Real Estate NFT Platform Comparison Tool

Use this tool to compare key features of top real estate NFT platforms. Select one or more platforms to see detailed information.

How This Tool Works

- Select platforms using checkboxes above to view their features

- Each card shows investment minimums, blockchain used, and special features

- Real Estate NFTs enable fractional ownership and transparent transactions

- Platforms vary in focus: residential rentals, commercial deals, metaverse lands

- Smart contracts automate rental payouts and property management

Imagine buying a slice of a downtown condo for the price of a coffee. That’s the promise of real estate NFT platforms. By turning bricks-and-mortar assets into digital tokens, these marketplaces let anyone with an internet connection own a piece of property, collect rental income, and trade it on a blockchain.

What Exactly Is a Real Estate NFT?

At its core, a real estate NFT is a non‑fungible token that represents a unique claim on a physical or virtual property. Unlike a regular NFT artwork, each token carries legal and financial data-location, appraisal value, and ownership history-stored on an immutable ledger. The process of turning property into a digital asset is called tokenization, and it enables fractional ownership, where each token equals a specific percentage of the underlying asset.

Key Technologies Behind the Platforms

Most platforms sit on the Ethereum blockchain, leveraging its robust smart‑contract capabilities. A smart contract automates the entire lifecycle: minting the token, handling escrow, distributing rental yields, and recording ownership transfers. Some newer entrants are experimenting with layer‑2 solutions or alternative chains to cut gas fees, but Ethereum remains the industry standard because of its mature tooling and large developer community.

Leading Real Estate NFT Platforms in 2025

Below are the most active marketplaces, each with a distinct approach.

- RealT is a U.S.-focused platform that fractionalizes rental homes on Ethereum. Investors can buy tokens starting at $200 and receive monthly rental payouts in stablecoins.

- Propy specializes in high‑value transactions, having closed multiple $1million‑plus property sales entirely on‑chain. Its end‑to‑end dashboard integrates title verification with NFT minting.

- Lofty AI adds artificial‑intelligence‑driven property scouting. The platform scores each asset for cash‑flow potential before tokenizing it, helping investors pick high‑yield opportunities.

- Ubitquity focuses on title management and record‑keeping. Its blockchain ledger is often used by municipalities and title companies to certify ownership.

- Decentraland brings the concept to the metaverse. Virtual parcels of land are minted as NFTs and can be developed into digital experiences or rented to advertisers.

Why Tokenized Real Estate Beats Traditional Investing

Transparency: Every transaction is recorded on an immutable ledger, eliminating the paperwork delays and hidden fees that plague conventional closings.

Accessibility: Fractional tokens lower the entry barrier from six‑figure down payments to a few hundred dollars, opening premium markets to retail investors worldwide.

Liquidity (potential): While secondary markets are still nascent, token holders can list their fractions on NFT exchanges, offering a faster exit than a traditional property sale.

Automation: Rental income distribution, tax documentation, and even property‑maintenance escrow can be programmed into smart contracts, reducing management overhead.

Challenges and Risks to Watch

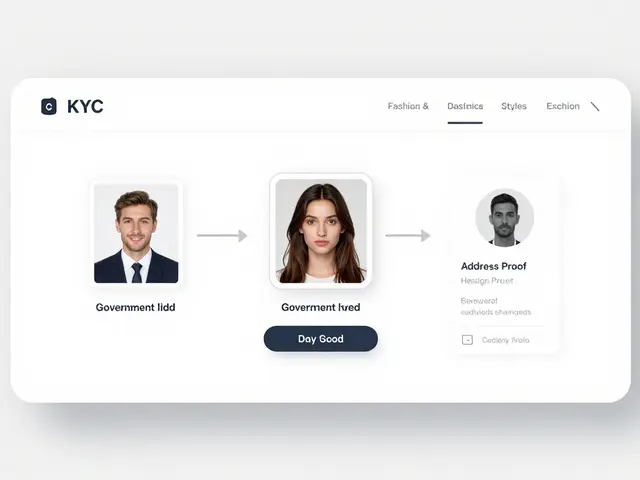

Regulatory uncertainty remains the biggest head‑wind. Jurisdictions differ on whether a token counts as a security, a commodity, or a property right, affecting KYC/AML requirements.

Technical friction: Users must grasp crypto wallets, gas fees, and private‑key security. Onboarding can take 2‑4 weeks for newcomers.

Liquidity gaps: Secondary markets exist, but price discovery is limited, especially for niche assets like a single‑family home in Detroit.

Platform risk: Newer marketplaces may lack robust customer support or fail to deliver promised yields. Due diligence on the team, audit reports, and insurance coverage is essential.

Step‑By‑Step: How to Start Investing on a Real Estate NFT Platform

- Choose a platform that matches your goals (e.g., RealT for U.S. rentals, Decentraland for virtual land).

