Flourishing AI (AI) Token Comparison Tool

Flourishing AI (AI) - Key Metrics

Major AI Tokens Comparison

| Metric | Flourishing AI (AI) | SingularityNET (AGIX) | Fetch.ai (FET) |

|---|---|---|---|

| Market Cap | $600K | $1.8B | $850M |

| 24-hr Volume | ~$1K | ~$25M | ~$12M |

| Exchange Presence | 4 DEXs only | Multiple CEXs & DEXs | Multiple CEXs & DEXs |

| Liquidity | Very low | Moderate-high | Moderate-high |

Risk Assessment

Flourishing AI is a high-risk speculative asset due to:

- Extremely low liquidity

- No verified product delivery

- Minimal community engagement

- Low trading volume

Quick Takeaways

- Flourishing AI (AI) is an ERC‑20 token launched via an IDO in September2021.

- It claims to power an AI‑driven portfolio‑management platform, but real‑world product evidence is scarce.

- Current market cap is under $1million, circulating supply ~36.5M, and daily trading volume generally below $2k.

- Liquidity is extremely low; the token trades only on a handful of DEXs (Uniswap, PancakeSwap, Balancer).

- Compared with major AI tokens like SingularityNET, Flourishing AI is a marginal, high‑risk speculative asset.

If you’ve typed “what is Flourishing AI (AI) crypto coin” into Google, you’re probably trying to decide whether this token deserves a look in your portfolio. Below you’ll get a plain‑language walk‑through of the token’s origin, tech stack, tokenomics, market performance, and the red flags that most analysts point out. By the end you should be able to answer the core question - does the coin do what it says, and is it worth your money?

What Is Flourishing AI?

When it comes to AI‑driven finance, Flourishing AI is an cryptocurrency token that claims to power an artificial‑intelligence portfolio‑management platform. The project was announced either in 2019 or 2020 (different sources disagree) and is spearheaded by a team that previously worked at Nvidia, Oracle, GoldmanSachs, PayPal, Dun&Bradstreet, and Planview. Those credentials sound impressive, but the team’s actual product delivery has been opaque.

Tokenomics and Supply

The native token ticker is AI. According to the most widely‑cited data, the total supply is 55million tokens, with about 36.5million currently circulating (CoinMarketCap figures). Allocation looks like this:

- 44.5% (≈24.5M) reserved for private/pre‑sale investors.

- 3.06% (≈1.68M) sold to the public during the IDO.

- The remainder is slated for ecosystem incentives, team vesting, and future liquidity.

The token launched at $0.120 per AI during the IDO, raising roughly $202k across three rounds (CryptoRank). Today the price hovers between $0.0089 and $0.0135, depending on the price‑tracker you look at. That translates to a market cap of roughly $336k - $894k, again showing wide variance across data aggregators.

