Korbit Exchange Compatibility Checker

Compatibility Assessment

Security Features

ISO 27001, SOC 1 Type 2 certifications and 9.75/10 safety rating from Traders Union.

Fee Structure

0.1% flat fee or 0% maker / 0.2% taker on Free Plan.

Looking for a deep dive into South Korea’s oldest crypto platform? This review breaks down Korbit crypto exchange from fees and security to user experience, helping you decide if it fits your trading style.

Key Takeaways

- Korbit is the longest‑running exchange in South Korea and the second‑largest by volume.

- Fees are simple: 0.1% flat on the Basic plan or 0% maker/0.2% taker on the Free plan.

- Security scores high - ISO 27001, SOC 1 Type 2, and a 9.75/10 safety rating from Traders Union.

- Only KRW is supported for fiat, so non‑Korean residents face hurdles.

- Limited crypto selection (192 pairs) but strong local banking integration.

What Is Korbit?

Korbit is a South Korean cryptocurrency exchange founded in 2013. It operates under the company name Korea Bitcoin Exchange Co., Ltd. and was the first Korean platform to list BTC/KRW trading pairs. The exchange now handles over $2.6million in 24‑hour volume (Oct2025) and sits behind just one domestic competitor in market share.

Where Does Korbit Fit in the Korean Crypto Landscape?

The platform’s home country, South Korea, boasts one of the world’s most regulated crypto markets. Korean investors value exchanges that comply with the Financial Intelligence Unit (KoFIU) and maintain transparent banking links. Korbit’s compliance gives it a moat against offshore players that struggle to meet these requirements.

Supported Coins and Trading Pairs

Korbit focuses on quality over quantity. Its catalog includes major assets such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and a handful of altcoins like Zcash (ZCH) and Monero (XMR). In total, the exchange offers 192 crypto/KRW pairs, which is modest compared with hundreds on global platforms.

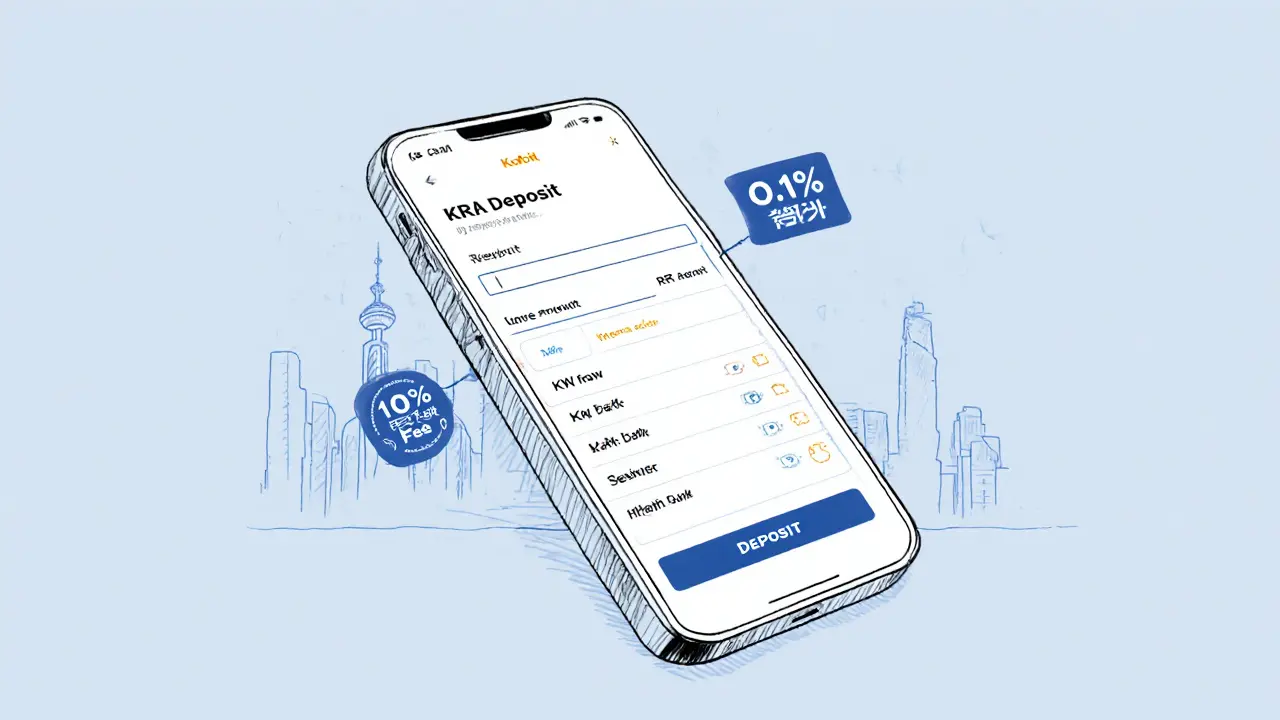

Fee Structure - What You Pay

Korbit offers two transparent plans:

- Basic Plan: 0.1% fee on every trade, regardless of maker or taker status.

