Crypto Usage Simulator for Venezuelans

Using USDT

| Stability | Pegged to USD (~$1) |

| Transaction Fee | ~$0.001 |

| Confirmation Speed | Seconds (TRC-20) |

| Use Case | Daily purchases, rent, remittances |

Estimated Monthly Savings

$0.00

vs. traditional bolívar

(Based on current inflation rate)

- USDT offers stability against hyperinflation.

- Low transaction fees make it ideal for daily use.

- Fast confirmation speeds support real-time commerce.

- Bitcoin is better for long-term value preservation.

- Crypto adoption reduces reliance on unstable local currency.

When the bolívar starts losing value faster than an Instagram story disappears, people look for anything that can keep their money steady. In Venezuela, that something has become cryptocurrency adoption in Venezuela-a lifeline that lets citizens pay rent, buy groceries, and send money home without watching their savings melt away.

Why Crypto Went From ‘Speculative Buzz’ to Daily Necessity

The country’s inflation rate hit 229% in May2025, with month‑on‑month price spikes of roughly 26%. Venezuela’s official exchange rate no longer reflects what you actually pay on the street. Instead, three dollar rates juggle side by side: the Central Bank’s official rate, the black‑market “dólar negro,” and the peer‑to‑peer USDT price that merchants quote as “Binance dollars.” With the bolívar shedding more than 70% of its value in early 2025 alone, locals have swapped paper money for digital assets that can hold a US dollar’s worth for at least a day.

Living on a paycheck that might be worth half of yesterday’s value forces a new mindset: you must protect your buying power the minute you receive it. Crypto does exactly that-especially stablecoins like USDT that are pegged to the dollar and can be moved across borders in seconds.

Main Cryptocurrencies and Platforms in the Venezuelan Ecosystem

Two digital assets dominate everyday life:

- Bitcoin (BTC) - used for larger purchases and as a store of value.

