SushiSwap V3 Liquidity Calculator

Estimate your potential earnings from providing liquidity on SushiSwap V3 on Arbitrum. The calculator uses the dual-reward structure (0.25% LP fee + 0.05% xSUSHI fee) and concentrated liquidity multiplier (up to 4,000x). Results are based on average trading volume and simplified assumptions.

Estimated Earnings

Daily LP Fee Earnings

$0.00

Daily xSUSHI Rewards

$0.00

Total Daily Earnings

$0.00

Annualized Returns

0.00%

Total Annual Earnings

$0.00

Note: This calculator uses simplified assumptions. Actual returns may vary based on market conditions, impermanent loss, and token price fluctuations. Concentrated liquidity multipliers are theoretical maximums and may not reflect actual performance.

Key Takeaways

- SushiSwap V3 on Arbitrum offers ultra‑low fees (≈$0.01‑$0.05 per swap) and fast 1‑2 second confirmations.

- Concentrated liquidity boosts capital efficiency up to 4,000× but adds complexity for liquidity providers.

- The dual‑reward model (0.25% LP fee + 0.05% xSUSHI fee) gives SUSHI stakers passive income.

- Compared with Uniswap V3 on Arbitrum, SushiSwap provides higher incentives via the Onsen Program, yet trails in total value locked and deepest liquidity pools.

- Security is solid, but users should stay alert to regulatory shifts and the platform’s competitive pressure.

SushiSwap V3 (Arbitrum) is a decentralized exchange (DEX) built on the Arbitrum layer‑2 network. It extends the broader SushiSwap ecosystem by leveraging Arbitrum’s EVM compatibility to cut gas costs and speed up trade execution. Launched in 2023, the protocol runs entirely through smart contracts, meaning users retain full custody of their assets while swapping tokens via an automated market maker (AMM) model.

Why Arbitrum Matters for SushiSwap

Arbitrum is an Ethereum Layer‑2 scaling solution that processes transactions off‑chain before finalizing them on Ethereum. The result is a dramatic fee drop-transactions cost a few cents instead of the hefty dollars seen on mainnet. For SushiSwap V3, this means users can trade without worrying about the fee spikes that often cripple Ethereum‑based DEXs. Confirmation times shrink to 1‑2 seconds, giving a smoother experience for both casual traders and high‑frequency bots.

Core Features and How They Work

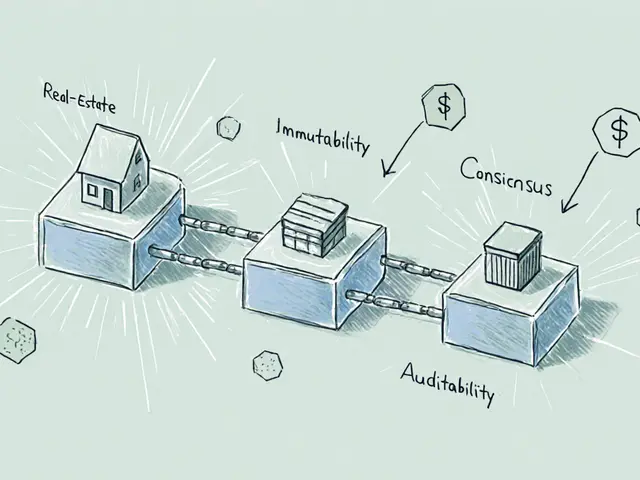

- Concentrated Liquidity: Introduced in V3, liquidity providers (LPs) can allocate capital to a specific price range instead of the entire curve. This concentrates capital, potentially raising fee earnings by up to 4,000× compared with the uniform liquidity of V2. However, managing these positions requires monitoring price ticks and impermanent loss, akin to handling options contracts.

- Dual‑Reward Fee Structure: Every trade charges a 0.30% total fee. Of that, 0.25% goes directly to LPs, while 0.05% is funneled to xSUSHI stakers. This creates a two‑tier incentive model that differentiates SushiSwap from Uniswap, which allocates 100% of fees to LPs.

