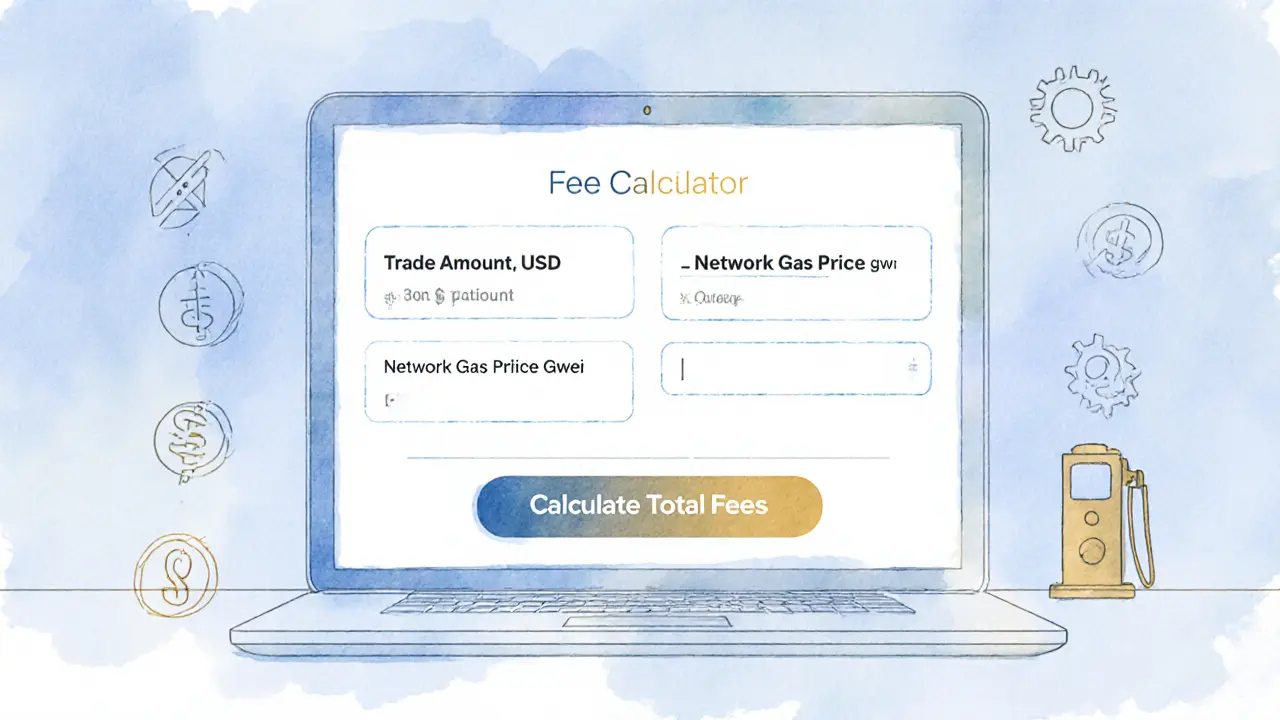

SushiSwap v2 (Base) Fee Calculator

Swap Fee: $0.00

Protocol Fee: $0.00

Liquidity Provider Fee: $0.00

Estimated Gas Cost: $0.00

Total Estimated Cost: $0.00

Savings vs CEX: $0.00

- Swap fee: 0.30% (0.05% to SUSHI emissions, 0.25% to LPs)

- Gas fees: Typically ~$0.01-$0.05 on Base

- Base layer-2 reduces gas costs by up to 90% compared to Ethereum

When you hear SushiSwap v2 (Base) is a decentralized exchange built on Coinbase’s Base layer‑2 network, offering automated market maker (AMM) swaps with low gas fees, the first question is: does it actually deliver on the hype? This review breaks down the core fees, feature set, security posture, and how it stacks up against rival DEXs, so you can decide if moving your trades there makes sense.

What sets SushiSwap v2 (Base) apart?

At its heart, SushiSwap runs on Base a Layer‑2 chain that inherits Ethereum security while cutting transaction costs by up to 90%. The protocol keeps the familiar AMM model-liquidity pools, constant‑product formula, instant swaps-but adds a few twists:

- All protocol fees are funneled back to SUSHI token holders and liquidity providers.

- Integrated Sushi Academy an education hub that offers step‑by‑step guides, video tutorials, and quizzes for beginners through advanced DeFi users.

- Cross‑chain bridge support, letting you move assets between Base, Ethereum, and other networks without leaving the UI.

