Fractional NFT Investment Calculator

Fractional Ownership Calculator

Determine how much your fractional NFT investment would be worth based on the total asset value.

Results

Enter values above to see your investment details

When you hear the term NFT marketplace technology, you might picture a chaotic bazaar of digital art and speculative hype. In 2025 the reality is far more refined - platforms now act as full‑stack ecosystems where art, finance, gaming, and even real‑world assets converge. This article walks you through the biggest shifts that are turning NFT marketplaces into serious, multi‑purpose hubs, and shows what to expect in the next couple of years.

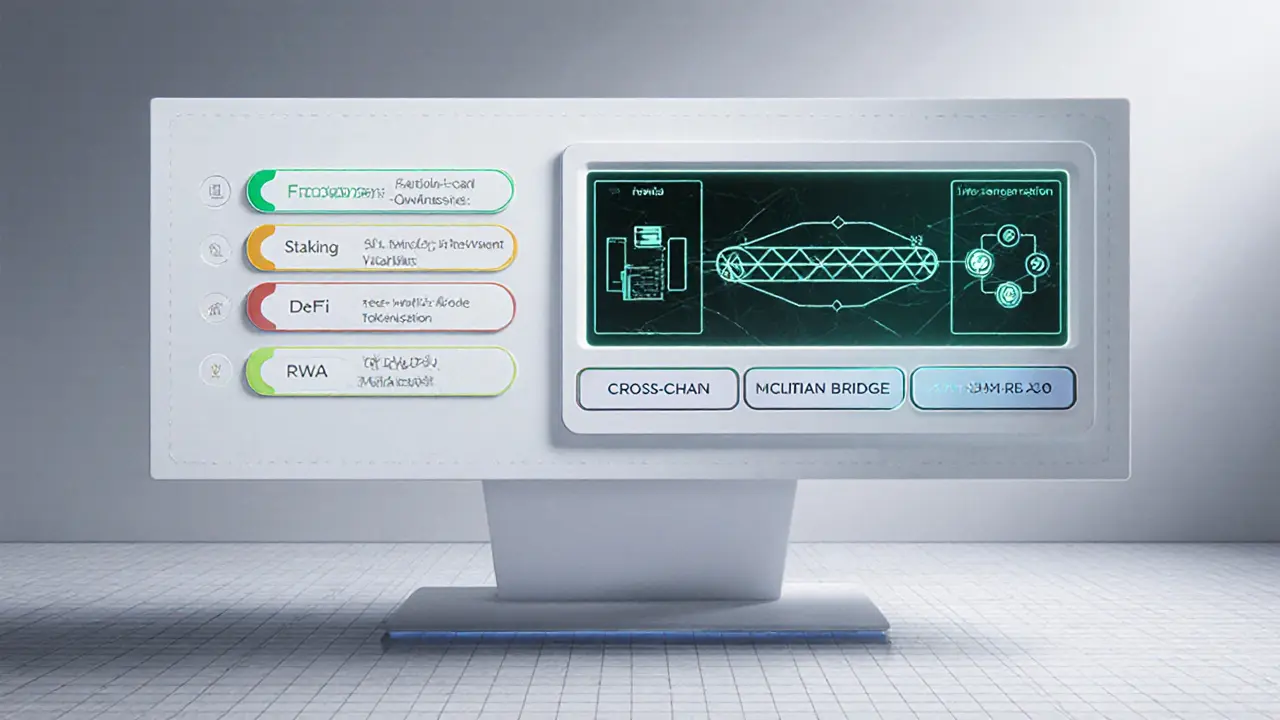

Core Layers of Modern NFT Marketplace Technology

Today’s platforms rest on a stack that’s become both modular and interoperable. Understanding each layer helps you see why new features can be added without rebuilding the whole system.

- Smart contracts are self‑executing code that enforce trades, royalties, and programmable ownership without a middleman. They also power advanced features like fractional splits and staking.

- Wallet integration now supports dozens of chains - Ethereum, Solana, Polygon, and emerging Layer‑2 solutions - letting users jump between networks with a single click.

