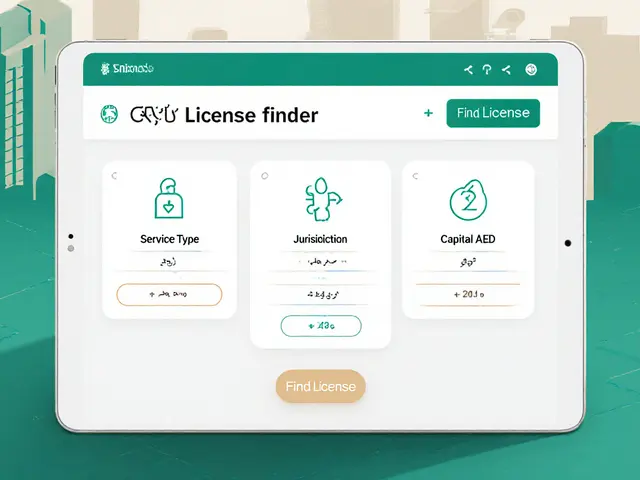

VASP License Calculator

License Requirements

Minimum Paid-Up Capital: ₦500,000,000 (~$325,000 USD)

Physical Office: Required in Nigeria

Resident Director: Must be a Nigerian citizen or permanent resident

AML/KYC Compliance: Must meet SEC and CBN standards

Documentation Needed

- Incorporation papers from CAC

- Audited financial statements

- Business model and risk management policies

- AML/KYC program documentation

- Technology risk management plan

- Seven-year record-keeping plan

License Options

Your Results

Crypto startups eyeing Nigeria’s massive market quickly learn that operating without a licence is a dead‑end. Since the 2025 Investments and Securities Act, the Securities and Exchange Commission (SEC Nigeria’s securities regulator that now oversees virtual assets) has made a full‑blown VASP licence mandatory for any service dealing with digital tokens, wallets or payments.

What does the process actually look like? Which paperwork will make you sweat? And can you shortcut the wait with the Accelerated Regulatory Incubation Program (ARIP a fast‑track licensing scheme for crypto firms)? Below you’ll find a plain‑English roadmap that takes you from idea to a legally recognised crypto business in Nigeria.

Key Takeaways

- Minimum paid‑up capital: N500,000,000 (≈$325k USD).

- You need a physical office and a resident director.

- Two licensing tracks: standard registration or the 12‑month ARIP incubation.

- AML/KYC records must be kept for at least seven years.

- Compliance costs are high, but a licence unlocks banking services and consumer trust.

Why Nigeria’s VASP Licence Matters

Before 2025, crypto firms operated in a gray zone, using peer‑to‑peer platforms and avoiding the Central Bank’s ban on banking services. The SEC’s new framework flips the script: virtual assets are now treated as securities, putting every exchange, wallet provider and token issuer under strict supervision. The result? Legitimate firms can finally open corporate bank accounts, attract institutional investors, and advertise with confidence, while regulators gain a clear line of sight into the market.

Core Eligibility Checklist

Before you even fill out the first form, make sure your business ticks these boxes:

- Incorporated with the CAC Corporate Affairs Commission, Nigeria’s company registrar as a limited liability company.

- Paid‑up capital of at least N500,000,000.

- Physical office space in Nigeria, managed by a director who lives in the country.

- Audited financial statements (or CPA‑prepared statements of affairs for brand‑new entities).

- Robust AML/KYC program that meets both SEC and CBN Central Bank of Nigeria, which sets financial‑service standards guidelines.

Standard Registration Process

The traditional route is thorough but predictable. Here’s how it unfolds:

- Prepare documentation. Gather incorporation papers, audited statements, a detailed business model, risk‑management policies, and a seven‑year record‑keeping plan.

- Submit the application. Upload everything to the SEC’s online portal and pay the non‑refundable fee (≈N10,000,000).

- SEC review. The regulator screens your capital, tech infrastructure, and AML/KYC controls. Expect a 60‑day turnaround.

- On‑site inspection. An SEC officer will visit your Nigerian office to verify physical presence and interview the resident director.

- License issuance. Once approved, you receive a VASP licence valid for three years, renewable upon review.

During the review, the SEC may ask for additional evidence-extra cybersecurity audits, letters of no objection from other regulators, or updated financial projections. Be ready to respond within 14 days to avoid delays.

