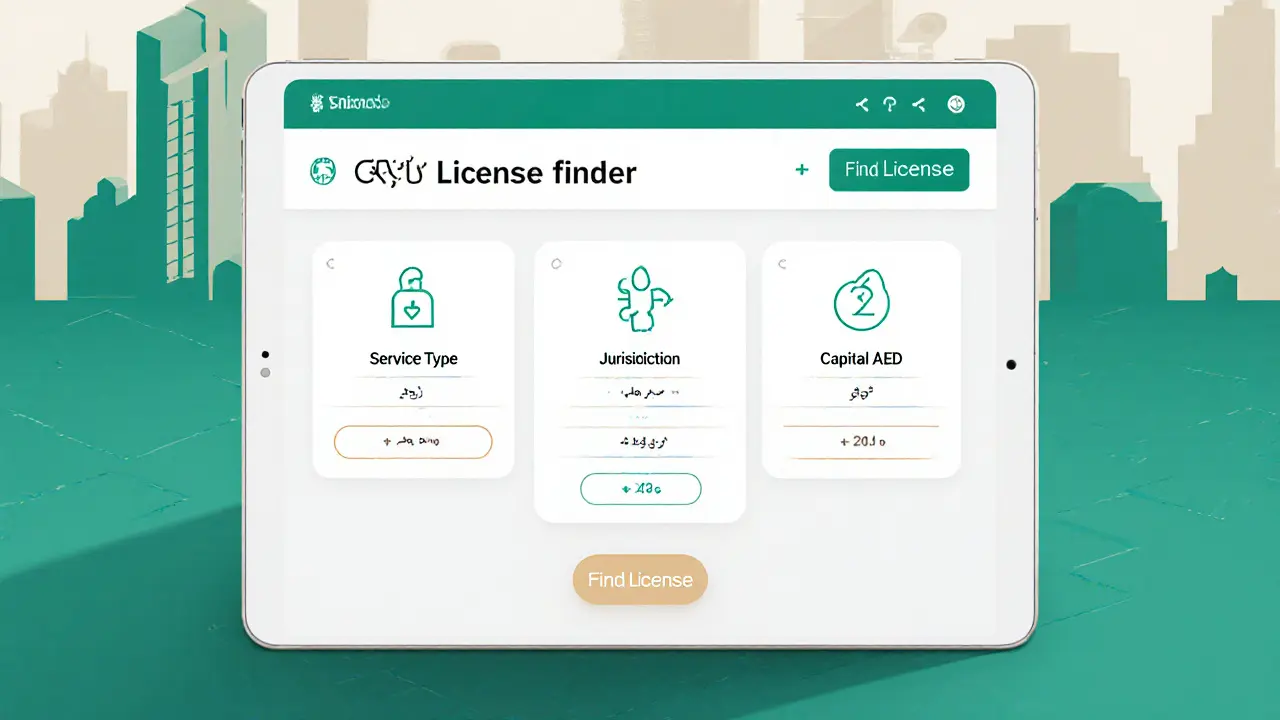

UAE Crypto Licence Finder

Recommended Regulatory Authority

Key Takeaways

- The UAE operates a five‑layer crypto regulatory system that became fully functional in 2025.

- VARA in Dubai offers the most detailed licensing path for exchanges, custodians, and token issuers.

- VAT on most crypto transactions is exempt, but the new Crypto‑Asset Reporting Framework (CARF) adds extensive reporting duties starting 2027.

- Capital requirements range from AED 100,000 for basic services up to AED 1.5million for full‑scale exchanges.

- Businesses can choose the jurisdiction that best fits their model - VARA for crypto‑first, DFSA for finance‑integrated, or FSRA for institutional‑grade services.

UAE Cryptocurrency Regulation Framework is a multi‑layered set of rules that aims to make the Emirates a global crypto hub while keeping investor protection tight. If you’re planning to launch a Bitcoin exchange, issue an altcoin, or simply accept crypto payments, you need to know which authority you’ll deal with, how much capital you must lock up, and what reporting obligations await you.