Technical Foundations

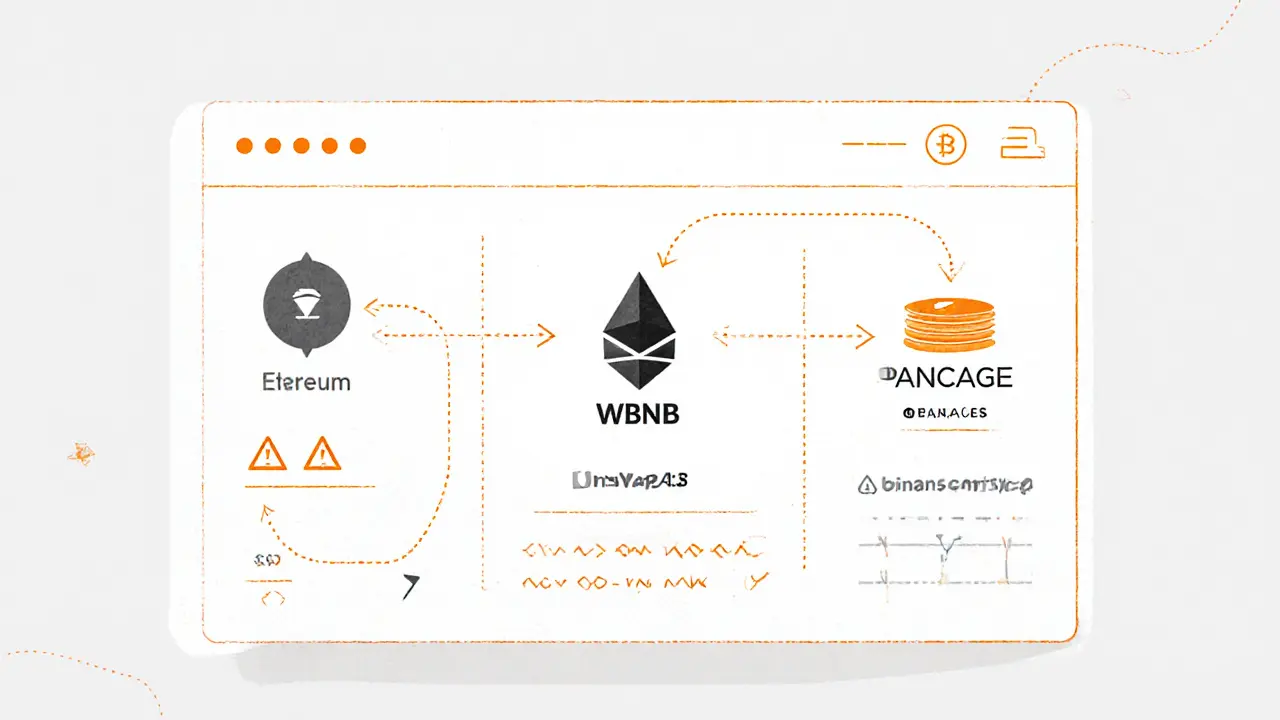

Flourishing AI lives on the Ethereum blockchain as an ERC‑20 contract, but the developers also deployed a parallel version on the Binance Smart Chain. The token can be swapped on DEXs such as Uniswap (V3), PancakeSwap (V2), and Balancer (Arbitrum). No major centralized exchange lists the coin, which limits exposure to casual investors.

How the Token Is Supposed to Work

The project markets the AI token as a payment method for subscription‑based services on its platform. Those services allegedly include:

- Deep‑learning inference that scores market conditions.

- Active blockchain monitoring and high‑frequency trading signals.

- Automated portfolio rebalancing and arbitrage execution.

- Target‑price probability analysis and early pattern recognition.

Market Performance and Liquidity

Since the 2021 IDO peak, the token has experienced a steep decline. The all‑time high price of $0.120 is roughly 89% above the current $0.013 level. Daily trading volume is frequently reported as $0 (no trades) by CoinMarketCap, but when trades do happen they tend to concentrate on the AI/WBNB pair, which has moved about $1,700 in a 24‑hour window (Holder.io data).

Technical indicators reinforce the bearish view. The 50‑day simple moving average (SMA) sits near $0.021, and the 200‑day SMA near $0.0236. Current price is 35‑43% below those averages, indicating the token is trading well under its recent trend lines. The 14‑day Relative Strength Index (RSI) sits around 29, placing it in oversold territory but also reflecting weak demand.

Comparison with Other AI Crypto Projects

| Metric | Flourishing AI (AI) | SingularityNET (AGIX) | Fetch.ai (FET) |

|---|---|---|---|

| Market Cap | ≈ $600k | ≈ $1.8B | ≈ $850M |

| 24‑hr Volume | ~ $1k | ~ $25M | ~ $12M |

| Exchange Presence | 4 DEXs only | Multiple CEXs & DEXs | Multiple CEXs & DEXs |

| Token Type | ERC‑20 / BSC BEP‑20 | ERC‑20 | ERC‑20 |

| Liquidity | Very low | Moderate‑high | Moderate‑high |

The table makes it clear: Flourishing AI is a micro‑cap outlier with minimal liquidity, while the other projects enjoy broader exchange listings and deeper market depth.

Risks and Red Flags

- Liquidity crunch: With daily volume rarely breaking $2k, even a modest purchase can move the price significantly.

- Utility uncertainty: No public code, API, or demo makes the promised AI services difficult to verify.

