Midnight Evergreen (NIGHT) Token Calculator

Current Token Metrics

Max Supply

3,000,000,000 NIGHT

Circulating Supply

622,000,000 NIGHT

Market Cap

$274,000

Price Range

$0.00034 - $0.00068

Investment Scenario Calculator

Investment Summary

Risk Factors

High Volatility: NIGHT has shown extreme weekly swings (up to 124%) over recent periods.

Low Liquidity: Daily trading volumes are under $150 on major exchanges, risking slippage.

Unclear Focus: Dual positioning between privacy and gaming markets may dilute development efforts.

If you’ve seen the ticker Midnight Evergreen popping up on price charts and wondered what it actually is, you’re not alone. The NIGHT token sits at the crossroads of privacy‑focused blockchain tech and a budding gaming ecosystem, making its story a bit tangled. This guide cuts through the confusion, laying out the token’s supply, technology, market data, and the risks you should weigh before dipping a toe in.

What Exactly Is Midnight Evergreen (NIGHT)?

Midnight Evergreen, marketed under the symbol NIGHT is a cryptocurrency token designed to power the Midnight Network’s privacy‑centred applications. The token trades on a handful of major exchanges, most notably Coinbase and Binance, and its price hovers between $0.00034 and $0.00068 as of October 2025.

Supply Numbers and Market Capitalisation

The token has a hard‑capped supply of 3billion NIGHT coins. Currently, about 622million tokens are circulating, representing roughly 21% of the total supply. With a market cap near $274k and a fully diluted valuation of $1.32million, NIGHT is a micro‑cap asset that can swing dramatically on modest trading activity.

Tokenomics: NIGHT vs DUST

Midnight Network employs a dual‑token model. While NIGHT serves as the utility token for governance, staking, and rewards, the platform’s native resource token, DUST covers transaction fees and network resource consumption, mimicking the gas‑fee structure of Ethereum but with built‑in privacy safeguards.

Key differences are summed up in the table below.

| Attribute | NIGHT | DUST |

|---|---|---|

| Purpose | Governance, staking, incentives | Transaction fees, resource allocation |

| Max Supply | 3billion | Variable (dynamic based on network demand) |

| Circulating Supply | 622million (≈21%) | Not applicable |

| Primary Exchange | Coinbase, Binance | Coinbase, Binance |

| Use Cases | Staking rewards, DAO voting, gaming incentives | Paying for private transactions, smart contract execution |

Technology Behind the Midnight Network

At its core, the Midnight Network relies on zero‑knowledge proofs to let users validate transactions without revealing underlying data. This “rational privacy” model grants selective disclosure: a user can prove ownership of an asset while keeping the address hidden from the public ledger.

Developers write contracts in Compact a TypeScript‑based language that compiles to the network’s bytecode. Because many devs already know TypeScript, Compact aims to lower the learning curve and accelerate dApp creation on the privacy‑preserving chain.

The network’s architecture also supports multi‑chain interoperability, meaning assets can move between Ethereum, Binance Smart Chain, and other ecosystems while retaining the same privacy guarantees.

Distribution Mechanics: The Glacier Drop

The initial token allocation was executed through a “Glacier Drop” event. Roughly 34million addresses across eight blockchains were targeted for a first‑phase airdrop of NIGHT. The goal was to seed a broad, cross‑chain community that could spring‑board development and adoption.

While the numbers look impressive, actual participation metrics are scarce. Trading volumes remain low-about $87k on Coinbase over the last 24hours-suggesting that many airdrop recipients may not have moved the tokens or engaged with the network yet.

Market Data, Price Volatility, and Trading Volume

Price history for NIGHT is a roller coaster. After an all‑time high of $0.000475 on July102025, the token slipped about 8% to its current range. Weekly price swings have been extreme: a recent week saw a 124% jump according to TradingView, while another source recorded a 41% rise. Over 60‑day and 90‑day windows, the token dropped roughly 60% and 55% respectively, underscoring high volatility.

Technical indicators paint a mixed picture. The 50‑day SMA sits at $0.000314, the 200‑day SMA at $0.000495, and the 14‑day RSI is 58, indicating neutral momentum. Volatility sits at 33.84%, with only about a third of recent days ending in positive price movement.