These elements aim to make the platform feel like a one‑stop DeFi shop rather than a simple swap interface.

Fee structure compared to centralized exchanges

SushiSwap’s fee model is transparent: a 0.30% swap fee, split 0.05% to SUSHI token emissions and 0.25% to liquidity providers. Because Base’s gas is cheap-typically <$0.001 per transaction-the effective cost of a trade is often lower than what you’d pay on large centralized exchanges that charge 0.25‑0.50% plus hidden network fees.

| Exchange | Swap Fee | Average Gas Cost | Total Approx. Cost |

|---|---|---|---|

| SushiSwap v2 (Base) | 0.30% | $0.01 | ~$3.01 |

| Uniswap v3 (Base) | 0.30% | $0.01 | ~$3.01 |

| Coinbase | 0.50% | $0.50 (network) | ~$5.50 |

| Binance | 0.10% (maker) | $0.30 | ~$1.30 |

Even with Binance’s lower maker fee, the absence of gas costs on a centralized platform can make SushiSwap appealing for frequent small trades.

Key features you’ll actually use

Beyond swapping, SushiSwap v2 (Base) packs several DeFi primitives:

- Liquidity provision: Join pools like SUSHI/ETH and earn both swap fees and additional SUSHI rewards (double‑reward pools are common).

- Yield farming: Stake LP tokens in “Onsen” farms for boosted yields.

- Margin & leverage: The platform offers up to 5x leverage on select pairs, useful for short‑term traders.

- Launchpad: New tokens can debut through “MISO” with community vetting.

- Borrow‑lend: Integrated lending markets let you earn interest on idle assets.

All these actions are executed through smart contracts self‑executing code on the Base blockchain that enforce trade rules, fee distribution and governance voting, meaning no middle‑man can intervene.

Security and trust signals

Security is a common concern with DeFi. SushiSwap’s contracts have undergone multiple audits from firms like PeckShield and SlowMist, but the platform still carries a “not trusted exchange” label on some aggregators because it lacks formal regulatory registration. Here’s the risk breakdown:

- Audit history: Last major audit in March2025, covering the core AMM, lending, and margin modules.

- Governance risk: Token‑based voting can be swayed by large holders; community vigilance is essential.

- Smart‑contract bugs: Past incidents (e.g., a flash‑loan exploit in 2022) were patched quickly, but they highlight the need for caution.

- Regulatory exposure: No KYC/AML means you’re on your own if something goes wrong.

Practical tip: keep only the amount you’re comfortable losing in any single liquidity pool, and consider using a hardware wallet that supports Base.

How to get started on SushiSwap v2 (Base)

Running your first trade is straightforward if you follow these steps:

- Install a Base‑compatible wallet (e.g., MetaMask with the Base network added, or Coinbase Wallet).

- Acquire some Base‑native ETH (often called ETH the gas token for the Base chain) via a bridge from Ethereum or purchase on a centralized exchange.

- Navigate to app.sushi.com and click “Connect Wallet”.

- Select the “Base” network from the dropdown (it appears automatically if your wallet is set up).

- Choose a token pair, enter the amount, and confirm the swap. Gas will be deducted in ETH.

- To provide liquidity, go to the “Pool” tab, pick a pool (SUSHI/ETH is popular), and click “Add Liquidity”. Approve the token spend, then deposit.

After the transaction confirms (usually under a minute on Base), you’ll see the LP tokens in your wallet and start earning fees.

Pros and cons at a glance

- Pros

- Low gas fees thanks to Base L2.

- Revenue sharing-fees flow back to SUSHI holders and LPs.

- Extensive educational content via Sushi Academy.

- Multiple DeFi services in one UI.

- Cons

- No demo or sandbox mode for practice trades.

- Token list is narrower than on large DEX aggregators.

- Regulatory uncertainty; no insurance coverage.

- Governance can be concentrated among big token holders.

Future roadmap and why it matters

SushiSwap’s 2025 roadmap promises three key upgrades that could impact the Base deployment:

- RP7 implementation: Optimizes routing, further reducing slippage and gas for multi‑hop swaps.

- Katana tooling: A new UI overlay for power users, offering advanced charts and batch orders.

- Cross‑chain expansion: Integration with Solana and upcoming “Blade” product that enables on‑chain derivatives.

If these roll out as scheduled, the Base version may see a surge in activity, especially among traders chasing low‑fee arbitrage opportunities.