Accelerated Regulatory Incubation Program (ARIP)

If you need to start operations fast, ARIP is the shortcut. It’s not a free pass; you still meet the core capital and office rules, but you get provisional approval after a lighter initial screening.

| Aspect | Standard Registration | ARIP (Incubation) |

|---|---|---|

| Initial approval time | ~60 days | ~30 days (pre‑approval) |

| Full documentation required up‑front | All required | Core docs only; detailed plans submitted later |

| Capital lock‑in | N500M fully paid | N500M pledged, can be released after 12‑month exit |

| Office & resident director | Mandatory | Mandatory |

| Program length | 3‑year licence term (renewable) | 12‑month incubation, then full licence or exit |

| Typical use case | Established firms, high‑risk services | Start‑ups, innovative token projects, pilot‑phase services |

Steps for ARIP:

- File a concise application stating your business model and confirming the core eligibility criteria.

- Sign a sworn undertaking to comply with SEC rules and to submit quarterly progress reports.

- Begin operating under SEC supervision-limited to activities outlined in the provisional approval.

- At month10, the SEC reviews your performance and decides whether you graduate to a full licence.

- If successful, you complete the remaining documentation and receive a standard three‑year VASP licence. If not, you must either cease operations or re‑apply after remedial changes.

ARIP is attractive for startups that need market traction quickly, but remember the 12‑month window is strict-miss a reporting deadline and you could lose the provisional status.

Deep‑Dive into Compliance Requirements

Getting the licence is only half the battle; staying compliant costs time and money. Below are the non‑negotiable pillars:

Anti‑Money‑Laundering (AML) & Know‑Your‑Customer (KYC)

- Identity verification must include government‑issued ID, facial verification, and proof of address.

- Enhanced due‑diligence for politically exposed persons (PEPs) and high‑value transactions (>N5million).

- Transaction monitoring system that flags unusual patterns and generates SARs (Suspicious Activity Reports) to the Financial Intelligence Unit (FIU).

- All records-customer data, transaction logs, communication-must be retained for at least seven years in a secure, auditable format.

Technology Risk Management

The SEC’s tech‑risk guidelines mirror global best practices. Your platform should have:

- Multi‑factor authentication for admin and user accounts.

- Cold‑storage for at least 80% of custodial assets, with geographically dispersed vaults.

- Regular penetration testing (at least quarterly) and a documented incident‑response plan.

- Data‑encryption at rest and in transit, compliant with Nigeria’s Data Protection Regulation (NDPR).

Financial Reporting & Taxation

Every VASP must register with the Federal Inland Revenue Service (FIRS) and submit:

- Annual audited financial statements.

- Quarterly VAT returns (if applicable).

- Monthly transaction summaries to the SEC’s compliance portal.

Common Pitfalls and How to Avoid Them

Many firms stumble on the same avoidable mistakes:

- Underestimating capital. The N500M requirement is a hard floor-any shortfall leads to immediate rejection.

- Missing the resident director. Appoint a local executive early; you cannot substitute a foreign manager later.

- Incomplete AML policies. Use a vetted KYC provider and retain all audit logs; regulators will ask for screenshots during inspections.

- Ignoring the SEC’s tech checklist. Run a pre‑audit with a cybersecurity firm familiar with Nigerian regulations to catch gaps before the on‑site visit.

- Delaying quarterly reports. Set automated reminders; a missed deadline can trigger a licence suspension.

Strategic Benefits of a VASP Licence

Beyond legality, a licence offers tangible advantages:

- Banking access. Licensed firms can open corporate accounts, obtain credit lines, and settle fiat payments with local banks.

- Investor confidence. Institutional investors only fund entities that can prove regulatory compliance.

- Market differentiation. In a crowded peer‑to‑peer scene, a licence signals trustworthiness to end‑users.

- Potential tax incentives. The Nigerian government has hinted at reduced tax rates for compliant fintech firms.

Next Steps for Your Crypto Business

Ready to start? Follow this quick checklist:

- Incorporate with the CAC and open a Nigerian bank account for the paid‑up capital.

- Hire a qualified resident director and secure a physical office (co‑working space works if it meets SEC standards).

- Develop AML/KYC SOPs and engage a certified compliance vendor.

- Choose between standard registration or ARIP based on your timeline and budget.

- Prepare the full documentation packet and submit via the SEC portal.

- Set up internal compliance monitoring to handle quarterly reporting from day1.

By ticking these boxes, you’ll be on a clear path to a fully licensed crypto operation in Nigeria.