Regulatory Landscape at a Glance

Since 2020 the United Arab Emirates has built five distinct bodies that together cover every crypto‑related activity:

- Virtual Assets Regulatory Authority (VARA) - Dubai‑wide, handles exchange, brokerage, custodian, wallet and token‑issuance licences.

- Dubai Financial Services Authority (DFSA) - Governs crypto activity inside the Dubai International Financial Centre (DIFC).

- Financial Services Regulatory Authority (FSRA) - Oversees Abu Dhabi Global Market (ADGM) crypto firms.

- Securities and Commodities Authority (SCA) - Federal regulator for investment‑type virtual assets.

- Central Bank of the UAE (CBUAE) - Handles payment‑token matters and overall monetary policy.

Each authority publishes its own licence categories, capital thresholds and supervision fees, giving businesses flexibility to pick a jurisdiction that matches their operational model.

VARA Licensing - The Crypto‑First Path

VARA is the most granular regulator for virtual assets outside the DIFC and ADGM. It defines six core service categories that you can apply for:

- Exchange services (spot and derivatives)

- Fiat‑to‑virtual‑asset and virtual‑to‑virtual‑asset brokerage

- Transfer services (P2P, remittance)

- Custody services

- Wallet provision

- Token issuance (Category1 and Category2)

To get a VARA licence you must incorporate a company in Dubai, meet a paid‑up‑capital floor (AED100,000 for wallet providers, up to AED1.5million for full‑scale exchanges) and pay an application fee of AED40,000‑100,000. Annual supervision fees range from AED80,000 to AED200,000 depending on the licence class.

Token issuance is split into two tracks:

- Category1 - Requires a stand‑alone token‑issuance licence plus explicit approval for each token.

- Category2 - Can be launched through a licensed distributor; closed‑loop tokens (e.g., loyalty points) are exempt but still fall under VARA oversight.

All applicants undergo strict AML/CFT checks, fit‑and‑proper testing for key personnel, and must demonstrate robust security controls (e.g., multi‑sig custodial wallets, regular penetration testing).

DFSA and FSRA - Bridging Crypto with Traditional Finance

Both the DIFC and ADGM operate under the internationally recognised financial‑services model. Their regulators, the DFSA and the FSRA, issue licences that look familiar to banks and asset managers:

- Dealers in crypto‑related securities (e.g., tokenised shares)

- Custodial services that meet “segregated client asset” standards

- Trading facilities that must be run on regulated market‑place platforms

Capital requirements are higher than VARA’s baseline - typically AED500,000 for custodians and AED2million for a full exchange. The upside is that firms benefit from the DIFC/ADGM’s extensive legal infrastructure, access to a large pool of qualified professionals, and the ability to offer both crypto and fiat services under a single licence.

Federal Oversight - SCA and the Central Bank

The SCA focuses on virtual assets that are treated as securities, such as security tokens or tokenised real‑estate. Its licensing process mirrors that of conventional securities firms and requires a minimum AED1million capital base.

The CBUAE, meanwhile, regulates payment tokens (stablecoins pegged to fiat). Since November2024, transactions involving payment tokens are exempt from the standard 5% VAT, aligning the UAE with many crypto‑friendly jurisdictions.

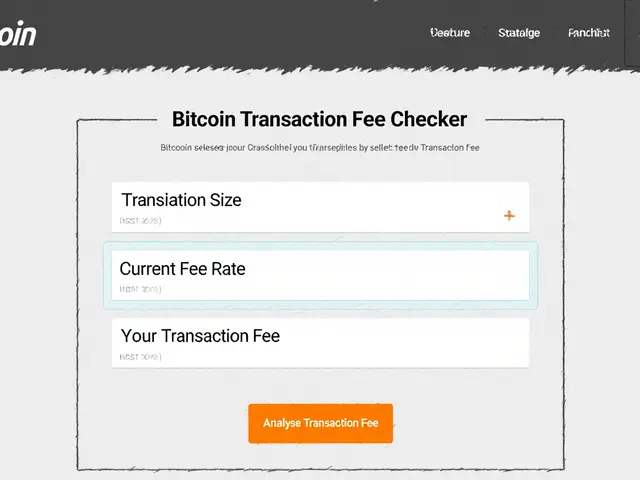

Tax, VAT & the Crypto‑Asset Reporting Framework (CARF)

From 15November2024 the UAE waived VAT on most crypto trades, meaning buying, selling or swapping Bitcoin, Ethereum or any other altcoin does not trigger the 5% tax that applies to most goods and services.

