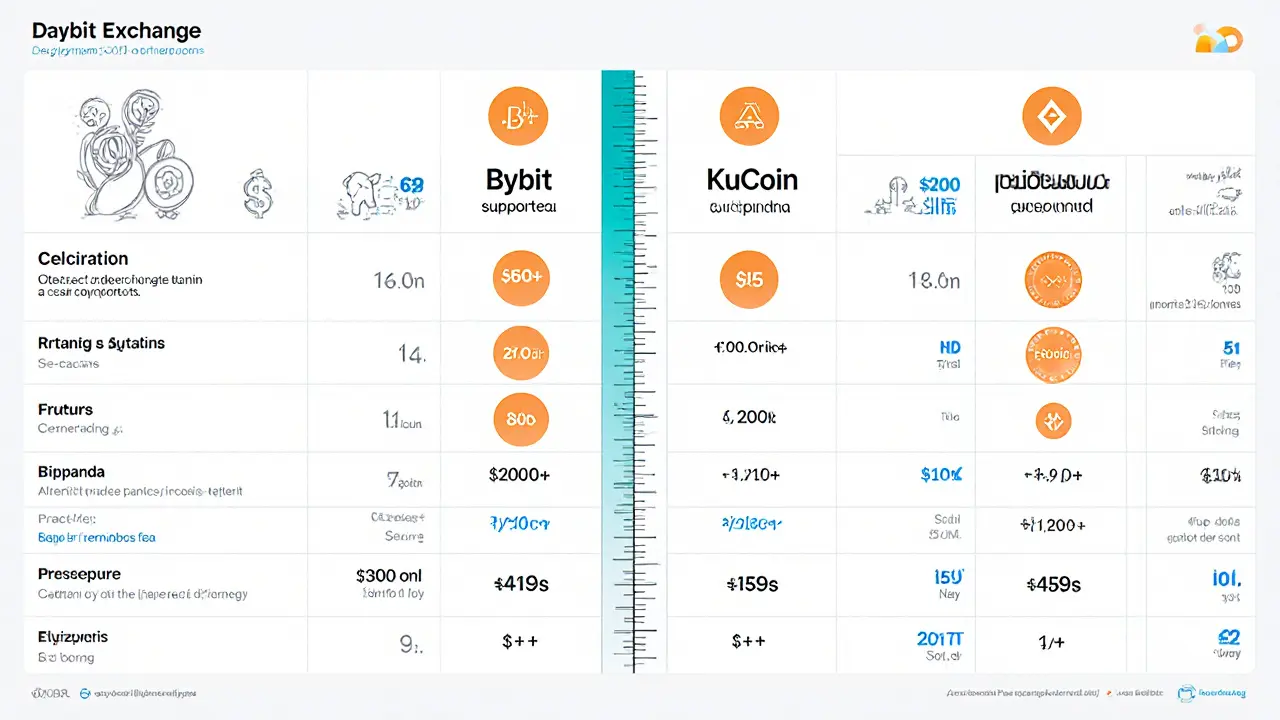

Daybit Exchange Feature Comparison Tool

Exchange Feature Comparison

Compare Daybit Exchange against major 2025 crypto exchanges to understand key differences in features, fees, and functionality.

| Attribute | Daybit Exchange | Binance | Bybit | KuCoin | Bitpanda |

|---|---|---|---|---|---|

| Trading Fees (taker) | 0.20% - 0.25% | 0.08% | 0.03% | 0.03% (promos can be 0%) | 0.10% |

| Supported Fiat | KRW only | USD, EUR, BNB, etc. | USD, EUR, GBP, etc. | USD, EUR, GBP, etc. | EUR, CHF, USD, GBP |

| Advanced Products | Spot only | Futures, Options, Staking, NFT Marketplace | Derivatives, Staking, Copy-Trading | Futures, Lending, Staking | Staking, Savings, Limited Futures |

| Liquidity (24h volume) | Untracked / negligible | $200B+ | $15B+ | $10B+ | $3B+ |

| Community & Support | Very limited, no active forums | Global Reddit, Discord, 24/7 chat | Active Discord, Telegram | Reddit, Telegram, Help Center | Help Center, email support |

Fee Comparison Summary

Daybit's fees are significantly higher than industry leaders:

- Daybit Taker Fee: 0.20% - 0.25%

- Binance Taker Fee: 0.08%

- Bybit Taker Fee: 0.03%

- KuCoin Taker Fee: 0.03% (promos can be 0%)

Key Limitations of Daybit Exchange

- Only supports KRW fiat deposits

- No futures, staking, or copy-trading

- No public proof-of-reserves audit

- Minimal community support

- No mobile app available

Recommendation

Based on the comparison, Daybit Exchange is not recommended for most traders due to:

- High fees compared to industry standards

- Limited features and no advanced trading options

- Low liquidity and unverified reserves

- No community or support channels

- Restricted fiat support to only KRW

Consider established exchanges like Binance, Bybit, or KuCoin for better value and features.

