Collateral Calculator

Calculate how much you can borrow using your crypto assets as collateral. The calculator shows you the borrowing capacity based on real DeFi haircuts and compares single vs multi-collateral systems.

Each asset has a haircut representing the discount applied to its value:

- Ethereum (ETH): 75% haircut → You can borrow 75% of ETH value

- Bitcoin (BTC): 70% haircut → You can borrow 70% of BTC value

- Solana (SOL): 75% haircut → You can borrow 75% of SOL value

- USDC: 95% haircut → You can borrow 95% of USDC value

The system calculates your total borrowing capacity based on current asset prices.

Results will appear here after calculation

Imagine you want to borrow $1,000 using your crypto as collateral. You’ve got Bitcoin, Ethereum, and a few altcoins sitting in your wallet. In a multi-collateral system, you can lock all of them up together-no need to sell anything first. The system adds up their value, applies a safety buffer, and lets you borrow. In a single-collateral system, you can only use one asset-say, Ethereum-to get that same $1,000. Everything else in your wallet? Locked out.

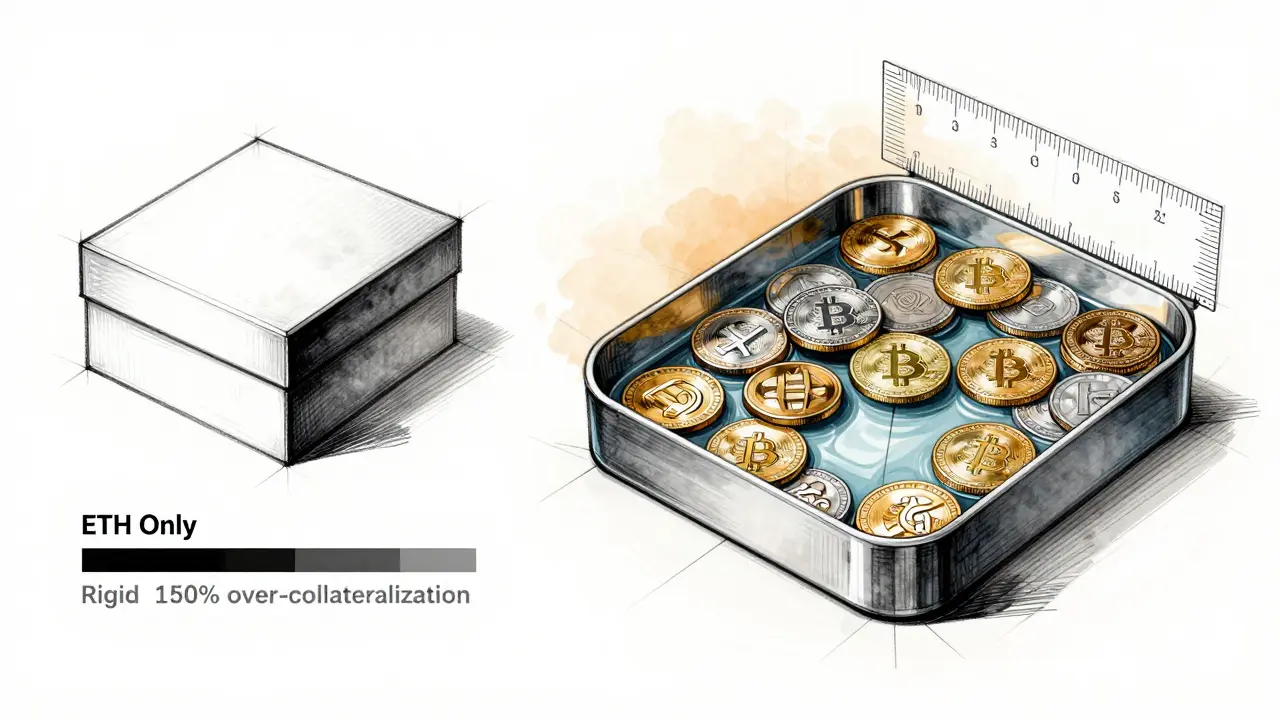

How Single-Collateral Systems Work

Single-collateral systems are simple by design. MakerDAO’s original version, called SAI (Single-Collateral Dai), ran from late 2017 until late 2019. It only accepted Pooled Ether (PETH)-a tokenized form of Ethereum-as collateral. If you wanted to borrow DAI, you had to lock up at least $1.50 worth of ETH for every $1 you borrowed. That 150% over-collateralization was the rule. No exceptions.This simplicity made it easy to understand. No confusing calculations. No different haircut rates for different assets. Just one price feed, one liquidation trigger, one clear path to risk. When the price of ETH dropped too fast, the system automatically auctioned off the locked ETH to cover the debt. The process was blunt but predictable.