Frequently Asked Questions

What is a VASP licence and who needs it?

A VASP (Virtual Asset Service Provider) licence is a legal authorisation issued by Nigeria’s SEC that allows a company to offer services such as crypto exchange, wallet custody, token issuance, mining, staking or crypto‑based payments. Any business that deals with virtual assets for customers must hold this licence under the 2025 Investments and Securities Act.

How much capital do I need to provide?

The SEC requires a minimum paid‑up capital of N500,000,000 (about $325,000USD). This amount must be fully funded before the licence is granted and remains locked as a financial safety net.

Can a foreign crypto exchange operate in Nigeria without a local office?

No. The SEC mandates a physical office and a resident director for every VASP applicant. Remote‑only models are not accepted, unlike some jurisdictions that allow purely virtual operations.

What’s the difference between the standard licence and ARIP?

Standard registration requires the full documentation set up front and takes roughly 60days for review. ARIP grants a provisional approval after a streamlined submission, letting you start limited operations while you finish the detailed paperwork over a 12‑month incubation period.

How long do I have to keep customer records?

The SEC and FATF standards require that all customer identification data, transaction logs and communications be retained for at least seven years in a secure, auditable format.

Holly Harrar

18 March, 2025 . 10:18 AM

Hey folks, just a heads‑up – the SEC really checks the AML/KYC policy depth, so make sure you’ve got a solid risk‑scoring matrix and keep all the ID docs on a secured server. A quick tip: run a mock audit with a compliance consultant before you hit “submit”.

Vijay Kumar

21 March, 2025 . 04:18 AM

Yo team! If you’re itching to get rolling, the ARIP route can shave off a month, but remember you still need that resident director on the ground. Grab a co‑working space that meets SEC criteria and you’ll be good to go – trade that paperwork for some real‑world traction!

Edgardo Rodriguez

23 March, 2025 . 22:18 PM

The process of obtaining a VASP licence in Nigeria is, in essence, a microcosm of regulatory evolution; it mirrors the global shift toward recognising digital assets as bona fide securities. First, one must appreciate the historical context – prior to 2025, crypto firms operated in a legal twilight, much like shadows at dusk. Second, the SEC’s mandate imposes a concrete framework, demanding capital, physical presence, and rigorous AML/KYC protocols. Third, the capital requirement of N500 million functions as both a safety net and a signal of seriousness to investors. Fourth, the resident director clause ensures local accountability, anchoring the enterprise within Nigerian jurisdiction. Fifth, the documentation checklist – incorporation papers, audited statements, risk‑management policies – is exhaustive, reflecting the regulator’s desire for transparency. Sixth, the dichotomy between standard registration and ARIP offers strategic choices, each with its own temporal horizon. Seventh, the ARIP’s provisional approval after merely thirty days is reminiscent of an incubator model, encouraging innovation while maintaining oversight. Eighth, the on‑site inspection serves as a tangible verification, a ritualistic rite of passage for fintech startups. Ninth, the seven‑year record‑keeping mandate aligns with FATF standards, underscoring the global nature of anti‑money‑laundering efforts. Tenth, the technology risk management guidelines – multi‑factor authentication, cold storage, penetration testing – are non‑negotiable in a threat‑rich environment. Eleventh, compliance is not a one‑off event; quarterly reports and continuous monitoring embed vigilance into daily operations. Twelfth, the benefits of a licence extend beyond legality, unlocking banking relationships and institutional capital. Thirteenth, the strategic use of a co‑working office can satisfy the physical presence clause without excessive overhead. Fourteenth, early engagement with a legal counsel familiar with SEC procedures can preempt costly delays. Fifteenth, ultimately, the VASP licence is a gateway, transforming a visionary crypto project into a regulated entity capable of thriving within Nigeria’s burgeoning digital economy.

mudassir khan

26 March, 2025 . 16:18 PM

While the guide is exhaustive, it glosses over the palpable bureaucracy that plagues the SEC’s review; the purported 60‑day timeline is, in practice, a best‑case scenario, and many applicants endure protracted delays, sometimes extending beyond ninety days. Moreover, the capital lock‑in requirement, although presented as a safeguard, effectively marginalises nascent startups lacking deep pockets. The insistence on a resident director, while ostensibly ensuring local accountability, often forces founders to appoint nominal figures, thereby compromising governance integrity. Additionally, the documentation checklist fails to address the nuanced challenges of integrating legacy banking APIs with emerging blockchain protocols. Consequently, the roadmap, though well‑structured, remains idealistic, and prospective applicants should brace for unforeseen obstacles beyond the outlined steps.