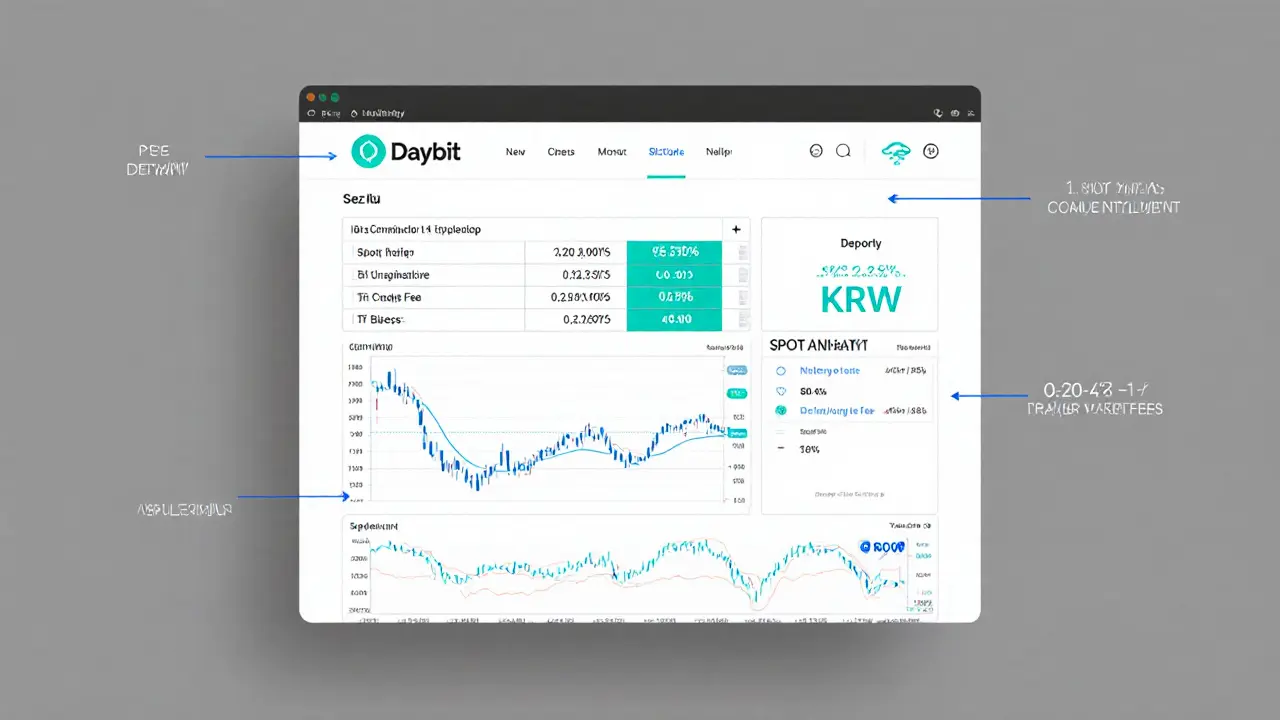

When you type “Daybit Exchange review” into Google, the results are a maze of scattered data and a possible mix‑up with a similarly named review site. The reality is that Daybit Exchange is an obscure platform that barely shows up on major market trackers, charges higher fees than the industry average, and only accepts Korean Won (KRW) for fiat deposits. If you’re weighing whether to open an account, you’ll want to know exactly what you’re getting - from fees to safety to the overall user experience.

Quick Take

- Daybit Exchange is listed as an “Untracked Listing” on CoinMarketCap, meaning volume and reserve data aren’t publicly available.

- Trading fees sit around 0.20%-0.25%, noticeably above the 0.10% benchmark for most 2025 exchanges.

- Only KRW fiat deposits are supported; no credit‑card or other fiat options.

- Feature set is limited to basic spot trading - no futures, staking, or copy‑trading.

