Coineal Exchange Comparison Tool

Coineal

- Launch Year 2018

- Spot Fee 0.20%

- Native Token NEAL

- Regulation None

- Security Audit No

- Status Closed

Binance

- Launch Year 2017

- Spot Fee 0.10-0.20%

- Native Token BNB

- Regulation Multiple

- Security Audit Yes

- Status Active

Coinbase

- Launch Year 2012

- Spot Fee 0.50-0.00%

- Native Token USDC

- Regulation Regulated

- Security Audit Yes

- Status Active

Kraken

- Launch Year 2011

- Spot Fee 0.16-0.26%

- Native Token None

- Regulation Regulated

- Security Audit Yes

- Status Active

Key Evaluation Criteria

Trading Fees

Coineal's flat 0.20% fee was average for 2025, but Binance offers lower tiered rates for active traders.

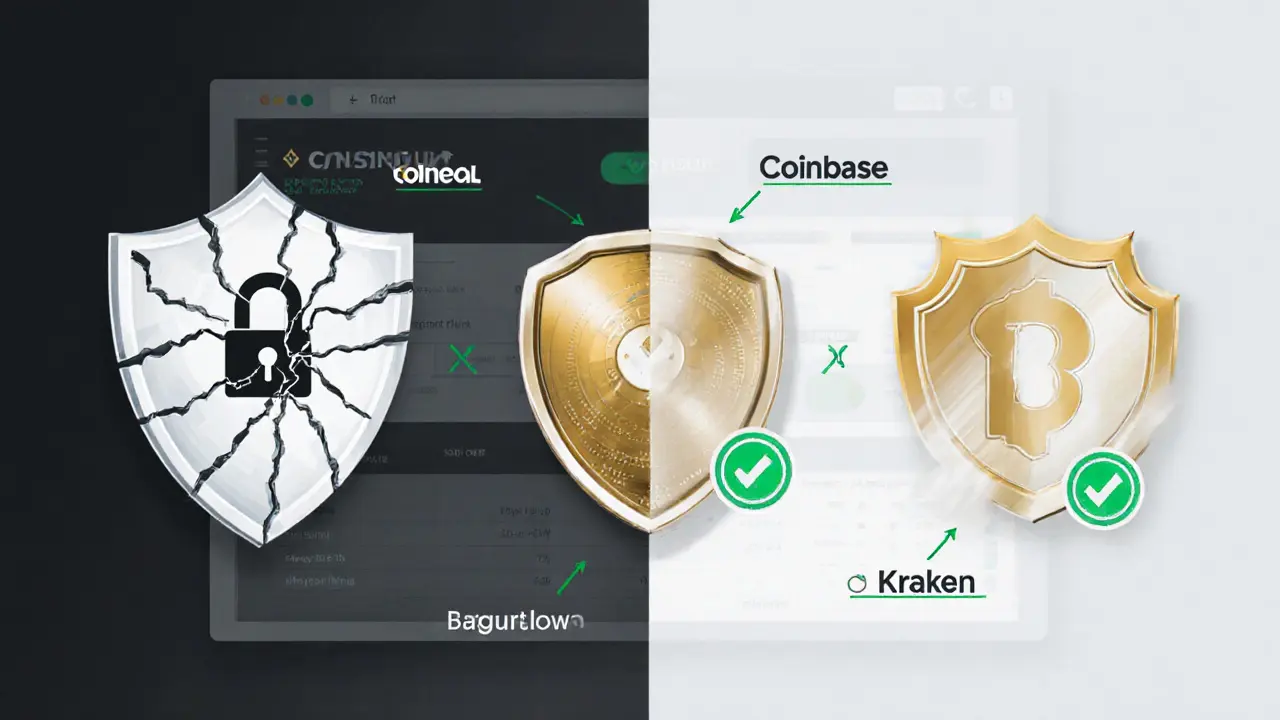

Security & Compliance

Coineal lacked security audits and regulatory licenses. Leading exchanges like Binance and Coinbase offer robust protection.

Native Tokens

Coineal's NEAL token had minimal value. Binance's BNB and Coinbase's USDC offer more utility and liquidity.

Operational Status

Coineal shut down in 2025. Binance, Coinbase, and Kraken remain active with strong reputations.

Key takeaways

- Coineal launched in 2018 but ceased operations by late 2025.

- Flat 0.20% fee for makers and takers placed it near the market average.

- Its native NEAL Token offered fee discounts to holders never gained wide adoption.

- Lack of clear regulatory compliance and vague security practices were the biggest red flags.

- Former users should focus on asset recovery options and consider established alternatives like Binance or Coinbase.