Liquidity is another concern. Daily volume on Binance is under $150, and on CoinMarketCap (as an aggregator) it’s just $300. Such thin order books can lead to slippage and make it hard for larger investors to enter or exit positions without moving the market.

Ecosystem Focus: Privacy Platform or Gaming Hub?

Two narratives coexist around NIGHT. The Midnight Network positions the token as a privacy utility for decentralized apps, competing with projects like Monero and Zcash. In parallel, CoinGecko lists Midnight Evergreen as a gaming‑centric blockchain that aims to connect multiple MMO titles through a shared token economy.

If the gaming angle materialises, NIGHT could serve as an in‑game currency, reward token, or governance asset for player‑driven economies. However, the project has yet to announce concrete game partnerships, leaving that side of the story speculative.

Investors should treat the dual positioning as a risk factor: the token’s value could be pulled in different directions depending on which market segment gains traction first.

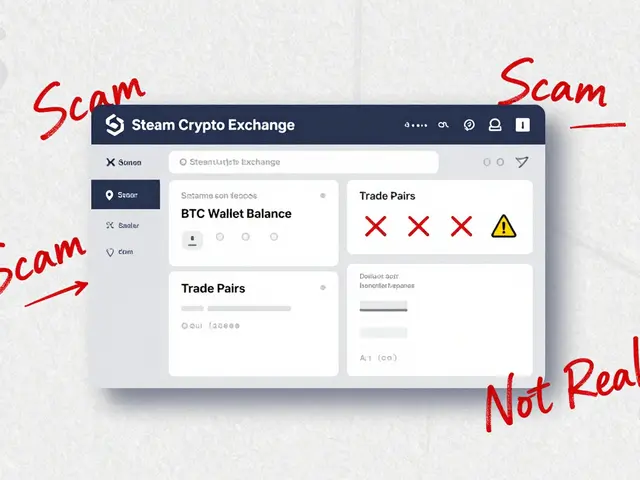

Risks, Red Flags, and Investor Considerations

- Liquidity constraints: Low daily volume means price can swing wildly on modest trade sizes.

- Unclear market focus: The split between privacy and gaming use cases may dilute developer and community attention.

- Regulatory exposure: Privacy‑centric tokens face heightened scrutiny from regulators worldwide; compliance mechanisms are still evolving.

- Community engagement: Social media signals and forum activity are muted compared to established privacy projects, suggesting limited grassroots support.

- Price outlook: Analyst forecasts from CoinCodex project a 25% decline to $0.000249 by early November 2025, indicating bearish sentiment.

Given these factors, a cautious approach is advisable. Small exposure, thorough due diligence, and a clear exit plan can help mitigate downside risk.

How to Buy and Store NIGHT Safely

- Create an account on a supported exchange-Coinbase and Binance currently list NIGHT.

- Complete any required KYC verification to unlock trading.

- Deposit fiat (USD, EUR, etc.) or transfer another crypto (e.g., BTC, ETH) to the exchange wallet.

- Search for the ticker “NIGHT” and place a market or limit order based on your price target.

- For long‑term holding, transfer the tokens to a non‑custodial wallet that supports ERC‑20 style assets (e.g., MetaMask, Trust Wallet). Ensure the wallet can handle custom tokens by adding the contract address from the exchange’s token page.

Always double‑check the contract address to avoid phishing scams, and consider using a hardware wallet for added security if you plan to hold a sizable amount.

Quick Takeaways

- Midnight Evergreen (NIGHT) is a micro‑cap utility token for a privacy‑focused blockchain.

- Supply: 3billion max, ~622million circulating.

- Key tech: zero‑knowledge proofs, Compact (TypeScript‑based) smart contracts.

- Market: Low liquidity, high volatility, bearish short‑term forecasts.

- Risk: Unclear focus between privacy and gaming, regulatory uncertainties.

Frequently Asked Questions

What is the primary use case for the NIGHT token?

NIGHT powers the Midnight Network’s privacy features, enabling developers to build dApps that protect user data through zero‑knowledge proofs. It also serves as a governance and staking token within the ecosystem.

How does the dual‑token system work?

