Crypto Exchange Safety Checker

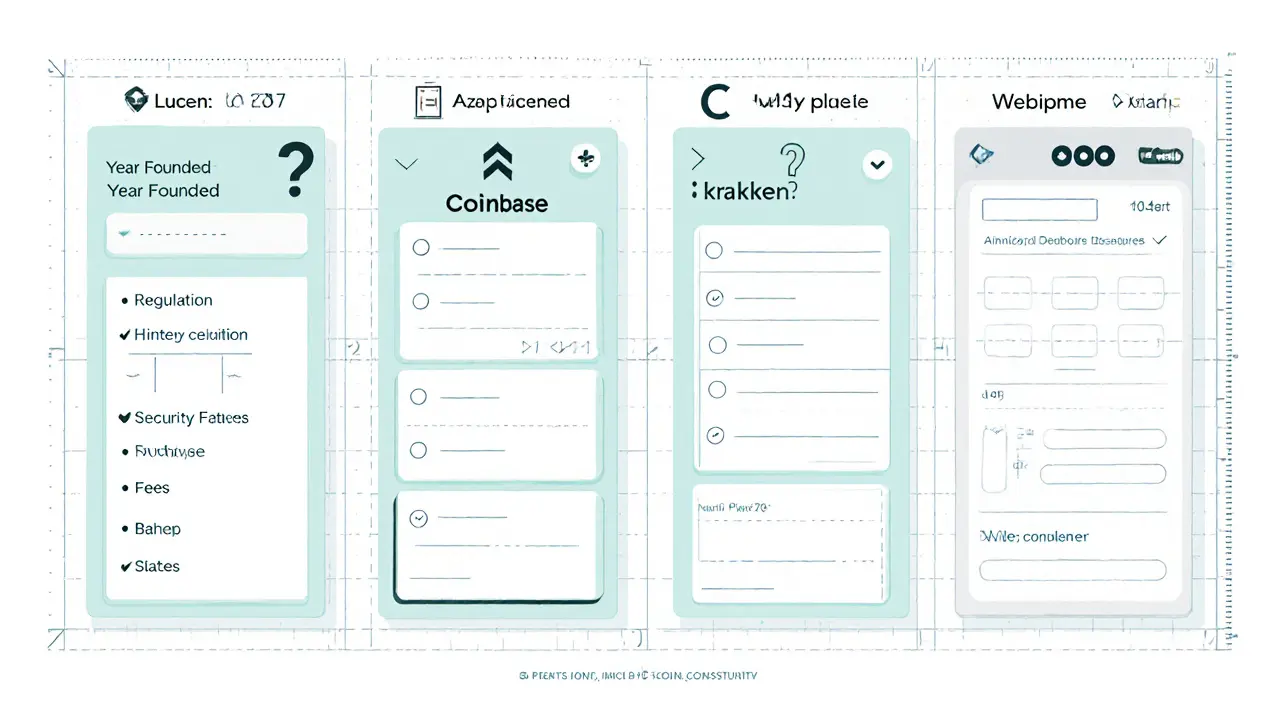

Comparison to Established Exchanges

| Criteria | Lucent | Binance | Coinbase |

|---|---|---|---|

| Regulation | N/A | Multiple licenses | US registered |

| Security | N/A | MFA, cold storage | MFA, insurance fund |

| Fees | Unclear | 0.10% maker/taker | 0.50% flat |

| Liquidity | N/A | $30B+ | $10B+ |

| Coins Supported | Not listed | 500+ | 200+ |

Quick Summary

- Lucent Crypto Exchange leaves almost no public trace; that silence raises serious concerns.

- Key safety criteria for any exchange include regulation, security tech, fee transparency, and liquidity.

- Compare Lucent (unknown) with Binance, Coinbase, and Kraken to see where it falls short.

- Use a step‑by‑step safety checklist before depositing any funds.

- If an exchange can’t prove its credentials, consider established alternatives.

When you hear the name Lucent Crypto Exchange is supposedly a digital platform for buying, selling, and swapping cryptocurrencies, the first thing most traders look for is trust signals. Unfortunately, a deep dive across industry reports, regulator lists, and popular exchange databases turns up almost nothing. That silence itself is a clue worth unpacking.

Lucent crypto exchange review may sound like a typical guide, but without concrete data the real review becomes a guide on how to evaluate any shady or unknown platform. Below we break down the most critical factors, give you a side‑by‑side comparison with major players, and hand you a practical checklist to stay safe.