However, the Ministry of Finance introduced the Crypto‑Asset Reporting Framework (CARF) on 20September2025. CARF aligns the UAE with global tax‑transparency standards and forces crypto service providers to collect and share detailed data with the tax authority:

- Buyer and seller identification, residency status

- Full transaction history (date, volume, token type)

- Account balances at year‑end

The rollout timeline looks like this:

- Public consultation - open until 8Nov2025

- Final regulations - expected 2026

- Mandatory compliance - 1Jan2027

- First automatic data exchange - 2028

For most exchanges, the cost of compliance will be an additional USD50‑100k per year for data‑collection systems and audit support.

Step‑by‑Step Checklist to Secure a UAE Crypto Licence

- Choose the optimal regulator (VARA, DFSA, FSRA, SCA, or CBUAE) based on your service model.

- Incorporate a local entity in the relevant jurisdiction (Dubai, DIFC, ADGM, or federal).

- Prepare a detailed business plan covering market, technology stack, risk management, and AML/CFT procedures.

- Secure the required paid‑up capital and arrange any necessary insurance (e.g., custodial loss insurance).

- Complete the online licence application - upload KYC documents for founders, proof of capital, and a compliance manual.

- Undergo fit‑and‑proper assessment of each key executive.

- Pay the application fee and schedule the on‑site inspection (if required).

- Obtain the licence, then implement ongoing reporting, AML monitoring, and annual supervision fee payment.

- Integrate CARF data‑collection modules ahead of the 2027 deadline.

Missing any of these steps can delay approval by months, especially the fit‑and‑proper checks which are scrutinised closely for AML risk.

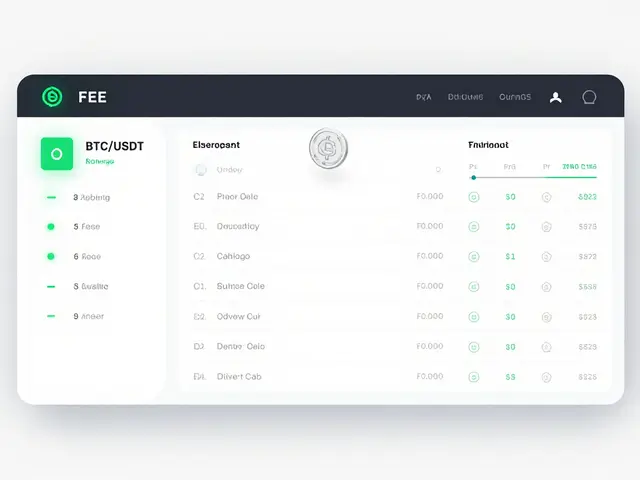

Comparison of UAE Crypto Regulatory Authorities

| Authority | Jurisdiction | Main Service Categories | Minimum Capital (AED) | Application Fee (AED) | Typical Use‑Case |

|---|---|---|---|---|---|

| VARA | Dubai (outside DIFC/ADGM) | Exchange, brokerage, custody, wallet, token issuance | 100,000 - 1,500,000 | 40,000 - 100,000 | Pure‑play crypto exchanges, DeFi protocols |

| DFSA | DIFC | Trading facilities, custodial services, security‑token dealing | 500,000 - 2,000,000 | 50,000 - 150,000 | Hybrid crypto‑fiat firms, institutional investors |

| FSRA | ADGM | Brokerage, custodial, fund management, token‑issuance | 500,000 - 2,000,000 | 50,000 - 150,000 | Asset‑token funds, institutional custodians |

| SCA | Federal | Security‑type tokens, investment‑related assets | 1,000,000 | 80,000 | Tokenised securities, real‑estate tokens |

| CBUAE | Federal | Payment tokens, stablecoins, monetary policy oversight | Varies - no specific licence fee for payment‑token use | N/A | Stablecoin issuers, cross‑border payment providers |

Real‑World Impact: What the Market Is Saying

Since the framework went live, more than 400 crypto‑related firms have set up shop in the UAE. Binance opened a regional hub in Dubai under a VARA licence, while Crypto.com secured a DFSA licence to run a full‑service crypto bank inside the DIFC. Institutional custodian BitGo obtained an FSRA licence, allowing it to serve sovereign wealth funds that demand ADGM‑level compliance.

