Bitcoin Mining Profitability Calculator

When Bitcoin miner capitulation refers to the wave of mining operations that shut down or scale back after a Bitcoin halving because revenue drops sharply while costs stay flat, the whole ecosystem feels the tremor. The most recent halving in April 2024 cut the block reward from 6.25BTC to 3.125BTC, slashing daily earnings per terahash by about 50%. For miners already juggling thin margins, that sudden dip can be a death knell. In this guide we unpack why capitulation happens, which players feel the pain the most, and how the survivors are adapting to stay in the game.

Why a Halving Triggers a Profitability Shock

The Bitcoin protocol halves the block subsidy every 210,000 blocks - roughly every four years - to keep supply capped at 21million coins. By design, each halving cuts the newly‑minted Bitcoin supply in half, creating a built‑in scarcity that historically fuels price appreciation. But on the supply side, miners face an immediate 50% revenue drop while variables like electricity, hardware depreciation, and staffing remain unchanged.

At the time of the 2024 halving, the average miner earned about $0.055 per day per terahash (TH/s). After the event, that figure fell to $0.0275 per day per TH/s. If a farm’s electricity price sits at $0.08 per kilowatt‑hour (kWh) - a common retail rate in many regions - the operation instantly becomes cash‑negative.

Who Gets Squeezed First? The Vulnerable Segments

Three factors determine who will capitulate:

- Hardware efficiency: Older ASIC generations (e.g., S19) consume more watts per TH/s than the latest 5nm chips. Operators still running legacy models lose up to 30% more profit.

- Electricity cost: Mines that pay above $0.05/kWh struggle to break even unless Bitcoin spikes above $60,000. High‑cost jurisdictions like parts of the US Midwest or Europe see the fastest shutdowns.

- Capital reserves: Companies with cash buffers can survive a few months of negative cash flow. Small‑scale miners often lack the 6‑12months of operating expenses recommended by analysts.

Publicly listed firms such as Marathon Digital a US‑based Bitcoin mining company with access to low‑cost hydro power and Iris Energy an Australian miner focused on renewable energy contracts weathered the drop better than hobbyist miners in Texas or the Philippines who rely on retail rates.

Real‑World Impact: Hashrate Decline and Market Consolidation

Mining pools reported a 10‑20% hashrate dip within six months of the halving, as smaller participants exited. The overall network difficulty adjusted downward over the next 3‑6months, giving the remaining miners a brief relief window. During this period, larger firms bought distressed assets - idle ASICs, cheap land, and renewable energy contracts - at steep discounts, accelerating industry consolidation.

For example, Bitdeer’s production fell 31% in May 2024 versus April, yet the company used the dip to acquire legacy hardware from shutdown farms, integrating them into more efficient data centers later on.

Survival Playbook: Boost Efficiency, Cut Energy, Keep Cash

If you’re operating a mining business or managing a mining pool, the following three pillars are essential to avoid capitulation:

- Upgrade to high‑efficiency ASICs. Modern chips achieve >30TH/s per 3,000W, translating to ~0.1J/TH. That’s a 15‑25% improvement over 2022‑generation hardware.