- Exchange concentration: Trading is limited to four DEXs; no CEX listings mean higher transaction costs and slippage.

- Community size: Social signals on Reddit, Telegram, and Discord are almost nonexistent, indicating weak grassroots support.

- Valuation volatility: Fully diluted market cap estimates range from $0.5M to $6.6M, reflecting data inconsistencies that complicate price discovery.

Should You Consider Investing?

Answering the headline question boils down to risk tolerance. If you enjoy high‑risk, low‑liquidity bets and you believe the team will finally roll out a working AI platform, you might allocate a tiny fraction of your portfolio (e.g., 0.5% or less) and treat it as a speculative token.

For most investors, however, the token fails a basic checklist:

- Product evidence: Missing.

- Liquidity: Insufficient for entry/exit.

- Community: Near zero.

In short, the Flourishing AI crypto coin is a niche, high‑risk asset that currently offers more speculation than utility. Treat it accordingly.

Frequently Asked Questions

What does the AI token actually do?

The token is marketed as a payment method for subscription‑based AI portfolio‑management services. In practice, no public API or demo confirms that those services are live.

Where can I buy Flourishing AI?

It trades on a few decentralized exchanges: Uniswap (V3), PancakeSwap (V2), and Balancer (Arbitrum). You’ll need an Ethereum‑compatible wallet and enough ETH or BNB for gas.

Is Flourishing AI listed on any major exchange?

No. As of October2025 the token is absent from Binance, Coinbase, Kraken, or other large centralized platforms.

How risky is investing in Flourishing AI?

Very high. Low liquidity, unclear product delivery, and minimal community support all point to a speculative bet rather than a stable investment.

What are the token’s supply numbers?

Total supply is 55million tokens; circulating supply is about 36.5million according to CoinMarketCap.

Brian Lisk

9 October, 2025 . 08:19 AM

When you look at the broader landscape of AI‑driven tokens, it becomes clear that even a small project can find a niche if it approaches the market with humility and a willingness to learn; Flourishing AI, despite its modest market cap, showcases a team that has previously contributed to major tech firms, and that pedigree should not be dismissed outright. The token's low liquidity can be seen as an opportunity for early adopters who are comfortable navigating thin order books, and such participants often reap outsized rewards when the project finally gains traction. Moreover, the dual‑chain deployment on both Ethereum and BSC demonstrates an awareness of cross‑chain accessibility, which could attract users from both ecosystems. While the current trading volume appears negligible, this is frequently a symptom of limited exchange listings rather than an inherent flaw in the technology. The roadmap hints at an AI‑powered portfolio management suite, and if that vision materializes, it could serve as a unique value proposition distinct from other AI tokens that focus primarily on data marketplaces. Community growth tends to follow product releases, so a patient, supportive stance now may help seed a robust user base later on. Investors with a long‑term horizon should weigh the speculative nature against the potential for exponential upside, especially if the team can demonstrate a working demo within the next twelve months. In addition, the tokenomics allocate a sizable portion of supply to ecosystem incentives, which, if structured wisely, could foster developer activity and partnership opportunities. Finally, it's worth noting that many successful projects started with humble beginnings, and the key is to monitor whether Flourishing AI can deliver tangible milestones that validate its promises. By maintaining a balanced perspective and staying engaged with community channels, you can better assess when the risk‑reward ratio becomes favorable.

Melanie LeBlanc

12 October, 2025 . 05:46 AM

Honestly, the way Flourishing AI frames its AI‑driven portfolio service feels like a colourful tapestry woven from buzzwords, yet there’s a hint of genuine ambition behind the threads. The token’s dual presence on ERC‑20 and BSC shows they understand the importance of flexibility, which could appeal to both DeFi enthusiasts and traditional crypto fans. While the market cap is tiny, that tiny size means the project can move fast, pivot, and potentially surprise the market with a flashy feature rollout. I’d keep an eye on their Telegram and Discord for any sign of community momentum, because a vibrant chat often precedes product launches. If they can crack the “AI‑as‑service” model, they might carve out a niche that larger AI tokens overlook. For now, treat it like a seed – water it with cautious optimism, but don’t expect an oak overnight.