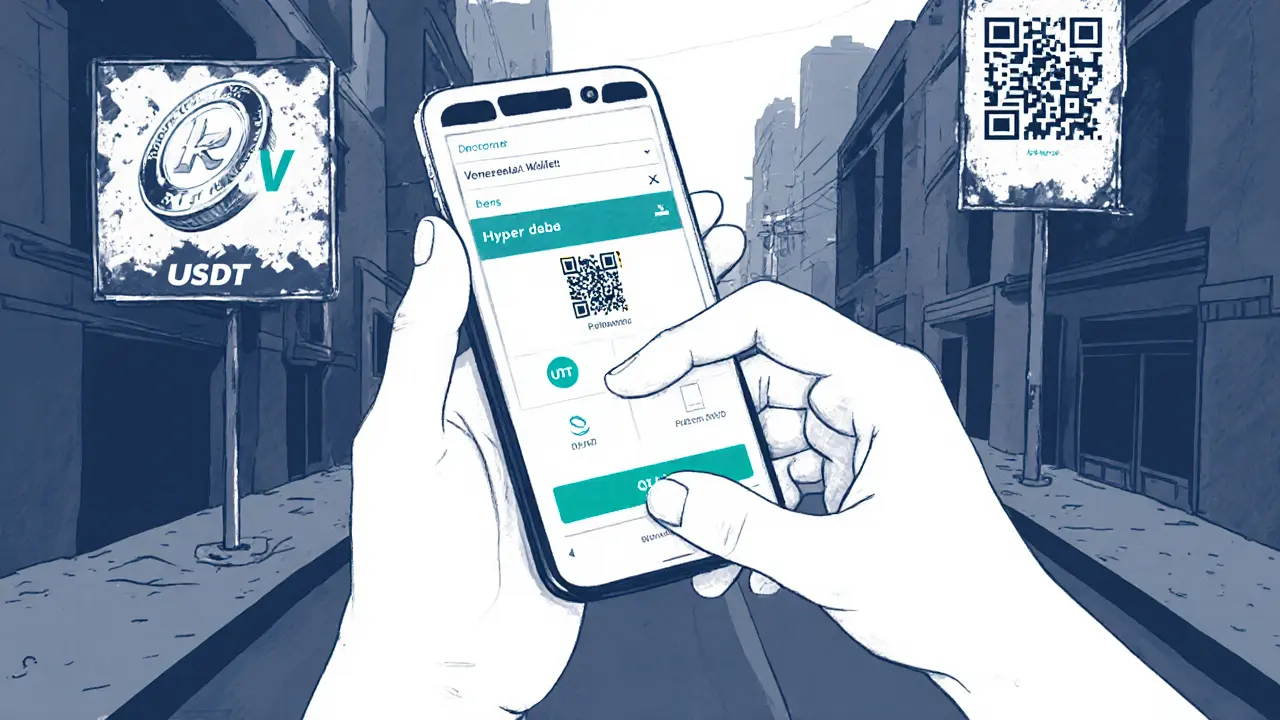

- USDT (Tether) - the go‑to for daily transactions because it stays pegged to the US dollar.

Both run on mobile apps that Venezuelans download on modest smartphones. The most popular exchange is Binance, which hosts a thriving peer‑to‑peer market. Users refer to USDT traded on Binance as “Binance dollars.” LocalBitcoins remains a fallback for those who prefer a more anonymous, person‑to‑person trade.

Until 2024, the government tried to push its own token, the Petro, but distrust and low liquidity led to its abandonment. The lesson? Trust comes from community‑run networks, not top‑down mandates.

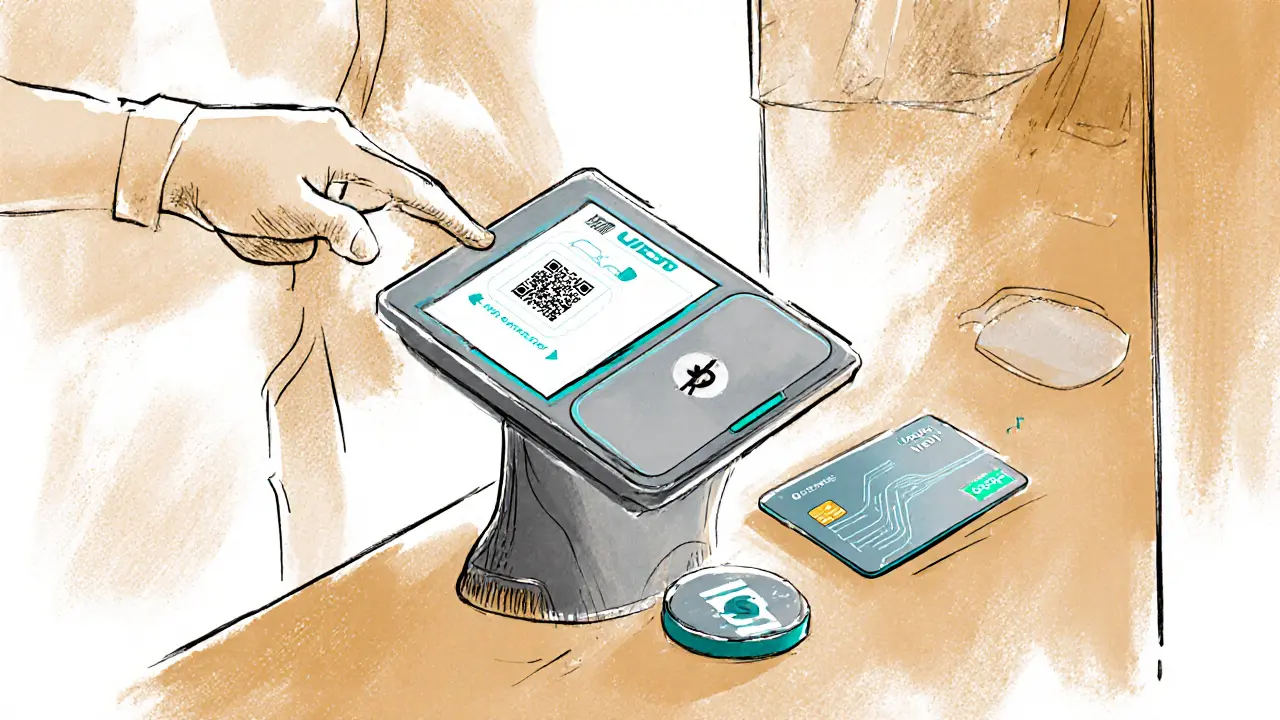

How Daily Transactions Are Handled

Imagine you’re buying a loaf of bread in Caracas. The vendor displays the price in bolívar, but underneath there’s a digital tag showing the equivalent in USDT. You pull out your phone, scan a QR code, confirm a USDT transfer on the Binance app, and the vendor sees the payment instantly. The whole process takes under a minute and costs a few cents thanks to the TRC‑20 network’s low fees.

