It’s 2026, and if you’re an Egyptian with a bank account, you’ve probably noticed something odd: your international transfer got flagged. Again. No warning. No explanation. Just a message saying your transaction is under review. If you sent money to Binance, Bitget, or even a peer-to-peer wallet, you already know why. Egypt’s banks aren’t just watching-they’re hunting for crypto transactions.

It’s Not Illegal to Own Crypto… But It Is Illegal to Use Your Bank for It

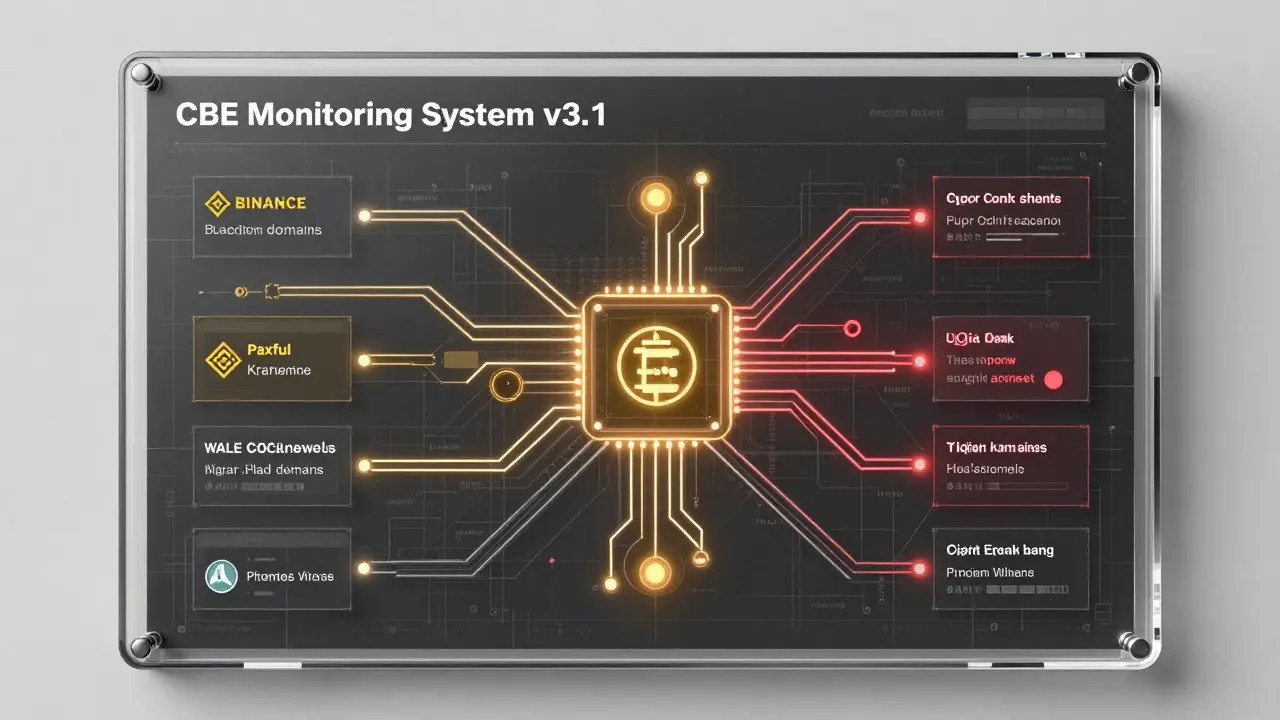

The truth is messy. You won’t go to jail for buying Bitcoin on a foreign exchange. But if you use your Egyptian bank account to fund that purchase? That’s where things get dangerous. The Central Bank of Egypt (CBE) doesn’t ban individuals from holding crypto. It bans banks from touching it. And because every dollar that moves through Egypt’s banking system must pass through their filters, your bank becomes the gatekeeper. This isn’t new. Back in 2020, Law No. 194 made it crystal clear: no bank, no payment processor, no financial service in Egypt can issue, trade, or promote cryptocurrency without CBE approval. And no one has that approval. So every time you send EGP to a foreign exchange, your bank’s system is scanning for signs of crypto activity.How Banks Detect Crypto Transactions

Egyptian banks don’t have magic tools. But they’ve built systems that catch patterns. Here’s what they look for:- Transfers to known crypto exchange domains (like binance.com, bitget.com, kraken.com)

- Recurring payments to the same foreign recipient with no clear business purpose

- Small, frequent transfers that match typical crypto deposit patterns (e.g., $500 every Monday)