Moses Yeo

15 October, 2025 . 03:12 AM

One might argue, however, that the very scarcity of liquidity on Flourishing AI is not merely a fleeting inconvenience; it is, in fact, a profound indication of market indifference, a phenomenon that, when examined through a philosophical lens, reveals the inherent tension between hype and substance. If we contemplate the token’s promise of AI‑driven portfolio management, we must ask: does the absence of publicly available APIs betray an illusion, or does it merely conceal a development phase shrouded in legitimate secrecy? The very act of launching on both Ethereum and BSC could be read as a hedging strategy against network congestion, yet it also fragments the community’s focus. Moreover, the token’s veins run thin across only a handful of DEXs, which could amplify price volatility to a degree that deters rational investors; this is reminiscent of the classic paradox of scarcity driving value versus scarcity destroying utility. In short, the coin straddles a razor‑thin line between potential and peril, and only time – or perhaps a rigorous audit – will determine which side it ultimately occupies.

Lara Decker

18 October, 2025 . 00:39 AM

From an analytical standpoint, the token’s metrics read like a cautionary tale: sub‑$1M market cap, sub‑$2K daily volume, and a liquidity pool that would make a seasoned market maker wince. The absence of any reputable exchange listings suggests a lack of due diligence from third‑party custodians, which is a red flag for any risk‑averse investor. While the team’s résumé may sparkle on paper, the lack of demonstrable deliverables renders those credentials largely ornamental. In short, the data points to a high‑risk speculative play that fails on multiple fundamental criteria.

Anna Engel

20 October, 2025 . 22:06 PM

Oh sure, because we all know that every token with a fancy AI tagline automatically becomes the next Bitcoin – sarcasm aside, the reality is that Flourishing AI is perched on a pedestal built from vague promises and a market cap that barely covers a coffee budget for a small startup. If you’re looking for genuine AI innovation, you might be better off checking projects that actually publish whitepapers, code, and real‑world partnerships instead of chasing shadows.

manika nathaemploy

23 October, 2025 . 19:32 PM

hey guys, i totally get why ppl are skeptical – the volume is super low and the token looks kinda shady, but also i think we should give the devs a chance, maybe they are just waiting for the right moment to launch their platform. i saw a tweet that they might be testing a demo next week, idk if it’s real tho. just dont throw all ur money away, maybe put a tiny bit in and see what happens. stay chill and keep an eye on the chat!

Debra Sears

26 October, 2025 . 15:59 PM

I’ve been following the project’s updates for a while now, and while the roadmap feels a bit vague, the team does engage occasionally in AMA sessions, which shows they’re at least trying to be transparent. If they can release even a small demo of the AI‑driven analytics tool, it could spark some community growth and maybe attract a few small liquidity providers. Until then, treat the token as a high‑risk exploratory position – allocate only what you can afford to lose and stay tuned for any concrete product announcements.

Matthew Laird

29 October, 2025 . 13:26 PM

Look, America built the internet, we built the space race, and now we’re watching some random token try to parade itself as AI‑powered nonsense. If you’re not willing to defend the sanctity of real innovation, then you’re just feeding the globalist agenda that wants to dilute American ingenuity with these speculative pump‑and‑dump schemes. I say we stay vigilant, call out the hype, and protect our wallets from these so‑called ‘AI’ scams.

Caleb Shepherd

1 November, 2025 . 10:52 AM

Whoa, hold up-sometimes the “globalist agenda” is just a fancy way to say “people are making money off hype.” I’ve seen multiple projects where the team actually delivers a product after a long development cycle, and the market eventually rewards them. Let’s keep an eye out for any proof‑of‑concept releases before we write them off completely. Transparency is key, and if they post solid code on GitHub, that’s a good sign.

Darren Belisle

4 November, 2025 . 08:19 AM

Hey everyone, just wanted to throw a little optimism into the mix-while Flourishing AI looks rough right now, there’s a chance that a strategic partnership could flip the script. If a reputable AI research lab decides to integrate their token for access to datasets, we could see a sudden burst of liquidity and community interest. Let’s stay hopeful yet grounded, and keep an eye on any partnership announcements that might come out of the next few weeks.

