Cyprus Crypto Exchange Access Guide

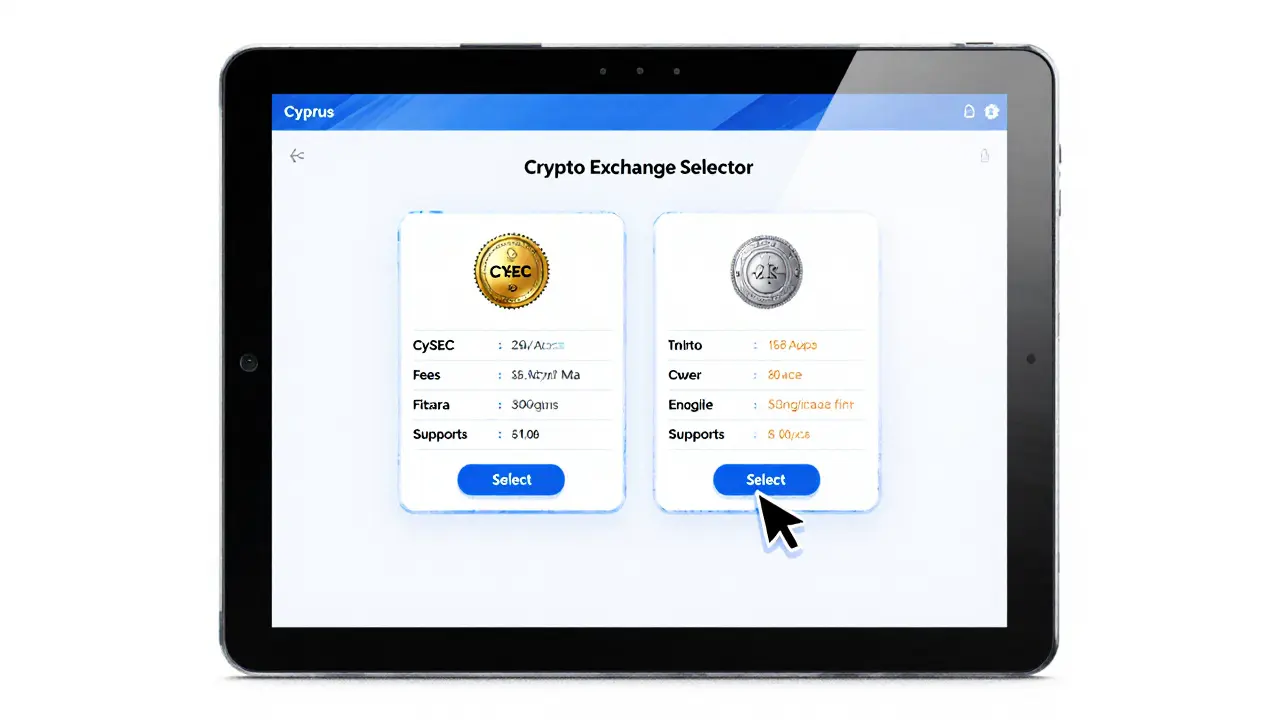

Follow these steps to legally access a cryptocurrency exchange in Cyprus:

- 1Select a licensed platform (CASP or MiCA compliant)

- 2Open an account with required documents

- 3Complete AML/KYC checks

- 4Link a payment method (SEPA preferred)

- 5Deposit funds and start trading

Selected Option Details:

Please select an option above to see details.

KYC Requirements:

For private individuals in Cyprus:

- Capital gains from crypto trading are tax-free

- Professional trading income is taxed at standard corporate rates

- Staking/lending interest is taxed at 12.5% if through a company

Note: Keep records for 5 years for audit purposes.

Ever wondered how people living on the sunny island of Cyprus actually buy, sell, and trade digital coins? The answer isn’t a magic button - it’s a mix of local regulations, EU rules, and a handful of practical steps. Below you’ll find a clear roadmap that takes you from the moment you decide to dip your toes in crypto to the point where you’re safely trading on a compliant exchange.

TL;DR - Quick Takeaways

- Crypto is legal in Cyprus, but exchanges must be licensed by CySEC or hold an EU MiCA licence.

- KYC is mandatory for transactions over €1,000; a passport or ID card and proof of address are enough.

- Capital gains on crypto are tax‑free for individuals, making trading attractive.

- Choose between domestic CASP‑licensed platforms and EU‑wide exchanges that operate under MiCA.

- Always check the provider’s AML compliance and keep records for at least five years.

