Liquid Staking Comparison Tool

cToken Model

Price-adjusted model where the LST price increases as rewards accumulate.

aToken Model

Supply-adjusted model where token supply increases to reflect rewards.

Model Comparison Table

| Aspect | cToken Model | aToken Model |

|---|---|---|

| Reward Representation | Conversion rate rises (e.g., 1.02 stETH per stETH) | Supply inflates - extra tokens minted |

| User Experience | Balance appears to grow; price feed needed | Balance grows; price stays stable |

| Integration Impact | Protocols must handle variable exchange rates | Treat like any other ERC-20 with fixed parity |

| Risk Profile | Potential rounding errors in conversion | Inflation may affect market perception |

DeFi Integration Example

If you stake 100 ETH via Lido and get stETH, how would each model affect your DeFi activities?

Expected Earnings Breakdown

Enter values and click "Calculate Potential Earnings" to see how cToken and aToken models compare in terms of DeFi integration benefits.

Liquid staking lets users lock tokens in proof‑of‑stake blockchains while still holding a tradable receipt token. This receipt, often called a liquid staking token (LST), bridges the gap between earning staking rewards and staying active in the decentralized finance (DeFi) world. Below is a quick snapshot of what you’ll learn.

TL;DR

- Liquid staking issues LSTs that represent staked assets plus rewards, keeping the value liquid.

- Two technical models exist: cToken (price‑adjusted) and aToken (supply‑adjusted).

- LSTs can be used as collateral, traded, or farmed, unlocking multiple yield streams.

- Key protocols - Lido, Aave, Liquid Collective - illustrate real‑world composability.

- Security hinges on smart‑contract audits, validator selection, and slashing protection.

How Liquid Staking Works

When you decide to liquid stake a token, you send it to a liquid‑staking protocol. The protocol’s smart contract validates the deposit and locks the asset in a validator set on the underlying blockchain. In return, you receive an liquid staking token (LST) that tracks your claim on the staked capital plus any accrued rewards.

The LST maintains a 1:1 peg with the underlying asset, but it also accrues value over time. While the native token continues to earn staking rewards, you can immediately deploy the LST across DeFi platforms - swap it on DEXs, supply it as collateral, or stake it in yield farms.

Technical Models: cToken vs. aToken

Liquid‑staking protocols generally adopt one of two accounting styles. Both achieve the same economic outcome - you own the underlying stake plus rewards - but they differ in how the token’s value is expressed.

| Aspect | cToken Model | aToken Model |

|---|---|---|

| Reward representation | Conversion rate between LST and underlying token rises (e.g., 1.02stETH per stETH) | Supply inflates - extra tokens minted to reflect rewards while 1:1 conversion is kept |

| User experience | Balance appears to grow; price feed needed for accurate accounting | Balance grows; price stays stable, simplifying collateral calculations |

| Integration impact | Protocols must handle variable exchange rates | Protocols can treat LST like any other ERC‑20 with fixed parity |

| Risk profile | Potential for rounding errors in conversion calculations | Inflation of token supply may affect market perception |

Ethereum’s Lido uses the cToken approach for stETH, letting the token’s price drift upward as rewards compound. Aave’s aToken‑style aEther keeps a stable 1:1 peg while minting extra tokens to reflect earned interest.

Why Liquid Staking Boosts DeFi Composability

DeFi composability is the ability to stack building blocks - smart contracts, APIs, SDKs - into richer financial products. LSTs act as a new primitive that can be plugged into virtually any DeFi module.

- Collateral: LSTs can secure loans on platforms like Aave. Borrowers unlock additional capital without unbonding their stake.

- Yield Farming: Farmers deposit LSTs into incentive pools, earning extra token rewards on top of the base staking yield.

- Trading: DEXs list LSTs, allowing users to arbitrage between the on‑chain price and the underlying stake value.

- Cross‑Protocol Strategies: A single LST can simultaneously serve as collateral, be part of a liquidity pool, and earn farm rewards, creating multi‑layered revenue streams.

This composability turns an otherwise idle staking position into a versatile asset, dramatically lowering opportunity cost.