What Is Lucent Crypto Exchange?

Aside from a handful of fleeting mentions, there is no verifiable record of a platform called Lucent operating under a registered corporate entity. No licensing body (such as the SEC, FCA, or MAS) lists it, and it does not appear on the CoinMarketCap exchange directory. This lack of visibility means you cannot confirm its headquarters, founding year, or leadership team - all standard pieces of information for legitimate services.

Why Absence of Information Is a Red Flag

In the crypto world, transparency is a safety net. Established exchanges publish whitepapers, audit reports, and contact details. When a platform hides these, it often signals one of three scenarios:

- It is brand‑new and hasn’t built a public profile yet.

- It operates under a different legal name, making it hard to trace.

- It deliberately shields itself to avoid regulatory scrutiny.

Given the industry’s history of scams, the third case is the most common.

Core Evaluation Criteria for Any Crypto Exchange

Before you trust any platform, run it through this checklist of must‑have attributes:

- Regulation and Licensing - Is the exchange registered with a financial authority?

- Security Architecture - Does it use multi‑factor authentication, cold storage, and regular audits?

- Fee Structure - Are trading, withdrawal, and deposit fees clearly disclosed?

- Liquidity - Can you execute large orders without huge price slippage?

- User Experience - Is the interface intuitive and is support responsive?

If any of these items are vague or missing, proceed with caution.

Security Features to Look For

Security is non‑negotiable. Here are the specific mechanisms that reputable exchanges implement:

- Multi‑Factor Authentication (MFA) - Combines passwords with a one‑time code or hardware token.

- Cold Storage - Stores the majority of user funds offline, away from hackers.

- Encryption Protocols - Uses TLS 1.3 for data in transit and AES‑256 for data at rest.

- Regular Security Audits - Independent firms examine code and infrastructure annually.

Lucent provides no public proof of any of these safeguards, while leading exchanges publish audit certificates on their sites.

Regulatory Compliance and KYC/AML

Legitimate platforms must follow Know‑Your‑Customer (KYC) and Anti‑Money‑Laundering (AML) rules. Look for statements like “registered with the Financial Conduct Authority (FCA) under registration number 12345” or “licensed by the New York State Department of Financial Services.” Without such disclosures, you risk being caught up in legal actions or losing access to your assets if authorities intervene.

Fees, Liquidity, and Trading Pairs

Transparency here builds trust. Exchanges usually list a fee schedule in a dedicated page and show real‑time order‑book depth. High fees can erode profits, while thin liquidity can cause slippage on even modest trades. For example, Binance charges 0.1% maker/taker fees, whereas an obscure platform might hide a 1% hidden charge.

Side‑by‑Side Comparison

| Attribute | Lucent (unknown) | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Year Founded | - | 2017 | 2012 | 2011 |

| Regulation | None publicly listed | Multiple licences (e.g., Malta, US) | US‑registered broker‑dealer | EU and US licences |

| Security Features | Not disclosed | MFA, cold storage, quarterly audits | MFA, insurance fund, SOC2 audit | MFA, cold storage, annual audit |

| Trading Fees | Unclear | 0.10% maker / 0.10% taker | 0.50% flat | 0.16% maker / 0.26% taker |

| Liquidity (24h volume) | - | $30B+ | $10B+ | $5B+ |

| Supported Coins | Not listed | 500+ | 200+ | 150+ |

The table makes it clear: Lucent fails to provide any verifiable data, while the competitors are fully transparent. That gap alone should influence your decision.

How to Protect Yourself with an Unknown Exchange

If you still feel drawn to try Lucent-perhaps due to a referral or a flashy advertisement-follow these protective steps:

- Start with the smallest possible deposit, preferably less than $100.

- Enable every security option the platform offers, even if it’s just email verification.

- Monitor the withdrawal process closely; if funds are held for days without explanation, pull out immediately.

- Keep records of all communications; this helps if you need to file a complaint.

- Consider using a hardware wallet for long‑term storage instead of keeping large balances on the exchange.

Remember, no amount of caution can fully offset the risk of a platform that refuses to publish basic company data.

Trusted Alternatives to Consider

Here are four well‑known exchanges that meet the security and compliance checklist:

- Binance - Best for low fees and a massive coin list.

- Coinbase - Ideal for beginners who want a regulated US broker.

- Kraken - Strong on security and offers futures trading.

- Gemini - Focuses on regulatory compliance and insurance coverage.

