India’s crypto market didn’t collapse when regulations tightened-it adapted. And no two exchanges show that shift better than CoinDCX and WazirX. Once seen as pioneers of India’s crypto boom, both platforms now operate under a legal framework that treats cryptocurrency like a bank transaction. No more anonymity. No more shortcuts. Just strict rules, constant audits, and zero tolerance for mistakes.

What Changed in March 2023?

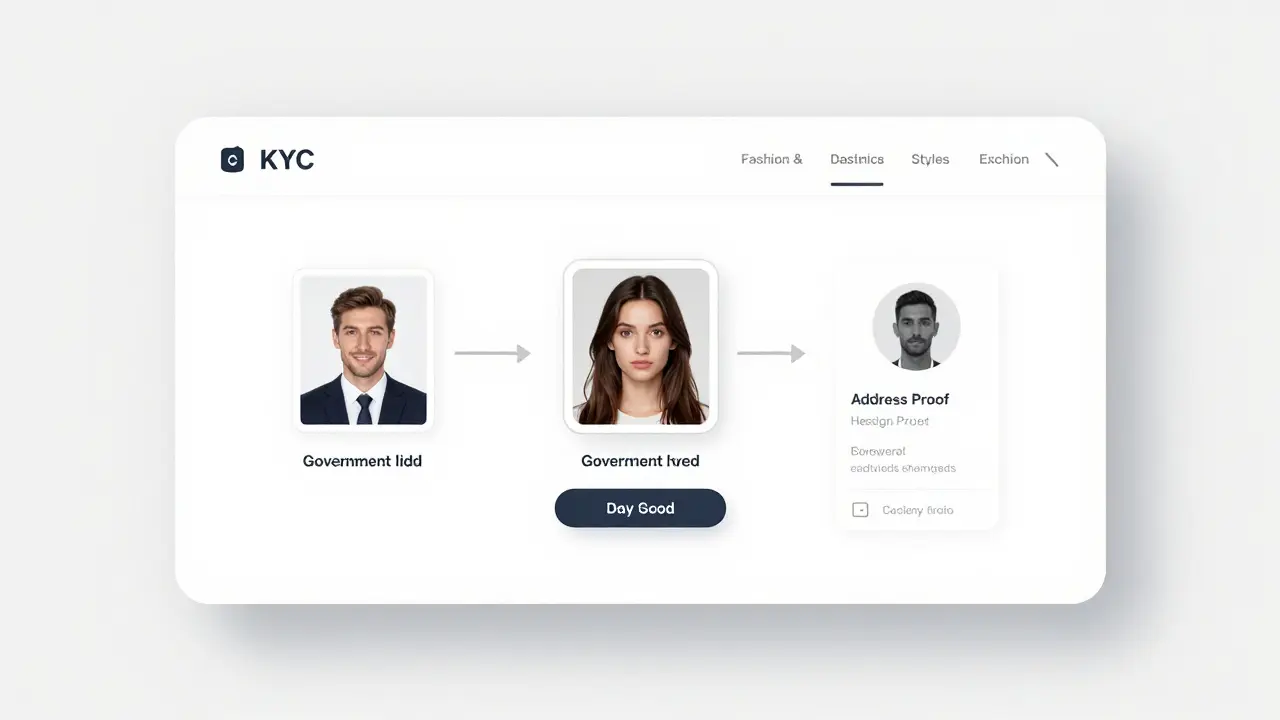

Before March 2023, Indian crypto exchanges operated in a gray zone. You could sign up with just an email. No ID checks. No transaction tracking. That changed overnight when the Financial Intelligence Unit of India (FIU-IND) slapped Virtual Digital Asset (VDA) providers with the same rules as banks under the Prevention of Money Laundering Act (PMLA). Suddenly, every user had to pass full KYC: government ID, address proof, face verification. Every trade had to be logged. Every transfer had to carry sender and receiver details-no exceptions.This wasn’t just a policy tweak. It was a full system overhaul. India became one of the few countries to enforce the FATF Travel Rule with no minimum threshold. That means even a ₹100 transfer from CoinDCX to a friend’s wallet must include both parties’ full names, addresses, and wallet IDs. No other major market does this. Not the U.S. Not the EU. Not even Singapore.

