Blockchain Fraud Prevention Checker

Select the scenario you want to analyze for blockchain fraud prevention benefits:

TL;DR

- Every transaction on a blockchain is recorded on an immutable, distributed ledger, making retroactive changes practically impossible.

- Consensus mechanisms force multiple independent nodes to agree on data, so a single bad actor can’t rewrite history.

- Real‑estate titles, supply‑chain records, and financial transactions gain automatic audit trails, dramatically lowering fraud opportunities.

- Smart contracts can enforce anti‑fraud rules in real time, reducing human error and manual tampering.

- The biggest weakness isn’t the technology; it’s bad data entered at the source. Trusted onboarding and KYC remain vital.

What is Blockchain Transparency?

At its core, blockchain is a distributed ledger technology (DLT) that stores data across a network of computers, called nodes. Each node holds a copy of the entire chain, and any new transaction must be broadcast to, validated by, and recorded on every participant’s copy. This open‑record approach is what we call “transparency.” Because the ledger is public (or permissioned but still visible to all authorized parties), anyone can verify the history of an asset without needing a middleman.

Why Transparency = Fraud Resistance

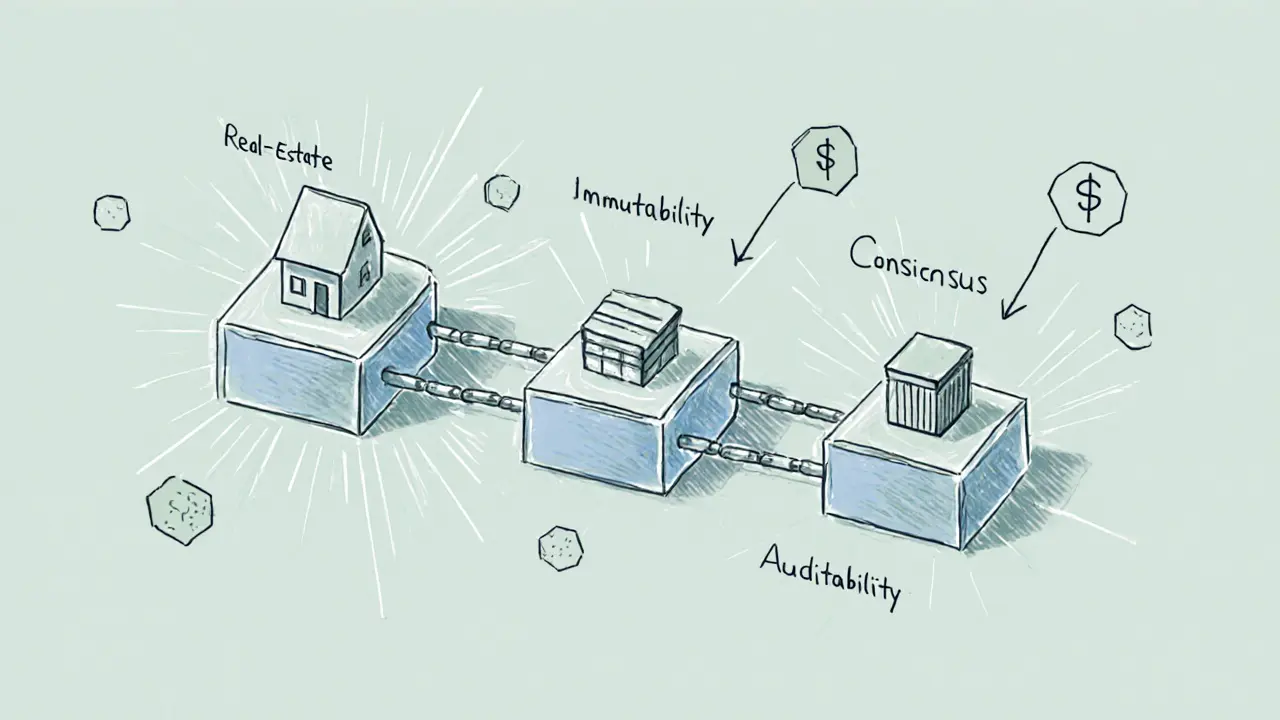

Three technical pillars turn that openness into a fraud‑busting weapon.

- Immutability: Every block contains a cryptographic hash of the previous block. Changing a single entry would require re‑hashing every subsequent block, a task that quickly becomes computationally infeasible unless you control >50% of the network’s processing power.

- Consensus: Before a block is added, the network runs a consensus algorithm (Proof‑of‑Work, Proof‑of‑Stake, or a permissioned variant like Practical Byzantine Fault Tolerance). This forces multiple, independent actors to agree on the validity of each transaction.