All of them publish audit reports, have clear KYC processes, and operate under recognized licences.

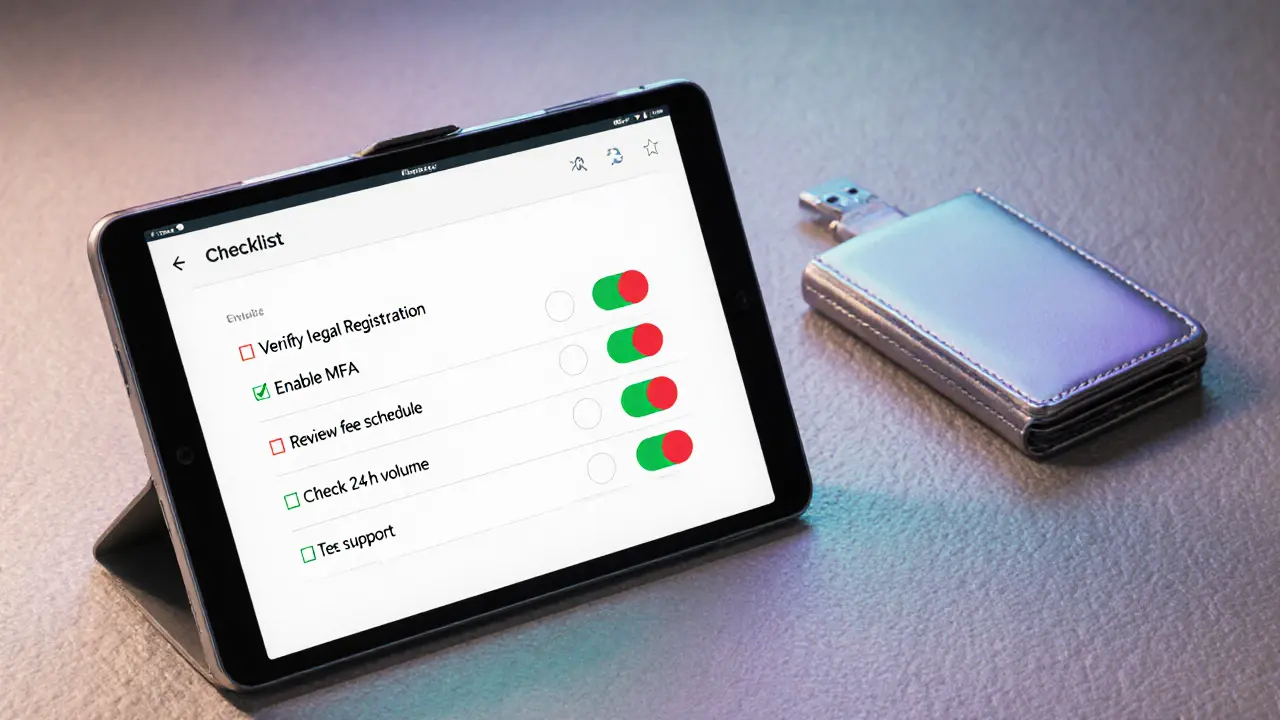

Quick Safety Checklist

- Verify the exchange’s legal registration.

- Check for MFA, cold storage, and audit certificates.

- Read the fee schedule before depositing.

- Confirm high 24‑hour trading volume for your chosen pairs.

- Test customer support with a real question.

If any item is missing, treat the platform as high‑risk.

Frequently Asked Questions

Is Lucent Crypto Exchange a legitimate platform?

There is no public record of Lucent being registered with any financial regulator, nor does it publish security or fee details. The lack of verifiable information makes it highly doubtful that it is a trustworthy exchange.

What security features should any crypto exchange provide?

Key features include multi‑factor authentication, cold storage for the majority of assets, end‑to‑end encryption (TLS1.3, AES‑256), and regular third‑party security audits. Exchanges that list these openly are generally safer.

How can I verify an exchange’s regulatory status?

Visit the regulator’s official website (e.g., FCA, SEC, MAS) and search the exchange’s name or registration number. Legitimate platforms proudly display their licence IDs on their “About” or “Compliance” pages.

What should I do if I’ve already deposited funds on an unknown exchange?

Immediately request a withdrawal of the full balance. Document every response, and if the platform stalls, consider filing a complaint with your local consumer protection agency or crypto‑asset recovery service.

Are there any red flags that indicate a scam exchange?