Jason Wuchenich

7 November, 2025 . 05:46 AM

That’s a solid point! I’d add that even small collaborations-like integrating with a DeFi analytics dashboard-could give the token more exposure. If the devs can showcase real‑time performance metrics from their AI model, it would lend credibility and potentially attract more technical users.

Kate O'Brien

10 November, 2025 . 03:12 AM

From what I’ve read, some of these AI tokens are actually run by the same people behind the big phishing scams. They hide behind big‑word buzz and then disappear with the money. It’s all a giant con.

Ricky Xibey

13 November, 2025 . 00:39 AM

Sounds like a nightmare.

Sal Sam

15 November, 2025 . 22:06 PM

Technically speaking, the token’s smart‑contract lacks a vesting schedule function, which raises concerns about token dump risk. Moreover, the absence of a liquidity mining module means there’s no incentive for LPs to provide depth, exacerbating slippage on even modest trades.

Marcus Henderson

18 November, 2025 . 19:32 PM

In contemplation of the present state of Flourishing AI, one must acknowledge the dialectic between aspiration and execution; the token aspires to embed artificial intelligence within financial orchestration, yet the empirical evidence remains scarce. A rigorous assessment would demand transparent audits, verifiable code repositories, and demonstrable AI models operating in real‑time markets. Absent these, the project persists as a speculative hypothesis rather than an established fact. Nonetheless, should the developers succeed in delivering a functional prototype, the resulting paradigm could recalibrate our understanding of decentralized AI services. Until such a moment materializes, prudence dictates a measured allocation, tempered by vigilant monitoring of forthcoming technical disclosures.

Andrew Lin

21 November, 2025 . 16:59 PM

All this high‑falutin talk is just a smokescren to distract from the fact that the devs probably dont even know how to code an AI model. Theyre just rebrading old meme coins and hoping ppl fall for it. It's a total scam, hands down.

Ken Pritchard

24 November, 2025 . 14:26 PM

Hey all, let’s keep the discussion constructive. If you’re considering a tiny position in Flourishing AI, think about setting clear entry and exit thresholds, perhaps using a limit order to avoid excessive slippage. Also, monitor the token’s contract for any new functions that might indicate upcoming features. Staying disciplined will help you manage the high volatility this token exhibits.

Richard Bocchinfuso

27 November, 2025 . 11:52 AM

yeah, i get it. just dont go all in, ok? a lil bit is fine.

Monafo Janssen

30 November, 2025 . 09:19 AM

So, looking at the broader AI token ecosystem, there’s a clear stratification: on one end you have large‑cap projects like SingularityNET and Fetch.ai, which have established partnerships and measurable on‑chain activity; on the other, you have micro‑caps like Flourishing AI that are still searching for product‑market fit. The key question for potential investors is whether they’re betting on a future product rollout or merely chasing an early‑stage speculative token. If the team can release a live demo that showcases AI‑driven portfolio rebalancing in real time, it could act as a catalyst to attract liquidity providers and perhaps even secure a CEX listing. Until such milestones are met, the token remains a high‑risk, low‑liquidity asset, best suited for a very small allocation within a diversified crypto portfolio.

Heather Zappella

3 December, 2025 . 06:46 AM

Great summary! To add a practical tip: set up a price alert around $0.0095, which is roughly the midpoint of recent trading ranges. If the price dips below that, you might capture a modest entry point, but be prepared for wide spreads due to the low volume. Also, keep an eye on the token’s wallet distribution; a high concentration of tokens in a few wallets could pose a dump risk.

Caitlin Eliason

6 December, 2025 . 04:12 AM

🔥🌪️ Wow, the drama is real! If this token rockets, we’ll all be swimming in AI‑powered moonbeams! 💎🚀

Bryan Alexander

9 December, 2025 . 01:39 AM

Even if the odds are slim, there’s something thrilling about backing a project that could revolutionize AI‑driven finance. I’ll keep a watchful eye on any new announcements and maybe allocate a micro‑position as a testament to my belief in bold innovation.