But here’s the catch: if your portfolio had even a single Bitcoin or Solana token, you couldn’t use it. You had to sell it, convert it to ETH, then lock it up. That meant extra fees, slippage, and time. For users holding diverse crypto portfolios, this was a major limitation. And if ETH’s price crashed hard, the whole system faced pressure-because everything depended on one asset. No diversification. No backup.

How Multi-Collateral Systems Work

In November 2019, MakerDAO switched to Multi-Collateral DAI (MCD). That change didn’t just add more assets-it rewrote the rules of how DeFi handles collateral.Now, you can lock up Bitcoin, Ethereum, Solana, Chainlink, even stablecoins like USDC, and use them all together as one pool of collateral. The system doesn’t care what you put in. It just calculates the total USD value, applies a specific haircut to each asset based on its volatility, and lets you borrow against the net amount.

For example, ETH might have a 75% haircut (meaning you can only borrow 75% of its value), while BTC might have a 70% haircut. PEPE, being highly volatile, might get a 50% haircut. The system does all the math in real time. You don’t need to convert anything. Your portfolio stays intact. Your capital stays efficient.

And the liquidation process? More advanced. When a position becomes undercollateralized, the system doesn’t just sell the collateral. It first auctions off MKR tokens (Maker’s governance token) to raise DAI and cover the debt. Then, it sells the collateral assets to buy back and burn those MKR tokens. This creates a feedback loop that helps stabilize the system-instead of just dumping assets and crashing prices, it tries to absorb the shock.

Why Flexibility Beats Simplicity

The biggest advantage of multi-collateral systems is freedom. You’re no longer forced to sell your Bitcoin just to borrow DAI. You can hold your entire portfolio and still access liquidity. That’s huge for long-term holders who don’t want to time the market.It also opens the door to more complex financial products. With multi-collateral, MakerDAO can now price-feed traditional assets like Apple stock or gold into the system. You can deposit 400 DAI, then borrow tokenized shares of Apple stock-without ever touching a centralized exchange. The collateral stays crypto, but the exposure is real-world. That’s financial innovation built on open protocols.

Platforms like Kraken and Aave have followed suit. Their leverage trading features now accept multiple crypto assets as collateral. Traders use this to hedge positions, amplify gains, or just stay liquid without selling their core holdings. The capital efficiency gain isn’t small-it’s often 2x to 3x better than single-collateral setups.

The Hidden Costs of Complexity

But multi-collateral isn’t magic. It’s more complicated. And complexity brings new risks.First, there are haircuts. Each asset has a different haircut based on its historical volatility, liquidity, and correlation to other assets. If Bitcoin and Ethereum drop at the same time-which they often do-you’re not just facing one risk. You’re facing correlated risk. The system might not have enough buffer if everything crashes together.

Second, conversion fees. Some collateral assets require on-chain swaps to be converted into DAI during liquidation. Those swaps cost gas and slippage, which gets passed on to users. It’s not always obvious how much you’re paying until you get liquidated.

Third, governance. With more assets comes more decisions. Should Solana get a 70% or 75% haircut? Should USDC be allowed? Who decides? MakerDAO’s governance is open, but it’s also slow. Votes can take weeks. In a crisis, that delay can matter.

Single-collateral systems didn’t have these problems. They were rigid, but predictable. You knew exactly what you were getting into. No surprises. No hidden fees. Just ETH and a 150% buffer. For beginners, that was easier to trust.

Who Uses What, and Why?

Most active DeFi users today use multi-collateral systems. Why? Because they’re more powerful. If you’re trading, lending, or building on DeFi, you need flexibility. You need to use all your assets. You need to avoid unnecessary sales. Multi-collateral gives you that.But single-collateral isn’t dead. Some small protocols still use it-for regulatory reasons, or because they’re targeting users who want simplicity over power. Think of it like a basic savings account versus a brokerage account. One is easy to understand. The other lets you do more, but you need to learn how it works.

