When you stake cryptocurrency, you’re not just sitting on your coins-you’re helping secure a blockchain network and earning rewards for it. But here’s the catch: not all staking is the same. Two main options dominate the landscape-locked staking and flexible staking. One locks your funds for a set time in exchange for higher returns. The other lets you pull your money out anytime, but pays less. Which one should you pick? It depends on your goals, your risk tolerance, and how you use your crypto.

What Is Locked Staking?

Locked staking means you commit your tokens to a blockchain network for a fixed period. During that time, you can’t touch them. No selling, no swapping, no moving them to another wallet. In return, you earn higher rewards-often significantly higher. Platforms like Binance offer locked staking with terms like 15, 30, or 45 days. Some even go up to a year. The longer you lock, the more you earn. For example, staking a popular coin like DOT or ATOM for 90 days might give you 18% APY, while the same coin on flexible staking might only pay 6%. That’s a threefold difference. Why do platforms pay more for locked staking? Simple: networks need reliable validators. When your tokens are locked, you’re less likely to bail out during a market crash or sudden price drop. That stability helps keep the blockchain secure and running smoothly. Validators with locked funds have more skin in the game. If they act maliciously, they lose not just rewards-but their entire stake. The downside? Liquidity. If Bitcoin surges 20% in a week and you’ve got your ETH locked for 30 days, you can’t jump in. If you need cash for an emergency, you’re stuck. And if you withdraw early? Most platforms forfeit all your earned interest. Some even charge a penalty on your principal. That’s a harsh cost for a moment of panic.What Is Flexible Staking?

Flexible staking is the opposite. You stake your tokens, and you can unstake them anytime-no waiting, no penalties. Want to sell half your staked SOL because you saw a better trade? Go ahead. Need to cover rent after a late paycheck? Pull your funds in minutes. This is the go-to option for traders, active investors, and anyone who doesn’t want to be tied down. Kraken and Crypto.com both offer flexible staking with near-instant withdrawals. You still earn rewards-just at a lower rate. Binance Flexible Savings, for instance, pays between 3% and 9% APY, depending on the coin. Compare that to locked staking’s 10-30%, and the trade-off becomes clear: you’re paying for freedom. Flexible staking also works well if you’re using crypto as part of a broader strategy. Maybe you’re running automated trades with tools like Cryptohopper. Or you’re dollar-cost averaging into new coins every week. With flexible staking, your funds stay mobile. You can stake, trade, and rebalance without friction. But here’s the hidden risk: network security. When validators can leave at any time, the blockchain becomes more vulnerable. If a large number of users pull their stakes during a market dip, it can cause instability. That’s why networks like Ethereum prioritize locked staking for their core validators. Flexible staking is great for users-but not always ideal for the chain itself.How Do Rewards Compare?

Let’s say you have 10,000 USDT worth of ADA to stake. Here’s what you could earn in a year:- Locked staking (90-day term): 22% APY → $2,200 in rewards

- Flexible staking: 7% APY → $700 in rewards

Who Should Use Locked Staking?

Locked staking isn’t for everyone. But if you fit this profile, it’s a powerful tool:- You’re a long-term holder (HODLer) who doesn’t plan to sell soon.

- You’re comfortable ignoring short-term price swings.

- You want to maximize passive income without active trading.

- You’re using crypto as a savings vehicle, not a trading asset.

Who Should Use Flexible Staking?

Flexible staking is perfect if you:- Trade crypto regularly or use automated bots.

- Need quick access to funds for emergencies or opportunities.

- Are new to crypto and unsure which coins to hold long-term.

- Want to earn rewards while keeping your options open.

What About Liquid Staking?