- Community feedback and expert analysis are practically nonexistent.

What We Know About Daybit Exchange

Public information on Daybit is thin. CoinMarketCap classifies it as an Untracked Listing, which means the platform does not share its order‑book data with aggregators. There are no listed trading pairs on the major tracking sites, suggesting either extremely low activity or a deliberate decision not to expose data.

Cryptowisser, a niche crypto‑service reviewer, notes that the exchange’s fee structure is “a bit on the high end” compared with an emerging industry norm of 0.10%. Fee details are vague, but user reports indicate a taker fee of roughly 0.20% and a maker fee of 0.15% - still higher than the 0.08% you’d see on Binance or the 0.03% on Bybit.

The platform only accepts KRW for deposits. No credit‑card, PayPal, or other fiat gateways are listed, limiting the audience to Korean residents or users who can access Korean bank transfers. This fiat restriction is a major hurdle for international retail traders who typically rely on quick card purchases.

Feature Gap Compared to Leading Exchanges

By 2025, the top exchanges have expanded far beyond basic spot trading. They offer futures, options, staking, NFTs, and robust educational tools. Daybit’s offering stops at a handful of spot pairs, with no advanced products on the roadmap. Below is a side‑by‑side snapshot of the most relevant attributes.

| Attribute | Daybit Exchange | Binance | Bybit | KuCoin | Bitpanda |

|---|---|---|---|---|---|

| Trading Fees (taker) | 0.20% - 0.25% | 0.08% | 0.03% | 0.03% (promos can be 0%) | 0.10% |

| Supported Fiat | KRW only | USD, EUR, BNB, etc. | USD, EUR, GBP, etc. | USD, EUR, GBP, etc. | EUR, CHF, USD, GBP |

| Advanced Products | Spot only | Futures, Options, Staking, NFT Marketplace | Derivatives, Staking, Copy‑Trading | Futures, Lending, Staking | Staking, Savings, Limited Futures |

| Liquidity (24h volume) | Untracked / negligible | $200B+ | $15B+ | $10B+ | $3B+ |

| Community & Support | Very limited, no active forums | Global Reddit, Discord, 24/7 chat | Active Discord, Telegram | Reddit, Telegram, Help Center | Help Center, email support |

Safety, Regulation, and Transparency

One of the biggest red flags for any exchange is how transparent it is about reserves and compliance. Daybit does not publish a proof‑of‑reserves audit, nor does it appear on any regulatory whitelist in South Korea or elsewhere. In contrast, platforms like UpBit (ranked 4th most trusted by Forbes Adviser) provide regular security audits and have clear KYC/AML policies.

Without a publicly available audit, users cannot confirm that the balances shown on the platform match actual on‑chain holdings. The lack of expert commentary - there are no analyses from Coin Bureau, CryptoAdventure, or major research outlets - adds to the uncertainty. If you value knowing that your assets are held securely, the absence of any third‑party verification is a serious drawback.

User Experience: What Real Traders Are Saying

Even the most basic user‑generated feedback is scarce. A quick search across Reddit, Trustpilot, and the Korean crypto forums turns up a handful of comments, most of which simply note “hard to fund” or “no mobile app.” There is no documented customer‑service response time, no tutorial library, and no community channels where newcomers can ask questions. By comparison, KuCoin offers a comprehensive Academy and a bustling Reddit community, while Bitpanda provides step‑by‑step guides for fiat on‑ramps.

If you’re a first‑time crypto buyer, the lack of educational material on Daybit means you’ll need to rely on external sources for everything from wallet setup to security best practices. That extra effort can be a deal‑breaker for many new investors.

Potential Confusion with DayBit.com

Another source of uncertainty is the similarly named DayBit.com. That site is not an exchange at all; it operates as a review and recommendation portal for crypto platforms, with a focus on gambling‑related services. The near‑identical branding leads users to the wrong destination when they search for “Daybit Exchange.” Make sure you’re on the actual trading platform - usually a sub‑domain with a URL ending in “daybitexchange.com” - before entering any credentials or funds.

Should You Consider Daybit Exchange?

Bottom line: unless you have a very specific reason to use a KRW‑only platform and you’re comfortable with limited transparency, Daybit Exchange falls short on almost every metric that matters in 2025. Here’s a quick decision guide:

- Are you based in South Korea and need a KRW‑only spot market? If yes, Daybit might be a niche option, but weigh the higher fees and lack of support against domestic alternatives like Bithumb or UpBit.