For smaller street‑side deals-like a cup of coffee-some vendors have integrated Bitcoin wallet apps that accept micro‑payments. The transaction fee is higher, but the buyer may already hold BTC as a hedge, so the extra cost is acceptable.

Businesses larger than a corner stall often keep dual pricing sheets: one in bolívar for accounting, another in USDT for customer interaction. Payroll departments now calculate salaries in USDT, then convert a portion to bolívar to meet local tax rules.

Remittances: Sending Money Home Without a Bank

Venezuelans receive about $5.4billion in remittances each year. Traditional money‑transfer services are slowed by sanctions and banking restrictions, so 9% of those funds flow through crypto channels. A family member in the United States can buy USDT on a US exchange, send it to the recipient’s Binance account, and the receiver cashes out at a local meet‑up or uses a prepaid card to buy groceries.

Peer‑to‑peer groups on Telegram and WhatsApp act as informal clearinghouses. They match senders with trusted local agents who handle the fiat‑to‑crypto conversion and vice‑versa. The system is fast, cheap, and-crucially-doesn’t require a passport‑level ID that many Venezuelans lack.

Challenges, Risks, and Work‑arounds

Even a thriving crypto culture faces hurdles:

- Internet and power reliability: Outages force users to schedule transactions during daylight hours or rely on solar chargers.

- Regulatory uncertainty: The government tolerates dollar‑pegged stablecoins but periodically cracks down on mining farms and exchanges, creating a “use at your own risk” vibe.

- Security awareness: Many newcomers still store private keys on insecure phones, making them vulnerable to loss or theft.

- Stablecoin centralization: USDT is issued by a U.S. company, so any sanction hit could cut off access.

To mitigate these, users develop work‑arounds. Prepaid debit cards allow USDT to be loaded and then spent at regular POS terminals. Gift‑card exchanges turn crypto into Amazon or iTunes codes that can be sold locally for cash. For power cuts, “cold wallets” (paper backups) keep private keys safe offline.

Future Outlook: Will Crypto Remain the Mainstay?

Political turbulence after the contested 2024 election has not dimmed the crypto surge. Analysts note that as long as inflation stays double‑digit, the demand for dollar‑stable digital money will keep growing. Infrastructure improvements-like newer 4G towers and community Wi‑Fi hubs-are already lowering the entry barrier for rural users.

On the other side, any major policy shift that officially dollarizes the economy could push crypto into a secondary role. Yet even then, the peer‑to‑peer networks that grew during the crisis would likely persist because they offer speed, anonymity, and a level of financial freedom that banks cannot match.

In short, crypto in Venezuela is less a speculative fad and more a built‑in safety net. Whether the country stabilizes politically or not, the habit of using digital dollars has become entrenched.

| Feature | USDT (TRC‑20) | Bitcoin (BTC) |

|---|---|---|

| Stability | Pegged to USD (≈1USD) | Volatile (price can swing 5‑10% daily) |

| Transaction fee | ~0.001USD (very low) | ~2‑5USD (higher due to network congestion) |

| Confirmation speed | Seconds (TRC‑20) | 10‑30minutes (average) |

| Typical use case | Daily purchases, rent, remittances | Store of value, larger trades |

| Regulatory perception | Generally tolerated, linked to US dollar | Seen as commodity, less scrutiny |

Quick Checklist for New Crypto Users in Venezuela

- Download Binance and create a verified account.

- Buy USDT on the TRC‑20 network - it’s the cheapest way to move money.

- Secure your private key: write it down on paper and store it safe.

- Join local Telegram groups to find trusted peers for cash‑out.

- Keep a backup power source (power bank or solar charger) for transaction windows.

