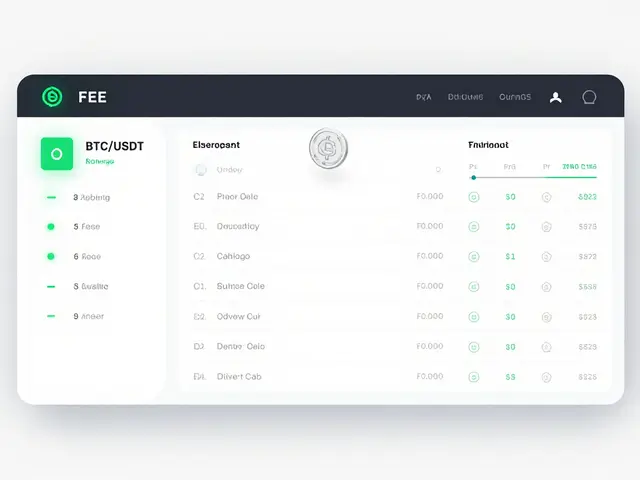

PoloniDEX Trading Fee Calculator

Estimated Fee

How Fees Work

PoloniDEX uses a tiered fee structure with maker fees lower than taker fees. The base taker fee is 0.25%, decreasing to 0.15% for high-volume traders. Maker fees are slightly lower. Fees are calculated based on your trading volume and type.

When you hear the name PoloniDEX is a cryptocurrency‑to‑cryptocurrency exchange that markets itself as a secure, institution‑friendly platform with a high‑rate API, the first question is whether it still fits today’s trading landscape. Launched in 2014, the exchange has survived a crowded market, a series of security incidents, and a complete pull‑back from the United States in late 2023. This review breaks down what you’ll actually experience in 2025, from onboarding hurdles to the nitty‑gritty of its API, and helps you decide if PoloniDEX deserves a spot in your portfolio.

Platform Overview

PoloniDEX focuses exclusively on crypto‑crypto pairs - you can’t deposit fiat directly, which means you’ll need another service to buy Bitcoin, Ether or any other token before moving funds over. The exchange lists roughly 100+ assets, covering all major coins (BTC, ETH, USDT, etc.) but lagging behind rivals that boast 250+ listings. Its UI is utilitarian: a dark‑mode chart window, order book, and a sidebar for balances. For casual traders the layout feels a bit spartan, yet professional users appreciate the minimal distractions.

Security & Reliability

Security is where PoloniDEX tries to shine. All withdrawal requests and every API call require two‑factor authentication (2FA) a one‑time code generated by an authenticator app, adding a second layer beyond passwords. In addition, the platform stores the majority of user funds in cold wallets, a standard practice among serious exchanges.

That said, the exchange’s history isn’t spotless. Past breaches reported in 2018 and 2020 exposed a fraction of user balances, prompting a tighter security policy and the mandatory 2FA rule. Recent user reviews (G2, Sep2023) still praise the platform as “one of the safest crypto‑crypto exchanges”, but critics point out the lingering reputation risk.

Trading Features & API

PoloniDEX’s biggest differentiator is its API a low‑latency, high‑rate interface designed for algorithmic and high‑frequency traders. The API offers up to 10k requests per minute, order‑book depth snapshots, and real‑time ticker data. Institutional users love the ability to run automated strategies without throttling, while retail traders might never tap into it.

The platform also provides a built‑in “savings” product, letting users earn passive yields on select assets. Reviewers highlighted the “high passive returns” as a standout feature, especially for those who prefer a hands‑off approach.

Token Selection & Listings

With about 100+ listed tokens, PoloniDEX follows a curated strategy: only projects that pass a stringent vetting process make the cut. This reduces exposure to fraudulent “pump‑and‑dump” coins but also means you’ll miss out on many new DeFi or meme tokens that appear on larger exchanges.

Compared to competitors:

- Crypto.com - 250+ tokens, aggressive new‑token onboarding.

- Binance - 500+ tokens, most extensive catalog.

- PoloniDEX - 100+, quality‑over‑quantity.

If you’re a risk‑averse trader, the limited list can feel like a safety net. If you chase the next big altcoin, you’ll probably look elsewhere.

Fees, Savings & Cost Structure

PoloniDEX charges a tiered maker‑taker fee model typical of many exchanges: 0.25% taker fee for the base tier, decreasing to 0.15% for high‑volume traders. There are no hidden deposit fees because the platform doesn’t accept fiat. Withdrawal fees vary by coin but are generally in line with network costs.

The “savings” product lets you lock certain assets (e.g., USDT, BTC) for a fixed term and earn up to 8% APY, according to user‑reported data from Sep2023. The yields are higher than most traditional bank accounts, but they come with the usual crypto‑risk caveats.