- Onsen Program: A rotating list of newly listed tokens receives boosted SUSHI rewards for LPs who provide liquidity to those pairs. This attracts early‑stage projects and offers higher yields for risk‑tolerant users.

- BentoBox & Trident: Under the hood, SushiSwap’s vault architecture (BentoBox) isolates asset custody, while the newer Trident AMM engine powers flexible pool types, improving capital efficiency and developer integration.

Tokenomics: SUSHI and xSUSHI

The native governance token, SUSHI, serves three main purposes: voting on protocol upgrades, earning a share of the 0.05% fee, and staking for yield. Holders can lock SUSHI to receive xSUSHI, which accrues fee revenue automatically. As of 2025, SUSHI trades around $1.70, with staking APY hovering between 4%‑7% depending on the reward pool size. The token’s value is closely tied to the platform’s fee income-if liquidity mining incentives dwindle, SUSHI’s attractiveness could erode.

Performance Metrics (2025 Snapshot)

| Metric | Value |

|---|---|

| Number of tokens | 20 |

| Trading pairs | 31 |

| Average bid‑ask spread | 0.737 % |

| Daily volume (estimate) | $50‑$100 million |

| Average swap fee | 0.30 % (0.25 % LP + 0.05 % xSUSHI) |

| Typical gas cost per swap | $0.01‑$0.05 |

How SushiSwap V3 Stacks Up Against Uniswap V3 on Arbitrum

| Feature | SushiSwap V3 | Uniswap V3 |

|---|---|---|

| Base fee | 0.30 % (0.25 % LP + 0.05 % xSUSHI) | 0.30 % (all to LP) |

| Liquidity mining incentives | Onsen Program + continuous SUSHI rewards | No native token rewards |

| TVL (approx.) | ~$700 M | ~$1.2 B |

| Number of pairs | 31 | 45+ |

| Gas cost per swap | $0.01‑$0.05 | $0.02‑$0.07 |

| Complexity for LPs | High (concentrated liquidity, reward tracking) | Medium |

In plain terms, SushiSwap offers richer reward mechanics but sacrifices some depth of liquidity and simplicity. Traders who prioritize low fees and extra yield may lean toward SushiSwap, while those needing massive order‑book depth for large swaps often prefer Uniswap.

Getting Started: Step‑By‑Step Walkthrough

- Install a supported wallet (MetaMask or WalletConnect). Connect the wallet to the SushiSwap web UI.

- Select “Arbitrum” as the network. If your wallet isn’t already on Arbitrum, follow the bridge prompt to transfer assets from Ethereum.

- Navigate to the “Swap” tab. Choose the token pair, enter the amount, and review the estimated price impact and fee breakdown.

- Confirm the transaction. The gas fee will be a few cents; the swap should settle within 1‑2 seconds.

- Optional - provide liquidity. Click “Pool”, pick “Concentrated”, set your price range, and supply the desired token amounts. Remember to claim any earned SUSHI rewards via the “Earn” section.

The entire onboarding process typically takes 2‑4 hours for a newcomer, mainly due to learning the concentrated liquidity UI and bridging assets.

Risks and Caveats

- TVL Gap: SushiSwap’s total value locked trails Uniswap, which could limit resilience during market downturns.

- Complex LP Mechanics: Managing narrow price ranges can lead to sudden impermanent loss if the market moves outside your band.

- Regulatory Uncertainty: Ongoing global discussions about DeFi rewards could affect the Onsen Program’s future.

- Competitive Pressure: New layer‑2 DEXs (e.g., Trader Joe, Kromatika) are constantly improving fee structures, narrowing SushiSwap’s edge.

Community Sentiment and Expert Opinions

Reddit threads often praise the extra SUSHI incentives but complain about the steep learning curve for concentrated liquidity. CoinCodex flags the platform as “not yet trusted” while noting the absence of major safety concerns. Milkroad calls SushiSwap “beginner‑friendly” for basic swaps but acknowledges that advanced features demand DeFi knowledge. Noone.io’s risk assessment highlights the protocol’s strong code base but stresses the need for sustainable fee growth.

