VARA Licensing: What It Is and Why It Matters

When navigating the fast‑moving world of digital assets, VARA licensing, the official approval process for virtual asset service providers (VASPs) issued by the Monetary Authority of Singapore, Virtual Asset Regulatory Authority is the gateway to legitimacy. A recent survey showed that over 60% of crypto firms consider a VARA license the single most important factor for attracting institutional partners. In plain terms, VARA licensing confirms that a platform meets anti‑money‑laundering (AML), know‑your‑customer (KYC), and cybersecurity standards set by regulators. VARA licensing therefore isn’t just paperwork—it’s a trust badge that can unlock banking relationships, lower transaction fees, and broaden market reach.

How VARA Licensing Connects to VASP Licenses

The term VASP (Virtual Asset Service Provider) appears in every jurisdiction’s crypto rulebook, and VASP license, a certification that a company can legally offer services like exchange, wallet, or custodian functions, is the baseline requirement before a VARA application is considered. In Singapore, regulators treat the VARA license as an enhanced VASP license that adds a layer of risk‑based supervision. This relationship means that firms first secure a VASP license, demonstrate robust AML/KYC controls, then submit a VARA application that details governance, capital adequacy, and data protection measures. The semantic triple here is: VARA licensing requires a VASP license, and the VASP license influences VARA approval.

Across Asia, similar structures exist. For example, Indonesia’s Bappebti licensing, the certification for crypto‑asset trading platforms overseen by the Commodity Futures Trading Authority, mirrors the VASP‑VARA pipeline. Companies that have cleared Bappebti’s strict capital and security criteria find the VARA submission smoother because both regulators prioritize AML compliance and transparent governance. The triple: Bappebti licensing influences VARA licensing in cross‑border operations, reinforcing a unified compliance framework.

When it comes to actual trading venues, crypto exchange licensing, the authorization that lets a platform match buy and sell orders for digital assets, is often the most visible part of the VARA process. An exchange must demonstrate real‑time monitoring, incident response plans, and segregation of customer funds before a VARA authority will grant full approval. This creates a chain: crypto exchange licensing builds the operational backbone, VASP licensing adds the regulatory overlay, and VARA licensing crowns the effort with official recognition. In practice, firms that skip any step face delays or outright rejection.

Looking at Africa, the Nigeria VASP licensing, the framework set by the Securities and Exchange Commission for crypto service providers, offers a useful case study. Nigerian firms that first secure a VASP license and then align with global standards—especially those outlined by VARA—enjoy faster onboarding with international partners. The cross‑regional lesson is clear: local VASP rules act as a stepping stone to VARA licensing, and aligning early with VARA expectations can future‑proof a business against regulatory changes.

Putting it all together, the VARA licensing journey can be broken into three practical phases. Phase one focuses on foundational compliance: setting up AML/KYC systems, securing a VASP license, and documenting corporate governance. Phase two tackles operational safeguards—implementing robust cybersecurity, establishing capital buffers, and passing a Bappebti‑style audit if operating in multiple jurisdictions. Phase three is the formal VARA application, where firms submit detailed risk assessments, audit reports, and proof of ongoing compliance monitoring. Throughout, regulators expect transparent communication, regular reporting, and a culture of continuous improvement. Companies that treat VARA licensing as a one‑time hurdle often stumble; those that embed its requirements into daily operations see smoother audits and quicker market entry.

Below you’ll find a curated set of articles that dive deep into each element of this ecosystem— from step‑by‑step VASP licensing guides to Bappebti oversight analysis and real‑world exchange reviews. Whether you’re just starting out or looking to fine‑tune an existing operation, the collection offers actionable insights, checklists, and the latest regulatory updates to help you navigate the VARA licensing landscape with confidence.

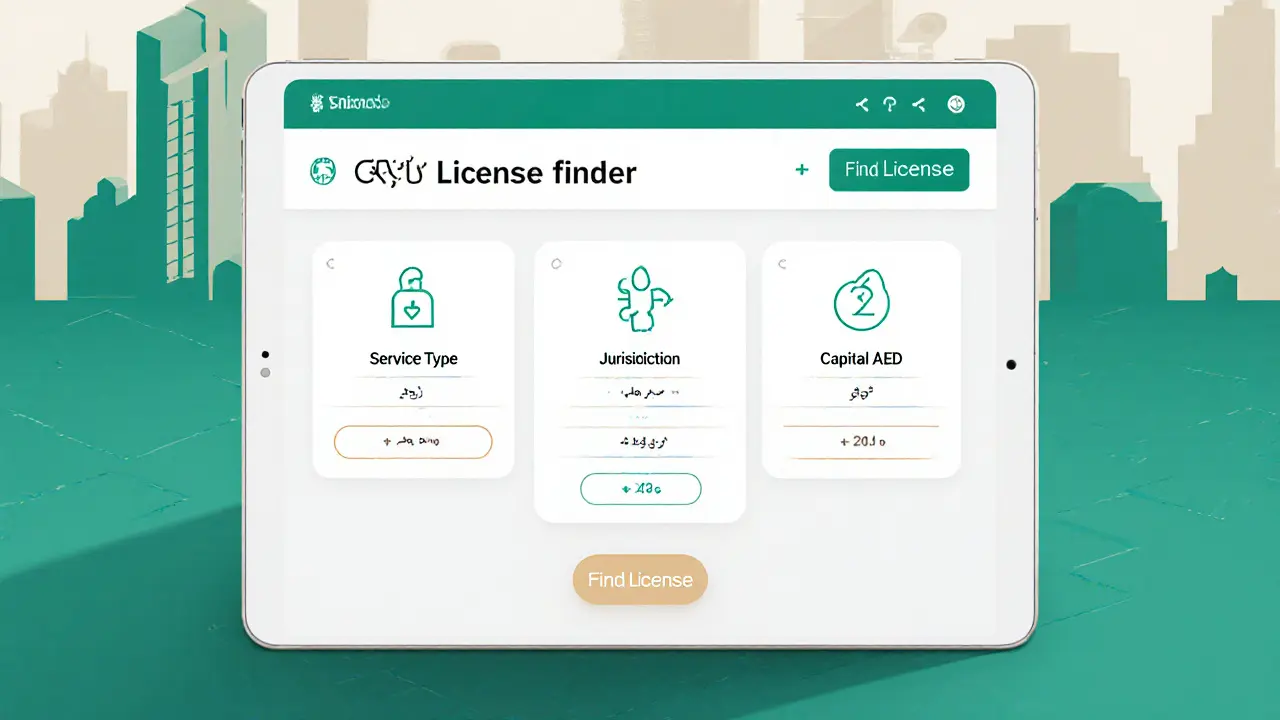

UAE Crypto Regulations 2025: Bitcoin, Altcoins & Licensing Guide

Explore the UAE's 2025 crypto regulations, licensing steps, VAT exemptions, and the new Crypto-Asset Reporting Framework for Bitcoin and altcoins.

View More