Running a crypto exchange in Canada isn’t just about building a website and listing Bitcoin. If you’re trying to serve Canadian users, you’re stepping into one of the strictest, most detailed regulatory systems in the world. And it’s not optional. If you’re operating without a license, you’re breaking the law - and regulators are actively shutting down unregistered platforms.

Who Needs a License?

Any company that lets Canadians buy, sell, or trade cryptocurrencies needs to register with FINTRAC. That includes foreign exchanges too. If you’re based in the U.S., Singapore, or anywhere else but serve Canadian customers, you still need to register as a Foreign Money Services Business (FMSB). There’s no loophole for "just a few Canadian users." Once you have even one Canadian client, the rules apply.Domestic exchanges - those incorporated in Canada - must register as a Money Services Business (MSB). Both MSB and FMSB follow the same rules. The only difference is where the company is legally based. Either way, you’re subject to the same compliance burden.

The Core Requirements

Getting licensed isn’t a form you fill out in an hour. It’s a full-year project with multiple moving parts. Here’s what you absolutely need:- A legal entity in Canada (for MSB) or clear Canadian business ties (for FMSB)

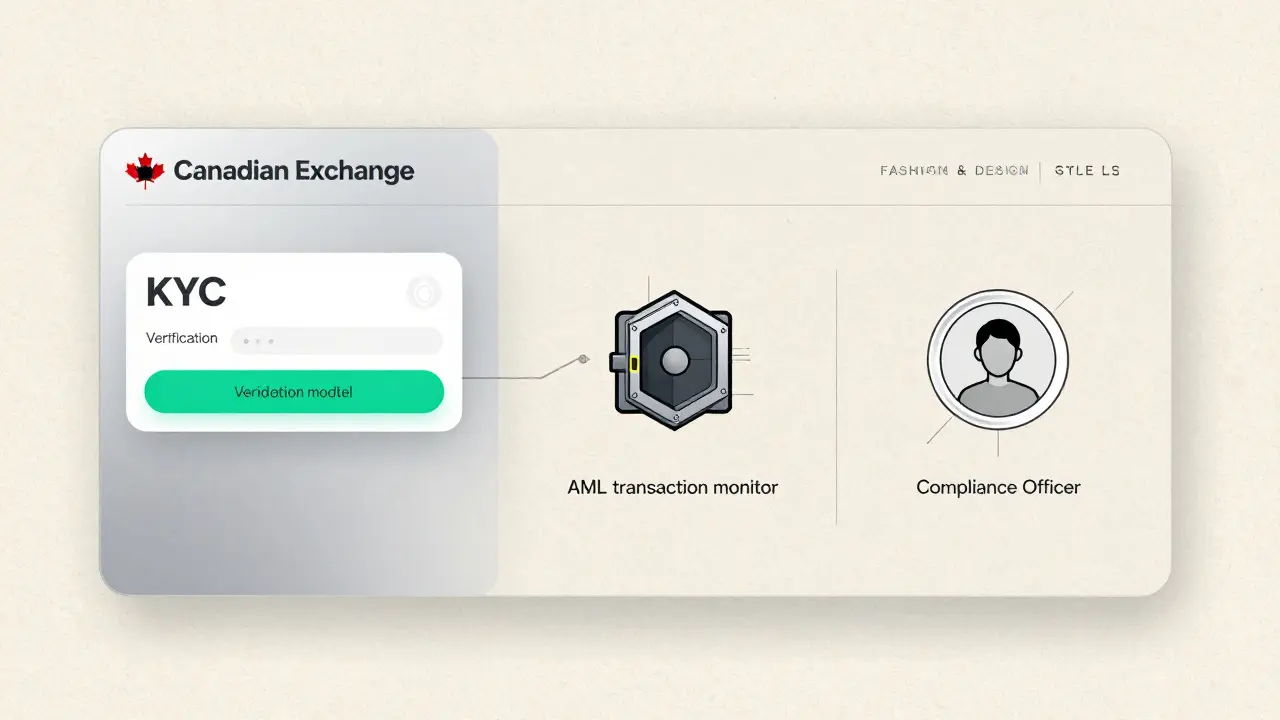

- A designated Compliance Officer - this person must be available, accountable, and trained. They can’t be a figurehead. FINTRAC will interview them.