- Auditability: Because every transaction is timestamped and linked to a public address, auditors can trace the full lineage of an asset. Any attempt to insert a bogus record instantly stands out as an outlier.

Put together, these features create a self‑policing ecosystem where fraudulent edits are not just hard-they’re detectable in seconds.

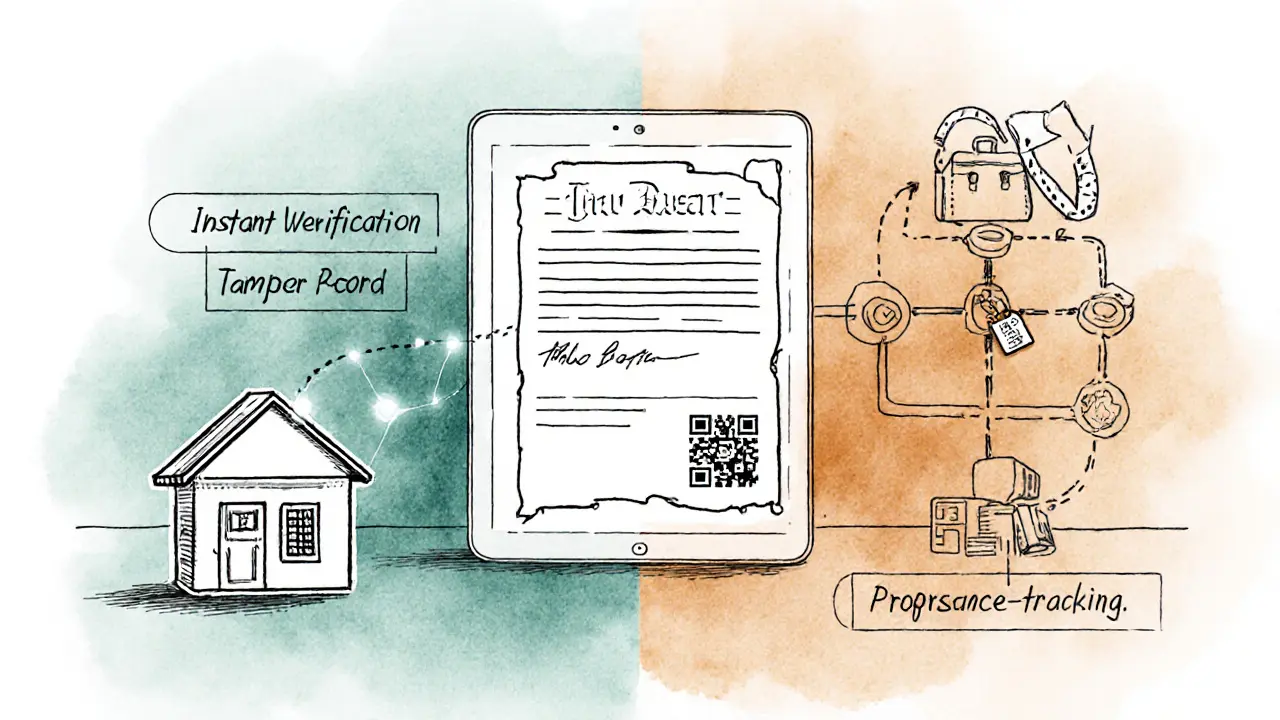

Real‑Estate Title Management: A Proven Use Case

Title fraud has long plagued property markets. Traditional registries rely on paper deeds and siloed databases, which can be forged, lost, or altered without notice. By moving title data onto a blockchain ledger, each property receives a unique, tamper‑proof identifier tied to its ownership history.

When a sale occurs, the transfer is recorded as a new transaction that instantly updates every node. Potential buyers, lenders, and government agencies can verify the chain of ownership within minutes, eliminating the need for costly title searches. The result? A dramatic drop in fraudulent transfers and a smoother closing process.

Supply‑Chain Security: From Mine to Marketplace

Counterfeit goods cost the global economy billions each year. A blockchain‑based supply‑chain solution attaches a digital twin to every physical item. Each hand‑off-raw material extraction, processing, shipping, retail-creates a new, timestamped entry on the ledger.

Consumers can scan a QR code and instantly view the product’s provenance, confirming that a luxury handbag, for instance, truly originated from the claimed factory. Because the ledger is immutable, a bad actor cannot insert a fake “origin” record without the entire network noticing the inconsistency.

Financial Services: Strengthening Internal Controls

Banks and fintech firms already use blockchain to settle payments, but the same tech can tighten internal fraud controls. By recording every purchase‑order, invoice, and settlement on an immutable ledger, auditors gain a real‑time view of cash flows.

Smart contracts can be programmed to flag anomalous patterns-say, a sudden surge in vendor payments outside normal business hours. When a rule is triggered, the contract can automatically place a hold on the transaction and alert compliance teams, reducing both loss and investigation time.