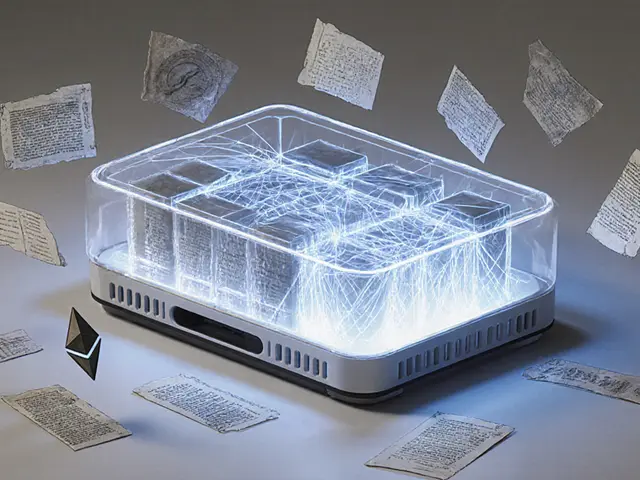

- Blockchain connectivity provides immutable provenance, audit trails, and cryptographic proof of ownership for every token.

- Royalty mechanisms automate creator payouts on every secondary sale, turning NFTs into sustainable revenue streams rather than one‑off purchases.

- User interface & API layers give developers and creators the tools to embed marketplaces into games, social apps, and e‑commerce sites.

Intelligent NFTs (iNFTs) - AI Meets Blockchain

Artificial intelligence is no longer a side project; it’s becoming a core attribute of many tokens. The ERC‑7857 standard, released by 0G Lab in early 2025, defines how AI agents can be wrapped inside a token and transferred securely.

Key capabilities of intelligent NFTs include:

- Dynamic content - visual or behavioral changes triggered by user interaction.

- Re‑encryption of AI model weights whenever ownership changes, protecting intellectual property.

- On‑chain billing hooks that let creators earn per‑use fees whenever the AI is invoked.

Real‑world examples are already popping up: a generative‑art collection that evolves its palette based on the holder’s social media sentiment, and a gaming character whose skill tree grows every time the owner completes a real‑world fitness challenge.

DeFi Fusion - Turning NFTs into Financial Instruments

The line between collectibles and finance is blurring fast. Modern marketplaces embed DeFi primitives directly into the trading flow, giving token owners more ways to monetize their assets.

- Fractional ownership splits a high‑value NFT into hundreds of tradable shares, opening doors for small investors to co‑own rare art or virtual land.

- NFT staking lets holders lock their tokens in a smart contract and earn yield in native or stable‑coin rewards.

- Lending against NFTs provides instant liquidity without selling the underlying asset, similar to a crypto‑backed loan.

These services are built on composable protocols, meaning a single NFT can be simultaneously staked, fractionalized, and used as collateral across different platforms.

Real‑World Asset Tokenization - Bridging Physical and Digital

Tokenizing real‑world assets (RWAs) is the next frontier. By attaching a legally‑binding proof of ownership to an NFT, marketplaces let people trade fractions of physical items - from a downtown loft to a vintage wine collection.

Key technical pieces include:

- Secure custody solutions that store the underlying asset and issue a tamper‑proof certificate.

- Legal wrapper contracts that define profit‑sharing, escrow, and dispute‑resolution rules.

- Cross‑chain bridges that let an RWA‑backed NFT move from Ethereum to a lower‑fee network for day‑to‑day trading.

In practice, a buyer could own a 0.5% slice of a NewYork office building, receive quarterly rent payouts automatically via smart contract, and sell that slice on a global marketplace without ever setting foot in the city.

Multi‑Chain and Cross‑Chain Capabilities

Scalability and user choice drove the shift to multi‑chain support. Instead of forcing every trade onto Ethereum (with its high gas fees), top marketplaces now run a unified front‑end that routes orders to the cheapest, fastest chain that hosts the requested token.

Features that matter to users:

- One‑click bridging powered by automated liquidity pools.

- Unified wallet UI that displays balances across Ethereum, Solana, Polygon, and emerging Layer‑2s.

- Dynamic gas‑price optimization that selects the lowest‑cost path in real time.

This approach not only reduces transaction costs by up to 80% for low‑value swaps but also opens the market to regions where high fees were a barrier.

Utility‑Focused NFTs - From Collectibles to Services

Utility NFTs are the workhorses of the new ecosystem. Instead of being pure status symbols, they grant real benefits:

- Access tokens for exclusive events, private Discord servers, or premium content streams.

- Playable in‑game assets that affect gameplay - think a sword that upgrades automatically based on the holder’s achievements.

- Service vouchers, such as a month of consulting or a physical product redeemable at a partner retailer.

Smart contracts enforce these rights, automatically checking token ownership before granting access. This verifiable control is what makes utility NFTs attractive to brands seeking trustworthy, anti‑fraud mechanisms.