- Do you prioritize low fees and deep liquidity? No - other exchanges beat Daybit by a wide margin.

- Is regulatory compliance a must‑have for you? No - Daybit provides no public compliance documentation.

- Do you need advanced trading tools (futures, staking, copy‑trading)? No - Daybit offers only basic spot trading.

If you answered “yes” to any of the above, look for a better‑known platform. If you’re purely curious about Daybit’s existence, treat it as a case study of how a crypto exchange can slip under the radar when it lacks the hallmarks of a trustworthy service.

How to Stay Safe When Exploring Low‑Profile Exchanges

- Start with a small amount - never deposit more than you’re willing to lose.

- Verify the URL and SSL certificate to avoid phishing copies.

- Check for a proof‑of‑reserves audit; if none exists, consider the risk high.

- Use a hardware wallet for long‑term storage instead of keeping assets on the exchange.

- Keep an eye on community forums for any emerging complaints or security alerts.

Frequently Asked Questions

Is Daybit Exchange regulated in South Korea?

There is no publicly available regulator registration or licensing information for Daybit Exchange, which means its compliance status is unclear. Users should assume it operates without official oversight.

What fiat currencies can I deposit?

Only Korean Won (KRW) is supported for fiat deposits. No credit‑card, PayPal, or other fiat gateways are available.

How do Daybit’s fees compare to Binance?

Daybit charges roughly 0.20%-0.25% taker fees, whereas Binance’s taker fee is about 0.08% after the standard discount tier. Daybit is therefore significantly more expensive per trade.

Does Daybit offer futures or staking?

No. The platform currently only provides basic spot trading. Futures, staking, NFTs, and copy‑trading are not available.

Is there any community support for Daybit?

Community activity appears minimal. There are no active Reddit threads, Discord servers, or Telegram groups specifically for Daybit, making peer‑help scarce.

Jeff Carson

17 August, 2025 . 06:37 AM

Daybit looks like a niche KRW‑only playground that missed the 2025 upgrade train. Its taker fees hover around 0.20‑0.25 % - far above the 0.08 % you’d see on Binance. The lack of futures or staking makes it feel stuck in 2022, especially when every other major exchange is pushing NFT and DeFi tools. 🤔 If you’re only looking for basic spot trades and you’re based in Korea, it might still serve a purpose, but the cost‑to‑benefit ratio is shaky.

Consider the alternatives before you lock in funds.

Alex Yepes

21 August, 2025 . 04:46 AM

In accordance with contemporary market standards, the fee structure presented by Daybit is demonstrably suboptimal when juxtaposed with leading platforms. Consequently, prudent investors should allocate capital toward venues offering superior liquidity and diversified product suites.

Fiona Padrutt

25 August, 2025 . 02:55 AM

From a proud American standpoint, it’s baffling that a platform would confine itself to a single fiat like KRW and ignore the global dollar market. Such insular policy limits accessibility and hinders the very spirit of open finance that the United States champions.

Briana Holtsnider

29 August, 2025 . 01:04 AM

Analyzing the data reveals a stark deficiency: no proof‑of‑reserves, negligible volume, and an absent community-hallmarks of a fragile exchange. The risk profile is elevated, and any capital exposure should be minimized to a token amount.

Corrie Moxon

1 September, 2025 . 23:14 PM

While Daybit certainly has its drawbacks, there are traders who value a simple, straightforward spot‑only interface. If you’re just dipping your toes into crypto and prefer to avoid the complexity of derivatives, a minimalistic platform can be a gentle entry point. Just keep an eye on the fee impact and consider moving to a larger exchange as your portfolio grows.

Anne Zaya

5 September, 2025 . 21:23 PM

Totally get the vibe-if you just wanna buy a bit of Bitcoin without the fuss, Daybit could work. Just don’t forget those higher fees, huh?

Emma Szabo

9 September, 2025 . 19:32 PM

Daybit Exchange, in its current incarnation, reads like a relic from a bygone crypto era, offering little more than a basic spot‑trading canvas painted in muted tones while the rest of the industry splashes vibrant hues of innovation across its platforms. First and foremost, the fee structure-a flat 0.20‑0.25 % for takers-acts as a silent tax on every trade, eroding margins faster than a leaky faucet in a rainstorm, especially when competitors such as Binance and Bybit pour out sub‑0.10 % rates for comparable services.