There’s also a learning curve. If you’re new to DeFi, starting with a single-collateral system can help you understand over-collateralization, liquidations, and debt positions without being overwhelmed. Once you’re comfortable, moving to multi-collateral makes sense.

And let’s not forget: MakerDAO’s MCD system now backs over $5 billion in DAI stablecoins. That’s more than most centralized stablecoins. It’s proof that the complexity pays off-at scale.

The Future of Collateral Systems

The next wave of innovation isn’t about adding more assets. It’s about making the system smarter.Automated collateral rebalancing is already being tested. Imagine your portfolio shifts because ETH went up and BTC went down. Instead of manually adjusting your Vault, the system could automatically sell a bit of ETH and buy more BTC to keep your collateral ratio optimal. No action needed from you.

Machine learning is being used to predict correlation spikes between assets before they happen. That means haircuts could adjust dynamically-not just based on past data, but on real-time market behavior.

And cross-chain collateral? That’s coming. Soon, you might be able to lock up Polygon tokens, Avalanche assets, or even Bitcoin from the Lightning Network, all in one DeFi protocol. The goal is to make collateral as universal as money itself.

Regulators are watching. Some countries are starting to require clearer disclosures on haircut risks and liquidation mechanics. That could push more protocols toward transparency-something single-collateral systems already had by default.

Which One Should You Use?

If you’re just starting out and want to understand how borrowing works in DeFi, try a single-collateral setup. It’s easier to track. You’ll learn the basics without extra noise.If you’re already holding multiple crypto assets and want to use them without selling, go multi-collateral. You’ll unlock more value from your portfolio. You’ll get better rates. You’ll have more control.

Don’t think of it as one being better than the other. Think of it as tools for different jobs. Single-collateral is a hammer. Multi-collateral is a Swiss Army knife. One does one thing well. The other does many things-sometimes messy, but far more powerful.

Most DeFi users today choose the knife. And as the ecosystem grows, that’s only going to become the norm.

What’s the difference between single-collateral and multi-collateral systems?

Single-collateral systems only accept one type of asset as collateral-like Ethereum in MakerDAO’s original SAI system. Multi-collateral systems accept multiple assets, such as Bitcoin, ETH, SOL, and USDC, combining their value into one collateral pool. Multi-collateral offers more flexibility and capital efficiency, while single-collateral is simpler but more restrictive.

Why did MakerDAO switch from single to multi-collateral?

MakerDAO switched in November 2019 to allow users to back DAI with more than just Ethereum. This gave holders of other cryptocurrencies access to stablecoin loans without selling their assets. It also improved the system’s resilience by reducing dependence on a single volatile asset and enabled more advanced DeFi products like tokenized stocks.

Is multi-collateral riskier than single-collateral?

It can be. Multi-collateral systems have more variables: different haircuts, conversion fees, and asset correlations. If multiple assets crash at once, the system’s buffers might not hold. Single-collateral is simpler to assess-only one asset’s price matters. But multi-collateral’s advanced liquidation mechanics and diversified collateral often make it more stable in the long run.

Can I use Bitcoin as collateral for DAI?

Yes, in multi-collateral DAI systems, Bitcoin is one of the approved collateral assets. The system assigns it a haircut (usually around 70%) based on its volatility and liquidity. You lock your BTC in a Vault, and the system lets you borrow DAI against its value after applying that haircut.

Do I need to convert my crypto to ETH to borrow in a multi-collateral system?

No. One of the biggest advantages of multi-collateral systems is that you don’t need to convert your assets. You lock BTC, ETH, SOL, or other approved tokens directly into the system. The platform calculates their combined value in USD and applies the correct haircuts. Your assets stay as they are.

Are single-collateral systems still used today?

Most major DeFi protocols have moved to multi-collateral, but some smaller or regulatory-focused platforms still use single-collateral setups. They’re often chosen for simplicity, ease of auditing, or to meet specific compliance requirements where diversification isn’t allowed.

What’s a haircut in DeFi collateral?

A haircut is a discount applied to the value of your collateral to account for price volatility. For example, if ETH is worth $3,000 and has a 75% haircut, you can only borrow up to $2,250 against it. This buffer protects the system if the asset’s price drops suddenly.

Can I borrow non-crypto assets using crypto collateral?

Yes, in advanced multi-collateral systems like MakerDAO, you can borrow tokenized versions of real-world assets-like Apple stock or gold-by using crypto as collateral. The system uses price oracles to track those assets’ values. As long as your collateral stays above the required ratio, you can hold exposure to traditional assets without leaving blockchain.