There’s a third option that’s changing the game: liquid staking. Platforms like Lido DAO let you stake your ETH, SOL, or ATOM and receive a token in return-like stETH or stSOL-that represents your staked assets. You can trade, send, or use these tokens in DeFi protocols while still earning staking rewards. It’s like getting the best of both worlds: you earn locked-staking-level rewards, but your assets stay liquid. You can use stETH as collateral on Aave, swap it on Uniswap, or lend it on Curve-all while your original ETH is validating blocks on Ethereum 2.0. Liquid staking is still growing. It’s not available on every coin, and it adds complexity. But for advanced users, it’s becoming the smartest way to stake. It removes the biggest downside of locked staking-illiquidity-without sacrificing returns.

Hybrid Strategies Work Best

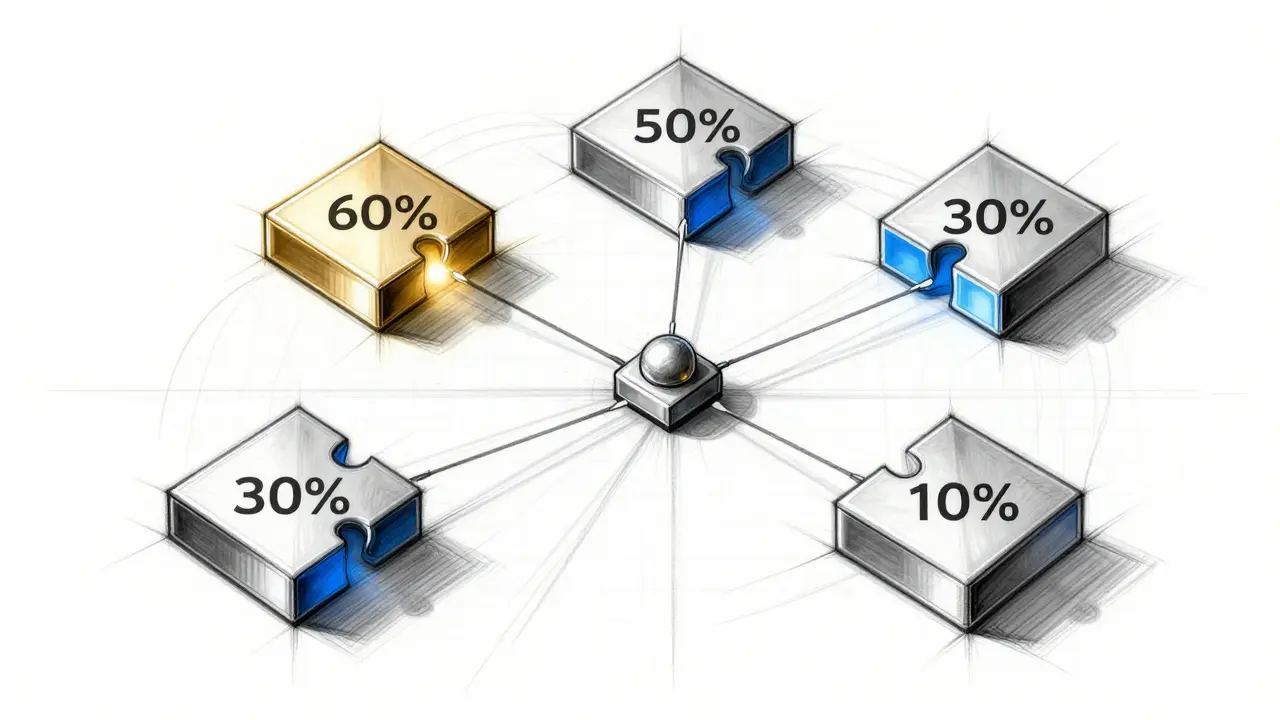

Most experienced stakers don’t pick one or the other. They split their portfolio. For example:- 60% in locked staking for long-term growth