Flagship Protocols Showcasing Composability

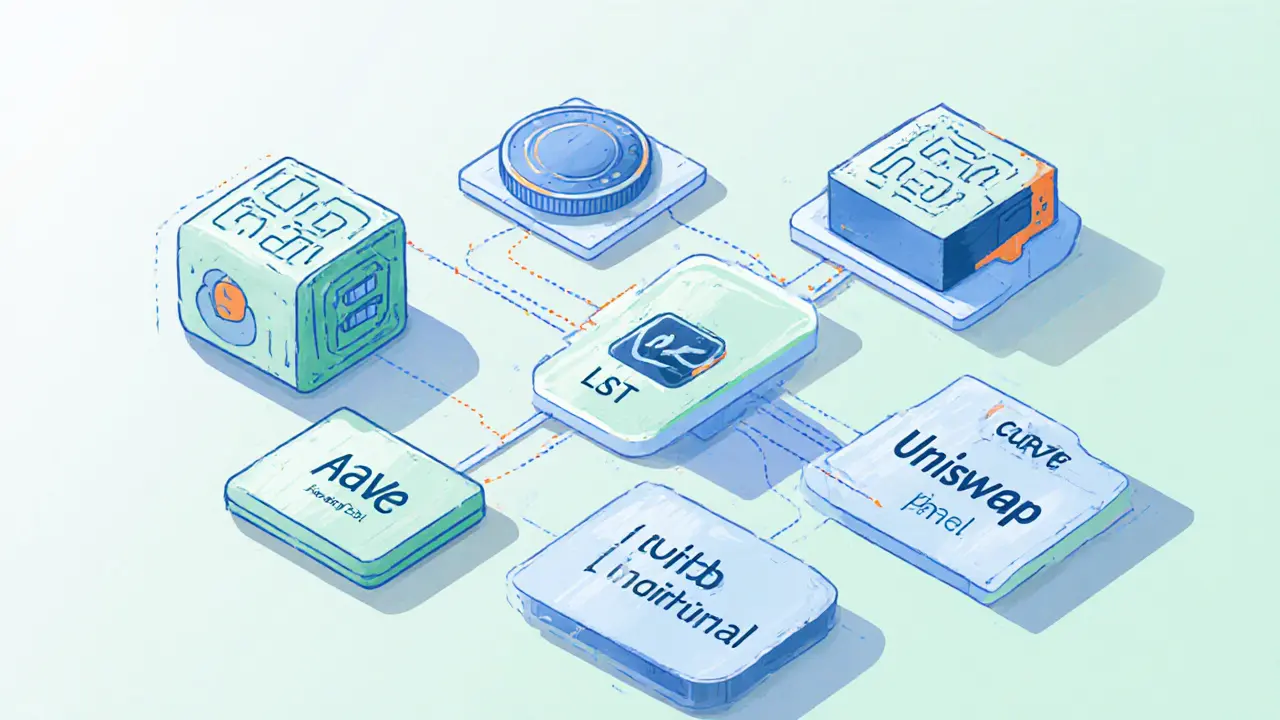

Lido pioneered liquid staking on Ethereum. By staking ETH through Lido, users receive stETH. stETH can be deposited into Aave, used on Curve’s liquidity pools, or swapped on Uniswap, all while continuing to earn Ethereum’s proof‑of‑stake rewards.

For institutional players, Liquid Collective offers an enterprise‑grade standard called LsToken. The protocol adds KYC/AML checks, real‑time monitoring, and multi‑chain support, making it palatable for banks and asset managers who need regulatory compliance alongside DeFi flexibility.

Both examples illustrate how a single LST can flow through multiple DeFi layers, creating network effects that amplify liquidity for the entire ecosystem.

Security & Risk Management

Liquid staking inherits risks from two domains: staking and DeFi. Key safeguards include:

- Smart‑contract audits: Reputable auditors review the issuance and redemption contracts. Most top‑tier protocols publish audit reports.

- Validator selection: Protocols run diversified validator sets and rotate them to avoid concentration risk.

- Slashing protection: If a validator misbehaves, the protocol’s insurance fund or slashing insurance covers user losses.

- Governance controls: Decentralized governance can pause minting or adjust parameters in emergencies.

Users should still assess platform‑specific factors: audit depth, historical uptime, and governance token distribution.

Market Trends & Institutional Adoption

Since 2023, liquid‑staking TVL (total value locked) has grown from roughly $15B to over $45B in 2025, reflecting both retail enthusiasm and institutional pilots. Major DeFi aggregators now list LSTs as native assets, and several hedge funds allocate a portion of their crypto exposure to LST‑backed strategies.

Cross‑chain liquid staking is gaining traction. Protocols allow users to stake Cosmos‑based ATOM on a beacon chain and receive an LST usable on Ethereum, effectively decoupling the staking location from the DeFi playground.

Future Outlook: Standards, Interoperability, and Regulation

Standardization will be the next catalyst. Initiatives like the Liquid Collective LsToken aim to create a universal receipt format so any DEX or lending market can accept it without custom adapters.

Regulators are beginning to view LSTs as “staking derivatives.” Clear classification will shape custody rules, KYC requirements, and tax treatment. Early‑mover institutions are already building compliance layers, which should unlock a wave of capital from traditional finance.