Geographic Availability & US Exit

In October2023 PoloniDEX announced a complete shutdown of US operations. Existing US users were given a 30‑day window to withdraw or transfer assets. The move reflects mounting regulatory pressure and the exchange’s decision to focus on markets with clearer crypto frameworks.

Outside the United States, the platform remains accessible in Europe, Asia‑Pacific, and parts of Latin America. However, the lack of fiat on‑ramps means you’ll still need an intermediary exchange or broker to get crypto onto PoloniDEX.

Customer Support & User Experience

Support is a mixed bag. The help center offers a searchable knowledge base, but live chat is limited to business hours and response times can stretch to 48hours during peak periods. Multiple reviews (Cryptoninjas, Mar2023) flag “negative reviews for customer support” as a consistent pain point.

For seasoned traders who can navigate documentation, the learning curve is manageable. Beginners may feel stuck, especially when dealing with external fiat conversion and the delayed support.

Pros & Cons at a Glance

| Pros | Cons |

|---|---|

| Institution‑grade low‑latency API | No fiat deposit support |

| Strong 2FA‑only withdrawal security | Limited token selection (~100) |

| Savings product with competitive yields | US market shutdown |

| Cold‑wallet majority for funds | Customer‑support delays |

Comparison with Major Competitors

| Feature | PoloniDEX | Binance | Crypto.com |

|---|---|---|---|

| Fiat on‑ramps | No | Yes (multiple) | Yes (multiple) |

| Token count | ~100 | ~500 | ~250 |

| API rate limit | 10k req/min | 5k req/min | 3k req/min |

| 2FA requirement | Yes (all withdrawals & API) | Optional | Optional |

| US availability | Closed (Oct2023) | Open | Open |

| Savings yields | Up to 8% APY | Variable (0‑12%) | Variable (0‑10%) |

Final Verdict

If you’re a professional trader who needs a robust, low‑latency API and you already have crypto in a wallet, PoloniDEX can be a solid secondary exchange. Its security posture, cold‑storage bias, and savings product add genuine value. However, for newcomers, the lack of fiat entry points, the US shutdown, and the slower support response may outweigh the benefits. We’d recommend keeping PoloniDEX as a niche tool rather than your primary gateway to crypto.

Frequently Asked Questions

Can I buy crypto directly on PoloniDEX?

No. PoloniDEX only supports crypto‑to‑crypto trading. You’ll need to purchase crypto on another exchange or through a broker, then transfer the assets to PoloniDEX.

Is PoloniDEX still usable for US residents?

As of October2023 the exchange halted all US services. Existing US accounts were required to withdraw or move funds elsewhere; new US users cannot create accounts.

What security measures protect my funds?

PoloniDEX enforces mandatory 2FA for withdrawals and API calls, stores the bulk of assets in offline cold wallets, and employs industry‑standard encryption for data in transit.

How do the fees compare to other exchanges?

The base taker fee is 0.25%, with maker fees slightly lower. This is comparable to many mid‑tier exchanges, but higher than the sub‑0.10% rates you might find on high‑volume tiers of Binance or Kraken.

Is the PoloniDEX savings product safe?

The savings product is non‑insured and subject to market risk. While APY rates can be attractive, you should only allocate funds you’re comfortable keeping in a crypto‑based investment.

Jeff Moric

14 October, 2025 . 08:17 AM

If you're new to crypto exchanges, the first thing to check is whether the platform actually secures your keys with industry‑standard encryption and cold‑storage practices. Most reputable services will store the bulk of funds offline and only keep a hot wallet for withdrawals. Look for a clear audit report or a third‑party security assessment on their website. Also, make sure they support two‑factor authentication and offer withdrawal whitelists.

Bruce Safford

23 October, 2025 . 03:29 AM

Did you ever notice how every "secure" exchange suddenly drops a new update right after a major hack? It's like they're hiding backdoors in the code while preaching transparency. I swear PoloniDEX's fee calculator script has some hidden telemetry that reports every trade to an unknown server. Also, those tiered fees? Just a way to lure high‑volume whales and then skim off the top. The whole thing feels like teh perfect scam.

Shrey Mishra

31 October, 2025 . 21:41 PM

In the grand tapestry of digital asset marketplaces, PoloniDEX positions itself as a modest contender, yet the veneer of professionalism masks a series of subtle inefficiencies. The fee hierarchy, while ostensibly competitive, fails to account for the hidden latency costs incurred during order execution. Moreover, the absence of a transparent incident‑response protocol raises concerns about consumer protection.