Merchants are also feeling the shift. Starting August2025, every non‑free‑zone retailer must process crypto payments only through licensed providers. This has spurred a boom in payment‑gateway startups that partner with VARA‑licensed custodians, creating a robust ecosystem for everyday crypto use.

Future Outlook - Beyond 2025

The CARF rollout will be the next big test. By 2028 the UAE expects its first automatic exchange of crypto tax data with international counterparts, meaning compliance systems will need to be interoperable with global tax platforms.

Regulators have already hinted at expanding the framework to cover emerging DeFi aggregators, NFT marketplaces, and token‑backed real‑world assets. The FSRA, for example, is drafting a sandbox for tokenised infrastructure projects, while VARA plans to issue a specific licence class for cross‑chain liquidity providers.

All signs point to a deeper integration of crypto into the UAE’s broader financial strategy, positioning the country as the “Silicon Valley of the Middle East” for digital assets.

Frequently Asked Questions

Do I need a separate licence for each crypto service?

Yes. VARA, for instance, issues distinct licences for exchanges, custodial services, wallet providers and token issuance. Trying to bundle them under a single licence will lead to rejection.

Is VAT truly zero on crypto trades?

Effective 15Nov2024, most transactions involving virtual assets are exempt from the standard 5% VAT. The exemption does not apply to services like consulting or software development that happen to be paid in crypto.

When does CARF become mandatory?

Full compliance kicks in on 1Jan2027. Companies should start integrating data‑capture tools now to avoid a rushed implementation later.

Can a foreign company operate in the UAE without a local partner?

For VARA licences you must incorporate a UAE‑registered entity, but you can own 100% of the shares. The DFSA and FSRA, however, often require a local sponsor or a UAE‑based board member.

What are the biggest penalties for non‑compliance?

Regulators can revoke licences, impose fines up to AED5million, and add the entity to a public blacklist that bars future licensing. In severe AML breaches, criminal prosecution is also possible.

Amal Al.

4 October, 2025 . 08:12 AM

The UAE's multi‑layered framework is a clear signal that the region is embracing digital assets; you should view this as an opportunity to tap into a thriving ecosystem; the licensing paths are well‑defined, and with proper compliance you can launch confidently; regulators have provided detailed capital thresholds and reporting duties, which reduces uncertainty for founders.

Katherine Sparks

7 October, 2025 . 21:17 PM

It is evident that the comprehensive regulatory approach adopted by the Emirates will likely attract substantial foreign investment, and the clarity of the capital requirements is particularly reassuring; however, prospective entrants must still navigate the nuanced procedural steps, which can be a bit daunting at times – but with diligent preparation you can succeed, definately :)

stephanie lauman

11 October, 2025 . 10:23 AM

While the official documents present a veneer of transparency, a closer examination reveals that the underlying agenda may be oriented towards consolidating state control over digital asset flows; the emphasis on extensive AML reporting could be interpreted as a mechanism for surveillance; many observers have warned that the CARF framework aligns with broader geopolitical data‑collection initiatives; therefore, entities should remain vigilant about potential overreach; compliance should not be mistaken for endorsement of hidden motives.

Twinkle Shop

14 October, 2025 . 23:28 PM

The regulatory architecture of the United Arab Emirates represents a paradigm shift in the governance of virtual assets, integrating distinct supervisory bodies to address heterogeneous market segments.

The VARA, operating under the Dubai Economic Department, delineates six core service categories, each accompanied by calibrated capital thresholds that reflect risk exposure.