- Payments routed through P2P platforms like LocalBitcoins or Paxful

- Transactions to wallets linked to darknet markets or ransomware groups (blacklisted by the Financial Regulatory Authority)

The Real Goal: Stopping Money Laundering and Terror Financing

The CBE doesn’t say they’re against crypto because it’s “un-Islamic” or “too risky.” They say it’s because it’s untraceable. And that’s the real fear. In 2025, the FRA issued a public warning specifically about crypto ads promoting “guaranteed returns.” But behind the scenes, they were reacting to intelligence: crypto was being used to move funds for terrorist networks operating in the Sinai. Why? Because unlike banks, crypto transactions don’t require ID verification. A person in Cairo can send money to a wallet in Turkey, then to a mixer, then to a burner wallet in Iran-all without a single bank employee knowing. That’s why Egyptian banks now treat any crypto-linked transaction as a potential red flag. Not because they hate Bitcoin. Because they’re forced to assume the worst.

What Happens When Your Transaction Gets Flagged?

If your transfer gets caught:- Your transaction is frozen for 3-7 business days.

- You get a call from your bank’s compliance team. They’ll ask: “Why are you sending money to this address?”

- You may be asked to submit proof: invoices, contracts, screenshots of goods purchased.

- If you can’t prove it’s not crypto-related, your account may be restricted.

- In extreme cases-repeated violations, large sums, or links to blacklisted entities-your account can be closed.

Why This Isn’t Changing Soon

You might think Egypt will soften its stance. After all, Gulf countries like the UAE and Saudi Arabia are rolling out licensed crypto exchanges. But Egypt’s economy is different. The Egyptian pound has lost nearly 60% of its value since 2022. Capital flight is a real threat. If people start using crypto to move savings out of the country, the central bank loses control. That’s why they’re doubling down. Even religious authorities back the ban. Dar Al-Ifta, Egypt’s top Islamic legal body, says crypto isn’t money because it’s not issued by a state. That’s not just theology-it’s policy. The CBE uses that argument to justify why crypto has no legal protection. And with inflation still above 30%, the government can’t afford to let people gamble their savings on volatile assets. The FRA’s May 2025 warning wasn’t a coincidence. It came right after a spike in online crypto ads targeting young Egyptians. The message: we see you. And we’re watching.What Egyptians Are Doing Instead

Despite the restrictions, crypto adoption is rising. How? People are bypassing banks entirely.- Using cash-based P2P platforms: Meeting in person to trade EGP for USDT or BTC.

- Buying gift cards (Amazon, Steam) with bank money, then selling them on crypto marketplaces.

- Using foreign bank accounts (in Jordan, Lebanon, or the UAE) to receive transfers, then moving crypto from there.

- Working for international clients and getting paid in crypto via crypto payroll services (like Bitwage or Crypto.com Pay).

The Human Cost

This isn’t just about compliance. It’s about trust. A 28-year-old freelancer in Alexandria got her account closed after sending $1,200 to a freelance platform that paid in USDT. She didn’t know the platform was flagged. She just needed to get paid. Now she can’t receive international transfers. Her clients use PayPal. She can’t use PayPal. She’s stuck. Another man in Giza lost his business loan because his bank flagged payments to a software developer who accepted crypto. He didn’t know the developer had a crypto wallet. The bank didn’t care. He had to find a new supplier. These aren’t rare cases. They’re daily occurrences.What Comes Next?

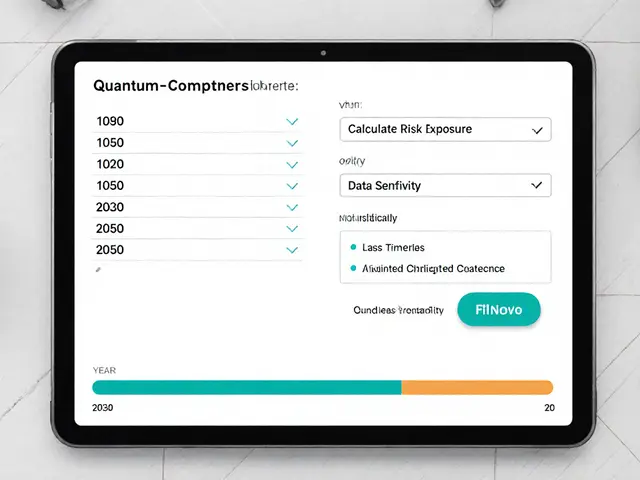

Banks are investing millions in better monitoring. New AI tools can now detect crypto-like behavior even when payments are disguised as “donations” or “consulting fees.” Some banks are even testing blockchain analytics tools that trace wallet movements across networks. The FRA is also pushing for mandatory reporting from fintech apps. If you use a mobile wallet to send money abroad, the app may soon be required to ask: “Is this for cryptocurrency?” There’s no sign of legalization. No CBDC pilot. No licensed exchange. Egypt’s path is clear: control, monitor, restrict. And if you’re using your bank account to touch crypto? You’re playing a game where the house always wins.Bottom Line