- Full AML/CFT policies - written, detailed, and actively enforced. This includes how you screen customers, flag suspicious activity, and report it.

- Know Your Customer (KYC) procedures - you must verify every user’s identity with government-issued ID and proof of address. Facial recognition and document authenticity checks are now standard.

- Transaction monitoring software - automated systems that flag unusual patterns, like sudden large deposits from new users or rapid trading between wallets.

- Record keeping - all transaction data, customer communications, and verification documents must be stored for at least five years.

- Cybersecurity controls - cold storage for 95%+ of assets, multi-signature wallets, penetration testing reports, and a documented incident response plan.

These aren’t suggestions. They’re mandatory. FINTRAC can and does audit exchanges. If you’re missing even one piece, your application gets rejected - or worse, you get fined after operating illegally.

What If You Trade Tokens That Are Securities?

This is where things get complicated. Not all crypto is treated the same. If your exchange lists tokens that the Canadian Securities Administrators (CSA) classify as securities - like many utility tokens, staking tokens, or tokens sold in ICOs - you need a second license.You can’t just register with FINTRAC and call it done. You also need to apply to the CSA as either an investment dealer or a marketplace operator. This means additional compliance: financial reporting, custody rules, and restrictions on how you handle customer assets.

Since February 2023, the CSA made it even harder. Platforms now need to submit a Pre-Registration Undertaking (PRU) with strict conditions:

- No pledging or lending customer crypto assets

- Separate custody accounts for each user’s holdings

- Monthly financial disclosures

- Written consent from the CSA before offering any stablecoin trading

Only a handful of exchanges - like Coinsquare and Bitbuy - made it through. Most global platforms either pulled out of Canada or got stuck in limbo. If you’re trying to list tokens like UNI, AAVE, or SOL, you need legal advice before you even launch.

Stablecoins Are a Separate Beast

Stablecoins like USDT or USDC aren’t treated like regular crypto. The CSA introduced an interim framework in October 2023 that demands:- Proof that the stablecoin issuer holds 1:1 reserves in cash or short-term government bonds

- Monthly audits by a Big Four accounting firm

- Clear disclosures to users that the stablecoin isn’t guaranteed by the Canadian government

- Separate segregation of stablecoin deposits from other customer funds

That’s why most stablecoin trading on Canadian exchanges is either limited or completely blocked unless the platform has explicit CSA approval. Even then, trading volume is capped until the issuer passes a full audit.

Costs and Timelines

Don’t underestimate the price tag. The average cost to get licensed is between CAD $50,000 and $200,000 just for legal help, compliance setup, and application filing. That’s before you buy software, hire staff, or upgrade your infrastructure.Annual ongoing costs? At least CAD $100,000 for small exchanges. For a mid-sized platform with thousands of users, it’s closer to CAD $500,000 - mostly for compliance staff, audits, monitoring tools, and legal updates.

The timeline? Six to twelve months from submission to approval - if everything’s perfect. Most applications get rejected on the first try. Common reasons: incomplete KYC procedures, vague AML policies, or a Compliance Officer with no real authority.

Who’s Still Operating in Canada?

Before 2023, over 40 crypto exchanges served Canadian users. Today, only about 15 to 20 are fully licensed. The big names are:- Coinsquare

- Bitbuy

- Newton

- NDAX

- Crypto.com (licensed under FMSB)

- Kraken (licensed under FMSB)

Most others - including well-known global platforms - either shut down their Canadian operations or stopped accepting new users. The market has consolidated. Smaller exchanges can’t afford the compliance costs. Only well-funded players survive.

What’s Coming Next?

Regulators aren’t slowing down. By 2025, Canada is expected to require:- Real-time reporting of cross-border crypto transactions over $10,000

- Reserve transparency rules for all stablecoins, similar to the U.S. and EU

- Clear rules for DeFi protocols and NFT marketplaces - even if they’re decentralized

There’s also talk of a national crypto license that would combine FINTRAC and CSA oversight into one application. That could simplify things - but only if you’re ready to meet the highest standard from day one.

What Should You Do?

If you’re building a crypto exchange for Canada:- Get legal counsel who specializes in Canadian financial regulation - not just crypto lawyers. You need someone who understands securities law and MSB rules.

