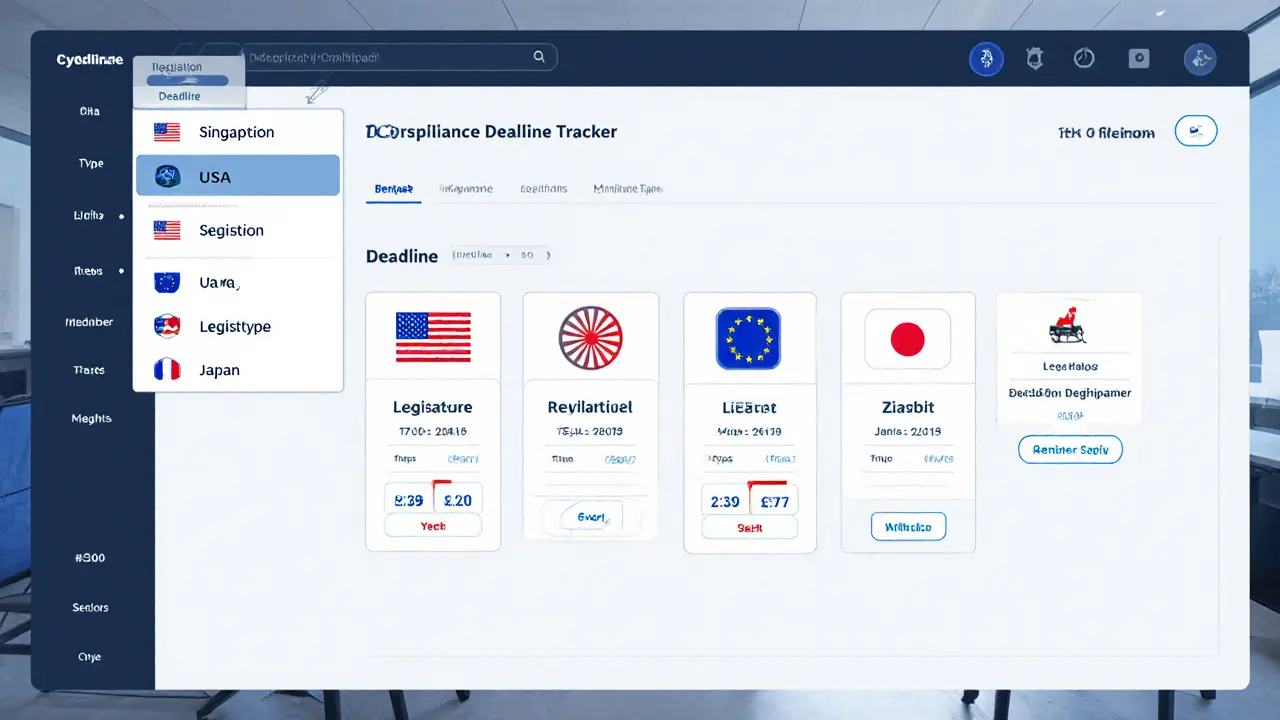

Crypto Compliance Deadline Tracker

Important Notes

- Singapore’s FSMA deadline is June 30, 2025 - no extensions.

- Europe requires PSD2 authorization by March 2, 2026.

- Japan’s PSA amendments take effect in 2025-2026.

- U.S. CLARITY Act classifications determine regulatory jurisdiction.

If you run a crypto exchange, wallet service, or any digital‑asset platform, you’ve probably felt the pressure of juggling different sets of rules around the world. The Payment Services Act umbrella now covers everything from Singapore’s tight licensing regime to the United States’ new CLARITY Act, Europe’s PSD2‑MiCA blend, and Japan’s evolving PSA amendments. This guide pulls those pieces together, explains what you need to do before the next deadline, and shows how to keep compliance from turning into a nightmare.

Quick Takeaways

- Singapore’s FSMA deadline is June302025 - no extensions.

- The U.S. CLARITY Act splits crypto into three categories, assigning oversight to the SEC or CFTC.

- Europe requires PSD2 authorization for crypto‑payment services by March22026, with strong customer authentication.

- Japan’s PSA amendment (2025) tightens cold‑wallet storage and introduces a three‑tier licensing model.

- Cross‑border providers must run separate compliance programs for each jurisdiction while maintaining a unified operational backbone.