Egyptian banks aren’t anti-tech. They’re anti-risk. And right now, crypto looks like the biggest risk to financial stability the country has faced since the 2016 currency devaluation. If you want to trade crypto in Egypt, you can. But you can’t use your bank to do it. And if you try? You’re not just breaking rules. You’re risking your account, your access to international payments, and your financial reputation. The system isn’t perfect. It’s slow. It’s frustrating. But it’s working exactly as designed.Can I get in trouble for buying Bitcoin in Egypt?

You won’t be arrested for owning Bitcoin. But if you use your Egyptian bank account to buy it-through a wire transfer, mobile payment, or card-you risk having your account frozen, restricted, or closed. The law targets banks, not individuals. But banks are forced to report anything that looks like crypto activity.

Why do Egyptian banks block transfers to Binance or Coinbase?

Because those platforms are explicitly listed by the Central Bank of Egypt as unlicensed crypto services. Any transaction to their domains triggers automated alerts. Banks are legally required to freeze and investigate these transfers under Banking Law No. 194 of 2020.

Is it possible to use crypto without a bank account in Egypt?

Yes. Many Egyptians use cash-based P2P trades, gift card reselling, or foreign bank accounts to access crypto. But these methods carry high risk: no consumer protection, no legal recourse, and potential violations of foreign exchange laws. They’re not illegal per se, but they’re not safe either.

What happens if my bank account is closed for crypto activity?

You’ll lose access to domestic and international transfers. Reopening the account is nearly impossible unless you can prove the transactions were unrelated to crypto-and even then, banks often refuse. You’ll need to open a new account at a different bank, which may also flag you if your financial history shows patterns linked to crypto.

Are Egyptian banks working with international agencies to track crypto?

Yes. Egyptian banks use compliance software from international vendors like Chainalysis, Elliptic, and Actimize, which provide real-time blockchain monitoring. These tools help identify wallet addresses linked to criminal activity. The Financial Regulatory Authority also shares blacklists of high-risk crypto entities with banks quarterly.

Will Egypt ever legalize cryptocurrency?

Not anytime soon. Egypt’s economy is under pressure from inflation and currency instability. Legalizing crypto would risk capital flight and undermine the central bank’s control over the Egyptian pound. The government’s focus is on strengthening monitoring, not regulation. Any future move would likely be a state-backed digital currency-not decentralized crypto.

Can I use crypto to send money to family abroad?

Not through your bank. If you send EGP to a crypto exchange and then convert it to USD and send it to a family member’s wallet, that’s flagged as crypto activity. Even if your intent is legitimate, the bank sees the pattern. The safest way is to use licensed remittance services like Western Union or MoneyGram.

Krista Hoefle

14 January, 2026 . 00:06 AM

lol why are banks even doing this? its 2026 not 2012. crypto is just money now.

Frank Heili

15 January, 2026 . 17:54 PM

The system isn't broken-it's working exactly as designed. Banks aren't targeting crypto because they hate it, they're terrified of losing control over capital flows. When the pound loses 60% of its value, any escape hatch looks like a floodgate.

Sabbra Ziro

16 January, 2026 . 13:30 PM

I get why Egypt’s doing this… but it’s crushing real people. Freelancers, small businesses, families sending remittances-they’re all getting punished because the system can’t tell the difference between a criminal and a college student paying for a course. There’s no nuance. Just flags. And then silence.

Emily Hipps

17 January, 2026 . 09:29 AM

You know what’s wild? People are still finding ways. Cash meets, gift card swaps, foreign accounts-this isn’t stopping adoption. It’s just pushing it underground. And guess what? Underground markets are way riskier. The CBE isn’t protecting people. They’re just making things scarier.

Kip Metcalf

18 January, 2026 . 13:57 PM

bro just use p2p. cash in hand. no bank. no problem. simple.