- Create a crypto wallet compatible with Ethereum (MetaMask, Trust Wallet, or a hardware wallet for extra security).

- Buy a small amount of ETH or a stablecoin (USDC/DAI) on a reputable exchange.

- Complete KYC on the chosen platform. Most require a photo ID and proof of residence.

- Browse token listings. Review the property’s location, appraisal report, expected yield, and smart‑contract terms.

- Purchase the desired number of tokens. The transaction will appear instantly on the blockchain.

- Monitor your portfolio. Rental payouts are usually automated monthly; you can reinvest or cash out via an NFT marketplace.

After the initial setup, the ongoing time commitment drops to a few minutes per month, thanks to automated income distribution.

Market Outlook: 2025‑2031

The global real‑estate‑NFT market was valued at $602million in 2024 and is projected to hit $2.03billion by 2031, a CAGR of 20.2%. North America currently holds ~40% of market share, but the Asia‑Pacific region is the fastest‑growing, driven by metaverse land sales and emerging regulatory sandboxes.

Industry analysts forecast that tokenized assets will represent over 25% of commercial‑property transactions by 2030. Institutional players-banks, REITs, and sovereign wealth funds-are piloting tokenization pilots, further legitimizing the model.

Comparison Table: Platform Features at a Glance

| Platform | Primary Market | Minimum Investment | Blockchain Used | Special Feature |

|---|---|---|---|---|

| RealT | U.S. residential rentals | $200 | Ethereum (L2 options) | Automated crypto‑cash rental payouts |

| Propy | High‑value commercial & residential | $5,000 | Ethereum + Polygon | End‑to‑end title verification on‑chain |

| Lofty AI | U.S. & European cash‑flow assets | $300 | Ethereum | AI‑driven property scoring & yield forecasts |

| Ubitquity | Title & record‑keeping services | N/A (B2B) | Ethereum + private‑chain option | Regulatory‑grade immutable title ledger |

| Decentraland | Metaverse virtual land | $150 | Ethereum | 3D development tools & virtual‑event monetization |

Frequently Asked Questions

Can I lose my money if the platform goes bankrupt?

Token ownership is recorded on the blockchain, so the asset itself remains yours even if the marketplace shuts down. However, you might lose access to the platform’s UI and any automated services (like rental payout automation). You’d need to interact directly with the smart contract or move the tokens to another compatible platform.

Do tokenized properties generate tax documents?

Most platforms provide quarterly statements showing rental income and any capital gains. Because the income is often paid in stablecoins, you’ll report it as foreign‑currency income on your tax return, similar to other crypto earnings. Always consult a tax professional familiar with crypto assets.

Is the token a security?

In the U.S., most fractional property tokens are classified as securities, meaning platforms must follow SEC registration or exemption rules. Jurisdictions differ, so the legal status depends on where the property is located and where the investor resides.

How liquid are these tokens?

Liquidity varies. High‑profile assets on Propy can find buyers quickly, while niche residential tokens on RealT may sit for weeks. Listing on secondary NFT marketplaces improves chances, but expect a discount compared to the underlying property’s appraised value.

Do I need a crypto wallet to invest?

Yes. A compatible Ethereum wallet stores your tokens and signs transactions. Many platforms guide you through wallet creation, and you can start with a software wallet before upgrading to a hardware device for extra security.

Tokenized real estate is still early, but the momentum is undeniable. Whether you’re after steady rental yields, exposure to emerging metaverse land, or a tech‑savvy way to diversify your portfolio, a real‑estate‑NFT platform gives you a foothold. Do your research, start small, and watch the market evolve-you may find that the future of property ownership is already here.

mudassir khan

13 October, 2024 . 17:30 PM

While the article admirably enumerates several promising platforms, it regrettably skirts substantive analysis of token‑omics, regulatory risk, and the actual liquidity of the listed assets; a reader seeking actionable insight is left with a glossy inventory rather than a critical appraisal, which, in a domain as nascent and legally fraught as real‑estate NFTs, is frankly indispensable.

Bianca Giagante

20 October, 2024 . 16:00 PM

The overview does a solid job of laying out the core features of each marketplace, and the inclusion of minimum investment thresholds helps newcomers gauge accessibility; however, a brief note on the varying jurisdictional considerations would further enhance its utility for a global audience.

Corrie Moxon

27 October, 2024 . 13:30 PM

I appreciate the concise breakdown of each platform’s specialty, especially the distinction between residential rentals and metaverse parcels; this clarity makes it easier to align personal investment goals with the appropriate service.

Jeff Carson

3 November, 2024 . 12:00 PM

👍 Great summary! I especially liked the note on AI‑driven scoring in Lofty AI – that’s a neat way to sift through the noise. A quick tip for newcomers: keep an eye on gas fees during peak times; they can erode those sweet rental yields.