- Start compliance work at least 12 months before launch. Build your KYC system, hire your Compliance Officer, and document every process.

- Don’t assume your offshore platform works in Canada. You’ll get blocked.

- Don’t list securities without CSA approval. You’ll be shut down.

- Don’t offer stablecoins without written consent. It’s not worth the risk.

Canada isn’t trying to kill crypto. It’s trying to make it safe. The rules are tough, but they’ve created a level playing field. Legitimate businesses thrive here because customers trust them. The ones that skip compliance? They disappear.

Can a U.S.-based crypto exchange legally serve Canadian customers?

Yes, but only if it registers as a Foreign Money Services Business (FMSB) with FINTRAC. The exchange must comply with the same AML/CFT rules as Canadian-based companies, including KYC, transaction monitoring, and reporting. Simply having Canadian users without registration is illegal.

How long does it take to get a crypto exchange license in Canada?

The process typically takes 6 to 12 months from submission to approval. Most applications are rejected on the first try due to incomplete documentation or weak compliance policies. Building the required systems - like KYC and transaction monitoring - often takes 6-9 months before you even submit the application.

Do I need a separate license if I trade stablecoins in Canada?

Yes. Trading stablecoins like USDT or USDC requires written consent from the Canadian Securities Administrators (CSA). You must prove the issuer holds 1:1 reserves, submit monthly audits, and segregate customer deposits. Without this approval, offering stablecoin trading is prohibited.

What happens if I operate without a license in Canada?

You risk being shut down by FINTRAC or the CSA, fined up to $500,000, and potentially facing criminal charges. Regulators have already blocked dozens of unlicensed platforms and frozen assets. Your Canadian users’ funds could be seized, and your reputation destroyed.

Can I use a third-party KYC provider to meet Canadian requirements?

Yes, but you’re still responsible for compliance. Using a provider like Jumio or Onfido helps, but you must ensure the system meets FINTRAC’s standards: government ID verification, address proof, facial matching, and fraud detection. You also need to retain records and monitor for anomalies - the provider doesn’t take legal responsibility for you.

Are DeFi platforms regulated in Canada?

Currently, there’s no formal rule for DeFi, but regulators are working on guidance expected by 2025. If a DeFi platform acts like a financial intermediary - offering lending, staking, or trading services to Canadians - it will likely need to register as an MSB or investment dealer. Ignoring this could lead to future enforcement actions.

Anthony Ventresque

16 January, 2026 . 12:29 PM

This is actually one of the clearest breakdowns I’ve seen on Canadian crypto regs. A lot of people think it’s just a paperwork hurdle, but the real cost is in time and operational overhead. If you’re not planning to spend six months just on KYC system design, you’re already behind.

Also, the part about stablecoins needing CSA consent? That’s huge. Most devs think USDT is just ‘crypto money’ - but in Canada, it’s treated like a regulated security instrument. Mind blown.

Jason Zhang

17 January, 2026 . 02:20 AM

Canada’s got the regulatory equivalent of a 12-step program for crypto startups. ‘First, admit you’re not a bank.’

Meanwhile, the U.S. is still arguing whether crypto is a commodity or a security. We’re over here trying to figure out if we can legally sell a meme coin without hiring a compliance officer who’s also a CPA and a lawyer.

Patricia Chakeres

17 January, 2026 . 02:48 AM

Of course they’re making it this hard. This isn’t about ‘protecting investors’ - it’s about keeping the banks in control. You think FINTRAC gives a damn about your users? Nah. They care about making sure no one bypasses the Fed’s surveillance state.

And don’t get me started on the ‘Big Four audits’ for stablecoins. That’s just a pay-to-play scheme for Deloitte and PwC. The real crypto revolution? It’s happening underground.

Telleen Anderson-Lozano

17 January, 2026 . 21:12 PM

Okay, I’ve read this three times. And I’m still not sure if I’m impressed or terrified.

On one hand - wow, Canada’s actually doing something real about crypto regulation. No more shady exchanges draining wallets. On the other hand - $200K just to *apply*? That’s more than most startups make in their first year.

And the fact that you need a Compliance Officer who can *actually* answer questions? That’s genius. Most places just hire someone with a title and no authority. FINTRAC’s not having it.