Second, the fiat ecosystem is shackled to a sole currency, the Korean Won, which instantly narrows the user base to a niche demographic and excludes the vast majority of global traders who operate in USD, EUR, or even emerging digital fiat corridors.

Third, the platform’s feature set is conspicuously barren; there is no futures market to hedge, no staking options to earn passive yields, and not a single NFT marketplace to explore the burgeoning digital collectibles sector.

Moreover, the liquidity pool appears either untracked or infinitesimally small, a red flag that could transform a modest purchase into a painful slippage nightmare during volatile market swings.

On the safety front, the glaring absence of a publicly audited proof‑of‑reserves audit leaves a dark cloud over custodial integrity, making it difficult for users to verify that the on‑chain balances truly match the ledger entries displayed on the site.

Community engagement is another casualty; with no active Reddit threads, Discord servers, or Telegram groups, newcomers are left to navigate the platform in isolation, without the safety net of peer guidance or timely support.

In contrast, the leading exchanges not only flaunt robust KYC/AML frameworks but also publish regular security audits, fostering a sense of trust that Daybit sorely lacks.

From a user‑experience perspective, the platform's lack of a mobile app further hampers accessibility, forcing traders to tether themselves to a desktop environment even when on the move.

Regulatory clarity is also murky; the exchange does not display any licensing information for South Korean authorities or any other jurisdiction, adding another layer of uncertainty for risk‑averse investors.

For those who are exceptionally price‑sensitive or who require advanced trading instruments, the opportunity cost of staying on Daybit outweighs any perceived convenience of a KRW‑only gateway.

In sum, while Daybit might serve as a footnote for an extremely localized trading strategy, the broader crypto community would do well to channel their capital toward platforms that champion transparency, competitive pricing, and a rich tapestry of features that empower both novice and seasoned traders alike.

Choosing a well‑established exchange not only safeguards your assets but also provides a fertile ground for learning, growth, and diversified exposure in the ever‑evolving digital asset landscape.

Fiona Lam

13 September, 2025 . 17:41 PM

Honestly, Daybit feels like a cheap knock‑off that tried to ride the crypto hype train but missed the station. It’s stuck in the past while everyone else is sprinting ahead with futures, staking, and slick mobile apps. If you want real action, look elsewhere.

OLAOLUWAPO SANDA

17 September, 2025 . 15:50 PM

Daybit is just a bad choice.

Sumedha Nag

21 September, 2025 . 14:00 PM

Even though many call out Daybit’s shortcomings, there’s a tiny slice of the market that appreciates a no‑frills spot‑only service, especially if they’re already comfortable with Korean banking channels. Still, the fee cliff makes it hard to recommend for anyone chasing efficiency.

Holly Harrar

25 September, 2025 . 12:09 PM

i hear ya, sumedha! daybit may be ok for some but those fees r sooo high, u know? better stick with a big exchange if u want smooth rides.

Vijay Kumar

29 September, 2025 . 10:18 AM

From a practical standpoint, the safest approach is to allocate only a modest test amount to Daybit, monitor the execution speed and fee deductions, and then transition to a more liquid venue once you’ve verified the platform’s reliability. This staged strategy mitigates risk while still allowing you to explore the KRW market if needed.

Edgardo Rodriguez

3 October, 2025 . 08:27 AM

Indeed; the methodology you propose-starting small, observing performance metrics, and subsequently reallocating assets-aligns perfectly with fundamental risk‑management principles; nevertheless, the elevated taker fees inherent to Daybit introduce an additional cost layer that may erode the marginal gains realized during the initial testing phase; thus, a rigorous cost‑benefit analysis becomes indispensable before committing even modest capital.

Moreover, continuous monitoring of order‑book depth and slippage is crucial; any significant deviation from expected fill rates should trigger an immediate reassessment of the platform’s suitability within your broader portfolio strategy.

mudassir khan

7 October, 2025 . 06:37 AM

While the aforementioned cautionary stance is commendably thorough, it fails to acknowledge the stark reality that an exchange devoid of transparent reserves and community support constitutes a systemic liability; consequently, any allocation-however nominal-constitutes an implicit endorsement of an opaque operational model, which, in my view, is unequivocally indefensible from a fiduciary perspective; investors would be well‑served to eschew such entities entirely.

In summary, Daybit’s structural deficiencies render it unsuitable for serious market participants seeking reliability, accountability, and competitive pricing.