- Free Plan: 0% maker fee, 0.2% taker fee. This plan is ideal for high‑frequency traders who can stay on the maker side.

Both plans require a minimum trade size of KRW5,000 (≈$3.70) and a minimum deposit of KRW10,000. There are no hidden withdrawal fees for KRW transfers, but network fees apply for crypto withdrawals.

Security and Regulatory Compliance

Security is where Korbit shines. The exchange earned the ISO 27001 certification in July 2018, becoming the first Korean crypto venue to meet this international information‑security standard. It also holds a SOC 1 Type 2 certification for financial controls.

According to Traders Union, Korbit received a 9.75/10 safety rating, reflecting robust cold‑storage practices, mandatory two‑factor authentication (2FA), and regular compliance audits with Korean regulators.

While it lacks some biometric tools (e.g., facial recognition) that competitors like Binance offer, its tier‑1 regulatory standing and government oversight provide a strong safety net for Korean users.

Trading Features and Order Types

Korbit’s web and mobile interfaces support the following order types:

- Limit buy/sell

- Market buy/sell

- Stop‑limit (both buy and sell)

- OCO (Order Cancels the Other)

The platform also offers staking for Ethereum (APR up to 5.2% until the full ETH 2.0 rollout) and an NFT marketplace. Advanced charting is limited; traders needing deep technical analysis often connect Korbit’s API to external tools like TradingView.

User Experience - Who Likes It?

For native Korean speakers, Korbit feels intuitive. The UI is clean, the KRW deposit/withdrawal flow integrates directly with local banks, and customer support offers Korean‑language chat. However, non‑Korean users report friction:

- Verification requires three levels beyond email, including a Korean phone number and bank account.

- English translations are partial, making advanced settings harder to navigate.

Support response times can stretch beyond 48hours during peak periods, a common criticism across review platforms.

Pros and Cons At a Glance

| Pros | Cons |

|---|---|

| Strong regulatory compliance in South Korea | Only KRW fiat support limits global users |

| Simple fee structure with a zero‑maker‑fee option | Limited crypto selection compared to Binance |

| High security ratings (ISO 27001, SOC 1, Traders Union) | Customer support can be slow |

| Native Korean banking integration for fast deposits/withdrawals | Basic charting tools; no built‑in TradingView |

| Additional services: ETH staking, NFT marketplace, savings “Piggybank” | English UI is still a work‑in‑progress |

How Does Korbit Compare to Global Players?

| Feature | Korbit | Binance | Coinbase |

|---|---|---|---|

| Supported Fiat | KRW only | USD, EUR, GBP, and many others | USD, EUR, GBP |

| Number of Crypto Pairs | 192 | >5,000 | ~600 |

| Maker/Taker Fees | 0%/0.2% (Free) or 0.1% flat | 0%/0.1% (VIP) or 0.1% flat | 0%/0.5% (Standard) |

| Security Certifications | ISO 27001, SOC 1 Type 2 | ISO 27001, 2FA, SAFU fund | ISO 27001, FDIC insurance on USD balances |

| Regulatory Standing in Home Country | Tier‑1 Korean regulator | Mixed (global) | U.S. FinCEN compliance |

| Mobile App Rating (Google Play) | 4.4 | 4.6 | 4.5 |

Is Korbit Right for You?

If you are a Korean resident or have a Korean bank account, Korbit’s seamless KRW flow and strong compliance make it a top choice for spot trading and staking. For international traders who need a wide range of assets and fiat options, platforms like Binance or Kraken may feel more comfortable.

Consider the following decision tree:

- Do you hold a Korean bank account? Yes → Korbit’s instant KRW deposits give you a speed advantage.

- Do you need more than 200 crypto pairs? No → Korbit’s selection covers most major coins.

- Is advanced charting essential? No → Use external tools via API.

- Do you prioritize maximum security certifications? Yes → Korbit’s ISO 27001 and high safety rating are reassuring.

Following this flow will help you gauge whether the exchange’s strengths align with your priorities.

Future Outlook

Regulatory stability in South Korea remains a key factor. Analysts predict continued growth in domestic crypto adoption, and Korbit’s already‑secured compliance positions it well for future market share gains. The exchange plans to expand its reward programs across six digital assets and keep refining mobile UX, although no public roadmap details have been disclosed.

Frequently Asked Questions

Can I use Korbit if I don’t live in South Korea?

Technically you can create an account, but full verification requires a Korean bank account and phone number. Without those, KRW deposits/withdrawals are blocked, making the platform impractical for most non‑Korean users.

What are the withdrawal fees for crypto?