The Breaches That Forced the Hand of Regulators

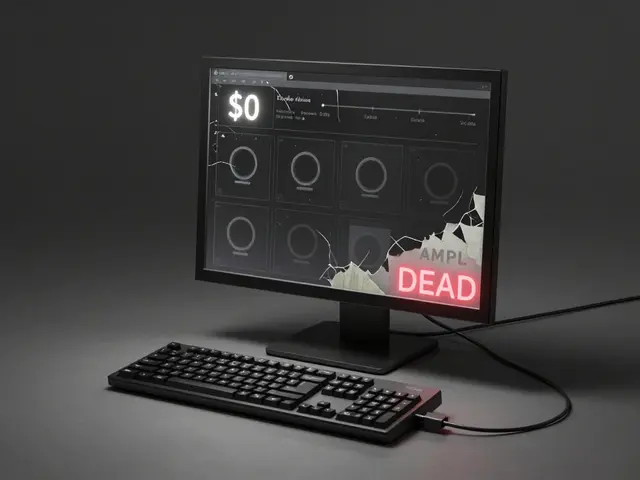

Regulations don’t exist in a vacuum. They’re often born from disaster. In 2024, WazirX got hacked. $230 million vanished. Not a few coins. Not a glitch. A full-scale breach that exposed how little security was built into the platform. Users lost life savings. Social media exploded. The government took notice.Then, in July 2025, CoinDCX-India’s first crypto unicorn-suffered its own major breach. This wasn’t a coincidence. It was a pattern. Two of the biggest names in Indian crypto, both hit within 16 months. Regulators didn’t just get angry. They got systematic.

By September 2025, FIU-IND issued a new mandate: every crypto exchange in India must pass a cybersecurity audit by a CERT-In-approved firm. Not just any firm. Government-vetted. Independent. And it’s not a one-time check. It’s annual. And it’s expensive. For a small startup, that audit might cost ₹15 lakh. For CoinDCX or WazirX? It’s a line item in their budget.

Why International Exchanges Are Getting Notices Too

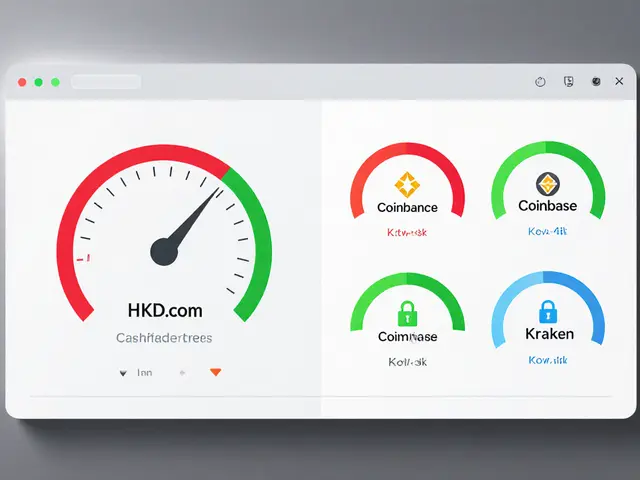

It’s not just Indian platforms under pressure. The government sent notices to 25 offshore exchanges-including BingX, Huione, and CEX.IO-giving them 45 days to register with FIU-IND or face a ban. These platforms don’t have offices in India. They don’t have local teams. But millions of Indians still trade on them because they offer lower fees and more coins.Here’s the catch: if you’re serving Indian users, Indian law says you’re operating in India. That means you need to comply with KYC, AML, and now cybersecurity audits. Binance paid $2.2 million to register. KuCoin paid $41,000. Coinbase registered without a fine. But platforms like BingX? They’re still silent. If they don’t respond, they’ll be blocked. No warning. No grace period.

