MILK Crypto Price Prediction Calculator

Current Market Data

- Current MILK Price $0.0415

- 24-Hour Volatility 6.61%

- 50-Day SMA $0.0468

Prediction Parameters

Prediction Results

Forecast Comparison

| Source | Predicted Avg Price |

|---|---|

| Exolix | $0.1190 |

| CoinCodex | $0.0299 |

MilkyWay (MILK) is a cross‑chain DeFi utility token built to reward liquidity providers, stake holders and governance participants across several blockchain networks. Launched in early 2024, it aims to simplify yield farming for newcomers while giving power users the tools to chase higher returns. If you’ve typed “MILK crypto” into a search box, you’re probably looking for exactly this token and wondering how it works, whether it’s worth your time, and what the market says about its future.

Quick Summary

- MilkyWay (MILK) is a cross‑chain DeFi token that powers liquidity, staking and governance.

- Current price (Oct22025) sits around $0.0415 with a 6.6% volatility rate.

- Two major price forecasts clash: Exolix sees a 2025 average near $0.12, while CoinCodex expects a bearish range below $0.04.

- Bitcoin’s price direction heavily influences MILK’s upside potential.

- Investors should treat MILK as a high‑risk, speculative asset and balance it with diversified holdings.

Core Features of MilkyWay (MILK)

The token’s design revolves around three pillars:

- Cross‑chain liquidity: MILK can move between Ethereum, Binance Smart Chain, Polygon and other EVM‑compatible networks, letting users farm yields where the rates are best.

- Yield aggregation: The platform automatically routes user deposits to the most profitable farms, reducing the need for manual pallet‑shuffling.

- Governance: Holding MILK grants voting rights on protocol upgrades, fee structures and new chain integrations.

These capabilities are underpinned by smart contracts that execute without a central authority. Smart Contract audits from reputable firms have been published, but the cross‑chain bridges still carry inherent risk, as is common in the DeFi space.

How Does MILK Fit Into the DeFi Landscape?

DeFi, short for Decentralized Finance, aims to recreate banking services-lending, borrowing, trading-without intermediaries. Within DeFi, Yield Farming lets users earn extra tokens by providing liquidity to pools. MILK differentiates itself by bundling multiple farms across chains into a single interface, a concept similar to what established platforms like Curve or Uniswap offer, but with an emphasis on beginner friendliness.

Because MILK is a utility token, it isn’t meant to be a store of value like Bitcoin. Instead, its value is derived from the demand for the platform’s services. When more users stake or provide liquidity, the protocol may burn a portion of MILK to control supply, potentially nudging the price upward.

Market Data Snapshot (October2025)

| Metric | Value |

|---|---|

| Current Price | $0.0415 |

| 24‑hour Volatility | 6.61% |

| 50‑day SMA | $0.0468 |

| 14‑day RSI | 44.25 (neutral‑to‑bearish) |

| Fear & Greed Index | 43 (fear) |

| Green Trading Days (30‑day) | 17 (57% positive) |

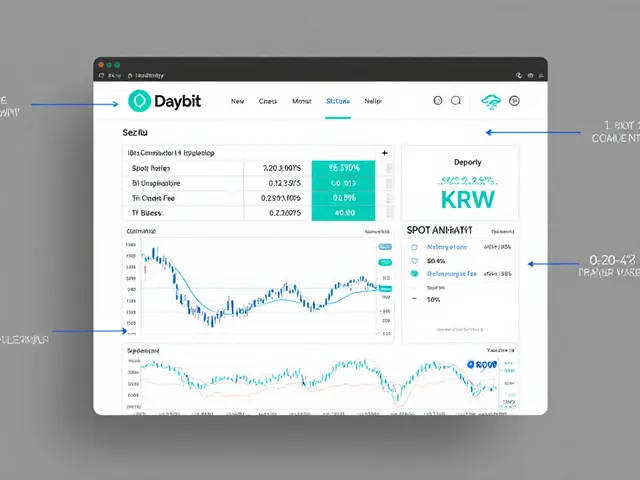

Price Predictions: Exolix vs. CoinCodex

Two independent analysts have published divergent outlooks for MILK in 2025. Below is a side‑by‑side look.