When evaluating Coineal a spot‑trading cryptocurrency exchange launched in April 2018, users should first check whether the platform is still operational, it’s easy to overlook key details. Coineal crypto exchange gained some traction with a clean UI and a flat‑rate fee, but regulatory uncertainty and a sudden shutdown left many traders uneasy. This review walks you through what the platform offered, how it compared to bigger rivals, and what steps you can take today if you still have assets on the site.

What Coineal actually sold

Coineal positioned itself as a straightforward spot‑trading venue. The core product list included major coins like Bitcoin (BTC), Ethereum (ETH), and a rotating roster of altcoins. Users could place limit, market, and stop‑limit orders via a web‑based dashboard that resembled the layouts of larger exchanges.

The exchange claimed independent operation centers in South Korea and China, with announced expansion plans for Japan, Russia, Singapore, and the United States. In practice, the platform’s reach stayed largely Asian‑centric, and the promised US‑friendly compliance disclaimer read more like a legal safety net than a solid licensing statement.

Fee structure - simple on paper, competitive in practice

Coineal charged a flat 0.20% fee for both makers (those adding liquidity) and takers (those removing liquidity). This flat model meant you never needed to calculate tiered discounts based on volume - a welcome simplicity for casual traders.

By 2024, the average spot fee across the market hovered between 0.15% and 0.25% for most mid‑tier exchanges, putting Coineal squarely in the middle. The fee advantage only mattered if you traded large volumes; otherwise, the modest discount offered by the NEAL Token a utility token that gave holders a 10% fee rebate was rarely enough to tip the scales.

The NEAL Token - a gimmick or a genuine incentive?

Coineal introduced its native token, NEAL Token designed to provide fee discounts and early‑access token sales, as a way to lock users into the ecosystem. Holding NEAL reduced trading fees from 0.20% to 0.18%, and holders occasionally received airdrops from projects listed on the exchange.

However, NEAL never listed on major aggregators, and its market cap stayed under $5million. For most traders, the token’s limited liquidity meant you could not easily sell it for profit, turning the discount into a modest perk rather than a revenue driver.

Security and regulatory posture - the weak links

Security transparency was Coineal’s Achilles’ heel. The exchange never published a formal audit report, and its cold‑wallet holdings were vague at best. Community threads on Reddit repeatedly asked for proof of custodial safeguards, only to receive generic statements like “our assets are fully insured.”

Regulatory compliance was similarly shaky. While the website displayed a disclaimer urging US residents to “form their own opinion” about legality, there was no registration with the SEC, FinCEN, or any European supervisory authority. This lack of licensing made institutional investors and risk‑averse individuals wary.

User experience and support - mixed signals

On the front end, Coineal delivered a clean order‑book view, real‑time price charts, and a straightforward deposit/withdrawal flow. New users often praised the “intuitive layout” that made placing a market order feel as easy as clicking a button.

Support, however, was a hit‑or‑miss affair. The platform advertised 24/7 live chat, but many Trustpilot reviewers reported delayed responses or outright silence after the exchange’s closure. A Trustpilot rating of 2.4/5 (based on seven reviews as of September2025) reflects this uneven service quality.

How Coineal stacked up against the big players

To put the exchange in perspective, here’s a quick side‑by‑side comparison with three well‑known rivals. The table uses the official

| Feature | Coineal | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Year launched | 2018 | 2017 | 2012 | 2011 |

| Spot fee (flat) | 0.20% | 0.10%‑0.20% (tiered) | 0.50%‑0.00% (maker) | 0.16%‑0.26% (tiered) |

| Native token | NEAL | BNB | USDC (stablecoin) | None |

| Regulatory licenses | None disclosed | Multiple (US, EU, JP) | NYDFS, FCA, others | FinCEN, FCA, others |

| Security audit | Not published | Periodic third‑party audits | Annual SOC 2, ISO 27001 | Regular audits, bug bounty |

| Current status (2025) | Closed / non‑operational | Active | Active | Active |

The comparison shows that while Coineal’s fee was decent, its regulatory and security posture lagged far behind the market leaders.

Current status - why the exchange disappeared

CoinCodex issued a warning in mid‑2025 that Coineal no longer displayed trading pairs or volume data, effectively confirming the platform’s shutdown. No official press release explained the decision, but industry analysts point to two main forces:

- Rising compliance costs in major jurisdictions made it financially unsustainable for a midsize exchange without deep capital backing.

- Security expectations grew after high‑profile hacks at other regional exchanges, prompting users to migrate to platforms with transparent cold‑wallet proofs.