That’s causing chaos. Traders who relied on BingX for altcoins like Solana or Arbitrum are scrambling. Some switched to CoinDCX. Others turned to Liminal Custody, a Singapore-based firm now registered with FIU-IND, to hold their assets securely. A new market is forming: compliant custody services for Indian institutions.

The Real Cost of Compliance

Compliance isn’t free. It’s not just paperwork. It’s people. It’s software. It’s 24/7 monitoring systems. CoinDCX hired 40 new compliance officers. WazirX rebuilt its entire security stack. Smaller exchanges? Many shut down. Others merged. The cost of staying legal is so high that only the biggest can afford it.That’s creating a two-tier market. On one side: CoinDCX, WazirX, and a handful of others with deep pockets and legal teams. On the other: users who still use unregistered offshore platforms because they’re cheaper and faster. But here’s the risk: if an offshore exchange gets shut down tomorrow, your funds could disappear with no recourse. No FDIC. No insurance. Just a message saying, “We’re offline.”

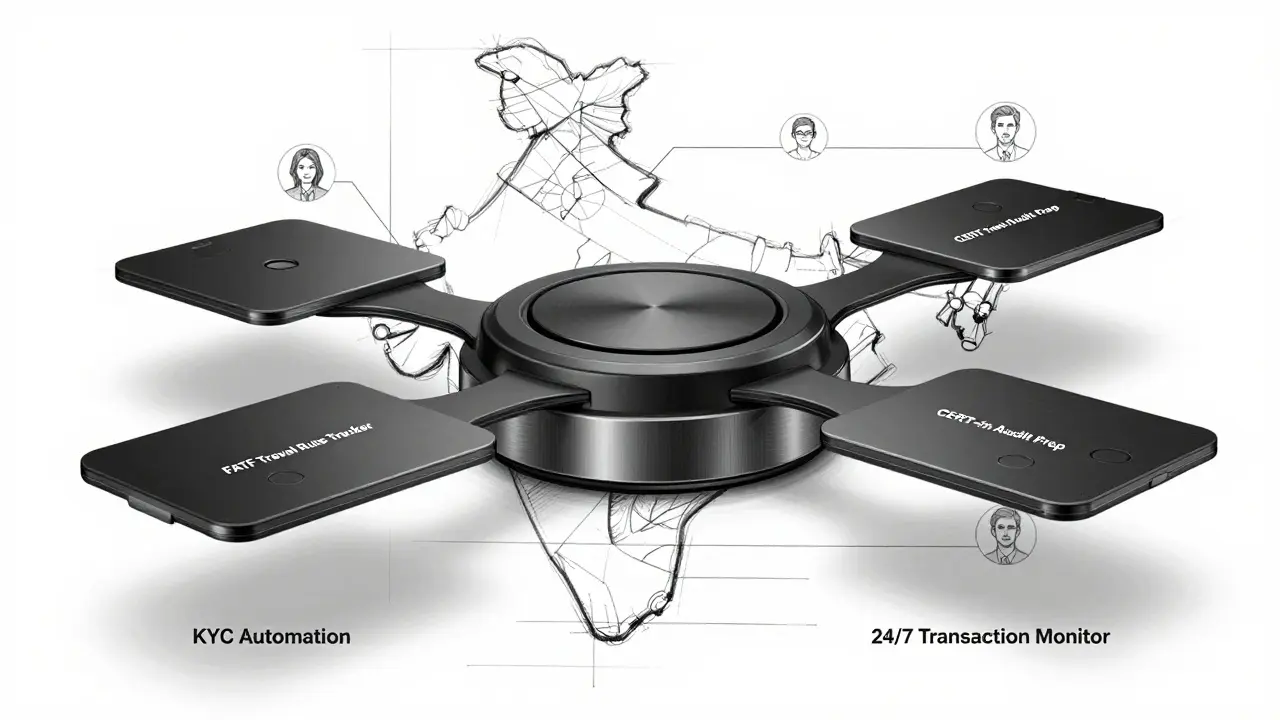

Meanwhile, companies like Pi42 and Mudrex are thriving-not by trading crypto, but by helping exchanges comply. They sell cybersecurity tools, KYC automation, and audit prep packages. Their business model? Profit from regulation.