Future Outlook

The SushiSwap team is actively iterating on BentoBox and Trident, aiming to attract more developers and increase protocol fees. If the Onsen Program continues to draw emerging projects, the platform could see a TVL boost. However, without a clear path to higher fee capture, SUSHI’s price may remain volatile, especially if competitors tighten their fee structures or if regulatory bodies clamp down on reward farming.

Bottom Line

For users who value low fees, fast confirmation times, and extra yield from SUSHI incentives, SushiSwap V3 on Arbitrum offers a compelling package. The trade‑off is higher operational complexity for liquidity providers and a smaller liquidity pool compared with Uniswap. As the Arbitrum DEX landscape keeps evolving, keeping an eye on TVL trends and reward program adjustments will be essential for anyone looking to stay ahead.

Frequently Asked Questions

Is SushiSwap V3 on Arbitrum safe to use?

The protocol runs on audited smart contracts and benefits from Arbitrum’s proven security model. While no platform is risk‑free, there have been no major exploits reported for SushiSwap V3 on Arbitrum up to 2025. Users should still safeguard private keys and consider using hardware wallets.

How do I claim SUSHI rewards?

After providing liquidity, go to the “Earn” tab on the SushiSwap UI, select the pool you’re in, and click “Harvest”. Rewards will be deposited directly to your connected wallet.

What is the difference between SUSHI and xSUSHI?

SUSHI is the native governance token. When you lock SUSHI in the staking contract, you receive xSUSHI, which continuously accrues a share of the protocol’s 0.05% fee. Holding xSUSHI lets you earn without actively providing liquidity.

Can I trade on SushiSwap V3 without using Arbitrum?

Yes, SushiSwap V3 also runs on Ethereum mainnet and other L2s, but fees and latency will be higher compared with the Arbitrum deployment.

What wallets are compatible with SushiSwap on Arbitrum?

MetaMask, Trust Wallet, Ledger (via MetaMask), and any wallet supporting WalletConnect can connect to the platform.

Marina Campenni

18 October, 2025 . 08:16 AM

I think SushiSwap V3 on Arbitrum is a solid option for traders who want cheap swaps, and the low gas fees really make a difference for everyday users. The dual‑reward model adds an extra layer of incentive that can help offset the higher complexity for LPs. Overall, it feels like a good balance between cost efficiency and yield opportunities.

Irish Mae Lariosa

22 October, 2025 . 11:42 AM

While the article does a decent job of outlining the basic features, it glosses over several critical pain points that anyone considering this platform should be aware of. First, the concentrated liquidity mechanism, though theoretically impressive, often becomes a minefield for LPs who lack the discipline to monitor price ranges constantly; the risk of impermanent loss spikes dramatically when markets shift beyond the narrow bands you set. Second, the Onsen Program’s rotating rewards are attractive on the surface, but their transient nature can lead to a constant churn of capital, undermining long‑term stability.

Furthermore, the comparison with Uniswap V3 is somewhat one‑sided. Yes, SushiSwap offers a modest fee reduction and extra SUSHI incentives, yet the total value locked remains substantially lower, meaning larger trades may experience slippage that Uniswap can absorb more gracefully. The article also fails to address the governance implications of SUSHI token distribution, where a concentrated holder base could influence fee structures to the detriment of ordinary users.

On the security front, while there have been no major exploits reported, the reliance on Arbitrum’s roll‑up security model adds an extra layer of abstraction that not every user fully understands, and that’s a subtle risk factor. In terms of user experience, the UI for setting price ranges can feel unintuitive, especially for newcomers transitioning from V2 or other DEXs. Lastly, the regulatory outlook remains uncertain; reward farming mechanisms are increasingly under scrutiny, and any policy shifts could impact the sustainability of the Onsen Program.

In summary, SushiSwap V3 on Arbitrum presents a compelling package for the fee‑conscious trader, but it demands a higher degree of sophistication from LPs and carries hidden complexities that the article underrepresents.