Singapore: FSMA Crypto Requirements

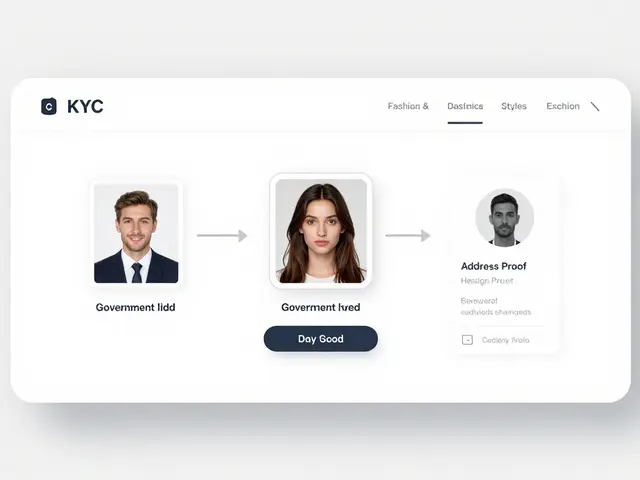

Financial Services and Markets Act is Singapore’s legal backbone for digital‑asset providers. The Monetary Authority of Singapore (MAS) treats crypto platforms like banks: they must obtain a licence, conduct rigorous customer suitability checks, and publish clear risk disclosures. Key points:

- Consumer‑protection rules (updated Sep2024) forbid misleading marketing and require detailed risk statements.

- Credit‑card purchases of crypto are outright banned.

- The Travel Rule applies to any transfer above the MAS‑defined threshold - both the sending and receiving platform must exchange sender/receiver details.

- June302025 is the absolute cut‑off. Any unlicensed service must shut down on that date.

Failure to comply triggers immediate enforcement, hefty fines, and possible imprisonment for senior executives.

United States: The CLARITY Act Framework

Clarifying Law Around Intent of Congress To Regulate Your (CLARITY) Act re‑writes the crypto‑regulation puzzle in the U.S. It classifies digital assets into three buckets:

- Digital commodities (regulated by the CFTC).

- Investment‑contract assets (SEC jurisdiction).

- Permitted payment stablecoins (treated like money‑market instruments).

Implications for service providers:

- Broker‑dealers can now handle digital commodities and stablecoins without separate CFTC registration, provided they are SEC‑registered.

- Exchanges must adopt hybrid record‑keeping capable of tracking blockchain transactions alongside traditional trade books.

- DeFi platforms may qualify for limited exemptions, but they still need to file detailed reports on token classifications.

European Union: PSD2 Meets MiCA

European Banking Authority issued guidance that aligns the Payment Services Directive2 (PSD2) with the Markets in Crypto‑Assets (MiCA) regulation. The key outcome: crypto‑asset transfers count as payment services, triggering PSD2 licensing.

- Authorization deadline: March22026.

- Strong Customer Authentication (SCA) is mandatory for custodial wallets that qualify as payment accounts.

- Payment‑fraud reporting and capital‑adequacy calculations apply equally to electronic‑money tokens (EMTs) and fiat.

- Exchanges of crypto‑for‑crypto or crypto‑for‑funds are excluded from PSD2, staying under MiCA alone.

National Competent Authorities (NCAs) can use the information submitted for a Crypto‑Asset Service Provider (CASP) licence to fast‑track the PSD2 authorisation.

Japan: 2025 PSA Amendments

Japan's Payment Services Act has been updated several times, most recently in March2025. The amendments build on the 2019 overhaul that renamed “virtual currency” to “crypto assets.” Main changes:

- Cold‑wallet storage is mandatory for all user assets - exchanges must keep the majority of holdings offline.

- A three‑tier licensing system (Type1,2,3) matches the scale of services, from simple remittance to full‑blown exchange operations.

- Advance reporting of changes to handled crypto assets is required, cutting the lag between market moves and regulator awareness.

- Advertising rules now forbid any “guaranteed return” language and demand clear disclosure of fees and risks.

Implementation guidelines are expected later in 2025, but providers should start redesigning custody architecture now.

Cross‑Jurisdictional Compliance Challenges

Running a global crypto business feels like playing chess on several boards at once. The biggest pain points are:

- Timeline fragmentation: Singapore’s hard June2025 deadline versus Europe’s March2026 window can force staggered releases.

- Technical variance: Travel Rule data formats differ from Europe’s SCA APIs, while Japan demands offline cold‑wallet segregation.

- Consumer‑protection divergence: Singapore bans credit‑card purchases, Europe focuses on SCA, and the U.S. emphasises investor‑category disclosures.