What Users Are Saying

On Reddit and Twitter, Indian crypto traders are split. One side says: “Finally, some safety. I lost money in the WazirX hack. I don’t want that to happen again.” The other side says: “I can’t trade Shiba Inu on CoinDCX. Why should I pay more for less choice?”Some are hedging. They keep 30% of their portfolio on CoinDCX for security. The rest on BingX for access. It’s a risky game. But it’s the only way to balance safety and opportunity right now.

The Bigger Picture: India’s Strategy

India isn’t trying to kill crypto. Finance Minister Nirmala Sitharaman said that in 2022. What India wants is control. It wants to know who’s trading what, when, and why. It wants to stop money laundering, ransomware payments, and terrorist financing-all real problems in the crypto space.That’s why the rules are so strict. No loopholes. No exceptions. If you want to operate here, you play by Indian rules. It’s not about stifling innovation. It’s about protecting people. And for now, that means making compliance the cost of doing business.

What’s Next?

The next 90 days will decide the future of India’s crypto market. If offshore exchanges register, we’ll see a more diverse, regulated ecosystem. If they don’t, we’ll see a sharp drop in trading volume and a sudden surge in demand for compliant local platforms.One thing’s clear: the era of crypto in India as a wild west is over. The banks are here. The auditors are here. The regulators are watching. The question isn’t whether you can trade crypto in India anymore. It’s whether you’re trading it the right way.

Mandy McDonald Hodge

27 December, 2025 . 20:48 PM

I lost everything in the WazirX hack. I don't care how strict the rules are anymore. I just want to know my money is safe. 🙏

surendra meena

27 December, 2025 . 22:42 PM

India finally got some backbone! All these offshore exchanges thought they could just steal our money and vanish. Now they have to play by our rules. Long overdue.

Emily L

28 December, 2025 . 19:33 PM

You people are acting like this is a revolution. It’s just bureaucracy with crypto labels. I can’t even buy Dogecoin without submitting my birth certificate. What’s next? A tax on memes?

Josh Seeto

30 December, 2025 . 12:41 PM

Let’s be real - CoinDCX and WazirX didn’t get hacked because of lax regulation. They got hacked because they built their platforms on duct tape and hope. The regulations didn’t cause the problem. Their incompetence did.

NIKHIL CHHOKAR

31 December, 2025 . 15:50 PM

I used to trade on BingX for the altcoins. Now I’ve moved 80% to CoinDCX. It’s slower, pricier, but at least I can sleep at night. Sometimes safety isn’t a luxury - it’s the only option left.

prashant choudhari

1 January, 2026 . 02:57 AM

The real winners here aren’t the exchanges. They’re the compliance startups like Pi42. They’re the ones cashing in while everyone else scrambles. Regulation is just another business model now.

Khaitlynn Ashworth

1 January, 2026 . 11:04 AM

Oh please. You think this is about protecting people? It’s about control. The government wants to know every transaction you make. Welcome to the crypto surveillance state. 🤡

SUMIT RAI

1 January, 2026 . 14:52 PM

I miss the wild west 😭 but honestly? I’d rather lose 20% in fees than lose 100% in my portfolio. 🤷♂️

Jordan Fowles

2 January, 2026 . 13:07 PM

There’s a quiet irony here. The same people who screamed about decentralization are now begging for centralized, government-approved custody. We wanted freedom. Now we’re asking for a security guard at the gate.

Adam Hull

3 January, 2026 . 17:29 PM

The FATF Travel Rule applied to ₹100 transfers? That’s not regulation. That’s performance art. No other jurisdiction does this. Not even the EU. India isn’t leading innovation - it’s performing a grotesque spectacle of overcompliance.

rachael deal

4 January, 2026 . 11:12 AM

I get why people are mad about the fees. But look at the alternative - WazirX losing $230M. That’s not a glitch. That’s a systemic failure. Sometimes the cost of safety is just… expensive.