Anne Zaya

10 November, 2024 . 10:30 AM

Nice rundown, but I wish there were more on the user experience side – like how easy the wallets are to set up.

Emma Szabo

17 November, 2024 . 09:00 AM

First off, kudos to the author for stitching together a panorama of the real‑estate NFT landscape that feels both comprehensive and inviting; the table is crisp, the bullet points are crystal‑clear, and the prose walks the line between tech‑savvy and lay‑person‑friendly. The inclusion of platforms ranging from the brick‑and‑mortar‑focused RealT to the virtual‑world‑centric Decentraland showcases the breadth of tokenization opportunities, and that diversity is precisely what makes the sector feel like a playground for the adventurous investor. I especially love how Lofty AI’s AI‑driven property scoring is highlighted – it’s like having a seasoned analyst tucked into your wallet, whispering yield forecasts in real time. The discussion on regulatory uncertainty is spot‑on; any seasoned crypto‑enthusiast knows that the SEC’s stance can turn a promising token into a legal quagmire overnight. Moreover, the step‑by‑step guide demystifies the wallet setup process, which is often the biggest hurdle for newcomers who fear they’ll lose their private keys. The article wisely advises users to start with a modest amount – a few hundred dollars – before scaling up, mirroring the prudent “test‑the‑waters” approach many veterans swear by. I also appreciate the nod to secondary markets, reminding us that while liquidity isn’t perfect, it’s improving as more platforms adopt standardized NFT standards. The risk section could perhaps benefit from a deeper dive into platform solvency, especially for newer entrants that may lack an audit trail. Nevertheless, the balance between optimism and caution feels authentic, which is refreshing in a space that can sometimes sound like hype‑filled marketing copy. The visual layout, with its interactive cards, makes the data digestible, and the use of a simple checkbox filter is a clever UX touch. On the technical side, the emphasis on Ethereum’s dominance, coupled with mentions of layer‑2 solutions, acknowledges both the security pedigree of the mainnet and the cost‑efficiency drives pushing the industry forward. The mention of stablecoins for rental payouts underscores the importance of minimizing volatility for income‑seeking investors. In short, this article serves as a solid launching pad for anyone curious about dipping their toes into tokenized property, offering enough depth to spark further research without drowning the reader in legalese. Keep up the great work, and perhaps a future update could explore emerging chains like Solana or Avalanche, which are starting to nibble at the Ethereum‑centric market share.

Fiona Lam

24 November, 2024 . 07:30 AM

Listen, if you think buying a $150 virtual plot is “the future,” you’re living in a fantasy world – it’s all hype until someone actually builds something useful on it.

OLAOLUWAPO SANDA

1 December, 2024 . 06:00 AM

It’s just a gimmick.

Alex Yepes

8 December, 2024 . 04:30 AM

The procedural rigor outlined herein, particularly the emphasis on KYC compliance and on‑chain title verification, constitutes a commendable alignment with emerging regulatory frameworks, thereby mitigating fiduciary exposure for institutional stakeholders.

Sumedha Nag

15 December, 2024 . 03:00 AM

Honestly, I think most of these platforms are overblown – the real profits still come from traditional real estate, not some crypto token gimmick.

Holly Harrar

22 December, 2024 . 01:30 AM

Yo, if u r startin out, grab a hardware wallet first – it’ll keep ur tokens safe an avoid sum nasty hacks that happen on software only wallets.

Vijay Kumar

29 December, 2024 . 00:00 AM

Great piece, but a quick heads‑up: always double‑check the smart contract audit reports before committing funds; a flawed contract can turn your token into a paper weight.

Edgardo Rodriguez

4 January, 2025 . 22:30 PM

Indeed, as we contemplate the digitization of property rights, one must ask: does the immutable ledger merely codify existing inequities, or can it serve as a catalyst for democratized wealth distribution, transcending borders and traditional financial gatekeepers?

Andrew Else

11 January, 2025 . 21:00 PM

Wow, another list of platforms – because what the world really needed was another spreadsheet.

Susan Brindle Kerr

18 January, 2025 . 19:30 PM

One might argue that the very act of tokenizing bricks and mortar elevates the discourse of real‑estate investment to an almost esoteric art form, reserved for the culturally enlightened few.

Jared Carline

25 January, 2025 . 18:00 PM

While the exposition is admirably detailed, it would be prudent to incorporate a comparative analysis of platform governance structures, as such an evaluation is indispensable for discerning the long‑term sustainability of each venture.

raghavan veera

1 February, 2025 . 16:30 PM

At the end of the day, buying a slice of a building is just a modern twist on the age‑old question: what does it truly mean to own a piece of the world?