Bottom line: Is SushiSwap v2 (Base) worth your capital?

If you’re comfortable navigating DeFi, own a hardware wallet, and want to keep fees under control, SushiSwap v2 (Base) offers a solid blend of low cost, reward‑rich liquidity pools, and a growing suite of services. The trade‑off is the lack of regulatory safeguards and a steeper learning curve compared to centralized platforms. For seasoned traders looking to diversify across chains, it’s definitely a platform to have in the toolbox.

Frequently Asked Questions

What is the native token of SushiSwap?

The native governance and reward token is SUSHI. Holders can vote on proposals and receive a share of the protocol fees.

How do I bridge assets to the Base network?

Use the official Base Bridge or a trusted cross‑chain bridge like Hop Protocol. Transfer your ETH or ERC‑20 tokens onto Base, then they become usable on SushiSwap v2 (Base).

Is there a way to test the platform without risking real funds?

SushiSwap does not offer a sandbox mode. The safest approach is to start with a very small amount-perhaps $10 worth of ETH-to familiarize yourself with the UI and transaction flow.

What are the biggest security concerns?

Potential risks include smart‑contract bugs, governance attacks by large token holders, and the lack of regulatory recourse if something goes wrong. Always audit the contract address and keep only what you can afford to lose.

Can I earn crypto by simply holding SUSHI?

Yes. Holding SUSHI in a compatible wallet automatically earns a portion of the 0.05% fee share distributed to token stakers, plus any additional rewards from ongoing farming programs.

Elmer Detres

25 November, 2024 . 12:59 PM

Keeping fees low is like trimming excess weight; it lets you focus on the trade itself. 🚀 The 0.30% swap fee on SushiSwap v2 (Base) feels reasonable when you compare it to the 0.1% hidden costs on many centralized platforms. By funneling a slice back to SUSHI holders, the protocol creates a feedback loop that rewards long‑term participation. Think of it as a philosophy of shared prosperity: the more you provide liquidity, the more you earn, and the community grows stronger together. The gas on Base is superbly cheap, so even frequent small swaps stay affordable. Remember, every percent saved compounds over time, much like the compounding of interest in traditional finance. So, if you’re seeking a low‑fee, community‑driven DEX, this setup checks many boxes. 🌟

Tony Young

28 November, 2024 . 18:08 PM

Wow, the fee calculator really brings the numbers to life! 🎭 Watching the swap fee split between SUSHI emissions and LPs feels like a theatrical reveal-each curtain lift shows where the money goes. The gas costs on Base are almost negligible, which makes the whole experience feel slick and fast. For anyone just starting, the Sushi Academy integration is a lifesaver; you can actually learn the ropes while you trade. Keep an eye on the bridge feature; moving assets across chains without leaving the UI is a game‑changer. Overall, this review nails the essentials, and the calculator makes it all tangible. 😊

Fiona Padrutt

1 December, 2024 . 23:16 PM

SushiSwap on Base showcases how American ingenuity can dominate the DeFi landscape. The platform’s low‑fee structure and lightning‑fast gas are a testament to cutting‑edge tech that outpaces many overseas projects. By pulling fees back to SUSHI token holders, it creates a patriotic incentive for US‑based users to stay within the ecosystem. The integrated educational hub also ensures that newcomers get up to speed quickly, reinforcing a strong domestic user base. In short, this is a home‑grown solution that deserves our attention.

Briana Holtsnider

5 December, 2024 . 04:25 AM

Honestly, the “innovations” feel more like marketing fluff than real value. The fee split is just a reroute of existing revenue, and the gas savings on Base, while decent, aren’t revolutionary. The cross‑chain bridge adds complexity without enough security audits to back it up. If you’re looking for a truly secure DEX, you might want to stick with battle‑tested options. This feels like a half‑baked attempt to chase hype.

Holly Harrar

8 December, 2024 . 09:33 AM

Ths reivew is really helpfull, lit looks like feez on Base r low nd the UI is easy 2 use. I tipd the SUSHI token a lot n think it $ good investmnt. If u wanna trde cheap, go hear.