Kevin Gilchrist

4 January, 2026 . 14:38 PM

They say it’s about stopping money laundering. But let’s be honest - the real target is the little guy who just wants to buy Shiba Inu without paperwork. The big players? They’ll pay the fee. The rest of us? We get left behind. Again.

Elisabeth Rigo Andrews

4 January, 2026 . 17:29 PM

The compliance arms race is real. KYC, audit, AML, blockchain analytics, cold storage certification - it’s a full-stack regulatory treadmill. And the only ones who can keep up are the ones who already had venture capital. This isn’t regulation. It’s a wealth transfer to the already wealthy.

Willis Shane

5 January, 2026 . 07:30 AM

The idea that offshore exchanges are being ‘blocked’ because they didn’t register is laughable. They’re not operating in India - they’re being accessed by Indians. That’s like banning Netflix because someone in Germany uses a VPN. Legal overreach disguised as sovereignty.

Jake West

6 January, 2026 . 21:11 PM

So now you need a $15L audit to run a crypto exchange? Congrats, you just killed innovation. The next big thing won’t come from India. It’ll come from somewhere that doesn’t treat traders like criminals.

Steve Williams

7 January, 2026 . 02:14 AM

As someone from Nigeria, I see this as a model. We’ve had our own crypto chaos - exchange collapses, scams, stolen funds. India is proving that structure doesn’t kill innovation - it protects it. Respect.

Shawn Roberts

7 January, 2026 . 20:23 PM

I don’t care if it’s regulated. I just want my memecoins back 😭 I lost my entire rent money on BingX and now it’s gone. No one even replied to my ticket. This isn’t safety - it’s betrayal.

Gavin Hill

9 January, 2026 . 13:45 PM

There’s a difference between regulation and control. One builds trust. The other builds fear. India is walking a fine line. I hope they don’t cross it.

Mike Pontillo

10 January, 2026 . 01:12 AM

Oh look, another country trying to be the ‘crypto police’. Next they’ll require you to file a form before buying a Bitcoin. At this point, why not just make crypto illegal and be done with it?

Joydeep Malati Das

11 January, 2026 . 09:25 AM

The truth no one wants to admit: India didn’t crack down because of hacks. They cracked down because they saw how much tax revenue they were missing. Crypto isn’t a threat - it’s an untapped income stream.

Bruce Morrison

12 January, 2026 . 03:19 AM

To the traders still on BingX: you’re not being edgy. You’re being reckless. If your exchange doesn’t answer to Indian law, then when it vanishes, you have zero recourse. That’s not freedom. That’s gambling with your life savings.

Abhisekh Chakraborty

14 January, 2026 . 01:48 AM

I’ve been on CoinDCX since 2021. I’ve lost money. I’ve gained money. But now? I trust them. Not because they’re perfect - because they finally stopped pretending they were invincible.

Andrea Stewart

14 January, 2026 . 04:15 AM

The real story isn’t the regulations. It’s the rise of compliant custody providers. That’s where the real innovation is happening now - not in trading, but in holding. That’s the future: regulated custody, not speculative trading.

dina amanda

14 January, 2026 . 09:25 AM

This is all part of the globalist agenda. The UN, the IMF, the FATF - they’re all working together to destroy financial freedom. Next they’ll ban cash. Then Bitcoin. Then your right to think for yourself.

Andrew Prince

16 January, 2026 . 05:53 AM

The notion that India’s regulatory framework is uniquely draconian is empirically false. The FATF Travel Rule has no threshold in India, yes - but the EU’s MiCA regulation mandates similar traceability for transactions above €1000, and the U.S. FinCEN has proposed similar measures under its 2024 AML reforms. The difference is not in substance, but in enforcement posture. India is not an outlier - it is a precursor.