Korbit charges the standard blockchain network fee for each asset. For example, Bitcoin withdrawals cost approximately 0.0005BTC, while ERC‑20 token withdrawals are around 0.005ETH.

Is Korbit’s staking service safe?

Staking is handled off‑chain by Korbit’s custodial service, which follows the same security protocols as its spot wallets (cold storage, multi‑sig). The APR for Ethereum is currently 5.2% and is payable in ETH.

How long does the KYC verification take?

After submitting all three verification levels, most users see their accounts approved within 24-48hours, assuming all documents are clear and the bank link works.

Does Korbit offer a mobile app?

Yes, Korbit provides Android and iOS apps that support spot trading, staking, and account management. The app currently holds a 4.4‑star rating on Google Play.

Bottom Line

For Korean traders, Korbit delivers a secure, compliant, and fee‑friendly environment that’s hard to beat locally. International users may find the KRW‑only focus and language gaps a dealbreaker, pushing them toward more globally oriented exchanges. Ultimately, the platform’s strong security certifications and simple fee plans make it a solid pick if you meet the residency requirements.

Marcus Henderson

7 October, 2025 . 08:15 AM

For traders seeking a regulated environment, Korbit’s ISO 27001 and SOC 1 certifications represent a solid foundation of trust. The flat 0.1% fee on the Basic plan simplifies cost calculations, especially for occasional spot traders. Moreover, the platform’s deep integration with Korean banks accelerates KRW deposits, reducing friction for domestic users. Those aspects collectively make Korbit a compelling choice for residents aligning with local compliance requirements.

Debra Sears

11 October, 2025 . 08:15 AM

I can see how the limited fiat options might feel restrictive if you’re outside Korea, yet the security metrics are impressive. The 9.75/10 safety rating indicates robust cold‑storage practices that many globally‑focused exchanges still strive for. While the crypto pair count sits at 192, the selection covers the major assets most users need for regular trading. If you primarily trade BTC, ETH, and a few altcoins, the platform’s simplicity could actually be an advantage. It’s worth weighing the trade‑off between breadth and regulatory certainty.

Andrew Lin

15 October, 2025 . 08:15 AM

Korbit is a joke for anyone outside Korea.

Matthew Laird

19 October, 2025 . 08:15 AM

While some dismiss it outright, the exchange’s compliance with Korean financial authorities cannot be ignored; regulators there are notoriously strict. The platform’s certification suite suggests a level of oversight that many offshore services lack. Dismissing Korbit solely because of geography overlooks its strong security posture. However, the requirement for a Korean phone number does create a genuine barrier for international participants.

Caitlin Eliason

23 October, 2025 . 08:15 AM

🌟 For Korean residents, Korbit shines like a beacon of reliability in a sea of volatile exchanges. Its fee structure is refreshingly transparent, and the staking rewards add a modest passive income stream. Yet the platform’s insular focus on KRW means you’re essentially locked into a domestic financial ecosystem. If you value high‑frequency trading across dozens of pairs, you’ll feel the pinch. Still, for those who prioritize security and seamless bank transfers, the trade‑off feels justified.

Ken Pritchard

27 October, 2025 . 07:15 AM

Debra raised a good point about pair variety; a practical workaround is to use Korbit’s API to connect to external charting tools like TradingView. This bridges the gap between limited on‑site analytics and the richer data many traders rely on. Additionally, you can diversify by maintaining a small balance on a global exchange for the more exotic assets while keeping core holdings on Korbit for stability. Balancing both worlds often yields the best of both security and breadth.

Melanie LeBlanc

31 October, 2025 . 07:15 AM

Marcus, you’re spot on about the bank integration-nothing beats a same‑day KRW deposit for keeping your trading momentum. The straightforward 0.1% flat fee also means you won’t be surprised by hidden costs, which is a breath of fresh air. One caveat, though, is the customer support lag during peak times; a delayed response can be frustrating when you need urgent assistance. Overall, the platform offers a solid foundation for Korean‑centric traders looking for a hassle‑free experience.