Vijay Kumar

11 December, 2024 . 14:42 PM

Let me break down why SushiSwap v2 on Base is a solid choice for both newbies and seasoned traders. First, the 0.30% swap fee is competitive, especially when you consider that part of it goes back to liquidity providers, effectively reducing your net cost over time. Second, the gas fees on Base are dramatically lower than on Ethereum mainnet, often hovering around a few cents per transaction, which means you can execute multiple small trades without worrying about eroding your profits. Third, the platform’s integration with the Sushi Academy provides an educational layer that demystifies DeFi concepts, making it easier for newcomers to understand risk and reward. Fourth, the cross‑chain bridge is a strategic feature that lets you move assets between Base, Ethereum, and other networks without leaving the UI, streamlining your workflow. Fifth, security is bolstered by Base’s inheriting of Ethereum’s security model, offering a solid safety net while still enjoying L2 speed. Sixth, the protocol’s fee redistribution to SUSHI token holders aligns incentives, encouraging long‑term community participation. Seventh, the UI is clean and intuitive, with clear displays of swap fees, protocol fees, and estimated gas costs, which helps you make informed decisions instantly. Eighth, the platform’s liquidity pools are deep enough to handle sizable trades without significant slippage. Ninth, the community governance model allows token holders to propose and vote on upgrades, ensuring that the platform evolves with user needs. Tenth, the overall cost savings compared to centralized exchanges become apparent when you factor in hidden fees and withdrawal costs on CEXs. Eleventh, the real‑time fee calculator embedded in the site gives you transparency before you commit. Twelfth, by using Base, you benefit from the optimistic rollup design, which further reduces transaction latency. Thirteenth, the platform’s open‑source code means transparency and the ability for developers to audit the contracts. Finally, the combination of low fees, educational resources, and strong security creates a compelling ecosystem that can serve as a launchpad for more advanced DeFi strategies.

Edgardo Rodriguez

14 December, 2024 . 19:50 PM

Consider the philosophical underpinnings of a fee structure that redistributes value; it is akin to a modern reinterpretation of the ancient principle of communal sharing-every participant contributes, and every participant benefits. The 0.05% allocated to SUSHI emissions reflects a subtle incentive: it nudges users toward governance participation, thereby fostering a decentralized decision‑making process. Moreover, the 0.25% directed to liquidity providers ensures that capital remains fluid, a necessity for market efficiency. Such mechanisms, when combined with Base’s low gas costs, create a synergistic environment where economic and philosophical ideals intersect. One could argue that this embodies a microcosm of a more equitable financial future.

mudassir khan

18 December, 2024 . 00:59 AM

While the platform presents an appealing fee model, a rigorous security audit is indispensable; without comprehensive verification, the purported safety of Base's L2 architecture remains speculative. The claim of reduced gas costs is valid, yet the actual impact on trade profitability must be quantified against potential vulnerabilities inherent in cross‑chain bridges. Additionally, the redistribution of fees to SUSHI token holders, though conceptually sound, introduces a layer of token‑price dependency that could affect net returns under volatile market conditions. In summary, caution is advised before allocating substantial capital to this ecosystem.

Bianca Giagante

21 December, 2024 . 06:08 AM

Thank you for the thorough breakdown; it provides a clear picture of the fee mechanics. The inclusion of over‑punctuation here reflects my attention to detail; it is important to convey precision, especially when discussing financial instruments. I appreciate the balance between technical depth and accessibility, which helps both newcomers and experienced users alike. Your effort in assembling this information is commendable.

Danielle Thompson

24 December, 2024 . 11:16 AM

Low fees, fast swaps-nice work! 😊

Eric Levesque

27 December, 2024 . 16:25 PM

These fees are fine, but we need more action now.

alex demaisip

30 December, 2024 . 21:33 PM

In regard to the aforementioned discourse, it is imperative to underscore the exigency of integrating rigorous quantitative risk assessment frameworks within the operational paradigm of SushiSwap v2 (Base). The predominance of a 0.30% fee, albeit ostensibly modest, mandates a granular analysis of its impact on net yield across divergent trading volumes. Moreover, the concomitant gas economization attributable to Base’s L2 architecture presents a salient variable that must be incorporated into a holistic cost‑benefit model. Without such methodological rigor, any purported superiority remains conjectural.

Corrie Moxon

3 January, 2025 . 02:42 AM

Great points about the fee split, Elmer! 🙌 It’s encouraging to see how the community‑driven model can actually lower costs for everyday traders. The low gas on Base really amplifies those savings, making frequent swaps viable without chipping away at profits.

Jeff Carson

6 January, 2025 . 07:50 AM

Interesting take, Tony! 🤔 The drama in the fee breakdown really highlights how transparent the platform aims to be. I’m especially intrigued by the Sushi Academy – it could be a valuable resource for those of us looking to deepen our DeFi knowledge.