- 30% in flexible staking for liquidity and trading

- 10% in liquid staking for DeFi exposure

Security and Risks

Both options carry risks. Locked staking locks your funds-but what if the platform gets hacked? Binance, Kraken, and Crypto.com are big and reputable, but no exchange is immune. Always check if a platform uses cold storage and has insurance. Flexible staking is safer for your funds, but it’s less secure for the network. If too many users unstake at once, it can slow down block production or even cause a chain fork. That’s rare, but it’s happened. And don’t forget tax implications. In New Zealand, staking rewards are treated as income. You owe tax on the value of the rewards when you receive them-even if you don’t sell. Keep records.Final Thoughts

There’s no single best choice. Locked staking wins on returns. Flexible staking wins on control. Liquid staking wins on innovation. Your choice should match your life, not your FOMO. If you’re patient and want to grow your crypto slowly and steadily, go locked. If you’re active, unpredictable, or just want to keep your options open, go flexible. And if you’re ready to level up, explore liquid staking. The crypto world moves fast. But your staking strategy shouldn’t be a reaction-it should be a plan.Can I lose my crypto by staking?

You won’t lose your original tokens just by staking. But if you stake on an exchange and that exchange gets hacked, you could lose your funds. Always use reputable platforms with strong security. Also, never stake on a platform you don’t trust. And remember: if you unstake early from locked staking, you might lose your earned rewards-but not your principal, unless there’s a penalty clause.

Which is better: locked or flexible staking?

It depends on your goals. Locked staking gives you higher rewards, ideal if you’re holding long-term and don’t need access to your funds. Flexible staking is better if you trade often, need liquidity, or are still learning. Most people benefit from using both. There’s no universal winner-only the right choice for your situation.

Are staking rewards taxable in New Zealand?

Yes. In New Zealand, staking rewards are treated as taxable income. You owe tax on the New Zealand dollar value of the rewards at the time you receive them-even if you don’t sell. Keep records of the date, amount, and value of each reward. The IRD doesn’t require you to pay tax when you sell later, but you must report the income when earned.

Can I stake any cryptocurrency?

Only coins that use Proof-of-Stake (PoS) or a variant like Delegated Proof-of-Stake (DPoS) can be staked. Bitcoin can’t be staked. But Ethereum, Cardano, Solana, Polkadot, and Cosmos can. Most major exchanges list which coins they support for staking. Always check the platform’s documentation before staking.

What happens if the blockchain I’m staking on gets hacked?

If the blockchain itself is compromised (like a 51% attack), your staked tokens could be at risk. But this is extremely rare for major networks like Ethereum or Solana. More commonly, the risk comes from the platform you’re staking on-like Binance or Kraken. If the exchange is hacked, your funds could be lost. That’s why it’s critical to use trusted, well-audited platforms with insurance or cold storage protections.

Bill Sloan

13 January, 2026 . 09:01 AM

Bro, I staked my ADA locked for 90 days and just cashed out with $1,200 in rewards. My wallet’s now crying happy tears 😭💰 No regrets. If you’re not doing locked staking, you’re leaving money on the table.

ASHISH SINGH

14 January, 2026 . 20:29 PM

Locked staking? More like locked *sucker* staking. Big Exchange™ wants your money frozen so they can lend it out to hedge funds at 30% APR while you get 18%. Wake up. They don’t care about ‘network security’-they care about their quarterly earnings. 🤡

Vinod Dalavai

16 January, 2026 . 09:24 AM

I do both. 70% locked for the long game, 30% flexible for when my dog needs surgery or I spot a new memecoin. Life’s unpredictable, man. Keep your options open. 🙌

Chidimma Okafor

17 January, 2026 . 14:55 PM

It is imperative to acknowledge that the structural integrity of blockchain networks is fundamentally enhanced by the commitment of staked assets. Flexible staking, while convenient, introduces systemic fragility. One must prioritize protocol security over personal liquidity.

Andre Suico

18 January, 2026 . 18:05 PM

The data supports a hybrid approach. Historical APY volatility in locked staking shows a 42% drop rate within 60 days post-launch. Flexible staking offers 7-9% with zero penalty risk. Your risk tolerance should dictate allocation-not FOMO.