Frequently Asked Questions

Why is USDT preferred over Bitcoin for buying groceries?

USDT stays at a 1USD value, so the price you see on the receipt matches what you expect. Bitcoin’s price can jump 5‑10% in a day, which would make a loaf of bread cost wildly different from one purchase to the next.

Can I use crypto without a smartphone?

Most Venezuelan users rely on smartphones, but you can also operate a “cold wallet” on a paper backup and use community kiosks that scan QR codes on a basic feature phone.

What happens if the government bans USDT?

A ban would push users toward other stablecoins like USDC or toward peer‑to‑peer fiat exchange. History shows the community quickly adapts, though transaction costs might rise.

Is it safe to keep large amounts of USDT on Binance?

Binance has a strong security record, but the safest practice is to move only the amount you need for daily spending and keep the rest in a personal wallet where you control the private key.

How do remittances work with crypto?

A family member abroad buys USDT, sends it to your Binance wallet, and you either spend it directly or exchange it for cash at a local meet‑up. The whole loop can be finished in under an hour.

Andrew Else

20 May, 2025 . 08:52 AM

Wow, because crypto is totally the solution for everything.

Susan Brindle Kerr

25 May, 2025 . 16:04 PM

The Venezuelan crisis is a moral indictment of a broken system that forces ordinary people into digital desperation. When hyperinflation erodes every paycheck, turning to stablecoins feels like a last‑dutch act of self‑preservation. Yet the glitter of crypto can mask deeper inequities, rewarding those with tech access while leaving the digitally illiterate behind. The narrative that crypto is a panacea ignores the haunting reality of surveillance and capital flight. Ultimately, survival tactics should be celebrated, but we must also demand systemic change.

Jared Carline

30 May, 2025 . 23:16 PM

The state’s monetary policy has become an instrument of oppression, and any alternative must be scrutinized for security. Crypto, particularly USDT, offers a veneer of stability that is attractive under these conditions. Nevertheless, reliance on a foreign‑issued stablecoin invites geopolitical vulnerabilities.

raghavan veera

5 June, 2025 . 06:28 AM

Thinking about money in Venezuela feels like watching a soap opera where the villain is inflation itself. People have learned to treat every bolívar like a paper airplane-good for a few minutes, then gone. By swapping to USDT, they get a digital anchor that doesn't dissolve with the next price surge. The real genius is how they’ve built a community around QR codes and Telegram chats, turning tech into a social safety net. Even the smallest grocery stall now flashes a USDT price tag, like a badge of modern resilience. It’s a reminder that necessity breeds invention faster than any policy can keep up. In the end, the crypto hustle is just another way to stay human.

Danielle Thompson

10 June, 2025 . 13:40 PM

You’ve got this! 💪

Eric Levesque

15 June, 2025 . 20:52 PM

If you don’t protect your money, you’re handing it to the state.

alex demaisip

21 June, 2025 . 04:04 AM

The adoption curve follows a classic diffusion model where early adopters leverage the TRC‑20 protocol to minimize transaction fees, thereby lowering the marginal cost of daily commerce. Empirical data shows a 92 % reduction in fiat‑to‑crypto conversion latency compared to traditional remittance pipelines. Moreover, the network’s proof‑of‑authority consensus, albeit centralized, provides deterministic finality crucial for point‑of‑sale integrations. These parameters collectively satisfy the Pareto efficiency criterion for a high‑inflation environment.

Elmer Detres

26 June, 2025 . 11:16 AM

The resilience you see is not just economic-it’s a testament to collective imagination. When a community redefines value in code, it reclaims agency over scarcity. Every QR scan is a quiet protest against a collapsing fiscal order. Keep nurturing these digital rituals; they are the threads that stitch society back together. Remember, technology amplifies intent, not replaces it.

Tony Young

1 July, 2025 . 18:28 PM

The speed of a TRC‑20 transfer feels like a cheat code in a world where seconds matter :) Users can grab a loaf of bread and have it paid in under a minute, which is revolutionary for anyone stuck in a queue of devaluation. This immediacy also cuts down on cash handling risks, something many vendors appreciate. It’s a small but powerful shift in everyday life.