- Enforcement posture: MAS is zero‑tolerance, EU authorities provide transition no‑action periods, and the SEC/CFTC coordinate but can still issue overlapping orders.

To survive, firms need a modular compliance engine that can toggle rules per jurisdiction while sharing a common data‑layer.

Practical Compliance Checklist

- Identify the jurisdictions you operate in and map each to the relevant PSA provision.

- Secure licences before the earliest deadline (e.g., Singapore’s June302025).

- Implement Travel Rule data exchange (JSON‑V2 format) for all outbound transfers above the threshold.

- Deploy strong customer authentication for custodial wallets in the EU and any SCA‑required flows in Japan.

- Adopt a cold‑wallet strategy that meets Japan’s mandatory offline storage while satisfying MAS and EBA safeguarding standards.

- Classify each token under the U.S. CLARITY Act to know whether the SEC or CFTC is the lead regulator.

- Prepare consumer‑disclosure documents that cover risk warnings, fee structures, and prohibited marketing language for all regions.

- Set up automated reporting pipelines for advance change notifications (Japan) and periodic capital‑adequacy calculations (EU).

Comparison of Key Requirements by Jurisdiction

| Jurisdiction | Primary Legislation | Compliance Deadline | Licensing Needed | Major Technical Obligation |

|---|---|---|---|---|

| Singapore | Financial Services and Markets Act (FSMA) | 30Jun2025 | Digital Token Service licence | Travel Rule data exchange for all transfers > threshold |

| United States | CLARITY Act (SEC & CFTC) | Ongoing - classification per asset | Depends on asset class (SEC broker‑dealer or CFTC registration) | Hybrid blockchain‑aware record‑keeping |

| European Union | PSD2 & MiCA (EBA guidance) | 2Mar2026 | PSD2 payment‑service authorisation | SCA for custodial wallets; fraud‑reporting APIs |

| Japan | Payment Services Act (2025 amendment) | Implementation guidelines 2025‑2026 | Type‑1/2/3 licence based on service scope | Mandatory offline cold‑wallet storage; advance reporting |

Next Steps & Troubleshooting

When you hit a roadblock, ask yourself:

- Is the issue regulatory (licence, deadline) or technical (API, data format)?

- Can I isolate the problem to a single jurisdiction’s rule‑set?

- Do I have a local legal counsel or compliance partner who understands the nuance?

- Is there a sandbox or regulatory‑test environment (e.g., MAS sandbox) I can use to validate before full rollout?

Typical fixes include:

- Switching from a generic JSON payload to the MAS‑approved Travel Rule schema.

- Adding an SCA module that supports both Open Banking (EU) and local 2FA (Japan).

- Re‑classifying a token from “digital commodity” to “investment contract” to align with SEC guidance, which may change reporting frequencies.

Keep a version‑controlled compliance repository so you can roll back changes quickly if a regulator raises a concern.

Frequently Asked Questions

Do I need a separate licence for each country?

Generally, yes. Singapore, the EU, Japan, and the U.S. each require their own authorisation or registration. Some jurisdictions allow reciprocal recognition, but you must still meet local technical rules like the Travel Rule or SCA.

What happens if I miss the Singapore deadline?

MAS will issue an immediate cease‑and‑desist, levy fines up to 10% of annual turnover, and may pursue criminal charges against senior officers. No grace period is provided.

How does the CLARITY Act affect DeFi platforms?

DeFi projects can apply for limited exemptions, but they must still submit token classification reports and maintain audit‑ready records. Failure to do so may trigger SEC enforcement for securities‑like tokens.

Is Strong Customer Authentication required for all crypto wallets in Europe?

Only custodial wallets that are considered payment accounts need SCA under PSD2. Non‑custodial or self‑hosted wallets fall outside PSD2 and are governed solely by MiCA.

What technical standards does the Travel Rule use in Singapore?

MAS adopts the FATF‑recommended JSON‑V2 schema, which includes sender/receiver names, addresses, dates of birth, and transaction identifiers. Platforms must exchange this data for every transfer above the set SAR (usually S$1,500).