In practice, expect three developments within the next 12‑18 months:

- Broad adoption of a multi‑chain LST standard, reducing friction for cross‑chain strategies.

- Layer‑2 integrations that let LSTs move at low cost, fueling high‑frequency arbitrage.

- Regulatory sandboxes that certify certain LST issuers, giving banks confidence to partner.

Getting Started: A Quick Checklist

- Choose a reputable liquid‑staking protocol (e.g., Lido, Liquid Collective).

- Confirm the LST’s underlying model (cToken or aToken) matches your collateral need.

- Verify smart‑contract audit reports and validator diversity.

- Test the LST on a low‑risk DeFi sandbox before committing large sums.

- Monitor governance proposals that could affect token peg or redemption rules.

Frequently Asked Questions

What exactly is a liquid staking token (LST)?

An LST is a derivative token that represents a user’s claim on a staked asset plus any earned rewards. It can be transferred, traded, or used as collateral while the underlying stake continues to secure the network.

How do cToken and aToken models differ in practice?

The cToken model adjusts the price of the LST relative to the underlying asset, so the token’s market price rises as rewards accrue. The aToken model keeps a 1:1 price but mints extra tokens to represent earned rewards, causing the holder’s balance to increase.

Can I use LSTs as collateral on lending platforms?

Yes. Major lending protocols like Aave and Compound accept LSTs such as stETH or LsToken as collateral, allowing you to borrow other assets without unstaking.

What are the main security risks?

Risks include smart‑contract bugs, validator slashing, and governance attacks. Reputable protocols mitigate these with audits, diversified validator sets, and slashing insurance funds.

Is liquid staking regulated?

Regulators are still defining the framework, but many jurisdictions treat LSTs as securities or derivative assets. Platforms that add KYC/AML layers, like Liquid Collective, are better positioned for compliance.

Sumedha Nag

11 October, 2024 . 17:21 PM

cToken model sounds like a sneaky way to hide fees.

Holly Harrar

11 October, 2024 . 19:18 PM

Both cToken and aToken approaches try to solve the same problem – how to represent staking rewards without locking up your assets.

In the cToken model the price per token drifts upward, so you need a price oracle to keep track of the conversion rate.

The aToken model simply mints extra tokens, which makes the balance look bigger but leaves the token price at 1:1.

For most DeFi protocols that already handle variable rates, cToken is not a big headache, but if you’re just swapping on a DEX the aToken route feels more straightforward.

Ultimately, pick the one that matches the integration complexity you’re comfortable with.

Jared Carline

11 October, 2024 . 21:15 PM

While the literature extols the virtues of tokenized staking, one must remain vigilant regarding the latent intricacies inherent to each schema. The cToken construct, albeit elegant, imposes the exigency of continuous rate calibration, thereby engendering potential systemic frictions. Conversely, the aToken paradigm, with its proliferation of supply, may precipitate perceptual depreciation among market participants. In sum, the ostensibly benign choice may, upon rigorous examination, betray subtle vulnerabilities.

raghavan veera

11 October, 2024 . 23:11 PM

Think of staking as planting a tree – you want the fruit without cutting down the roots. The cToken model lets your holdings ‘grow’ in price, which feels like watching the tree stretch toward the sun. The aToken model, on the other hand, just adds more branches, so the tree looks fuller but each branch is the same weight. In DeFi, that distinction matters when you plug the token into yield farms that expect a stable peg. If the protocol can handle a shifting conversion rate, cToken can give you a smoother experience. Otherwise, you might stick with aToken to keep the math simple.

Briana Holtsnider

12 October, 2024 . 01:08 AM

This whole liquid‑staking hype is just another way for projects to milk users.

Corrie Moxon

12 October, 2024 . 03:05 AM

Hey, don’t let the jargon scare you away! Both models let you keep your ETH liquid while earning rewards, which is already a win. If you’re comfortable tracking a conversion rate, cToken gives you a nice price appreciation look. If you prefer a straightforward balance boost, aToken keeps things tidy.

Jeff Carson

12 October, 2024 . 05:01 AM

I’m curious how the liquidation risk compares between the two models 😅.

Does the extra supply in aTokens ever trigger a chain‑wide over‑collateralisation event?

And for cTokens, how often does the rate need updating in real‑time?

Also, are there any real‑world examples where a protocol switched from one model to the other?

Would love to see some case studies.

Anne Zaya

12 October, 2024 . 06:58 AM

cToken feels a bit fancy, aToken feels plain.