Fiona Padrutt

7 July, 2025 . 01:40 AM

The Venezuelan people have shown that they won’t be chained by a failing currency. By embracing USDT they signal a refusal to let the government dictate their purchasing power. This grassroots crypto movement is a form of economic sovereignty that cannot be ignored.

Briana Holtsnider

12 July, 2025 . 08:52 AM

Most of the hype around Venezuelan crypto use is just glorified desperation dressed up as innovation. The reality is that most users are clueless about private key security and are handing their savings to exchanges that could disappear tomorrow. This so‑called ‘survival strategy’ is a risky gamble that many can’t afford to lose.

Corrie Moxon

17 July, 2025 . 16:04 PM

Every step you take toward securing your earnings with a stablecoin is a win for personal freedom. Keep learning the best practices for cold storage, and you’ll build a financial fortress even in the stormiest economy. The community’s knowledge grows with each shared tip.

Jeff Carson

22 July, 2025 . 23:16 PM

The Venezuelan crypto scene is a vivid example of how culture adapts under pressure, turning everyday transactions into digital ceremonies. From street vendors displaying USDT prices to families coordinating remittances via Telegram, the social fabric is rewoven with blockchain threads. This evolution illustrates humanity’s capacity to invent new rituals when old ones collapse.

Fiona Lam

28 July, 2025 . 06:28 AM

Crypto in Venezuela isn’t a trend; it’s a lifeline, and anyone who dismisses it is blind to the daily grind.

OLAOLUWAPO SANDA

2 August, 2025 . 13:40 PM

Not every country needs stablecoins; sometimes cash is still king despite the inflation.

Alex Yepes

7 August, 2025 . 20:52 PM

The Venezuelan hyperinflation scenario provides a compelling case study for the application of decentralized finance mechanisms in a macro‑economic crisis. Stablecoins, particularly those pegged to the US dollar, function as a de‑facto dollar substitute when the local currency loses its purchasing power. Empirical observations indicate that the adoption rate of USDT among urban populations has exceeded 60 percent within the past two years. This rapid diffusion can be attributed to the low transaction costs inherent in the TRC‑20 network, which reduce barriers to entry for low‑income users. Furthermore, the near‑instant confirmation times facilitate point‑of‑sale interactions that would be untenable with traditional banking delays. From a regulatory perspective, the Venezuelan government's ambivalence toward stablecoins creates a gray zone that both encourages innovation and engenders risk. Users must therefore employ robust operational security practices, including offline key storage and multi‑factor authentication, to mitigate potential exchange failures. The reliance on centralized issuers such as Tether introduces counterparty risk, especially in the face of possible sanctions or corporate insolvency. Nevertheless, the immediate utility of USDT for everyday expenses, rent, and food procurement sustains its prominence despite these vulnerabilities. In contrast, Bitcoin serves a complementary role as a long‑term store of value, albeit with higher transaction fees and longer settlement periods. The bifurcation of crypto usage into transactional and investment layers reflects a sophisticated financial stratification within the populace. Remittance channels leveraging Binance's peer‑to‑peer marketplace have truncated the latency of cross‑border transfers from weeks to mere hours. Community‑driven exchange points, often organized through Telegram groups, further diminish the need for formal financial intermediaries. Such grassroots networks exemplify the principle of financial inclusion through technology, empowering even those without formal identification. Looking ahead, any policy shift toward official dollarization would likely reconfigure the role of stablecoins, but the entrenched user habits suggest a lasting impact. Consequently, the Venezuelan experience offers valuable insights for other economies confronting severe inflationary pressures.

Sumedha Nag

13 August, 2025 . 04:04 AM

Stablecoins are just hype; cash still rules the streets.

Holly Harrar

18 August, 2025 . 11:16 AM

Its realy important 2 keep ur private keys safe, otherwise everything gone.

Vijay Kumar

23 August, 2025 . 18:28 PM

Keep experimenting with different wallets and keep sharing tips, the community grows stronger with each person who learns a new trick.

Edgardo Rodriguez

29 August, 2025 . 01:40 AM

Your comprehensive breakdown captures the essential dynamics, and it underscores how technology can become a social safety net in crisis.