Regulatory Landscape in a Nutshell

Cyprus follows the EU’s Markets in Crypto‑Assets (MiCA) regulation, which became enforceable in June2023 and sets a uniform set of rules for crypto‑asset service providers across the bloc. The island’s own watchdog, the Cyprus Securities and Exchange Commission (CySEC) oversees licensing, AML supervision, and consumer protection for crypto firms operating locally, acts as the conduit for MiCA compliance.

Because Cyprus is an EU member, any exchange licensed under MiCA can legally serve Cypriot residents without a separate national permit. However, the CySEC Innovation Hub still prefers that services targeting the local market obtain a Crypto‑Asset Service Provider (CASP) licence which certifies that the firm meets Cyprus‑specific AML, CFT, and consumer‑protection standards.

Who Regulates What?

The crypto ecosystem in Cyprus involves several authorities:

- CySEC issues CASP licences, conducts market surveillance, and coordinates with EU regulators.

- Central Bank of Cyprus (CBC) issues public warnings about crypto risks and clarifies that digital tokens are not legal tender.

- MOKAS the Unit for Combating Money Laundering, receives suspicious activity reports from licensed exchanges and enforces AML/CFT rules.

- European Banking Authority (EBA) sets EU‑wide AML guidelines that CySEC implements locally.

Step‑By‑Step: Getting on a Crypto Exchange

- Pick a licensed platform. Look for the CASP register on the CySEC website or verify that the exchange displays a valid MiCA licence number. Popular choices include local firms like CyCrypto Exchange (fictional example) and EU‑wide platforms such as Binance, Kraken, and Bitstamp that have secured MiCA authorisation.

- Open an account. Provide your full name, Cypriot ID number, and a recent utility bill. The KYC process is streamlined: a scanned passport or identity card plus a proof‑of‑address document satisfies the €1,000 threshold.

- Complete AML checks. The exchange will run you through sanctions screening (EU and UN lists) and may ask for the source of funds if you plan to deposit more than €10,000 in a single month.

- Link a payment method. Most Cypriot users prefer SEPA bank transfers because they are cheap and instantly recognised by EU‑based exchanges. Credit‑card deposits are also available, but they attract higher fees and stricter limits.

- Deposit crypto or fiat. After the account is verified, move funds from your bank or another wallet. Keep a screenshot of the transaction - MOKAS expects a five‑year audit trail.

- Start trading. Use the exchange’s spot market, futures, or staking features as you wish. Remember that any profit is considered a capital gain, which is tax‑free for individuals in Cyprus.

Domestic vs. EU‑Wide Exchanges - What’s the Difference?

| Aspect | Domestic CASP‑Licensed | EU‑MiCA‑Compliant International |

|---|---|---|

| Regulatory Body | CySEC (local licence) | EU regulator under MiCA |

| Typical Fees | 0.15%-0.25% per trade | 0.10%-0.20% per trade (often lower on volume) |

| Supported Fiat | EUR, GBP, CHF (direct SEPA) | EUR, USD, GBP, plus crypto‑to‑crypto pairs |

| KYC Level | Standard ID + proof of address (mandatory for €1,000+) | Similar, but some platforms offer “lite” verification for low‑value trades |

| Customer Support (Greek/English) | Local language support, Cyprus‑specific helpdesk | Multilingual, 24/7 chat |

Tax Implications - Why Cyprus Is Attractive

As of 2025, the Cyprus Tax Department treats crypto‑related gains the same way it treats capital gains from stocks or real estate - they are exempt for private individuals. That means if you bought Bitcoin for €5,000 and sold it for €8,000, you keep the €3,000 profit without filing a capital‑gains return.

There are two caveats:

- If you trade as a professional (i.e., you run a crypto‑trading business), the income may be classified as business profit and taxed at the standard corporate rate.

- Any interest earned from staking or lending is considered ordinary income and is subject to the 12.5% corporate tax if you receive it through a company structure.

For most retail users, the simple rule is: no capital‑gains tax on personal crypto trades. Keep a spreadsheet of purchase dates, amounts, and sale proceeds - it’s useful if the tax authority ever asks for documentation.

Security Tips - Staying on the Right Side of Regulators

- Only trade on platforms listed in the CySEC CASP register or with a valid MiCA licence number.

- Enable two‑factor authentication (2FA) on every exchange account.

- Use a hardware wallet for long‑term storage; keep the seed phrase offline.

- Download statements regularly and store them in an encrypted folder - MOKAS can request them within 30days of a suspicious‑activity report.

- Beware of “unlicensed” peer‑to‑peer services; they lack AML oversight and can lead to frozen assets.