NIGHT is the utility token for staking, rewards, and voting, while DUST covers transaction fees and network resource consumption. This separation mirrors gas‑fee models on other blockchains but keeps fee payments private.

Is NIGHT listed on major exchanges?

Yes, NIGHT can be traded on Coinbase and Binance. Volume is thin, so expect possible slippage on larger orders.

What are the main risks of investing in NIGHT?

Key risks include low liquidity, high price volatility, ambiguous project focus (privacy vs gaming), limited community traction, and potential regulatory scrutiny on privacy‑focused tokens.

How can I store NIGHT securely?

Transfer NIGHT to a non‑custodial wallet that supports custom ERC‑20 tokens, such as MetaMask or Trust Wallet. For larger holdings, consider a hardware wallet like Ledger or Trezor.

Liam Wells

8 October, 2025 . 08:14 AM

The data presented herein, whilst comprehensive, fails to address fundamental methodological flaws, notably the absence of robust liquidity safeguards; thus, any purported valuation appears speculative at best.

Nicholas Kulick

13 October, 2025 . 11:40 AM

The token's low liquidity is the primary risk; consider limiting exposure.

Kate O'Brien

18 October, 2025 . 15:06 PM

They’re hiding the real numbers, the airdrop never actually happened.

Ricky Xibey

23 October, 2025 . 18:31 PM

Yo, if you’re thinking about buying, just keep it tiny until volume picks up.

Sal Sam

28 October, 2025 . 20:57 PM

From a technical standpoint, the interoperability layer lacks adequate cross‑chain bridge audits, which could introduce vectorized attack surfaces.

Moses Yeo

3 November, 2025 . 00:23 AM

Ah, but what if the market’s about to swing the other way, and everyone’s missing the obvious upside??

Lara Decker

8 November, 2025 . 03:48 AM

Your optimism ignores the immutable fact that the project’s roadmap remains perpetually undefined.

Anna Engel

13 November, 2025 . 07:14 AM

Sure, because another privacy‑gaming token will magically solve all blockchain woes, right?

manika nathaemploy

18 November, 2025 . 10:40 AM

i feel u, but rly think u should read the whitepaper more deep.

Marcus Henderson

23 November, 2025 . 14:05 PM

While the present metrics suggest heightened volatility, a disciplined, long‑term perspective may yet reveal underlying value.

Jack Stiles

28 November, 2025 . 17:31 PM

Just watch the price, if it spikes, jump in quick.

Ritu Srivastava

3 December, 2025 . 20:57 PM

It's irresponsible to promote a token with such opaque governance; investors deserve transparency.

Darren Belisle

9 December, 2025 . 00:23 AM

Indeed, the community could foster growth-if only the devs deliver on promises!!!

Heather Zappella

14 December, 2025 . 03:48 AM

For newcomers, remember to verify the contract address on the official site before transferring funds.

Jason Wuchenich

19 December, 2025 . 07:14 AM

Consider starting with a few tokens to get a feel for the platform's UX before scaling up.

Caitlin Eliason

24 December, 2025 . 10:40 AM

🤯 The rollercoaster of NIGHT’s price is nothing short of a nightmare for the faint‑hearted!

Ken Pritchard

29 December, 2025 . 14:05 PM

Both the privacy angle and the gaming integration have merit; weigh each against your risk tolerance.

Brian Lisk

3 January, 2026 . 17:31 PM

When evaluating micro‑cap assets such as NIGHT, one must meticulously assess liquidity depth, token distribution mechanisms, governance structures, and the broader macroeconomic climate that influences speculative capital flows, thereby ensuring an informed investment decision.

EDWARD SAKTI PUTRA

8 January, 2026 . 20:57 PM

I understand the fear of volatility; a conservative allocation might ease that tension.

Bryan Alexander

14 January, 2026 . 00:22 AM

Believe in the vision; with community support, NIGHT could soar beyond current limits!

Patrick Gullion

19 January, 2026 . 03:48 AM

Honestly, I think everyone’s overhyping this – might be a good time to short.

Caleb Shepherd

24 January, 2026 . 07:14 AM

The real story is that regulators are already tracking NIGHT’s privacy features, preparing a crackdown before anyone notices.