Jared Carline

21 November, 2024 . 18:18 PM

The Payment Services Act framework, as delineated across jurisdictions, underscores a stark divergence in regulatory philosophy. Singapore's immutable June 30, 2025 deadline exemplifies a zero‑tolerance stance, whereas the United States adopts a fluid classification regime. Stakeholders must therefore architect compliance architectures that can pivot instantaneously between licensing imperatives and technical obligations. Failure to accommodate these disparate regimes invites not merely monetary penalties but also potential incarceration of senior executives.

raghavan veera

23 November, 2024 . 22:53 PM

One might argue that the very act of segmenting crypto regulation mirrors humanity's perennial quest to impose order upon chaos; yet the chaos itself fuels innovation. In that sense, each jurisdiction's rulebook is less a cage and more a compass pointing toward uncharted possibilities.

Vijay Kumar

26 November, 2024 . 03:27 AM

If you’re building a cross‑border exchange, start by mapping each jurisdiction’s licensing requirement to a dedicated micro‑service. This approach isolates legal risk and lets your core trading engine stay untouched while you swap out compliance adapters as needed. For Singapore, spin up a Travel‑Rule engine that spits out FATF‑compliant JSON‑V2 payloads; for the EU, integrate an SCA module that leverages Open Banking APIs; and for Japan, design a cold‑wallet vault that automatically flags any online exposure. By treating compliance as plug‑and‑play, you reduce both development time and operational overhead.

Edgardo Rodriguez

28 November, 2024 . 08:01 AM

Indeed, adopting a modular architecture-, as you suggested-, not only streamlines regulatory adaptation, but also future‑proofs the platform against emerging mandates,; consequently, the development cycle becomes both agile and resilient,; moreover, each compliance micro‑service can be version‑controlled independently, allowing for rapid patching,; finally, such segregation aligns perfectly with the principle of least privilege,; thereby enhancing overall security posture.

mudassir khan

30 November, 2024 . 12:36 PM

Honestly, this guide reads like a copy‑pasted brochure,; the author fails to differentiate between substantive compliance work and mere checkbox ticking,; a real practitioner would know that MAS’s Travel Rule is not just an XML snippet, but a complex data‑sharing protocol,; yet here we are served bullet points and empty reassurance,; the whole piece is a disservice to anyone hoping for actionable insight.

Bianca Giagante

2 December, 2024 . 17:10 PM

While I recognize your frustration, it’s essential to acknowledge that the guide does consolidate dispersed information,; for newcomers, such a synthesis can serve as a valuable starting point,; nevertheless, deeper technical guidance will indeed be required for implementation,; I encourage readers to view this as an overview rather than a detailed manual,; further discussion can flesh out the nuances.

Andrew Else

4 December, 2024 . 21:44 PM

Great, another checklist that tells us what we already know.

Susan Brindle Kerr

7 December, 2024 . 02:18 AM

In an age where digital gold is chased like a mirage, we cannot afford to ignore the moral compass that these regulations provide; they are not shackles but a lighthouse guiding us away from the treacherous reefs of fraud and exploitation. Ignoring them would be akin to sailing blindfolded into a storm, and no amount of hype can justify that reckless voyage.

Danielle Thompson

9 December, 2024 . 06:53 AM

Stay focused on building that compliance engine-step by step, you’ve got this! 🚀

Eric Levesque

11 December, 2024 . 11:27 AM

Don’t waste time with vague advice-if you want to succeed, lock down the Singapore licence now or you’ll watch your project crash under foreign red tape.