| Source | Average 2025 Price | Key Assumptions |

|---|---|---|

| Exolix | $0.1190 | Positive Bitcoin trend above $80k; strong DeFi inflow. |

| CoinCodex | $0.0299 (near‑term target) | Bearish momentum; potential short‑selling opportunities. |

Both models factor in MILK’s cross‑chain benefits, but they differ on macro‑level sentiment. Exolix leans on a bullish Bitcoin backdrop, while CoinCodex emphasizes current fear metrics and the token’s recent SMA crossover (50‑day below 200‑day), a classic bearish signal.

Why Bitcoin Matters for MILK

According to Bradley Pierce, a crypto niche expert at Exolix, altcoins like MILK tend to follow Bitcoin’s price trail. If Bitcoin stays above $80,000 throughout 2025, capital often flows into risk‑on assets, giving MILK the liquidity needed to push price higher. Conversely, a Bitcoin dip or prolonged consolidation squeezes speculative money out of the market, dragging MILK down.

Risks to Keep in Mind

Investing in MILK is not for the faint‑hearted. Here are the top risk factors:

- Market volatility: The token’s 6.6% daily swings can erode capital quickly.

- Regulatory uncertainty: DeFi protocols face an evolving legal landscape worldwide.

- Smart contract and bridge bugs: Cross‑chain bridges have historically been exploited.

- Competitive pressure: Established farms like Curve, Uniswap and newer interoperable projects may capture MILK’s potential user base.

- Naming confusion: Other coins use the “MILK” ticker (e.g., Udder Chaos), leading to accidental purchases.

How to Safely Get Started with MILK

- Do a quick wallet check: Make sure you have a non‑custodial wallet that supports EVM chains (MetaMask, Trust Wallet, etc.).

- Buy MILK on a reputable DEX or CEX that lists the token-always verify the contract address from the official MilkyWay site.

- Consider a small test transaction first to confirm the bridge works across the chain you intend to use.

- Stake or provide liquidity only with amounts you can afford to lose; start with a single pool before diversifying.

- Keep an eye on governance proposals-voting with MILK can affect fee structures and future token burns.

Using a hardware wallet adds an extra layer of security for large holdings, especially when interacting with cross‑chain bridges.

Frequently Asked Questions

What does the MILK ticker stand for?

MILK is the short symbol for the MilkyWay token, a utility token used for liquidity incentives, staking rewards and governance across multiple blockchains.

How can I verify I’m buying the real MILK token?

Always compare the contract address shown on the official MilkyWay website with the address displayed on the exchange. The official address is a 42‑character hex string starting with “0x”.

Is MILK a good long‑term investment?

It depends on your risk tolerance. MILK offers high upside if DeFi adoption grows and Bitcoin stays bullish, but the token is still speculative and can drop sharply, so treat it as a small, high‑risk position.

Can I use MILK on any blockchain?

MILK currently operates on Ethereum, Binance Smart Chain, Polygon and a few emerging EVM‑compatible chains. The project plans to add more in 2026.

What should I watch for in the market?

Key signals include Bitcoin’s price relative to $80k, the Fear & Greed Index (values < 50 signal caution), and the 50‑day SMA crossing the 200‑day SMA for MILK. Also track any new governance votes that could change token economics.

Jared Carline

18 February, 2025 . 20:07 PM

Although many proclaim MILK as the next DeFi darling, the token’s dependence on Bitcoin’s price trajectory renders it intrinsically volatile, and investors should regard its current 6.6 % daily swing as a substantial risk factor.

raghavan veera

19 February, 2025 . 12:47 PM

From a broader perspective, the pursuit of yield in such cross‑chain ecosystems mirrors the age‑old dilemma of chasing perpetual motion; without a stable anchor, the rewards evaporate as swiftly as they appear.

Vijay Kumar

20 February, 2025 . 05:27 AM

Hey folks, if you’re looking to dip a toe into MILK, start small, test the bridge on a testnet, and only scale up once you’re comfortable with the gas fees and slippage on each chain; this cautious approach can save you from painful losses while you learn the ropes.