Also - the 95% cold storage rule? That’s not just ‘good practice.’ That’s a death sentence for any exchange that doesn’t have a dedicated security team.

So… is this the future? Or just the beginning of the end for decentralized finance?

ASHISH SINGH

18 January, 2026 . 09:32 AM

Canada thinks it’s the center of the universe. But this is just state control dressed up as protection. You want to know why crypto is thriving in Dubai, Singapore, and even Nigeria? Because they don’t make you hire a lawyer to send a dollar to your cousin.

They call it ‘regulation.’ I call it fear. Fear of losing control. Fear of people owning their own money.

And don’t tell me ‘it’s for safety.’ The banks are the ones who stole trillions and got bailed out. Now they want to make sure you can’t even buy Dogecoin without filling out 47 forms.

Vinod Dalavai

18 January, 2026 . 15:15 PM

Man, I’ve been watching this space for years. And honestly? This is the first time I’ve seen a country get it right.

Not perfect - but real. No fluff. No ‘we’ll look into it.’ You want to operate here? Build it right.

And yeah, the cost is insane. But if you’re doing it right, you’re not just surviving - you’re building trust. And trust? That’s worth more than any ICO.

Also - shoutout to Kraken and Crypto.com for sticking it out. That’s real commitment.

✌️

Callan Burdett

19 January, 2026 . 12:47 PM

Canada just turned crypto into a corporate spa day. You don’t just ‘launch’ - you *ritualistically cleanse* your code with compliance consultants, audit trails, and soul-crushing paperwork.

But here’s the twist - the exchanges that made it? They’re the most secure, transparent platforms on the planet. No shady withdrawals. No rug pulls. No ‘oops, our CEO ran off with the keys.’

So yeah - it’s expensive. But if you’re tired of losing your life savings to some Telegram group with a whitepaper written in Comic Sans… maybe this is the price of peace of mind.

Also - Kraken’s in? Then I’m in. No questions.

Nishakar Rath

20 January, 2026 . 17:25 PM

This is all a scam to force small devs out and let the big boys dominate. You think Coinsquare cares about your KYC? They care about their stock price. The regulators are just their PR team in suits. Crypto is supposed to be free. Now it’s a gated community with a $200k membership fee

Katherine Melgarejo

21 January, 2026 . 18:08 PM

So let me get this straight - to list UNI in Canada, I need to hire a lawyer, a compliance officer, a cybersecurity firm, an auditor, and a therapist for my cofounder?

And you call this innovation? I miss the wild west. At least back then, if you got scammed, you could blame yourself. Now? You get fined for not having the right font on your privacy policy.

kristina tina

21 January, 2026 . 20:32 PM

Okay, I’m not a lawyer, but I’ve helped three crypto startups get off the ground - and I can tell you this: if you’re reading this and thinking ‘I’ll just wing it’ - STOP.

Every single one of those failed startups? They skipped the compliance phase because ‘it’s too slow.’ Then they got shut down. Users lost money. Reputation destroyed.

But the ones who took the time? They’re now profitable, trusted, and growing. The compliance isn’t the enemy - it’s the foundation.

Yes, it’s expensive. Yes, it’s slow. But if you want to build something that lasts - this is the price.

You got this. I believe in you. 💪

Anna Gringhuis

23 January, 2026 . 19:10 PM

Let’s be real - this isn’t about ‘protecting consumers.’ It’s about control. The same banks that caused the 2008 crash are now lobbying for rules that make it impossible for anyone else to compete.

And the ‘level playing field’? More like a playing field where only the rich get to buy tickets.

Also - ‘no pledging customer assets’? That’s a direct shot at Celsius and BlockFi. And yet, they’re still operating in the U.S. Why? Because they’re bigger. And the regulators are scared to touch them.

Canada’s just the latest example of regulation as a weapon - not a shield.

Michael Jones

24 January, 2026 . 09:55 AM

Minor grammatical note: The phrase 'you’re stepping into one of the strictest, most detailed regulatory systems in the world' should be followed by a comma before 'and it’s not optional' - but that’s a stylistic choice, not an error.

Otherwise, this is an impeccably structured guide. The breakdown of MSB vs. FMSB is particularly clear. The inclusion of specific regulatory dates (e.g., February 2023) adds significant credibility.

