risk of systemic censorship. Furthermore, the economic incentive mechanism inherent in proof-of-work and proof-of-stake models ensures network integrity without reliance upon institutional intermediaries.

Steve Fennell

26 January, 2026 . 10:26 AM

I run a full node on a Raspberry Pi 4 with a 1TB SSD. It takes 48 hours to sync, but once it’s up, I feel like I’m part of something real. Not just a user. A participant.

Most people don’t get it. They think crypto is about getting rich. It’s not. It’s about sovereignty. Your keys, your money. No one can freeze it. No one can reverse it. No one can charge you $10 to send $50.

That’s worth the hassle.

Heather Crane

27 January, 2026 . 14:20 PM

I just want to say-thank you for writing this. I’m a 52-year-old mom who used to think Bitcoin was for hackers and drug dealers. Then my nephew in Nigeria got paid in crypto for his freelance design work, and I saw how it changed his life. No more waiting weeks for Western Union. No more fees that eat half his paycheck.

I still don’t understand all the tech stuff. But I understand fairness. And this? This is fairer.

Also-please stop saying ‘crypto bros.’ We’re not all men in hoodies. Some of us are just tired of being ripped off by banks.

Catherine Hays

28 January, 2026 . 21:02 PM

So you’re telling me we spent 15 years building a global financial system that’s slower than a 1990s fax machine and uses more electricity than a small country?

And you think this is progress?

Wake up. This isn’t innovation. It’s a pyramid scheme dressed up in blockchain jargon. The only people winning are the ones selling mining rigs and NFTs.

Mike Stay

28 January, 2026 . 22:30 PM

Let’s not romanticize this. Running a node isn’t some noble act. It’s a technical burden most people aren’t equipped for. And yes, the energy use is insane-but let’s be honest, the entire internet runs on fossil fuels. We’re not saving the planet by switching from banks to blockchains.

What matters is access. In places like Nigeria or Argentina, this tech is life-changing. In the U.S.? It’s mostly a luxury for people who already have money and time to learn how to not lose their keys.

So yes-it’s powerful. But it’s not magic.

Taylor Mills

29 January, 2026 . 18:31 PM

Bitcoin is a failed experiment. The fact that people still think it's money is embarrassing. It's not. It's digital gold that takes 10 minutes to send and costs more than your coffee. And don't even get me started on the environmental damage.

Meanwhile, every single person using it for remittances? They're using it because their governments are corrupt, not because blockchain is better. That's not a win. That's a cry for help.

HARSHA NAVALKAR

30 January, 2026 . 19:05 PM

I read this whole thing. I didn't say anything. I just sat there. Thinking. About how we used to trust people. Now we trust code. And sometimes, that’s worse.

Ryan Depew

1 February, 2026 . 12:07 PM

Lightning Network is the real MVP here. I pay for coffee with BTC every morning. No fees. Instant. No one knows I’m using crypto. My barista thinks I’m just a weird guy who pays with an app.

That’s the future. Not people running full nodes. Just normal folks using the backend magic without knowing it. Like electricity.

Jessica Boling

3 February, 2026 . 04:03 AM

So the genius behind Bitcoin was to make the internet’s biggest file-sharing system into a global bank… that only 2% of people use and 98% of people can’t understand?

Brilliant. Just brilliant.

Tammy Goodwin

3 February, 2026 . 17:58 PM

I used to think blockchain was just hype. Then I watched my neighbor in Texas get paid in Bitcoin for his plumbing work. He didn’t need a bank account. Didn’t need PayPal. Just a phone and a QR code.

It’s not perfect. But it’s the first time in my life I’ve seen tech actually help someone who’s been left out.

That’s worth something.

tim ang

5 February, 2026 . 13:28 PM

Just ran my first node last week. Took 3 days. My wife thought I was building a server to watch porn.

Turns out I was just trying to be a tiny part of something bigger. Still not sure if it matters. But I like the feeling.

Julene Soria Marqués

7 February, 2026 . 07:15 AM

Why do people keep pretending this isn’t just a glorified spreadsheet?

It’s not magic. It’s not revolutionary. It’s just code that’s hard to change. Big deal.

Meanwhile, your wallet gets hacked because you clicked a link. Your keys get lost because you didn’t write them down. And you still think you’re ‘owning’ something?

Wake up.

Abdulahi Oluwasegun Fagbayi

8 February, 2026 . 08:15 AM

In Nigeria, we don’t need banks to tell us how to move money. We’ve been doing it for decades-through informal networks, mobile airtime, and cash couriers. Blockchain didn’t create trust. It just gave us a better tool to keep it.

This isn’t about replacing the West. It’s about empowering the rest of us to do it our way.

Anna Topping

9 February, 2026 . 09:13 AM

What if the real revolution isn’t the technology… but the fact that we’re finally willing to imagine a world without middlemen?

Maybe we’ve been too scared to trust each other. Maybe blockchain is just the mirror showing us how lonely we’ve become.

katie gibson

10 February, 2026 . 21:13 PM

So you’re telling me I can send money to someone in another country without a bank telling me I’m ‘suspicious’?

And no one can freeze it?

And I don’t have to prove I’m ‘worthy’ of having money?

…I’m crying. I didn’t know this was possible.

Ashok Sharma

11 February, 2026 . 18:28 PM

Simple truth: Napster was about taking. Blockchain is about sharing. One was theft. The other is trust.

That is the difference.