Don Price

4 November, 2025 . 07:15 AM

When you examine the Korean crypto regulatory environment, you quickly realize that the government has instituted a labyrinth of compliance measures designed to keep a tight grip on capital flows, and Korbit sits squarely at the center of this architecture. Its ISO 27001 certification is not merely a marketing badge; it mandates a systematic approach to information security that includes regular external audits, risk assessments, and a documented incident response plan. The additional SOC 1 Type 2 attestation further confirms that internal controls over financial reporting meet rigorous standards, something many Western exchanges cannot claim without extensive scrutiny. The 9.75/10 safety rating, while impressive, should still be interpreted in the context of a market where the authorities monitor transaction patterns for signs of illicit activity, potentially limiting anonymity for users. Coupled with the requirement for a Korean phone number and bank account, these safeguards create a fortress-like environment that deters fraud but also restricts true decentralization. Critics argue that such tight regulation stifles innovation, yet the trade‑off for many is increased confidence that their funds are insulated from sudden regulatory crackdowns. Moreover, the platform’s cold‑storage strategy reportedly holds the majority of assets offline, reducing exposure to hacks that have plagued other exchanges. The multi‑signature wallets employed add an additional layer of security, ensuring that no single insider can unilaterally move large sums. However, the centralized nature of these controls means that in the unlikely event of a government order, assets could be frozen without recourse. This duality-enhanced security versus reduced personal sovereignty-mirrors the broader ideological debate surrounding crypto’s role in modern finance. From a user perspective, the seamless KRW deposit and withdrawal process is a major convenience, especially when compared to the often‑cumbersome fiat on‑ramps of global platforms. The fee structure, while simple, does not hide maker‑taker differentials that could otherwise benefit high‑frequency traders. On the downside, the limited selection of 192 pairs excludes many emerging tokens that early adopters might wish to explore. Nevertheless, for the average investor focused on major coins, this list is sufficient. In conclusion, Korbit exemplifies a regulated, security‑first approach that aligns with South Korea’s cautious yet progressive stance on digital assets, and understanding these nuances is essential for anyone considering participation in its ecosystem.

Jasmine Kate

8 November, 2025 . 07:15 AM

Don’s deep dive is impressive, but at the end of the day, a platform that locks out non‑Korean users feels like crypto elitism wrapped in a compliance veneer.

Mark Fewster

12 November, 2025 . 07:15 AM

Jasmine, it's true-while security is paramount, the exclusivity of requiring a Korean phone number can discourage legitimate international traders from accessing a well‑secured service; this trade‑off should be weighed carefully.

Dawn van der Helm

16 November, 2025 . 07:15 AM

😊 Even with its KRW‑only focus, Korbit still offers a reliable gateway for Korean traders, and its strong security track record can serve as a benchmark for newer exchanges worldwide.

Monafo Janssen

20 November, 2025 . 07:15 AM

Dawn makes a good point; the solid security and local banking ties give Korean users an edge, and for those outside Korea, using a bridge service or a secondary global exchange can cover the fiat gap.

Michael Phillips

24 November, 2025 . 07:15 AM

From a philosophical standpoint, choosing an exchange is a balance between trust and freedom; Korbit leans heavily toward trust through regulation, which may appeal to risk‑averse investors.

Jason Duke

28 November, 2025 . 07:15 AM

Indeed, Michael; the emphasis on trust isn’t a weakness-it’s a strategic advantage that mitigates many of the systemic risks that plague less regulated platforms, and the flat fee simplifies budgeting for traders.

Franceska Willis

2 December, 2025 . 07:15 AM

Jason, while the flat fee is nice, don’t forget that the limited pair list can box you in-if you’re hunting for that next altcoin breakout, you’ll have to hop over to another exchange, which kinda defeats the “one‑stop‑shop” vibe.

EDWARD SAKTI PUTRA

6 December, 2025 . 07:15 AM

Understanding the user experience, it’s clear that the Korean‑only fiat support is a major hurdle for global participants, yet the platform’s rapid KRW processing times provide a distinct advantage for locals.

Bryan Alexander

10 December, 2025 . 07:15 AM

The drama of crypto can be overwhelming, but Korbit cuts through the noise with its straightforward fee schedule and robust security certifications, offering a calm harbor for traders who value stability over hype.

Patrick Gullion

14 December, 2025 . 07:15 AM

Sure, Bryan, but if you’re chasing the latest DeFi projects, the 192‑pair limit will leave you watching from the sidelines while other exchanges roll out the newest tokens daily.

Jack Stiles

18 December, 2025 . 07:15 AM

Patrick’s point is fair-while stability is great, the ecosystem moves fast, and missing out on emerging assets can feel like sitting on the bench when the game’s heating up.

Ritu Srivastava

22 December, 2025 . 07:15 AM

It’s disconcerting that a platform so entrenched in Korean regulation effectively gates out the global community, perpetuating a siloed market that runs counter to the decentralized ethos of crypto.

Liam Wells

26 December, 2025 . 07:15 AM

Ritu, while your critique highlights a legitimate concern regarding inclusivity, one must also acknowledge that the stringent regulatory framework safeguards users against fraud and enhances overall market stability, which, in turn, fosters long‑term confidence.

Nicholas Kulick

30 December, 2025 . 07:15 AM

Korbit’s API documentation is well‑structured, allowing developers to integrate external charting tools and automate trading strategies despite the platform’s limited native features.

Caleb Shepherd

3 January, 2026 . 07:15 AM

True, Nicholas, but keep an eye on the fact that the Korean government’s close monitoring could mean sudden policy shifts that affect API access or trading conditions without much warning.