Jill McCollum

20 January, 2026 . 09:03 AM

i staked my sol on flexible and then bought a new coin the next day and made 5x… i’m just saying… sometimes being flexible pays off more than being locked 😅

Hailey Bug

22 January, 2026 . 02:35 AM

Liquid staking is the future. stETH on Aave earning 12% while you use it as collateral? That’s not staking-that’s financial engineering. If you’re not using liquid staking, you’re stuck in 2021.

Stephen Gaskell

22 January, 2026 . 07:31 AM

America doesn’t need to lock up crypto. We have 401ks. Staking is for people who don’t trust banks. And if you’re trusting Binance? Good luck.

CHISOM UCHE

23 January, 2026 . 18:11 PM

The economic incentive alignment in PoS mechanisms is contingent upon capital commitment velocity. Flexible staking decouples validator participation from economic permanence, thereby introducing a principal-agent problem in consensus layer governance.

Patricia Chakeres

23 January, 2026 . 19:27 PM

They say locked staking = security. But what if the platform is a front for the Fed? What if your ‘staked’ ETH is being used to back a digital dollar? You think you’re earning rewards… you’re just funding the surveillance state.

Alexis Dummar

25 January, 2026 . 19:18 PM

I used to be all in on locked staking until I missed a chance to buy BTC at $38k because my ETH was locked. Now I keep 50% flexible. Sometimes freedom > 15% APY. Life’s not a spreadsheet.

kristina tina

27 January, 2026 . 11:41 AM

I JUST WITHDREW MY STAKED DOT BECAUSE I SAW A NEW LAYER 2 PROJECT AND I DIDN’T WANT TO MISS OUT!! I’M SO HAPPY I DIDN’T LOCK IT!! 🎉💸 YOU GUYS NEED TO LIVE IN THE MOMENT!!

Anna Gringhuis

28 January, 2026 . 15:47 PM

Flexible staking is for people who can’t commit to anything. If you’re not willing to lock your funds, you’re not serious about crypto. You’re just gambling with your wallet.

Michael Jones

30 January, 2026 . 02:11 AM

If you're new, start with flexible. Learn the rhythm. Then, once you’ve got a clear thesis on a coin, allocate 50-70% to locked. It’s not about maximizing yield-it’s about minimizing emotional trading.

Lauren Bontje

30 January, 2026 . 08:31 AM

Locked staking is just crypto socialism. You give up your freedom for a ‘reward’ that’s controlled by centralized exchanges. Wake up. This isn’t banking. This is digital feudalism.

Stephanie BASILIEN

30 January, 2026 . 15:16 PM

I find it fascinating how the discourse around staking often overlooks the psychological dimension. The act of locking funds serves as a behavioral nudge, reducing impulsive transactional behavior. This is not merely financial-it is epistemological.

Deb Svanefelt

1 February, 2026 . 14:01 PM

I used to be terrified of locking my crypto. Then I did it with DOT for 180 days and didn’t check the price once. When I unlocked, it was up 40%. I cried. Not because of the money-because I finally trusted myself to hold. That’s the real reward.

Telleen Anderson-Lozano

2 February, 2026 . 08:10 AM

I think… maybe… we should… consider… the environmental impact… of… staking… right? Like… how much energy… do… these… validators… really… use…? And… are… they… powered… by… coal…? I mean… it’s… just… a… thought…

Haley Hebert

3 February, 2026 . 04:40 AM

I just started staking last month and I’m already addicted. I love that I can see my rewards grow every day. It feels like magic. I’m not rich but I’m growing. And that’s enough for now. 💛

Dustin Secrest

4 February, 2026 . 00:53 AM

The real advantage of liquid staking isn’t liquidity-it’s composability. You’re not just earning staking rewards. You’re building a financial position that can interact with DeFi protocols. That’s the future of yield.