What the Data Says: Market Maturity in 2025

Numbers illustrate the shift from hype to steady adoption:

- Total NFT sales in H12025: $2.82billion, a modest 4.6% dip from late2024.

- Transaction volume rose by ~80%, indicating more users holding assets longer and trading more frequently.

- Approximately 30% of new projects now embed AI functionality, up from less than 5% in 2022.

These trends point to a marketplace that’s less about price spikes and more about recurrent utility, recurring royalty streams, and sustainable community growth.

Roadmap: What to Watch for in 2025‑2026

Looking ahead, the following developments are likely to define the next wave:

| Feature | Current (2025) | Expected (2026+) |

|---|---|---|

| AI‑driven NFTs | ERC‑7857 adoption ~30% of projects | Standardized AI inference on‑chain; marketplace‑wide AI marketplaces |

| Fractional liquidity | Manual pool creation, limited DEX support | Automated market makers for fractional NFTs, instant pricing oracle |

| RWA tokenization compliance | Pilot programs in select jurisdictions | Global legal framework, KYC‑linked NFTs, seamless fiat on‑ramps |

| Cross‑chain UX | One‑click bridges, but occasional latency | Fully atomic swaps, no‑trust bridging, universal gas abstraction |

| Marketplace governance | Centralized admin panels | DAO‑run fee structures, community‑curated curation algorithms |

These upgrades will tighten the feedback loop between creators, collectors, and investors, making NFT marketplaces a true digital asset hub.

Practical Checklist for Builders and Collectors

Whether you’re launching a new platform or deciding where to buy your next token, keep this short list handy.

- Verify the marketplace supports multi‑chain trading and has low‑fee routing.

- Check if the smart contracts implement royalty standards (e.g., EIP‑2981) and whether they’re updatable.

- Look for AI‑enabled NFTs if you want dynamic content; confirm the project uses ERC‑7857 or a compatible spec.

- Ask whether fractional ownership or staking options exist for the asset you’re eyeing.

- For RWA‑backed tokens, demand clear legal documentation and custodial proof.

- Review the platform’s DAO or governance model - it can affect fees and policy changes down the road.

Conclusion: From Buzz to Backbone

The buzz around NFTs has settled, but the technology keeps getting stronger. By blending AI, DeFi, and real‑world tokenization, marketplaces are evolving into versatile, financially robust platforms. If you follow the trends outlined above, you’ll be ready to either build the next‑gen marketplace or invest wisely in assets that deliver real value beyond fleeting speculation.

Frequently Asked Questions

What is an intelligent NFT (iNFT)?

An iNFT is a token that embeds an AI model or algorithm, allowing the asset to change its appearance, behavior, or output based on external inputs. The ERC‑7857 standard defines how ownership transfers securely re‑encrypt the AI data, ensuring creators retain control over their intellectual property.

How do fractional NFTs improve liquidity?

Fractional NFTs split a high‑value token into smaller, tradable shares using smart contracts. This lets many investors buy a piece of a pricey artwork or virtual land, creating secondary markets where each fragment can be bought or sold independently, thereby increasing overall market depth.

Can I stake my NFTs for passive income?

Yes. Many platforms now offer staking contracts that lock your NFT and reward you with native tokens, stablecoins, or even a share of marketplace fees. The reward rate typically depends on the token’s rarity, utility, and the overall pool size.

What advantages do multi‑chain marketplaces provide?

Multi‑chain platforms let you trade assets on the network that offers the best price and speed at any moment. They reduce gas fees, avoid network congestion, and broaden the user base by supporting both Ethereum‑centric collectors and those who prefer low‑cost chains like Solana or Polygon.

How are real‑world assets tokenized on NFT marketplaces?

Tokenization starts with a legally binding agreement that links a physical asset (e.g., a property deed) to a digital token. A custody provider holds the real item, while a smart contract issues an NFT that represents ownership or profit‑share rights. Transactions on the marketplace automatically trigger royalty‑like distributions, such as rental income.

Kim Evans

15 October, 2025 . 08:08 AM

Great rundown! The rise of iNFTs is especially exciting because they let creators keep control while offering dynamic experiences 😊. If you’re looking into building one, start by checking out the ERC‑7857 spec – it covers encryption of model weights on transfer. Also, many marketplaces now have built‑in royalty hooks that can be customized per‑use, which can turn a simple token into a revenue stream. Keep an eye on the upcoming AI marketplaces for the next wave.