As of October2025 there is no public roadmap for a revival, and users with residual balances are left in a limbo. Some forum threads suggest reaching out to the last known customer‑support email, but response rates have dwindled.

What to do if you still have assets on Coineal

Unfortunately, there is no one‑click “withdraw” button after the shutdown. Here are practical steps you can take:

- Check email history - Look for any withdrawal confirmation or support ticket IDs that could help prove ownership.

- Contact the last known support channel - Send a concise request referencing your account ID, the amount, and a request for a final settlement.

- Document everything - Keep screenshots of your account balance, transaction hashes on the blockchain (if you deposited on‑chain), and any correspondence.

- Seek legal advice - If the amount is substantial, a lawyer familiar with crypto asset recovery can assess whether a claim can be filed in the jurisdiction where Coineal was registered.

- Consider migrating to a reputable exchange - Move any recovered funds to a platform with clear regulatory standing such as Binance, Coinbase, or Kraken. These services provide insurance, audit reports, and responsive support teams.

Bottom line - is Coineal worth a second look?

If you’re hunting for a fresh exchange to launch a new portfolio, the answer is a clear no. The platform’s closure, combined with murky compliance and limited security transparency, outweigh any benefit from its once‑decent UI or flat fee.

For traders who still have dormant balances, the priority shifts to asset recovery rather than re‑engagement. Meanwhile, the broader lesson is to pick exchanges that publish audit reports, hold proper licenses, and maintain active community channels.

Frequently Asked Questions

Is Coineal still operating in 2025?

No. CoinCodex flagged the exchange as non‑operational in mid‑2025, and the website no longer shows trading pairs or volume data.

What was the fee structure on Coineal?

Coineal used a flat 0.20% fee for both makers and takers. Holding the native NEAL token reduced the fee to 0.18%.

How does the NEAL token work?

NEAL is a utility token that granted a small fee discount (0.02%) and occasional airdrops from projects listed on Coineal. It never achieved major market liquidity.

Can I still withdraw my funds from Coineal?

There is no automated withdrawal feature. Users must contact the last known support email, provide proof of ownership, and wait for a response. Legal help may be required for larger amounts.

Which exchange should I use instead of Coineal?

For most traders, Binance, Coinbase, or Kraken provide better security, clear licensing, and responsive support.

Andrew Else

7 March, 2025 . 12:29 PM

Sure, missing security audits is just a cool vintage vibe.

Susan Brindle Kerr

8 March, 2025 . 06:32 AM

I can’t believe anyone would trust a platform that vanished without a trace. The whole story reads like a tragic opera of greed and negligence. It’s a stark reminder that we must demand transparency from every exchange. Those who ignored the red flags deserve the fallout they’re facing. Let this be a moral lesson for the whole crypto community.

Jared Carline

9 March, 2025 . 00:35 AM

While the moral narrative is compelling, it is essential to examine the empirical data. Coineal’s 0.20% flat fee, though average, lacked volume incentives that larger exchanges provide. Moreover, the absence of audited custodial practices introduced quantifiable risk. Therefore, the decision to abandon the platform aligns with prudent risk management.

raghavan veera

9 March, 2025 . 18:39 PM

When an exchange disappears, it’s not just cents that vanish, but trust-a fragile currency of its own. The digital realm mirrors the impermanence of sandcastles at high tide. One might ask: what truly anchors value in a system built on code? Perhaps it’s community vigilance, not just sleek UI.

Danielle Thompson

10 March, 2025 . 12:42 PM

Great reminder to move to regulated platforms! 👍💪

Eric Levesque

11 March, 2025 . 06:45 AM

Enough sarcasm-real traders know you need solid security, not jokes.