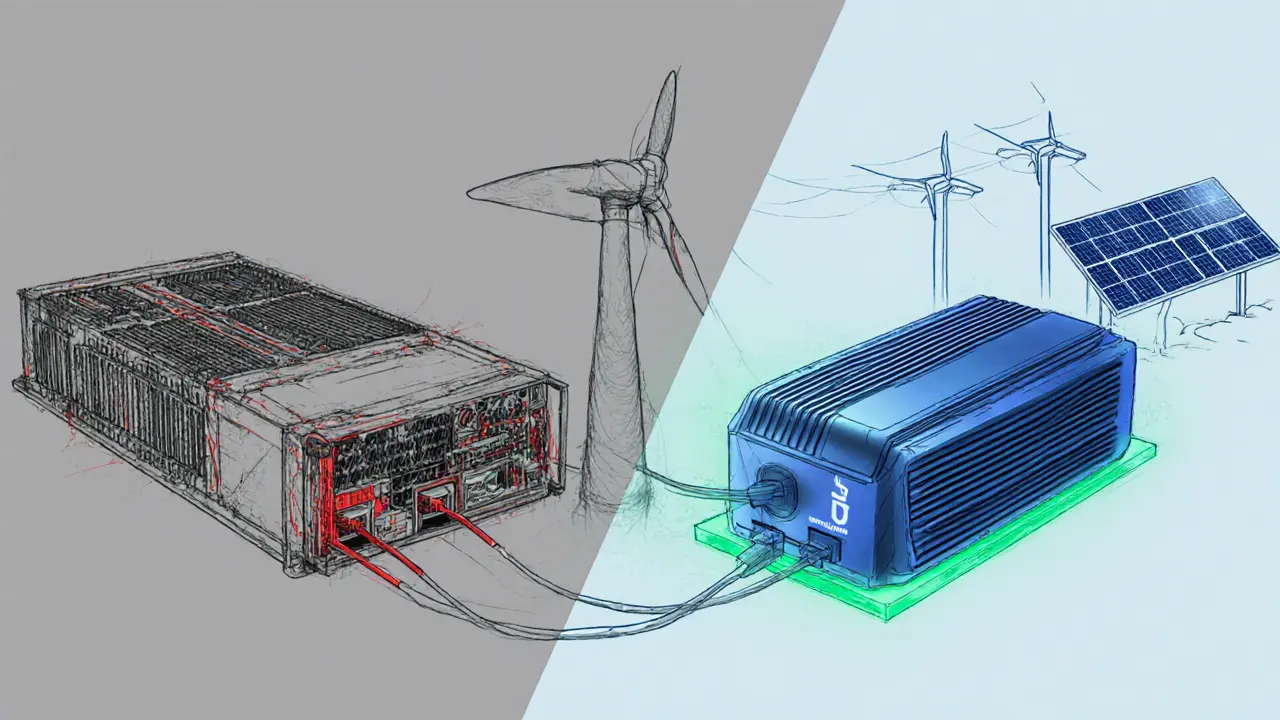

- Secure low‑cost, renewable power. Power purchase agreements (PPAs) with hydro or wind providers can lock rates below $0.03/kWh. Some miners even co‑locate with curtailment projects to capture stranded energy at near‑zero cost.

- Maintain a liquidity cushion. A reserve covering 6‑12months of OPEX lets you ride out price dips while the market recalibrates.

Implementing any one of these steps without the others often yields marginal gains that vanish under halving pressure.

Hardware Comparison: Legacy vs. Latest ASICs

| Model | Hashrate (TH/s) | Power (W) | Efficiency (J/TH) |

|---|---|---|---|

| Antminer S19 Pro (2020) | 110 | 3250 | 29.5 |

| WhatsMiner M50 (2023) | 112 | 3150 | 28.1 |

| Bitmain S19 XP (2024) | 140 | 3450 | 24.6 |

| WhatsMiner M55 (2024) | 150 | 3500 | 23.3 |

Switching from a S19 Pro to an M55 can shave roughly 20% off electricity bills at the same hash contribution - a decisive edge when block rewards halve.

Energy Strategies: From Retail Rates to Renewable PPAs

Electricity makes up 60‑80% of a miner’s cost structure. Below are three practical routes to lower that share:

- Direct PPAs: Negotiate multi‑year contracts with hydro plants in Quebec or wind farms in Texas. Fixed rates below $0.04/kWh protect against market spikes.

- Behind‑the‑meter generation: Co‑locate with battery storage or solar farms. Excess renewable power can be sold back to the grid, offsetting operational costs.

- Stranded energy sourcing: Tap into curtailed grid capacity in regions like Iceland, where excess geothermal or hydro power is sold at pennies per kWh.

Mining companies that moved 40% of their power mix to renewables reported a 12% boost in net margin during the first quarter after the 2024 halving.

Future Outlook: The Next Halving and Industry Concentration

The next halving is projected for 2028. With only 1.35million BTC left to mine, the competition for the dwindling reward will intensify. Analysts forecast that only operators sustaining electricity costs under $0.03/kWh and running the latest ASICs will stay profitable. This could cement an oligopolistic landscape dominated by a handful of industrial‑scale farms backed by renewable portfolios.

For now, the post‑2024 environment offers a clear lesson: miners must treat halving not as a one‑off event but as a recurring pressure test. Continuous investment in efficiency, strategic energy sourcing, and strong balance sheets will separate the survivors from the capitulators.

Frequently Asked Questions

What exactly is miner capitulation?

Miner capitulation describes the wave of mining operations that shut down or drastically cut hashrate after a Bitcoin halving because their revenue falls below operating costs.

How much does a miner earn per TH/s after the 2024 halving?

The average daily earnings dropped to roughly $0.0275 per TH/s, half of the pre‑halving $0.055 figure.

Which ASIC models are most efficient for 2024?

The WhatsMiner M55 and Bitmain S19XP lead the pack, delivering 23‑24J/TH, which is about 20% better than 2020‑era S19 Pro units.

What electricity price is needed to stay profitable post‑halving?

Analysts suggest sub‑$0.04/kWh is the break‑even point for most operations; under $0.03/kWh provides a comfortable margin even if Bitcoin stalls around $55,000.

Will the next halving further concentrate mining power?

Yes. With fewer coins left and tighter margins, only large, low‑cost, high‑efficiency miners are expected to survive, leading to higher concentration among industrial players.

vincent gaytano

19 March, 2025 . 20:15 PM

Sure, the halving is just a ploy by the shadow miners to reset the game.

Dyeshanae Navarro

20 March, 2025 . 18:28 PM

The halving reminds us that scarcity is a philosophical construct, not just a market mechanic. When supply tightens, we are forced to reconsider value beyond price tags. It’s a chance to reflect on the collective patience of the network. Ultimately, the resilience of miners shows a deeper trust in the system.

Matt Potter

21 March, 2025 . 16:42 PM

Look, the dip after the halving is a perfect opportunity to double down on efficiency! Aggressive upgrades now will pay off when the next reward drop hits. Don't let short‑term pain blind you from long‑term gains. Get those newer ASICs in place, lock cheap renewable power, and ride the wave. The future belongs to the bold.