Isabelle Graf

21 October, 2025 . 03:01 AM

If you’re still treating NFTs as pure speculation, you’re missing the point.

Steve Cabe

26 October, 2025 . 20:55 PM

American developers have been at the forefront of the NFT revolution, and it’s clear why the US ecosystem continues to dominate. The infrastructure we built – from Layer‑2 scaling solutions to robust legal frameworks – gives us a competitive edge. Other regions should study our model if they hope to catch up.

shirley morales

1 November, 2025 . 15:48 PM

The discourse has become overly watered down the true artistic merit of iNFTs is undeniable.

Mandy Hawks

7 November, 2025 . 10:41 AM

One could argue that the blending of AI and ownership is reshaping our notion of authorship. When a token can evolve, the line between creator and participant blurs, inviting a more collaborative view of art. This shift may lead us to rethink value beyond mere scarcity, embracing experience as a metric of worth.

Scott G

13 November, 2025 . 05:35 AM

I wish to commend the thoroughness of the analysis presented herein. The delineation of the various technological layers provides a valuable scaffold for future inquiry. It would be prudent for scholars to further investigate the regulatory implications of real‑world asset tokenization.

VEL MURUGAN

19 November, 2025 . 00:28 AM

While the article is informative, it glosses over the security ramifications of cross‑chain bridges. Recent exploits have demonstrated that even well‑audited contracts can harbor vulnerabilities. Developers should therefore prioritize formal verification before deployment.

Russel Sayson

24 November, 2025 . 19:21 PM

Buckle up, because the NFT marketplace landscape is on the brink of a seismic shift that will leave yesterday’s platforms in the dust.

First, the rise of intelligent NFTs isn’t a gimmick-it’s a paradigm shift that injects living code into digital assets.

Imagine buying a piece of art that learns your taste and reshapes itself in real time, rewarding you with fresh visual delights every week.

That’s no longer fantasy; the ERC‑7857 spec already empowers creators to encrypt AI models and pass them along with ownership.

Second, fractionalization is democratizing access to high‑value assets, turning once‑exclusive galleries into community pools.

When a $10 million painting is sliced into a thousand shares, the market’s liquidity skyrockets and price discovery becomes more efficient.

Third, DeFi integration means your NFT can now earn yield, act as collateral, or even generate per‑use fees without you lifting a finger.

Staking contracts are sprouting across chains, offering APYs that rival traditional finance while keeping the underlying art intact.

Fourth, multi‑chain bridges are slashing gas costs, allowing traders to hop between Ethereum, Solana, and Polygon with a single click.

Dynamic routing algorithms sniff out the cheapest path in milliseconds, saving users up to eighty percent on transaction fees.

Fifth, real‑world asset tokenization is bridging the gap between brick‑and‑mortar and the blockchain, letting you own a slice of a skyscraper and collect rent automatically.

Legal wrappers and custodial solutions are maturing, providing the necessary compliance to satisfy regulators across jurisdictions.

All these innovations converge to create a marketplace that is not just a trading floor but an entire financial ecosystem.

If you ignore these trends, you’ll be left trading relics while the rest of us ride the next wave of utility‑driven NFTs.

So gear up, experiment with the new tools, and position yourself at the forefront of this transformative era.

Shane Lunan

30 November, 2025 . 14:15 PM

Sure, looks flashy but most of those new features are just hype and will probably stall soon.

Jeff Moric

6 December, 2025 . 09:08 AM

I see where you’re coming from, yet it’s worth noting that many early adopters have already reported tangible benefits from staking and fractional ownership. Keeping an open mind can help uncover opportunities that surface over time.

Bruce Safford

12 December, 2025 . 04:01 AM

All these so called benefits are just a way for the big tech elite to control our finace more. They r already planting backdoors in every cross chain bridge, dont u see??

Teagan Beck

17 December, 2025 . 22:55 PM

Let’s keep the discussion focused on the tech itself-if there are security concerns, the community can address them through audits and transparency.

Millsaps Crista

23 December, 2025 . 17:48 PM

Exactly! Push the platforms to be more open, and we’ll all benefit from safer, faster transactions.

Matthew Homewood

29 December, 2025 . 12:41 PM

Ultimately, the evolution of NFT marketplaces mirrors our broader quest for value‑exchange mechanisms that honor both creativity and utility. As the technology matures, we may find that the true reward lies not in profit alone but in the shared experiences these digital assets foster.