Well done. This should be linked in every crypto startup’s onboarding doc.

Haley Hebert

24 January, 2026 . 23:45 PM

I just moved to Canada last year and I was so excited to get into crypto… until I tried to sign up for an exchange and realized I’d need to submit a 30-page document just to prove I’m not a terrorist.

My bank account is more private than my crypto wallet now. And I’m not even trading - I just want to buy some ETH to hold.

It’s like they want to make crypto feel like a government job application. And honestly? I’m kind of over it. I think I’ll just stick to Bitcoin in a hardware wallet and ignore the whole system.

But I do respect the effort. It’s just… heavy.

Jill McCollum

26 January, 2026 . 17:48 PM

okay so i read this and i’m like… wow canada is actually serious??

like i thought it was all talk but nooo they got the big 4 auditors and cold storage and compliance officers and like… i’m impressed??

but also… why does it cost more than my entire house? 😭

also i just bought some solana and now i’m scared to trade it here. what if i break the rules by accident??

ps: i love how they’re making stablecoins prove they’re backed. that’s actually smart. 🤓

Hailey Bug

28 January, 2026 . 15:24 PM

One thing this article misses: the human cost.

Compliance officers working 80-hour weeks. Developers rewriting core systems because a regulator said ‘this field isn’t documented well enough.’ Founders crying in their cars after the third rejection.

Canada’s system isn’t just expensive - it’s emotionally draining.

But here’s the thing: the exchanges that survived? Their users sleep better at night. No hacks. No disappearances. No ‘we’re going dark tomorrow.’

It’s not perfect. But it’s the least broken system out there.

Stephen Gaskell

29 January, 2026 . 17:19 PM

Canada thinks it’s better than the U.S.? Please. We let people trade freely. You want to build a crypto empire? Do it here. Not in this bureaucratic nightmare.

They’re not protecting users - they’re protecting the Fed. And if you’re dumb enough to play by their rules, you deserve to lose.

Pat G

30 January, 2026 . 03:54 AM

They’re not regulating crypto. They’re burying it.

Every rule is designed to make it impossible for normal people to participate. Only the rich get to play. The rest? They’ll be forced into DeFi or offshore platforms - where there’s zero protection.

So who’s really safe? The ones with lawyers? Or the ones who never trusted the system in the first place?

Hannah Campbell

30 January, 2026 . 21:49 PM

Canada wants to be the Switzerland of crypto? Lmao. Switzerland has banks that help you hide money. Canada has banks that make you fill out 17 forms to buy a sandwich with crypto. This isn’t regulation. It’s performance art. And we’re all the audience

Bryan Muñoz

1 February, 2026 . 06:53 AM

They’re not regulating crypto - they’re regulating *you*. Every KYC form, every audit, every cold storage requirement - it’s all just a way to track your every move.

Remember when you could send crypto without ID? Now you need a notarized letter from your mom saying you’re not a terrorist.

And don’t tell me it’s for safety. The same system that lets banks launder billions is now policing your ETH purchases.

They want control. Not security.

And they’re winning.

😭

Rod Petrik

2 February, 2026 . 06:28 AM

Did you know the Canadian government has a secret database that flags anyone who buys more than $5000 in crypto? It’s called ‘Project Iceberg’ and it’s run by the RCMP and FINTRAC together.

They don’t tell you this, but if you’re flagged, your credit score drops. Your bank account gets frozen. Your phone gets tapped.

That’s why Kraken only has 200k Canadian users. The rest? They’re in hiding.

And the ‘compliance officer’? He’s just a spy with a title.

They’re not protecting you. They’re watching you.

Trust no one.

🔒

Anthony Ventresque

2 February, 2026 . 23:44 PM

Re: @1674 - I’ve worked with FINTRAC auditors. There’s no ‘Project Iceberg.’ That’s pure conspiracy nonsense.

But I will say this - the system *feels* like surveillance because it’s so thorough. You’re literally documenting every keystroke that touches crypto. It’s not malicious - it’s just… overwhelming.

And yeah, the paperwork makes you paranoid. But that’s the point. If you’re doing something shady, you’ll break under the weight of it.

That’s not a bug. It’s a feature.