Anti‑Money‑Laundering (AML) and Know‑Your‑Customer (KYC) Integration

Regulators worldwide-through the EU’s 5AMLD and FATF’s VASP guidelines-are demanding transparency from crypto‑related services. By anchoring wallet addresses to verified KYC data on a blockchain, financial institutions can trace the flow of digital assets without sacrificing privacy.

When a suspicious transaction is detected, the blockchain’s audit trail provides investigators with a clear path from source to destination, making it far harder for illicit funds to be layered or hidden.

Smart Contracts: Automated Fraud Prevention

Smart contracts are self‑executing code living on the blockchain. They can enforce business rules without human intervention. For example, a contract governing a construction project could release payment only when sensors confirm that work meets predefined quality standards. If the sensor data is tampered, the mismatch shows up on the ledger, preventing the release of funds.

These programmable safeguards eliminate manual loopholes where employees might otherwise approve bogus invoices or manipulate records.

Limitations: Garbage In, Still Garbage Out

No technology can fix bad data. If an entity uploads false information-like a forged title or a mis‑labelled product-the blockchain will faithfully record that falsehood. The system’s transparency only shines when the input data is trustworthy. Hence, robust KYC, supplier vetting, and digitization standards remain essential front‑line defenses.

Implementation Tips for Organizations

Getting blockchain‑based fraud prevention up and running isn’t a plug‑and‑play job. Here are practical steps to follow:

- Start with a pilot: Choose a single process-like invoice verification-and test it on a permissioned blockchain.

- Secure onboarding: Integrate KYC/AML checks before assigning blockchain identities to participants.

- Choose the right consensus: Public blockchains offer maximum transparency but may be slower; private/consortium chains trade some openness for speed.

- Ensure interoperability: Use standards such as ISO 20022 for financial messages or GS1 for product IDs so the blockchain can talk to existing ERP and CRM systems.

- Educate stakeholders: Developers, auditors, and business users need training on reading ledger data and interpreting smart‑contract alerts.

Traditional Records vs. Blockchain Transparency

| Aspect | Traditional Systems | Blockchain Transparency |

|---|---|---|

| Data Storage | Centralized databases, often siloed | Distributed ledger replicated across many nodes |

| Immutability | Editable; prone to unauthorized changes | Cryptographic hash links; alteration requires majority consensus |

| Audit Trail | Often partial, requires manual reconciliation | Full, timestamped history visible to all authorized parties |

| Fraud Detection | Reactive, based on periodic audits | Real‑time monitoring via smart contracts and alerts |

| Access Control | Role‑based, managed by a single authority | Cryptographic keys and multi‑signature requirements |

Future Outlook

As more industries adopt blockchain, the network effect boosts security: the more participants validate transactions, the harder it becomes for a fraudster to slip through. Emerging standards from the OECD, ISO, and the Enterprise Ethereum Alliance aim to harmonize data formats, making cross‑industry fraud detection more seamless.

In the next five years, we can expect tighter regulatory integration-automated KYC checks baked into public ledgers, and AI‑driven analytics that flag suspicious patterns across multiple blockchains. The technology isn’t a silver bullet, but combined with solid governance, blockchain transparency will become a cornerstone of global fraud prevention.

Frequently Asked Questions

Can blockchain eliminate all types of fraud?

No. Blockchain makes it extremely hard to alter recorded data, but it cannot stop fraud that originates before data is entered. Strong KYC, supplier vetting, and internal controls remain essential.

Do I need a public blockchain to get transparency?

Not necessarily. Permissioned (private) blockchains can provide transparency among a defined group of participants while offering higher performance and privacy.

How do smart contracts help prevent fraud?

Smart contracts enforce business rules automatically. They can block payments unless conditions are met, trigger alerts on anomalies, and ensure that only authorized parties can modify records.

What are the biggest challenges when adopting blockchain for fraud prevention?

Key hurdles include integrating with legacy systems, achieving industry‑wide participation, managing data privacy regulations, and ensuring the quality of off‑chain data that feeds the blockchain.

Is blockchain suitable for small businesses?

Yes, especially through consortium or service‑provider platforms that handle the heavy lifting. Small firms can gain auditability and trust without building their own full network.

alex demaisip

28 July, 2025 . 15:56 PM

The intrinsic property of immutability within distributed ledger architectures fundamentally mitigates retroactive data alteration, thereby constraining fraudulent manipulation.

Consensus protocols enforce a multi‑node agreement that renders unilateral tampering computationally prohibitive.

By ensuring that every ledger entry is cryptographically chained to its predecessor, the system creates an audit trail that is both tamper‑evident and verifiable.