alex demaisip

13 December, 2024 . 16:01 PM

The Payment Services Act (PSA) and its global analogues constitute a multifaceted regulatory lattice that demands rigorous stratification of compliance responsibilities across jurisdictional boundaries. From a theoretical perspective, each jurisdiction imposes distinct operational constraints, thereby necessitating a decomposition of the compliance function into discrete, interoperable modules. In Singapore, the Digital Token Service licence operates under the auspices of the Monetary Authority of Singapore, which mandates adherence to the FATF‑recommended Travel Rule for transfers exceeding the prescribed SAR threshold. The United States, via the CLARITY Act, bifurcates digital assets into commodities and securities, obligating market participants to either register with the Commodity Futures Trading Commission or the Securities and Exchange Commission, respectively. The European Union’s synthesis of PSD2 and MiCA introduces the requirement for Strong Customer Authentication on custodial wallets deemed payment accounts, while simultaneously imposing capital‑adequacy calculations for electronic‑money tokens. Japan’s amended Payment Services Act prescribes a tiered licensing schema-Type‑1, Type‑2, and Type‑3-each calibrated to the scope of services rendered and enforces mandatory offline cold‑wallet storage for user assets. A pragmatic implementation strategy must therefore commence with a comprehensive asset‑classification engine capable of mapping each token to its regulatory bucket in real time. Subsequently, the architecture should provision distinct API gateways: one for MAS‑compliant JSON‑V2 payloads, another for EU‑mandated SCA flows, and a third for US‑specific reporting schemas. Data provenance and auditability become paramount, as each jurisdiction reserves the right to request historical transaction records for up to ten years. Moreover, the enforcement posture varies; MAS is notoriously zero‑tolerance, the SEC adopts a case‑by‑case approach, whereas European regulators often provide transitional grace periods. Consequently, the compliance backlog must be managed through a risk‑based prioritization matrix that balances deadline proximity against potential penalty exposure. Operational resilience can be further enhanced by deploying a sandbox environment that mirrors the production stack while allowing iterative testing against MAS, FINMA, and FCA mock interfaces. Integration testing should incorporate both positive and negative test cases, ensuring that edge‑case failures trigger automated remediation workflows. Finally, governance frameworks must enforce segregation of duties, with distinct teams overseeing licensing, technical implementation, and regulatory reporting to mitigate collusion risk. By adhering to this systematic, modular methodology, a crypto service provider can navigate the labyrinthine PSA landscape with measurable confidence and reduced exposure to regulatory sanctions.

Elmer Detres

15 December, 2024 . 20:35 PM

Your modular roadmap is spot on; remember that flexibility isn’t just a buzzword, it’s a survival tactic. Keep the compliance micro‑services loosely coupled, and you’ll be able to swap out a Travel‑Rule module for a new jurisdiction without rewiring the whole system. 🚀 Stay relentless, and let the data drive your decisions. 📊

Tony Young

18 December, 2024 . 01:10 AM

Picture this: a sprawling exchange platform, its servers humming like a relentless beast, yet every transaction is wrapped in a silken layer of regulatory armor. That’s the power of a well‑engineered compliance suite-dramatic, decisive, and ultimately, unstoppable. Dive deep into the JSON‑V2 schema now, and watch your risk profile shrink before your eyes.

Fiona Padrutt

20 December, 2024 . 05:44 AM

Enough talking-lock down that Singapore licence yesterday, or you’ll be left scrambling while other nations charge ahead. Patriotism isn’t just about flags; it’s about protecting our domestic innovators from foreign bureaucratic shackles. Move fast, act hard!

Briana Holtsnider

22 December, 2024 . 10:18 AM

The author seems to think slapping together bullet points suffices for a complex legal landscape, which is frankly a superficial treatment of a deep issue. Readers deserve more than a superficial checklist; they need actionable, nuanced guidance. This post falls short.

Corrie Moxon

24 December, 2024 . 14:53 PM

I hear your concerns, and while the guide may be concise, consider it a launchpad. Building on that foundation with your own due‑diligence will yield a robust compliance posture. Keep pushing forward-you’re on the right track.

Jeff Carson

26 December, 2024 . 19:27 PM

Curious how we can reconcile the disparate reporting formats without reinventing the wheel? Maybe a unified schema layer that maps MAS JSON‑V2, EU SCA, and US reporting into a single internal model? 🤔

Anne Zaya

29 December, 2024 . 00:01 AM

Totally agree-let's just keep it simple and test the idea in a sandbox first.

Emma Szabo

31 December, 2024 . 04:35 AM

Embarking on this compliance odyssey is like painting a masterpiece with every hue of regulation-vivid, challenging, yet profoundly rewarding. Let’s color‑code our tasks: red for licensing, blue for technical integration, green for reporting. With creativity and rigor, we’ll turn this regulatory maze into a vibrant tapestry of success!

Fiona Lam

2 January, 2025 . 09:10 AM

Your poetic flair is nice, but stop sugar‑coating the deadline-Singapore will crush anyone who drags their feet. Get the licence or get out.

OLAOLUWAPO SANDA

4 January, 2025 . 13:44 PM

Everyone’s hyped about the EU timeline, but the real game changer is the US’s classification – it’s a wild card that no one wants to admit.

Alex Yepes

6 January, 2025 . 18:18 PM

Indeed, the CLARITY Act’s tiered classification introduces a strategic pivot point; entities must therefore conduct a granular token audit, align each asset with the appropriate regulatory regime, and subsequently adapt their compliance infrastructure accordingly. This approach, while demanding, ensures alignment with both SEC and CFTC expectations and mitigates the risk of enforcement actions.