Marli Ramos

22 March, 2025 . 14:55 PM

omg this article is sooo good 😂 but like why does everyone talk about profit sooo serious??

Christina Lombardi-Somaschini

23 March, 2025 . 13:08 PM

It is evident from the data presented that miner capitulation after the 2024 halving is more than a mere reaction to reduced block rewards; it signifies a structural shift in the economics of Bitcoin mining. The combination of heightened electricity costs and the inevitable depreciation of legacy ASIC hardware creates a scenario where only the most capital‑intensive operations can survive. One must consider that the marginal profit per terahash has effectively been halved, forcing operators to re‑evaluate their cost bases with ruthless precision. Moreover, the concentration of hashpower in regions with subsidized renewable energy further exacerbates the disparity between large‑scale farms and smaller, retail‑rate miners. This bifurcation leads to a natural selection process, whereby distressed assets are acquired by entities possessing deeper pockets and strategic foresight. As a result, the industry is poised for accelerated consolidation, with a handful of dominant players emerging. It is also crucial to acknowledge that the physiological stress on the network’s difficulty algorithm temporarily softens after a significant hashrate drop, offering a brief window of reprieve for surviving miners. However, this respite is typically short‑lived, as difficulty eventually re‑adjusts to the new equilibrium, restoring competitive pressure. Consequently, the imperative for continuous investment in high‑efficiency ASICs and low‑cost power contracts cannot be overstated. In parallel, maintaining a robust liquidity buffer-ideally covering six to twelve months of operational expenditures-serves as an essential safeguard against volatile BTC price movements. The strategic partnership between mining firms and renewable energy providers, exemplified by power purchase agreements, also reduces exposure to market electricity price spikes. Importantly, these agreements not only cut operational costs but also align the industry with broader environmental sustainability goals, potentially attracting institutional capital. The confluence of these factors suggests that the next halving in 2028 will likely witness an even tighter concentration of mining power, with only the most efficient, well‑funded operators maintaining profitability. Hence, miners must adopt a proactive, forward‑looking stance, treating each halving as a recurrent pressure test rather than an isolated event. The lessons drawn from the 2024 capitulation should inform long‑term strategic planning, ensuring that the ecosystem remains resilient, innovative, and capable of sustaining the security of the Bitcoin network for years to come.

katie sears

24 March, 2025 . 11:22 AM

From a cultural perspective, the shift towards renewable‑based PPAs illustrates how mining can integrate with local economies. By aligning incentives with community energy projects, operators not only lower costs but also foster goodwill. This collaborative model may become a benchmark for future expansions, especially in regions seeking sustainable development.

Gaurav Joshi

25 March, 2025 . 09:35 AM

It is morally unacceptable that miners keep draining cheap grids while the poor pay more.

Kathryn Moore

26 March, 2025 . 07:48 AM

Profitability is a simple equation: revenue minus cost equals profit.

Christine Wray

27 March, 2025 . 06:02 AM

I think the article does a good job balancing technical detail with accessibility. It helps newcomers see the bigger picture without drowning them in jargon.

roshan nair

28 March, 2025 . 04:15 AM

Hey folks, just a quick tip – when you calculate profitability, remember to factor in the *actual* uptime of your rigs, not just the theoretical max. I’ve seen people over‑estimate earnings by 10‑15% because they forget maintenance downtime. Also, watch out for hidden fees in your electricity contract; they can sneak in and eat your margins. Lastly, keep an eye on firmware updates – newer versions can shave off a few watts per TH, which adds up fast.

Jay K

29 March, 2025 . 02:28 AM

Ensuring compliance with local regulations is paramount; failure to do so may result in severe penalties and operational disruptions.

Kimberly M

30 March, 2025 . 00:42 AM

Great summary! 👍

Navneet kaur

30 March, 2025 . 23:55 PM

i cant beleive how much the power cost can affect ur profit.

Marketta Hawkins

31 March, 2025 . 22:08 PM

America's miners are the real patriots, others are just leeching! 😤

Drizzy Drake

1 April, 2025 . 20:22 PM

I hear a lot of worries about the halving, but let’s keep perspective. Mining is a marathon, not a sprint, and the network has survived multiple reward cuts before. If you focus on building a solid operational foundation-efficient hardware, cheap power, and cash reserves-you’ll weather any storm. Also, consider diversifying revenue streams, like staking or providing ancillary services, to smooth out volatility. The community’s support and shared knowledge are invaluable resources during tough times.

AJAY KUMAR

2 April, 2025 . 18:35 PM

Only true patriots would stand firm when the odds are stacked against them.

bob newman

3 April, 2025 . 16:48 PM

Everyone pretends they understand the halving, yet most are clueless about who actually pulls the strings behind the scenes. It's not just economics; it's about control.

Anil Paudyal

4 April, 2025 . 15:02 PM

Stay chill, profit will come.

Kimberly Gilliam

5 April, 2025 . 13:15 PM

Well, that's a lot of boring data, but nice try.

Jeannie Conforti

6 April, 2025 . 11:28 AM

Keep learning and adapt, you’ll be fine.