This structural transparency precludes the classic “write‑once, read‑many” abuse vectors exploited in legacy databases.

Consequently, actors seeking to discreetly modify transaction histories encounter insurmountable barriers imposed by decentralized validation.

In practice, this translates to a marked reduction in opportunities for covert fraud across sectors.

Elmer Detres

29 July, 2025 . 00:16 AM

Exactly, the decentralized verification acts like a digital sentinel that never sleeps 😎.

Couple that with real‑time alerts and you’ve got a fraud‑fighting engine that’s hard to outmaneuver.

Tony Young

29 July, 2025 . 08:36 AM

Blockchain's transparent ledger shines like a lighthouse in a stormy sea of fraud.

Each transaction, cryptographically sealed, becomes an immutable beacon that cannot be retroactively erased.

Consensus mechanisms, whether PoW or PoS, marshal a chorus of independent nodes to validate every entry.

This distributed validation creates a formidable barrier against any single malicious actor.

In real‑estate, title deeds recorded on chain eliminate the shadowy corridors where deed fraud once thrived.

Buyers can instantly verify ownership history without commissioning costly title searches.

In supply chains, the digital twin attached to a product carries its provenance from mine to market.

Counterfeit goods falter when their lineage cannot be forged on an immutable ledger.

Financial institutions reap the benefits of real‑time audit trails that expose anomalous patterns in seconds.

Smart contracts act as impartial arbiters, releasing funds only when predefined conditions are met.

This automation cuts out the human error that often creates loopholes for fraudsters.

However, the technology is not a panacea; garbage in, garbage out still haunts the ecosystem.

Robust KYC and supplier vetting remain the first line of defense before data ever touches the blockchain.

Regulators are beginning to embed transparency requirements directly into compliance frameworks.

As more industries adopt this open architecture, the collective vigilance of the network will make fraud increasingly untenable.

Fiona Padrutt

29 July, 2025 . 16:56 PM

Patriotic enterprises that ignore the clear benefits of immutable ledgers are simply courting chaos.

Adopting transparent chains is a duty to protect national economic integrity.

Briana Holtsnider

30 July, 2025 . 01:16 AM

The supposed “silver bullet” narrative is a tired cliché that masks the reality of implementation nightmares.

Most firms rush to tout blockchain without addressing the critical data‑ingress problem.

If the upstream information is fraudulent, the ledger merely records that fraud permanently.

Therefore, these hype‑driven deployments often end up costlier and less secure than conventional systems.

Corrie Moxon

30 July, 2025 . 09:36 AM

While the challenges are real, a measured pilot can transform those obstacles into learning opportunities.

Optimism paired with disciplined governance will pave the way for sustainable adoption.

Jeff Carson

30 July, 2025 . 17:56 PM

It's fascinating how the decentralized model reshapes trust across borders.

When participants from varied jurisdictions share a common ledger, transparency becomes a universal language.

🌍 This cross‑cultural cooperation can spark innovative anti‑fraud solutions.

Anne Zaya

31 July, 2025 . 02:16 AM

Indeed, the global perspective fuels fresh ideas.

Emma Szabo

31 July, 2025 . 10:36 AM

The vivid tapestry of blockchain applications paints a picture where fraud is no longer a looming shadow but a distant memory.

Imagine a world where every product's heritage glows with a digital aura, instantly verifiable by a scan.

Such colorful transparency not only deters counterfeiters but also delights conscientious consumers.

Embracing this kaleidoscope of trust can revolutionize industries.

Fiona Lam

31 July, 2025 . 18:56 PM

Enough of the poetry-real results matter, and blockchain delivers them when properly wired.

Stop whining and start building.

OLAOLUWAPO SANDA

1 August, 2025 . 03:16 AM

Many claim blockchain is the ultimate fix, but that’s just hype.

True security still starts with honest people.

Alex Yepes

1 August, 2025 . 11:36 AM

While optimism is appealing, pragmatism dictates that rigorous onboarding processes precede any ledger entry.

Only by anchoring verified identities can the network reap the promised immutability benefits.

Thus, robust KYC remains the cornerstone of effective blockchain deployment.

Sumedha Nag

1 August, 2025 . 19:56 PM

Honestly, most of this tech is overblown and just another buzzword.

We should focus on basics before chasing shiny new ledgers.

Holly Harrar

2 August, 2025 . 04:16 AM

i get ur point but u cant just ditch all tech.

there's still room 4 blockchain if we do it right.

Vijay Kumar

2 August, 2025 . 12:36 PM

Bridging legacy systems with blockchain doesn’t have to be a nightmare; modular APIs can streamline the integration.

Start with a small, high‑impact use case like invoice verification to demonstrate value.

Success there will build confidence for broader rollout.