Common red flags include no licence information, vague or missing fee tables, lack of security details, no public office address, promises of guaranteed returns, and heavy reliance on “invite‑only” or referral programs.

VEL MURUGAN

13 October, 2025 . 08:19 AM

The absence of any regulatory registration is the single most glaring issue here. A legitimate exchange will proudly display its licence numbers, yet Lucent offers nothing. This silence is not a neutral gap; it is an active red flag that should scare off every prudent trader. In short, if you cannot verify who runs the platform, you cannot trust it.

Russel Sayson

21 October, 2025 . 10:46 AM

When you stare into the abyss of an unnamed exchange, the abyss stares back, demanding answers you will never get.

First, the regulatory vacuum is not a mysterious fog; it's a canyon of uncertainty that can swallow your capital whole.

Second, security architecture is a myth here-no MFA, no cold storage, no audit trails, just a promise that evaporates when the market dips.

Third, fee transparency is a joke; hidden charges are the silent thieves that loot unsuspecting users.

Fourth, liquidity is a phantom-without deep order books you will watch your trades slip away like sand through fingers.

The emotional toll of watching a promised platform crumble is comparable to a bad horror film that never ends.

Every seasoned trader knows that the first rule of crypto safety is “don’t trust what you cannot verify.”

Imagine depositing a modest sum, only to find withdrawals blocked for days while you scramble for support that never arrives.

This is not a rare anecdote; it is a pattern repeated across dozens of shadow exchanges that hide behind sleek UI designs.

The market has matured enough to demand accountability, and Lucent fails to meet even the most basic standards.

Regulators worldwide have issued warnings about entities that operate without licenses, urging users to stay clear-consider this your official warning.

Security audits are not optional; they are the backbone of trust, and their absence is a glaring omission that cannot be ignored.

Fee schedules should be transparent, listed in plain text, not buried in fine print that requires a microscope to decode.

Liquidity metrics are publicly available on sites like CoinGecko; if a platform cannot quote its 24‑hour volume, it is effectively invisible.

Finally, community support is the lifeline of any exchange; silence from customer service is a dead end that leaves users stranded.

Take these points, run your own checklist, and you will see that Lucent does not survive the scrutiny any reputable trader would demand.

Isabelle Graf

29 October, 2025 . 12:12 PM

If it can’t show a licence, stay away.

Shane Lunan

6 November, 2025 . 14:39 PM

Look, the thing about these ghost exchanges is they disappear the moment you need help – no support, no transparency, just a slick website that promises the moon.

Jeff Moric

14 November, 2025 . 17:06 PM

For anyone feeling uneasy, the best move is to run the exchange through a simple safety checklist: verify registration, confirm MFA and cold storage, read the fee page, check 24‑hour volume, and ping the support team with a real question. If any step falls short, treat the platform as high‑risk and consider an established alternative.

Kevin Duffy

21 November, 2025 . 15:46 PM

Good vibes only! 😊 Start tiny, keep an eye on withdrawals, and always have a hardware wallet ready for the big stash. 🌟

Tayla Williams

28 November, 2025 . 14:26 PM

Whilst the author presents a thorough analysis, it could benefet from citing specific regulatory registries and providing direct links to audit reports; such details would augment credibilty and ease verification for the readership.

Brian Elliot

5 December, 2025 . 13:06 PM

The withdrawal success rate on this platform remains undocumented, making it difficult to gauge real‑world risk.

Marques Validus

12 December, 2025 . 11:46 AM

Yo the whole thing reeks of a smoke‑and‑mirrors playbook – no KYC, zero audit trails, just hype‑driven tokenomics that sound slick but crumble under any market stress.

Mitch Graci

19 December, 2025 . 10:26 AM

Wow!!! Another “no‑regulation” exchange??!!! Who would *ever* trust such a pristine example of financial irresponsibility??? 😂

Mandy Hawks

26 December, 2025 . 09:06 AM

In the grand tapestry of digital finance, anonymity can be both a shield and a sword; when the shield hides nothing, the sword inevitably turns on its wielder.

Scott G

2 January, 2026 . 07:46 AM

The absence of verifiable licensing information, coupled with undisclosed security protocols, constitutes a breach of the fundamental fiduciary expectations that any reputable exchange must uphold.

Millsaps Crista

9 January, 2026 . 06:26 AM

Bottom line: do the homework, stick to exchanges that publish every detail, and never gamble your savings on a platform that refuses to lift the veil – your future self will thank you.