Nick O'Connor

26 October, 2025 . 14:07 PM

SushiSwap’s low‑fee structure, fast confirmations, and additional SUSHI rewards make it an appealing choice for many users, especially those seeking to maximize yields on modest capital; however, one must also consider the higher operational complexity for liquidity providers, which can be a barrier for newcomers.

Hailey M.

30 October, 2025 . 17:33 PM

Wow, another DeFi "miracle" that promises low fees but demands you become a part‑time mathematician to avoid losing everything 😅. The Onsen Program sounds like a reward fiesta, yet it’s basically a roulette wheel for your SUSHI tokens. Still, the sub‑cent gas fees are sweet, and the 1‑2 second confirmations feel like a crypto‑powered espresso shot ☕️. If you love juggling price ranges and harvesting tokens before the next meme coin spikes, jump in; otherwise, maybe stick to a simpler DEX.

Deepak Kumar

3 November, 2025 . 20:59 PM

Listen up, folks! If you’re looking to get the most out of SushiSwap V3 on Arbitrum, start by bridging your assets during off‑peak hours to snag the lowest gas prices. Then, set a tight price range for your liquidity – the tighter the band, the higher the fee earnings, but don’t forget to monitor it like a hawk. Finally, claim those juicy SUSHI rewards weekly; the compounding effect can boost your APY significantly. Keep the momentum going and you’ll see real gains!

Matthew Theuma

8 November, 2025 . 00:25 AM

Honestly, the whole thing feels like a calm sea with occasional ripples; low fees, fast txs, but the concentrated liquidity is a bit of a puzzle that can trip you up if you’re not paying attention. It’s a nice balance of simplicity and depth, though I sometimes wish the UI was a tad smoother. Overall, a solid option for those who want a bit more yield without the heavy cost.

Carolyn Pritchett

12 November, 2025 . 03:50 AM

This platform is a total overhype – the fees are low but the reward model is just a gimmick to keep users hooked. If you’re not into constantly checking price ranges, you’re better off elsewhere.

Jason Zila

16 November, 2025 . 07:16 AM

SushiSwap V3 is over‑engineered and not worth the hassle.

Cecilia Cecilia

20 November, 2025 . 10:42 AM

The low fees are great. The extra SUSHI rewards add value without complicating trades.

Kaitlyn Zimmerman

24 November, 2025 . 14:07 PM

SushiSwap really shines when you’re after cheap swaps, and the Onsen Program can boost yields if you’re willing to experiment with new tokens. Just keep an eye on the price range settings – they’re the key to making the most of the concentrated liquidity. And, of course, always double‑check the gas fees before confirming.

DeAnna Brown

28 November, 2025 . 17:33 PM

Alright, let’s get real – SushiSwap V3 is the underdog hero of the L2 DEX world, and if you ask me, it’s practically the best thing since sliced bread for yield farmers. The dual‑reward system? Pure genius, giving you both LP fees and SUSHI royalties, which means your wallet gets fed twice over. And those sub‑cent gas fees? They’re the kind of break‑even point that makes you wonder why anyone would settle for anything else.

But, of course, the magic comes at a price – you’ve gotta master the art of concentrated liquidity, which is basically the DeFi version of high‑stakes poker. If you’re not ready to monitor those price ticks, you’ll end up flat‑lined by impermanent loss. Still, for those who can handle the fast‑lane, SushiSwap V3 is a goldmine, and the Onsen Program is the cherry on top, feeding you fresh token rewards like a perpetual faucet.

Chris Morano

2 December, 2025 . 20:59 PM

I think it’s great that SushiSwap offers lower fees while still providing decent liquidity. The Onsen rewards are a nice bonus for those willing to explore new pools. It’s a positive step for the ecosystem.

Ikenna Okonkwo

7 December, 2025 . 00:25 AM

When you step back and look at the bigger picture, SushiSwap V3’s architecture reflects a thoughtful balance between efficiency and accessibility. The concentrated liquidity model, while demanding oversight, unlocks capital efficiency that traditional AMMs simply can’t match. Coupled with the dual‑reward system, it provides a compelling incentive structure that can attract both traders and LPs alike.