Ken Lumberg

9 November, 2025 . 16:53 PM

PoloniDEX is just another cash‑grab scheme.

Blue Delight Consultant

18 November, 2025 . 12:05 PM

One might ponder the philosophical implications of entrusting one's financial sovereignty to a centralized ledger that purports decentralization. The juxtaposition of regulatory compliance and user autonomy creates a paradox that warrants deeper contemplation. Nevertheless, the platform does adhere to KYC standards, which some may view as a concession to legitimacy.

Wayne Sternberger

27 November, 2025 . 07:17 AM

While it's easy to get caught up in alarmist narratives, it's also worth noting that many exchanges undergo regular security audits. If you feel uneasy, checking PoloniDEX's published audit logs can provide some reassurance, and taking advantage of withdrawal limits adds an extra layer of safety.

Gautam Negi

6 December, 2025 . 02:29 AM

Conversely, the very formality of the fee disclosure could be interpreted as a strategic smokescreen, diverting attention from latency discrepancies. A more transparent order‑book depth chart would alleviate such doubts.

Shauna Maher

14 December, 2025 . 21:41 PM

Honestly, the whole "audit" talk is just a PR stunt; the real issue is that the platform's codebase is likely riddled with hidden callbacks to offshore entities. Trust no one.

Kyla MacLaren

23 December, 2025 . 16:53 PM

Thanks for the breakdown. I think the fee calculator is handy, but it'd be cool if they added a real‑time spread overlay so traders can see actual market depth.

Linda Campbell

1 January, 2026 . 12:05 PM

The platform's fee structure appears reasonable, yet one cannot ignore the broader geopolitical ramifications of US‑based exchanges exiting markets. Such moves often signal underlying regulatory pressure that may affect user assets.

John Beaver

10 January, 2026 . 07:17 AM

When evaluating PoloniDEX, it's essential to look beyond the headline fee percentages and examine the full cost of trading on the platform. First, the base taker fee of 0.25% may seem modest, but when you factor in network transaction fees, the total expense can rise noticeably, especially for smaller traders. Second, the tiered discounts only kick in after you cross relatively high volume thresholds, which many retail users never reach. Third, liquidity depth on PoloniDEX has historically lagged behind major players like Binance, leading to occasional slippage on larger orders. Fourth, the order matching engine operates on a proprietary algorithm that hasn't been independently benchmarked, leaving some uncertainty about execution speed. Fifth, the exchange offers a limited selection of fiat on‑ramps, reducing convenience for newcomers who prefer direct bank transfers. Sixth, security measures such as cold storage and multi‑sig wallets are mentioned but not detailed in a transparent manner. Seventh, the platform's customer support response times have been reported as slow during peak market volatility. Eighth, regulatory compliance is evident through KYC and AML policies, but this also means users surrender a degree of anonymity that some value. Ninth, the recent US exit announcement raises questions about future asset custodianship and potential legal ramifications. Tenth, PoloniDEX's API documentation is fairly comprehensive, allowing developers to integrate trading bots with relative ease. Eleventh, the community forums show a mix of enthusiastic users and skeptics, suggesting a divided perception of the exchange's reliability. Twelfth, the mobile app experience feels polished, yet occasional bugs in order cancellation persist. Thirteenth, fee rebates for market makers are modest and may not offset the higher taker rates for most traders. Fourteenth, comparing the effective fee after all adjustments often places PoloniDEX in a middle‑ground position relative to its competitors. Finally, if you prioritize security above all else, it may be prudent to allocate only a portion of your portfolio to PoloniDEX while keeping the bulk on a hardware wallet.

EDMOND FAILL

19 January, 2026 . 02:29 AM

Interesting points, especially about the API. I’ve experimented with their endpoints and found the latency acceptable for day‑trading, but the lack of WebSocket depth data is a minor annoyance.

Jennifer Bursey

27 January, 2026 . 21:41 PM

From a market‑structure perspective, PoloniDEX’s tiered fee model is designed to incentivize liquidity provision, which can be beneficial for overall market health. However, the jargon‑heavy terminology in their fee schedule might deter casual investors.

Maureen Ruiz-Sundstrom

5 February, 2026 . 16:53 PM

Honestly, all that talk about “incentivizing liquidity” is just corporate buzzword bingo. The real takeaway is that they’re trying to squeeze every possible cent from traders.

Kevin Duffy

14 February, 2026 . 12:05 PM

Great insights, everyone! Looking forward to seeing more community feedback 🙂

Tayla Williams

23 February, 2026 . 07:17 AM

While the exchange claims adherence to regulatory standards, one must question the ethical implications of facilitating transactions that may fund illicit activities. A more rigorous due‑diligence framework would be commendable.