Common Payment Methods Used by Cypriots

Because the Euro is the official currency, most Cypriots rely on SEPA bank transfers. The average deposit size is €2,500, which comfortably clears the €1,000 KYC threshold. Credit‑card deposits are typically limited to €5,000 per month and carry a 3‑4% fee.

For higher‑value traders, the preferred route is a wire transfer to an EU‑based exchange’s escrow account, followed by a swift conversion to stablecoins (USDT, EURS) before entering the spot market. This method reduces conversion fees and speeds up settlement.

Future Outlook - What’s Coming Next?

MiCA’s full national transposition is expected to be finalised by the end of 2025, bringing a few changes:

- Standardised disclosure templates for all crypto‑asset offerings.

- Higher capital requirements for custodial services, which may push smaller local exchanges to merge or partner with larger EU players.

- Potential introduction of a “crypto‑sandbox” where startups can test innovative products under temporary regulatory relief.

For everyday users, the landscape will stay familiar - you’ll still sign a KYC form, link a bank account, and trade on a compliant platform. The main benefit will be clearer consumer protection rules and a more consistent set of fees across the EU.

Frequently Asked Questions

Do I need a CySEC licence to trade on a foreign exchange?

No. If the foreign exchange holds a valid EU MiCA licence, it can legally serve Cypriot residents without a separate CySEC licence. However, you should verify the MiCA licence number on the platform’s compliance page.

What documents are required for KYC?

A government‑issued ID (passport or identity card), a recent utility bill or bank statement showing your Cypriot address, and, for large deposits, a source‑of‑funds declaration (e.g., salary slip or sale agreement).

Are crypto profits really tax‑free?

For private individuals, yes - capital gains from buying and selling crypto are exempt from tax in Cyprus. The exemption does not apply to professional trading income or staking rewards earned through a company.

Can I use a credit card to fund my exchange account?

Most exchanges accept credit‑card deposits, but fees are higher (3‑4%) and limits are lower (usually €5,000 per month). For larger amounts, a SEPA bank transfer is cheaper and faster.

What happens if an exchange is not licensed?

Unlicensed platforms are not subject to AML or consumer‑protection rules, meaning your funds could be frozen or lost without recourse. MOKAS will also flag transactions with such providers, which could lead to investigations.

Anne Zaya

2 May, 2025 . 04:19 AM

Wow, this guide really breaks down the whole process in a way that's easy to follow. I love that it highlights both the local CASP‑licensed options and the EU‑wide platforms – gives you the full picture without the jargon.

Emma Szabo

2 May, 2025 . 05:11 AM

Alright, folks, let’s dive in! First off, the fact that Cyprus treats crypto capital gains as tax‑free for private individuals is a massive incentive – it’s like getting a sweet cherry on top of an already tasty sundae.

Second, the dual‑track licensing (CySEC’s CASP and the broader MiCA umbrella) means you can pick the playground that fits your vibe: local support with Greek/English helpdesk or the sprawling EU market with multilingual 24/7 chat.

Third, the step‑by‑step checklist is gold: pick a licensed exchange, upload a passport and a utility bill, breeze through AML checks, and link a SEPA transfer – it’s as smooth as a Mediterranean breeze.

Fourth, the KYC thresholds are crystal clear – €1,000 triggers full verification, and €10,000 adds a source‑of‑funds declaration, so you always know when you’re stepping into the deeper end of the pool.

Fifth, the tax section is a relief: no capital‑gains tax for personal trades, just remember to keep those receipts for five years in case the tax man knocks.

Sixth, the security tips are spot‑on: only trade on registered platforms, enable 2FA, and stash long‑term holdings in a hardware wallet – it’s the Fort Knox of crypto.

Seventh, the payment methods guide is practical – SEPA for cheap, fast transfers, credit cards if you’re okay with a 3‑4% fee, and for big fish, wire transfers to an escrow followed by stablecoin conversion.

Eighth, the future outlook hints at a sandbox for innovators, which could spawn cool new DeFi tools right here in Cyprus.

Ninth, keep an eye on the upcoming national transposition of MiCA – it’ll tighten disclosures but also standardise fees across the EU, making cross‑border trading a breeze.

Tenth, remember the consumer‑protection angle: licensed exchanges must adhere to AML rules, so your funds are safer than on unregulated P2P sites.

Eleventh, the FAQ clarifies that a MiCA licence suffices for foreign platforms, so you don’t need a separate CySEC licence to trade on giants like Binance or Kraken.

Twelfth, the document’s interactive elements (like the KYC checker) are a neat way to visualise what you’ll need before you even sign up.