Mark Stoehr

3 December, 2025 . 21:51 PM

multi collateral is just crypto wall street trying to look smart bruh i hold btc and eth and i just want to borrow dai without doing math

Shari Heglin

4 December, 2025 . 08:26 AM

The structural integrity of single-collateral systems remains fundamentally superior in environments of systemic uncertainty, as the reduction of variables inherently mitigates tail risk.

Murray Dejarnette

4 December, 2025 . 13:41 PM

yo you guys are overcomplicating this. multi-collateral is the future. if you're still using single-collateral you're basically using a flip phone in 2024. get with it.

Maggie Harrison

6 December, 2025 . 04:26 AM

i love how de-fi lets us be our own bankers 😍 no banks no rules just code and freedom 🌌✨

ashi chopra

6 December, 2025 . 20:12 PM

In my country, many people still don't understand even the basics of collateral. Single-collateral feels safer to them. It's not about being behind-it's about accessibility. We must not leave beginners behind.

Akash Kumar Yadav

7 December, 2025 . 11:33 AM

usa thinks its the center of everything. in india we know real finance. you guys call this innovation? we have real gold and rupees. this crypto mess is just digital gambling with fancy words

Christy Whitaker

9 December, 2025 . 11:05 AM

you think multi-collateral is safer? wait until btc and eth crash together and the system eats your collateral alive. they’re hiding this risk on purpose.

Ziv Kruger

10 December, 2025 . 09:37 AM

if you think simplicity is weakness you've never lived through a black swan. single collateral is the quiet monk. multi-collateral is the loud magician pulling rabbits out of a hat that's on fire

Heather Hartman

11 December, 2025 . 07:42 AM

you don't have to choose one over the other. start simple, learn the ropes, then level up. that's how you grow. no shame in starting slow

Catherine Williams

11 December, 2025 . 18:56 PM

i've helped five friends get into de-fi. three started with single-collateral. all of them moved to multi within a month. once they saw the freedom? they never looked back.

Paul McNair

13 December, 2025 . 16:36 PM

in many parts of the world, crypto is the first exposure to decentralized finance. single-collateral systems are the gateway drug. they build trust before complexity. don't underestimate that.

Mohamed Haybe

15 December, 2025 . 11:53 AM

usa thinks it invented finance. we had hundres of years of gold standard and hundres of years of smart risk. this multi-collateral thing is just another wall street scam repackaged with blockchain

Andrew Brady

16 December, 2025 . 07:13 AM

the fed is already working on a backdoor to monitor multi-collateral vaults. they hate decentralized finance. this is just step one before they shut it all down

Sarah Roberge

17 December, 2025 . 15:22 PM

ok but like... what if the oracles get hacked? what if the haircut algorithm is secretly rigged by the makerdao council? what if this is all just a ponzi dressed up as open finance? i'm not sleeping at night

Jess Bothun-Berg

18 December, 2025 . 09:30 AM

this post is 10,000 words of fluff. single-collateral: simple. multi-collateral: complicated. end of story. why are we even having this conversation?

Steve Savage

18 December, 2025 . 22:07 PM

take your time. no rush. the best traders i know didn't start with max leverage. they started with one asset, one rule, one lesson. then they expanded. that's wisdom, not weakness.

Joe B.

18 December, 2025 . 23:28 PM

let's break down the liquidation mechanics of MCD vs SAI. in SAI, liquidations were a binary event: ETH price drops below 150% -> auction. in MCD, you've got a multi-layered auction involving MKR token buybacks, then collateral liquidation, then rebalancing. the gas cost alone for a single liquidation can be $150+. That's not efficiency-that's a hidden tax on users. And don't even get me started on the correlation risk between ETH and WBTC during the 2022 LUNA crash. The system didn't collapse, sure, but the average user lost 37% of their collateral value in one day because the haircut model didn't account for black swan correlation. So yeah, it's 'more powerful'-but only if you're a bot running arbitrage on the liquidation queue. For the average guy holding 2 BTC and 5 ETH? You're just a meat puppet waiting for the next volatility spike.

Rod Filoteo

19 December, 2025 . 17:33 PM

they're lying about the haircuts. the real numbers are hidden in the governance votes. i checked the chain. they're secretly lowering BTC haircuts to pump their own MKR holdings. this isn't finance-it's a casino rigged by insiders