Single-Collateral System: How It Works and Why It Matters in DeFi

When you borrow crypto without a bank, you need something to back it up—that’s where the single-collateral system, a DeFi model where one asset secures all loans. Also known as single-collateral lending, it’s the backbone of early stablecoins like DAI and still powers major protocols today. Unlike multi-collateral setups that accept Bitcoin, Ethereum, and tokens all at once, this system uses just one asset—usually ETH or BTC—to mint new stablecoins. It’s simpler, easier to audit, and harder to game. But it’s also more fragile when that one asset crashes.

Think of it like a pawn shop that only takes gold. If gold drops 40%, everyone who borrowed against it suddenly owes more than their collateral is worth. That’s why liquidation risk, the chance your collateral gets seized if its value falls too far is the biggest worry. Protocols like MakerDAO set high collateral ratios—150% or more—to cushion against price swings. If ETH falls below that safety line, your position gets automatically sold off to pay back the loan. No warnings. No mercy. That’s the trade-off for keeping the system trustless and decentralized.

This model also shapes how stablecoins, crypto tokens designed to hold a steady value, usually pegged to the US dollar behave. DAI, for example, was built on ETH-only collateral for years. That made it predictable but vulnerable to Ethereum’s volatility. Now, many systems use multiple assets to spread risk. But single-collateral isn’t dead. It’s still the gold standard for transparency. If you’re looking at a DeFi protocol that only accepts one token as collateral, you’re seeing a system that’s been stress-tested by market crashes. It’s not flashy, but it’s reliable—if you understand the rules.

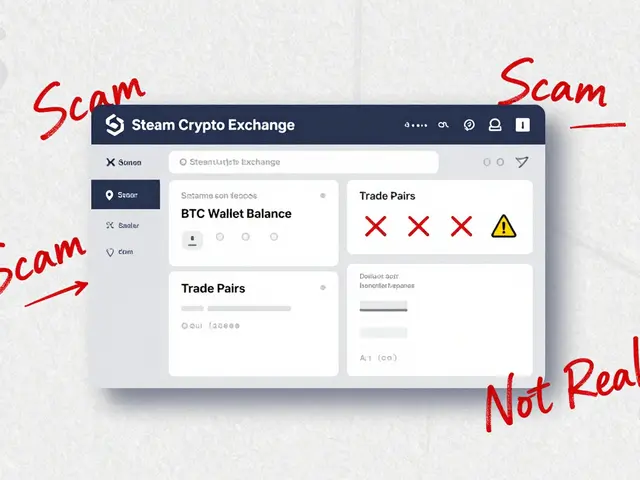

What you’ll find in the posts below are real-world examples of how this system plays out. From how Iran’s mining rules affect crypto liquidity to why a dead DeFi protocol like Sterling Finance failed because its collateral model couldn’t handle volatility, these stories show the single-collateral system in action—sometimes working, sometimes breaking. You’ll see how it connects to stablecoins like USDN, how liquidation risks show up in DEXs like SithSwap, and why even a meme coin like DADDY can’t escape the mechanics of collateral when it tries to borrow. This isn’t theory. It’s what’s happening right now in DeFi—and you need to know how it works before you lock up your assets.

Multi-Collateral vs Single-Collateral Systems in DeFi: What You Need to Know

Multi-collateral systems let you use Bitcoin, Ethereum, and other cryptos together as collateral for loans, while single-collateral systems only allow one asset. Learn which one suits your DeFi needs in 2025.

View More