Bianca Giagante

29 March, 2025 . 10:18 AM

It is commendable that the article delineates both licensing pathways, offering startups a clear choice between the standard process and the ARIP incubator; this duality accommodates varying risk appetites and operational timelines. Nevertheless, readers would benefit from a deeper exploration of the post‑licence compliance burden, particularly the frequency and granularity of SEC reporting requirements. Providing concrete examples of acceptable AML/KYC frameworks could further demystify the preparatory phase. Overall, the guide serves as a solid foundation, yet supplementary case studies would enhance its practical utility.

Danielle Thompson

1 April, 2025 . 05:18 AM

Great summary – very useful! 😊

Eric Levesque

3 April, 2025 . 23:18 PM

The SEC’s standards are there for a reason; without that capital safety net, the whole ecosystem could collapse under fraud.

alex demaisip

6 April, 2025 . 17:18 PM

From a jurisprudential standpoint, while the exposition enumerates procedural milestones, it neglects to address the statutory interpretive ambiguities inherent in the 2025 Investments and Securities Act, particularly concerning the delineation between “virtual asset” and “digital token” classifications, which could precipitate divergent regulatory outcomes.

Elmer Detres

9 April, 2025 . 11:18 AM

Absolutely, the ARIP’s rapid track can be a game‑changer for bootstrapped teams – just make sure you lock down that director and keep those quarterly reports tight. 🚀📊

Tony Young

12 April, 2025 . 05:18 AM

Picture this: you’ve just filed the AML/KYC dossier, and the SEC’s portal lights up with a green “Received” – that moment feels like crossing the finish line of a marathon, and the real race – compliance – is just beginning.

Fiona Padrutt

14 April, 2025 . 23:18 PM

We need more local talent in these crypto firms, otherwise Nigeria’s market will be dominated by outsiders, and that’s not good for our economy.

Briana Holtsnider

17 April, 2025 . 17:18 PM

Honestly, most of these requirements feel like a gate‑keeping exercise designed to keep smaller innovators out; it’s a classic case of regulation stifling progress.

Corrie Moxon

20 April, 2025 . 11:18 AM

Keep your head up, team! Even with the heavy paperwork, securing a licence opens doors to banks and investors – worth every ounce of effort.

Jeff Carson

23 April, 2025 . 05:18 AM

Interesting breakdown! I’m curious, how many startups have actually completed the ARIP path successfully so far?

Anne Zaya

25 April, 2025 . 23:18 PM

Nice guide – definitely helpful for anyone thinking about diving into the Nigerian crypto scene.

Emma Szabo

28 April, 2025 . 17:18 PM

The VASP licence is like a golden ticket – it turns a humble crypto hustle into a polished, trustworthy venture, ready to dance with banks and charm investors alike.

Fiona Lam

1 May, 2025 . 11:18 AM

Stop whining about the paperwork – if you can’t handle a few forms, you’re not cut out for the crypto game.

OLAOLUWAPO SANDA

4 May, 2025 . 05:18 AM

All this hype about licenses is just a distraction; real value comes from community adoption, not paperwork.

Alex Yepes

6 May, 2025 . 23:18 PM

It is imperative for prospective VASP applicants to allocate sufficient resources toward comprehensive compliance frameworks, as failure to do so may result in regulatory sanctions, financial penalties, or revocation of the licence, thereby jeopardizing operational continuity.

Sumedha Nag

9 May, 2025 . 17:18 PM

Honestly, the whole licensing circus feels like a bureaucratic nightmare, but if you pull it off, the payoff can be massive.

Andrew Else

12 May, 2025 . 11:18 AM

Oh great, another mountain of forms to fill out. 🙄

Susan Brindle Kerr

15 May, 2025 . 05:18 AM

Behold, the labyrinth of regulation! Only the bold may emerge, bearing the laurels of legitimacy in a realm where chaos once reigned.

Jared Carline

17 May, 2025 . 23:18 PM

While the regulatory framework is ostensibly designed to foster stability, one could argue that it inadvertently creates barriers to entry that disproportionately affect innovative startups seeking to disrupt the status quo.

raghavan veera

20 May, 2025 . 17:18 PM

In the grand tapestry of financial evolution, licensing is but a thread – essential, yet fleeting, as the true driver remains the collective trust of the participants.