Yet, the true test will be how the platform navigates the evolving regulatory landscape and competition from emerging L2 DEXs. If they continue to innovate while preserving security, SushiSwap could solidify its place as a cornerstone of the DeFi ecosystem.

lida norman

11 December, 2025 . 03:50 AM

SushiSwap V3 feels like a fresh breeze of low fees and quick swaps. The extra SUSHI rewards make it even more appealing 😊. Just watch those price ranges if you add liquidity.

Miguel Terán

15 December, 2025 . 07:16 AM

Let’s talk about the gorgeous tapestry that is SushiSwap V3 on the Arbitrum canvas – a masterstroke of engineering that fuses blisteringly cheap gas with a sophisticated reward architecture that would make even the most jaded yield farmer do a double‑take.

First, the low‑fee environment sets the stage for frictionless arbitrage and high‑frequency trades, turning every cent saved into a potential profit pool. Then, the concentrated liquidity mechanism, while demanding a keen eye, offers a capital efficiency boost that feels like discovering a hidden oasis in the desert of AMM design.

Layered atop this is the Onsen Program, a rotating carousel of token incentives that can turn a modest LP position into a cascade of SUSHI rewards, provided you’re nimble enough to hop between pools like a seasoned trader.

But beware – the elegance comes with a learning curve; mis‑positioned liquidity can lead to swift impermanent loss, and the dual‑reward split means you must juggle both LP fees and xSUSHI accruals, a dance of numbers that can be both exhilarating and exhausting.

In the grand scheme, SushiSwap V3 stands as a compelling alternative to its peers, offering the trifecta of low cost, high efficiency, and enticing incentives, provided you’re ready to invest the intellectual horsepower required to wield it effectively.

Shivani Chauhan

19 December, 2025 . 10:42 AM

SushiSwap V3 on Arbitrum impresses with its sub‑cent gas fees and swift confirmation times, making it a practical choice for daily traders. The Onsen Program adds a layer of reward potential, though its rotating nature means you need to stay engaged. Overall, it balances cost and incentive well.

Deborah de Beurs

23 December, 2025 . 14:08 PM

Stop pretending SushiSwap is some kind of miracle solution; the concentrated liquidity is a nightmare for anyone not willing to babysit their positions. The extra rewards are just a lure to keep users trapped in a cycle of chasing diminishing returns.

Sara Stewart

27 December, 2025 . 17:33 PM

From a technical standpoint, SushiSwap V3's Trident AMM engine provides flexible pool types that can be leveraged for specialized strategies, which is a solid upgrade over legacy designs. However, the increased complexity may raise the barrier to entry for casual users.

Laura Hoch

31 December, 2025 . 20:59 PM

The low transaction costs on Arbitrum are undeniably appealing, and the dual‑reward architecture adds an extra layer of yield that can be attractive for patient investors. Nonetheless, managing narrow price ranges requires vigilance, and the platform’s overall TVL lag behind competitors could limit deep‑liquidity trades.

In essence, SushiSwap V3 offers a compelling mix for those who are willing to engage with its nuances, but it may not suit everyone’s risk tolerance or time commitment.

Devi Jaga

5 January, 2026 . 00:25 AM

Oh great, another “innovative” DEX that promises the moon while hiding the fact that most users will lose money on impermanent loss. The Onsen Program is just a fancy way to keep token prices artificially inflated.

Schuyler Whetstone

9 January, 2026 . 03:50 AM

People need to wake up and realize that these reward schemes are nothing but a scam to keep you hooked. If you’re not constantly checking your positions, you’ll end up worse off.

David Moss

13 January, 2026 . 07:16 AM

There is a hidden agenda behind the low‑fee narrative; the real goal is to collect massive user data for future manipulation. Be cautious, they’re not just building a DEX, they’re building a surveillance platform.