Edgardo Rodriguez

20 February, 2025 . 22:07 PM

Indeed, the multi‑chain nature of MILK, while innovative, introduces additional layers of complexity-bridge fees, token wrapping, and potential latency issues-all of which demand vigilant monitoring, especially during periods of heightened market turbulence, and this cannot be overstated.

mudassir khan

21 February, 2025 . 14:47 PM

In reality, the projected price divergence between Exolix and CoinCodex is nothing more than speculative noise; without concrete adoption metrics, any forecast remains conjecture, and the token’s underlying utility appears marginal at best.

Bianca Giagante

22 February, 2025 . 07:27 AM

While it is understandable to be cautious, it is also worth noting that the governance mechanisms of MILC allow token‑holders to influence fee structures, and this participatory aspect could, over time, enhance community trust and incremental value growth.

Andrew Else

23 February, 2025 . 00:07 AM

Sure, another meme token with a dairy name.

Susan Brindle Kerr

23 February, 2025 . 16:47 PM

Honestly, the whole hype seems like a circus, and the real investors are the ones who keep their eyes on the real fundamentals, not the flashy ticker.

Danielle Thompson

24 February, 2025 . 09:27 AM

Great job on breaking down the steps! 🎉 Keep it simple and stay safe.

Eric Levesque

25 February, 2025 . 02:07 AM

America’s tech should lead, not rely on foreign DeFi tokens that can disappear overnight.

alex demaisip

25 February, 2025 . 18:47 PM

From a macro‑economic standpoint, MILK’s tokenomics present a nuanced interplay between inflationary pressure via minted rewards and deflationary mechanisms instantiated through periodic token burns, which, when modeled under stochastic differential equations, suggest a bounded but highly sensitive price corridor contingent on external liquidity influx.

Tony Young

26 February, 2025 . 11:27 AM

When you first encounter MILK, the most striking feature is its cross‑chain liquidity aggregation, which promises to consolidate yields that would otherwise be scattered across disparate farms. The platform’s architecture relies on a suite of smart contracts that automatically redirect deposits to the highest‑APY pools, thereby reducing the manual effort commonly associated with yield farming. This automation, however, is not without cost; bridge fees and gas expenditures can erode the net return, especially on congested networks like Ethereum. Moreover, the token’s governance token (MILK) grants voting rights, meaning that active holders can influence fee structures, token‑burn schedules, and future chain integrations. Such governance participation can create a positive feedback loop, where community‑driven improvements boost utility and, consequently, token demand. On the flip side, decentralized governance can also lead to decision‑making gridlock, especially if proposals become overly politicized. The current market data shows a 6.6 % daily volatility, which, while typical for emerging DeFi assets, signals that price swings can be abrupt and unforgiving. Bitcoin’s price trajectory remains a macro‑level driver; an extended bullish phase above $80k historically channels speculative capital into altcoins like MILK, whereas a correction pulls liquidity back into safer assets. The two divergent forecasts-Exolix’s $0.119 versus CoinCodex’s $0.0299-highlight the uncertainty embedded in these macro assumptions. It is prudent to monitor the Fear & Greed Index; values under 50 traditionally correlate with heightened risk aversion among retail investors. Additionally, tracking the 50‑day and 200‑day SMA crossover provides a technical cue: a bearish crossover could precede a downtrend. For newcomers, a recommended approach is to allocate a modest, disposable‑income portion to MILK, test the bridging process on a low‑value transaction, and only scale up after confirming consistent yields. Employing a hardware wallet for larger positions adds a layer of security against potential bridge exploits. Ultimately, MILK can serve as a useful component in a diversified DeFi portfolio, provided you respect its speculative nature and maintain rigorous risk management. 🚀

Elmer Detres

27 February, 2025 . 04:07 AM

Excellent analysis! 🔥 Your breakdown of both the technical and macro factors gives a clear roadmap for anyone considering MILK, and the emphasis on risk management is spot‑on.

Fiona Padrutt

27 February, 2025 . 20:47 PM

Patriots should invest in home‑grown blockchain solutions that prioritize national security over foreign tokens that could be weaponized against our economic sovereignty.