The DFSA, situated within the DIFC, applies a traditional financial services model, thereby bridging crypto activities with established banking regulations.

FSRA in ADGM similarly adopts a rigorous supervisory regime, emphasizing custodial safeguards and segregation of client assets.

At the federal level, the Securities and Commodities Authority focuses on tokenized securities, imposing a baseline capital requirement of AED 1 million to mitigate systemic risk.

Concurrent ly, the Central Bank of the UAE oversees payment tokens, offering a fee‑free licensing pathway for stablecoins that meet fiat‑peg criteria.

The tiered capital framework, ranging from AED 100,000 for wallet providers to AED 2 million for full‑scale exchanges, creates a proportionality principle that aligns financial resilience with operational scope.

Moreover, the introduction of the Crypto‑Asset Reporting Framework (CARF) in 2025 imposes granular data‑collection obligations, aligning the Emirates with OECD‑driven tax transparency standards.

CARF mandates the reporting of buyer‑seller identifiers, transaction timestamps, and year‑end balances, necessitating robust analytics infrastructure for compliance.

The anticipated compliance cost, estimated at USD 50‑100 k annually, reflects the sophisticated nature of the required technology stack.

In practice, firms must integrate blockchain analytics tools capable of real‑time monitoring and generate audit‑ready reports for the Ministry of Finance.

The centralized supervision model also facilitates cross‑border data exchange, positioning the UAE as a hub for regulated crypto activity in the MENA region.

Institutional participants, such as sovereign wealth funds, are particularly attracted by the FSRA’s stringent custodial standards, which enable tokenized asset management under a familiar legal framework.

Meanwhile, VARA’s openness to DeFi protocols encourages innovation, albeit within a regulated sandbox environment that enforces multi‑signature wallet controls and periodic penetration testing.

The regulatory ecosystem thus balances innovation incentives with investor protection mechanisms, fostering a sustainable digital asset market.

As the regulatory landscape evolves, stakeholders should monitor forthcoming amendments, including potential licensing categories for cross‑chain liquidity providers.

Ultimately, the UAE’s multi‑layered approach may serve as a blueprint for jurisdictions seeking to harmonize fintech advancement with prudential oversight.

Greer Pitts

18 October, 2025 . 12:33 PM

Hey there! I totally get how overwhelming all these licensing steps can feel, especially when you’re trying to get your platform off the ground. The good news is that once you lock down the paid‑up capital and get your AML procedures in place, the rest flows much smoother. Just make sure you have all the founders’ KYC docs ready – that part trips up a lot of teams. And don’t forget to budget for the audit support; it’s a small price to pay for a hassle‑free licence. You’re definitely on the right track, keep pushing forward!

Lurline Wiese

22 October, 2025 . 01:39 AM

Seriously, the whole scene feels like a blockbuster movie where the hero (your crypto startup) must battle bureaucratic dragons! Every new form feels like a cliff‑hanger, and the capital thresholds are the plot twists nobody saw coming. But when you finally get that VARA licence, it’s like the fireworks at the climax – pure triumph!

Adarsh Menon

25 October, 2025 . 14:44 PM

Wow another crypto rule just what we needed

Matt Nguyen

29 October, 2025 . 02:50 AM

One must acknowledge that the theatrical framing masks a deeper stratagem; the authorities subtly steer market participants toward jurisdictions that align with sovereign data extraction policies, and the apparent openness is merely a veneer that conceals long‑term state capture of digital wealth; this demonstrates the necessity for vigilant due diligence beyond the surface narrative.

Shaian Rawlins

1 November, 2025 . 15:55 PM

The excitement around the UAE’s crypto licensing regime is absolutely justified; it offers a clear roadmap for entrepreneurs eager to launch innovative services; the multi‑layered system ensures that each business model can find a regulator that fits its specific needs; from basic wallet providers to full‑scale exchanges, the capital requirements are laid out transparently; this reduces uncertainty and encourages investment; the exemption of VAT on most crypto trades further sweetens the deal; yet, the upcoming CARF reporting obligations will require firms to adopt robust compliance tools; preparing early will save time and money later; remember that building a solid AML framework is not just a regulatory checkbox but a trust‑building exercise with users; the UAE’s commitment to aligning with global tax transparency standards signals a mature market; as more institutions look for a stable base, the region is poised to become a leading hub for digital assets; stay focused, stay compliant, and you’ll reap the benefits of this progressive environment.