Emma Szabo

12 October, 2024 . 08:55 AM

Picture the DeFi ecosystem as a bustling rainforest, each token a vibrant creature. The cToken model is like a chameleon, subtly shifting its hue as rewards accumulate, dazzling the onlookers with its ever‑changing shade. Meanwhile, the aToken model is the flamboyant peacock, proudly sprouting extra feathers to flaunt its bounty. Both strategies let you stay liquid, but the chameleon requires a keen eye to track its color‑code, whereas the peacock’s display is instantly obvious. When you plug these tokens into a yield farm, the chameleon may need a smarter oracle, while the peacock just adds more feathers to the pile. If you love watching dynamic charts, the cToken’s rising price can be exhilarating. If you prefer a clean, no‑surprise balance, the aToken’s simple mint‑on‑reward approach wins. Either way, the forest thrives on the diversity of its inhabitants.

Fiona Lam

12 October, 2024 . 10:51 AM

aToken is the straight‑up no‑BS route, cToken is just over‑engineered.

OLAOLUWAPO SANDA

12 October, 2024 . 12:48 PM

Why bother with liquid staking when you can just hold ETH?

Alex Yepes

12 October, 2024 . 14:45 PM

In the rapidly evolving landscape of decentralized finance, liquid staking has emerged as a pivotal innovation that seeks to reconcile the dichotomy between asset immobility and yield generation. The cToken model, exemplified by instruments such as Lido’s stETH, operates on a price‑adjusted mechanism whereby the token’s exchange rate incrementally ascends in proportion to accrued staking rewards. Conversely, the aToken model, typified by Aave’s aETH, adopts a supply‑adjusted framework that mints additional tokens to represent the same reward accumulation, thereby preserving a one‑to‑one parity with the underlying asset. Proponents of the cToken architecture argue that the appreciation of token price provides a more intuitive reflection of compounded earnings, facilitating straightforward valuation for end‑users. Critics, however, contend that the variable conversion rate imposes a non‑trivial integration burden on downstream protocols, which must incorporate robust oracle solutions to mitigate rate‑staleness risks. The aToken approach, by contrast, simplifies integration by maintaining a static price peg, allowing smart contracts to treat the token as a conventional ERC‑20 without ancillary rate‑adjustment logic. Nevertheless, the inflationary nature of aToken issuance may engender perceptual distortions in market depth, potentially influencing liquidity dynamics on decentralized exchanges. From a risk‑management perspective, the cToken’s reliance on external price feeds introduces an oracle risk vector that must be diligently hedged. The aToken’s exposure, while ostensibly lower in that regard, is not immune to systemic shocks arising from sudden reward rate fluctuations that may prompt abrupt supply expansions. Moreover, the composability of each model within layered DeFi protocols varies significantly, as the cToken’s price drift can affect collateral valuation in lending platforms, whereas the aToken’s invariant price can streamline collateral calculations but may inflate debt positions through token over‑issuance. Empirical analyses of protocol performance have demonstrated that cToken‑enabled strategies often yield marginally higher net APYs after accounting for oracle fees, whereas aToken‑driven strategies exhibit lower operational complexity and reduced gas overhead. In practice, the selection between these paradigms hinges upon the specific use‑case requirements of the integrating protocol, including tolerance for price volatility, desired user experience, and engineering resource allocation. Ultimately, developers must conduct a comprehensive cost‑benefit assessment that weighs the nuanced trade‑offs of reward representation, integration overhead, and market perception. By meticulously aligning the chosen liquid staking model with the overarching strategic objectives, the DeFi ecosystem can continue to innovate while preserving user capital efficiency and systemic resilience.

Vijay Kumar

12 October, 2024 . 16:41 PM

Vijay here – just a quick note that both models let you keep your ETH liquid, which is the real game‑changer. If you’re feeding the token into a yield farm, make sure the farm can handle the variable rate of cTokens, otherwise you might see unexpected slippage. For aTokens, the extra supply can sometimes dilute your share of the pool, so double‑check the APY calculations. In my experience, a mixed‑formality dashboard that shows both the price index and the total supply helps users make informed decisions. Keep an eye on the oracle updates if you go cToken; they’re the silent hero behind the scenes.

Edgardo Rodriguez

12 October, 2024 . 18:38 PM

Indeed, the considerations you have outlined, Alex, are comprehensive, and they underscore, without doubt, the multifaceted nature of liquid‑staking integration, especially when one contemplates, for instance, the interplay between oracle latency, token inflation, and user experience, all of which demand meticulous analysis, and thus, your exposition serves as a valuable reference point for the community.

mudassir khan

12 October, 2024 . 20:35 PM

The assertion that liquid staking is merely a profit‑draining scheme lacks nuance; a rigorous evaluation reveals that, when structured correctly, tokenized staking can augment capital efficiency, albeit with attendant risks that merit careful scrutiny.