Natalie Kershaw

18 January, 2026 . 19:55 PM

Let’s be real-this isn’t about crypto. It’s about sovereignty. When your currency is collapsing, you don’t want people converting EGP to USDT and sending it abroad. That’s capital flight, and it kills economies. The banks are just the enforcers. The real enemy is inflation.

Jacob Clark

20 January, 2026 . 02:31 AM

I mean… if you’re using Binance, you’re basically asking for trouble. Why would you use a platform that’s explicitly blacklisted? It’s like driving through a red light and then crying when the cop pulls you over. The system is transparent. You just chose to ignore it.

Mollie Williams

20 January, 2026 . 07:53 AM

There’s a quiet tragedy here. People aren’t rebelling against the state-they’re rebelling against the collapse of trust. If your bank can freeze your money because you sent $500 to a domain they don’t like, then your bank isn’t your ally. It’s a gatekeeper with no conscience. And that changes how you see everything.

Surendra Chopde

21 January, 2026 . 23:10 PM

In India we have similar issues with forex controls. But here, people just use UPI to pay friends who then send crypto. No bank touch. No trace. It’s messy, but it works. Egypt’s system is rigid. That’s its weakness.

Tiffani Frey

22 January, 2026 . 15:11 PM

The irony? The very tools banks use-Chainalysis, Elliptic-were built by Western firms who profit from crypto regulation. So Egypt is paying Silicon Valley to police its own citizens. And the citizens? They’re just trying to survive.

Tre Smith

23 January, 2026 . 14:03 PM

This isn’t a financial policy. It’s a psychological control mechanism. By making crypto access feel dangerous, they discourage innovation. They don’t want you thinking outside the system. They want you dependent. And that’s the real crime.

Ritu Singh

24 January, 2026 . 17:22 PM

They say it’s for terror financing but they never show proof. Meanwhile, the same banks let emirati shell companies move billions in fake invoices. Double standard. This is just a tool to keep the poor poor and the elite elite. Crypto is the only thing that gives the little guy a shot

kris serafin

25 January, 2026 . 02:55 AM

P2P cash trades are the real crypto economy now 🤝💸

Jordan Leon

27 January, 2026 . 00:50 AM

The central bank’s position is logically consistent: if a currency is not issued by the state, it cannot be recognized as legal tender. This is not anti-technology. It is a defense of monetary sovereignty. The human cost is unfortunate, but institutional stability must come first.

Rahul Sharma

27 January, 2026 . 14:14 PM

In India, we use UPI to buy crypto via trusted friends. No bank sees the final destination. Simple. Safe. Smart. Egypt can learn from this model instead of blocking everything.

Gideon Kavali

29 January, 2026 . 06:44 AM

This is what happens when you let a nation go soft on financial discipline. Egypt should be proud of its strict rules. The West is falling apart because they let crypto run wild. We don’t want that here. No exceptions.

Allen Dometita

29 January, 2026 . 14:52 PM

People think crypto is just gambling. But for a freelancer in Alexandria? It’s survival. If your client pays in crypto and your bank freezes you? You’re not a criminal. You’re just trying to eat.

Calen Adams

31 January, 2026 . 06:27 AM

Let’s not pretend this is about terrorism. It’s about control. The CBE doesn’t want anyone building financial alternatives. They want you stuck with their failing system. Crypto is the only thing that gives people power. That’s why they fear it more than hackers.

Valencia Adell

31 January, 2026 . 09:22 AM

Oh please. Every time someone says 'it's not illegal to own crypto' they're just trying to feel better. The system is designed to make you feel guilty. And if you're smart, you'll just leave Egypt. The rest? They'll be stuck paying for someone else's bad decisions.

Sarbjit Nahl

31 January, 2026 . 14:44 PM

The real issue isn't crypto. It's the lack of digital infrastructure. If Egypt had a national blockchain-based payment system, they wouldn't need to block everything. But they'd rather be reactive than innovative. Classic

Paul Johnson

1 February, 2026 . 07:17 AM

if u r using crypto u r a criminal dont even try to justify it. banks are doing the right thing. stop whining

Meenakshi Singh

2 February, 2026 . 10:25 AM

The FRA’s blacklists are outdated. Wallets change every week. Banks are using 2022 tech to catch 2026 behavior. That’s why so many false positives. It’s not precision. It’s panic.

Frank Heili

4 February, 2026 . 02:22 AM

The most dangerous part? The compliance officers aren’t trained in crypto. They’re just following flowcharts. A freelancer sending $1,200 to a platform that happens to have a crypto payment option? They get flagged. No context. No empathy. Just a checkbox.