Amy Harrison

5 November, 2025 . 05:01 AM

Love the vibe here! 🌟 The step‑by‑step checklist is super helpful and makes the whole licensing journey feel way less scary. 🎉 Keep the positive energy flowing, and soon we’ll all be celebrating new crypto ventures in the UAE! 🚀

Alex Gatti

8 November, 2025 . 18:06 PM

I notice the structure of the licensing guide mirrors traditional financial regulation which helps bridge the gap between legacy finance and emerging crypto services this alignment could foster greater institutional participation while still preserving the innovative spirit of digital assets

John Corey Turner

12 November, 2025 . 07:12 AM

In the grand tapestry of financial evolution, the UAE’s regulatory mosaic weaves together threads of prudence and audacity, crafting a canvas where decentralized dreams can dance alongside institutional rigor; it is a symphony of order and chaos, inviting visionaries to compose their own verses within a regulated chorus.

Kimberly Kempken

15 November, 2025 . 20:17 PM

The hype surrounding the UAE’s crypto framework is nothing but a smoke screen; beneath the polished press releases lies a concerted effort to centralize control and stifle true decentralization; anyone buying into the “progress” narrative is ignoring the authoritarian undercurrents at play.

Eva Lee

19 November, 2025 . 09:22 AM

From a compliance architecture standpoint, the integration of VARA's AML/CFT protocols with the CARF data exchange interface necessitates a granular approach to transaction monitoring, leveraging blockchain forensic analytics to satisfy both regulatory granularity and operational efficiency.

Natalie Rawley

22 November, 2025 . 22:28 PM

Let’s be real – anyone who thinks they can skip the capital thresholds is deluding themselves; the numbers are there for a reason, and the regulators will not hesitate to pull the plug on half‑baked projects.

Scott McReynolds

26 November, 2025 . 11:33 AM

Embarking on the journey to secure a UAE crypto licence is akin to setting sail on uncharted waters, guided by a lighthouse of regulatory clarity; each prerequisite-be it capital allocation, AML framework, or CARF compliance-serves as a compass point, directing founders toward sustainable success; the process, while demanding, cultivates resilience and sharpens strategic insight; as entrepreneurs navigate these requirements, they simultaneously forge trust with stakeholders, laying a foundation for long‑term credibility; the collaborative spirit between regulators and innovators breeds an ecosystem where risk is managed without stifling creativity; ultimately, the disciplined approach championed by the UAE paves the way for a vibrant, globally‑connected crypto landscape, inviting visionaries to contribute to a future where digital assets are both secure and accessible.

Cathy Ruff

30 November, 2025 . 00:39 AM

Do not underestimate the supervision fees they’ll hit you with later if you slack off

Miranda Co

3 December, 2025 . 13:44 PM

Listen, if you don’t get your AML policies right you’ll face huge fines and get blacklisted fast.

Marc Addington

7 December, 2025 . 02:50 AM

The UAE’s strategic positioning as a crypto hub strengthens national economic sovereignty and showcases our commitment to leading in digital innovation.

Jenise Williams-Green

10 December, 2025 . 15:55 PM

It is a moral imperative that we hold these regulators accountable; without vigilant oversight, the promise of financial freedom is reduced to a shadow of exploitation.

Kortney Williams

14 December, 2025 . 05:01 AM

Collaboration between regulators and innovators can foster a balanced ecosystem where security and creativity coexist.

Laurie Kathiari

17 December, 2025 . 18:06 PM

Sure, the new reporting framework will be “seamless,” once you’ve spent a fortune on compliance consultants.

Jim Griffiths

21 December, 2025 . 07:12 AM

Prepare your AML manual, gather all KYC documents, and submit the application before the capital is fully raised to avoid delays.