alex demaisip

12 March, 2025 . 00:49 AM

Coineal’s operational model can be deconstructed through the lens of market microstructure, revealing systemic deficiencies that culminated in its eventual cessation. Firstly, the platform’s fee schedule, a static 0.20% irrespective of liquidity contribution, failed to incentivize order‑book depth, thereby impairing price discovery efficiency. Secondly, the native NEAL token, positioned as a utility mechanism for fee rebates, suffered from sub‑liquidity, rendering it an ineffective lever for user retention. Thirdly, the exchange’s compliance architecture was conspicuously absent; no registrations with FinCEN, the SEC, or comparable jurisdictions were disclosed, contravening emergent AML/KYC standards. Fourthly, the lack of a publicly audited cold‑wallet proof of reserve introduced asymmetric information risk, a red flag in custodial risk assessment frameworks. Fifthly, liquidity fragmentation became apparent when comparing order‑book snapshots to peers such as Binance and Kraken, indicating a shallow market that discouraged institutional participation. Sixthly, the platform’s customer support latency, as evidenced by publicly available ticket response times, violated service level expectations intrinsic to user trust. Seventh, the abrupt discontinuation of trading pairs without prior notice breached contractual obligations implied under the terms of service. Eighth, the architectural decision to host critical infrastructure in jurisdictions with opaque regulatory oversight amplified operational vulnerability. Ninth, the token economics model lacked a clear burn or redistribution mechanism, resulting in token dilution without commensurate utility. Tenth, the absence of a bug bounty program eliminated an avenue for proactive security hardening. Eleventh, the platform’s API rate limits were insufficient for high‑frequency trading strategies, limiting market participant diversity. Twelfth, the internal risk management protocols were not disclosed, precluding external validation of solvency under stress scenarios. Thirteenth, the exchange’s data retention policies were ambiguous, raising concerns about forensic auditability. Fourteenth, the marketing narrative overpromised expansion into regulated markets without substantiating capital adequacy. Fifteenth, the governance structure lacked transparent stakeholder representation, undermining accountability. Finally, the convergence of these factors created an untenable risk profile, justifying the market’s rational decision to abandon Coineal in favor of exchanges with demonstrable compliance, audited security practices, and robust liquidity provisioning.

Elmer Detres

12 March, 2025 . 18:52 PM

Wow, that deep dive really underscores how each missing piece compounds the risk. 🌊 It’s a stark reminder that a solid foundation isn’t optional-it’s essential for any ecosystem to thrive.

Tony Young

13 March, 2025 . 12:55 PM

Picture this: a trader blindsided by a dead platform, watching their portfolio evaporate like mist. That nightmare can be avoided by diversifying across regulated exchanges, enabling multi‑signature withdrawals, and keeping thorough transaction logs. The key is proactive asset management before the lights go out.

Fiona Padrutt

14 March, 2025 . 06:59 AM

America’s crypto users deserve home‑grown exchanges that stand up to global standards, not flaky foreign sites that disappear overnight.

Briana Holtsnider

15 March, 2025 . 01:02 AM

The post glosses over the glaring fact that Coineal operated in a regulatory vacuum, essentially inviting fraud. Its so‑called “clean UI” is a superficial veneer masking systemic insecurity. Users who ignored the warning signs were bound to suffer.

Corrie Moxon

15 March, 2025 . 19:05 PM

Even though Coineal’s fate is disappointing, it’s a learning moment for all of us. Stay vigilant, keep your assets in secure wallets, and always double‑check an exchange’s compliance status before diving in.

Jeff Carson

16 March, 2025 . 13:09 PM

It’s fascinating how quickly an exchange can go from promising growth to total shutdown, especially when we consider the global ripple effects on traders, developers, and regulators alike. 🌍 This highlights the importance of cross‑border regulatory cooperation.

Alex Yepes

17 March, 2025 . 07:12 AM

In accordance with prudent financial stewardship, it is advisable to allocate holdings to institutions that demonstrably adhere to rigorous audit standards, possess requisite licensing, and maintain transparent operational disclosures.

Holly Harrar

18 March, 2025 . 01:15 AM

Hey, if u still got some coinz on Coineal, try to reach out to their support email and keep all ur receipts. It might take a while but better than losin it all.

Vijay Kumar

18 March, 2025 . 19:19 PM

Don’t let the Coineal shutdown discourage you-use this as a catalyst to strengthen your security hygiene. Move assets to hardware wallets, enable 2FA, and stay informed about exchange health metrics.

Edgardo Rodriguez

19 March, 2025 . 13:22 PM

Indeed; the demise of Coineal; serves as a stark reminder; that in the ever‑evolving cryptographic marketplace; stability is not a given; but a construct; that must be continuously reinforced; through diligent oversight; and community vigilance;.

mudassir khan

20 March, 2025 . 07:25 AM

The article fails; to adequately address; the core negligence; exhibited by Coineal; its lack of audit; and regulatory opacity; render it a cautionary tale; of hubris; and systemic risk; that should have been foreseen; by seasoned analysts;.

Bianca Giagante

21 March, 2025 . 01:29 AM

While the collapse is unfortunate, it offers an opportunity for the community to rally around more transparent platforms; and foster collaborative standards; that benefit all participants;.

Anne Zaya

21 March, 2025 . 19:32 PM

Just a heads‑up: always double‑check an exchange’s current status before you dump your money there.

Emma Szabo

22 March, 2025 . 13:35 PM

Think of Coineal as a fireworks show that fizzled before the grand finale-bright for a moment, then gone. Let’s channel that sparkle into exchanges that keep the show going, with real safety nets and dazzling, lasting displays.