Thirteenth, the comparison table shows fees: domestic 0.15‑0.25% vs. EU 0.10‑0.20%, which can add up if you’re a high‑volume trader.

Fourteenth, the emphasis on record‑keeping cannot be overstated – a simple spreadsheet with dates, amounts, and pairings will save you headaches down the line.

Fifteenth, overall, this guide is a comprehensive, user‑friendly roadmap that demystifies the crypto journey for Cypriots and makes the regulatory maze feel like a walk in Nicosia’s old town. Keep it bookmarked, share it, and happy trading!

Fiona Lam

2 May, 2025 . 06:02 AM

Listen up – if you think you can just hop on any random exchange and dodge the rules, you’re dreaming. The CySEC and MiCA watchdogs are not playing games, and they’ll hammer you with AML checks if you try to sneak €10k+ without proper paperwork. Get your passport, utility bill, and source‑of‑funds docs ready, or you’ll be stuck at the login screen forever.

OLAOLUWAPO SANDA

2 May, 2025 . 06:54 AM

All this talk about licences is a circus. I say use a peer‑to‑peer platform, no licence, no rules, pure freedom. Sure, you might get scammed, but that’s the price of independence.

Sumedha Nag

2 May, 2025 . 07:46 AM

Honestly, the whole regulated exchange thing feels overblown. If you’re just swapping a few euros, why bother with KYC? Let’s keep it simple and use the old school ways.

Holly Harrar

2 May, 2025 . 08:37 AM

hey guys, just a heads up – i tripped over the docs and got my id and bill all set in one go. thx for the clear steps, it saved me a ton of time lol.

Vijay Kumar

2 May, 2025 . 09:29 AM

Yo, this is the kind of roadmap that gets you pumped! 🎉 Grab that SEPA transfer, fire up your exchange, and remember to keep those receipts – you’ll thank yourself later when the tax office comes knocking.

Edgardo Rodriguez

2 May, 2025 . 10:21 AM

Consider, dear readers, the philosophical implications of a nation harmonising crypto regulation: on one hand, the pursuit of liberty; on the other, the relentless march of institutional oversight; thus, a dialectic emerges wherein the individual must navigate both the sovereign’s codified statutes and the universal aspirations of decentralisation, a balance that is, in essence, the very soul of modern finance.

mudassir khan

2 May, 2025 . 11:12 AM

Honestly, this guide is riddled with unnecessary fluff; the regulatory landscape is straightforward, and the average user will simply skim the bullet points without engaging the verbose explanations. Precision over verbosity would serve a more critical audience.

Bianca Giagante

2 May, 2025 . 12:04 PM

Thank you for the thorough breakdown; I appreciate the clear distinction between domestic and EU‑wide platforms, and the emphasis on record‑keeping aligns well with best practices.

Andrew Else

2 May, 2025 . 12:56 PM

Sure, great-another endless guide.

Susan Brindle Kerr

2 May, 2025 . 13:47 PM

Well, if it isn’t yet another attempt to sugar‑coat the cold, hard truth that only the elite truly benefit from tax‑free crypto gains. The rest of us are left to navigate a maze of compliance while the privileged few bask in their windfalls.

Jared Carline

2 May, 2025 . 14:39 PM

It is imperative to note, with the utmost formality, that any deviation from the prescribed procedural standards may result in regulatory scrutiny, thereby necessitating strict adherence to the enumerated steps delineated herein.

raghavan veera

2 May, 2025 . 15:31 PM

Yo, that whole MiCA thing is just another layer of bureaucracy. At the end of the day, you’re still moving crypto, so chill.

Danielle Thompson

2 May, 2025 . 16:22 PM

👍 Keep it simple, follow the steps, and you’ll be trading in no time! 🚀

Eric Levesque

2 May, 2025 . 17:14 PM

Stop whining and just get a legit exchange – it’s not that hard.

alex demaisip

2 May, 2025 . 18:06 PM

From a systemic perspective, the integration of CySEC‑mandated CASP licensing with the broader MiCA framework exemplifies a harmonisation of regulatory schemas, thereby reducing arbitrage opportunities and promoting market stability; however, the operational overhead associated with dual compliance may impose additional transactional friction for market participants.

Elmer Detres

2 May, 2025 . 18:57 PM

Nice breakdown! 👍 Remember to enable 2FA and keep your hardware wallet safe – security first! 😎

Tony Young

2 May, 2025 . 19:49 PM

Honestly, this guide is a masterpiece of clarity and depth – every bullet point feels like a beacon of wisdom in the chaotic sea of crypto. 🌊✨🙌