KRK Crypto Platform: Your Gateway to South Korean Crypto Trading

When working with KRK crypto platform, a South Korean cryptocurrency exchange that blends low fees, robust security, and a suite of trading tools. Also known as Korbit, it serves both newcomers and seasoned traders looking for a reliable entry point to global digital assets.

The crypto exchange, a digital marketplace where users can buy, sell, and trade cryptocurrencies is the larger ecosystem that KRK belongs to. Within that ecosystem, exchange fees, the costs charged per trade, withdrawal, or deposit directly influence user adoption; lower fees usually attract higher volume. KRK crypto platform encompasses secure trading, low transaction costs, and a user‑friendly interface, making it a strong contender in the competitive Asian market. Because the platform requires robust security protocols, it implements two‑factor authentication, cold‑storage wallets, and regular audits—features that protect assets from hacks and insider threats. At the same time, the platform’s liquidity pools connect to major global markets, ensuring that orders execute quickly and at expected prices.

What sets KRK apart is its blend of localized support and international reach. The platform offers Korean‑language customer service, fast Korean won deposits, and partnerships with local banks, which reduces friction for domestic users. Yet it also lists 200+ altcoins, futures contracts, and staking options, letting traders diversify without hopping between multiple services. This dual focus means KRK crypto platform influences market liquidity while also responding to regional regulatory changes, such as South Korea’s recent tightening of anti‑money‑laundering rules. As a result, the exchange continuously updates its compliance framework, which in turn raises the bar for security standards across the whole crypto exchange sector.

What to Expect from KRK in 2025

In 2025, KRK crypto platform is likely to roll out a next‑generation mobile app that integrates AI‑driven price alerts, on‑chain analytics, and automated tax reporting. Those features will make it easier for users to monitor market swings, manage risk, and stay compliant with local tax laws. The platform also plans to launch a peer‑to‑peer lending marketplace, allowing users to earn interest on idle assets without leaving the exchange. If you’re curious about how exchange fees will evolve, expect a tiered fee schedule that rewards higher‑volume traders with deeper discounts—an approach that mirrors the fee structures of global leaders like Binance and Coinbase. Security will stay front‑and‑center, with biometric login options and real‑time monitoring for suspicious activity.

All of these developments link back to the core idea that a crypto exchange must balance accessibility, cost, and safety. KRK crypto platform demonstrates that balance by offering a streamlined onboarding process, transparent fee breakdowns, and a security roadmap that adapts to emerging threats. Whether you’re hunting for the next airdrop, exploring DeFi yields, or simply swapping BTC for KRW, the platform gives you the tools to act quickly and confidently.

Below you’ll find a hand‑picked collection of articles that dive deeper into KRK’s fee model, security audits, trading features, and how it compares to other exchanges. Each piece breaks down complex topics into bite‑size insights, so you can decide if KRK crypto platform matches your trading style and goals.

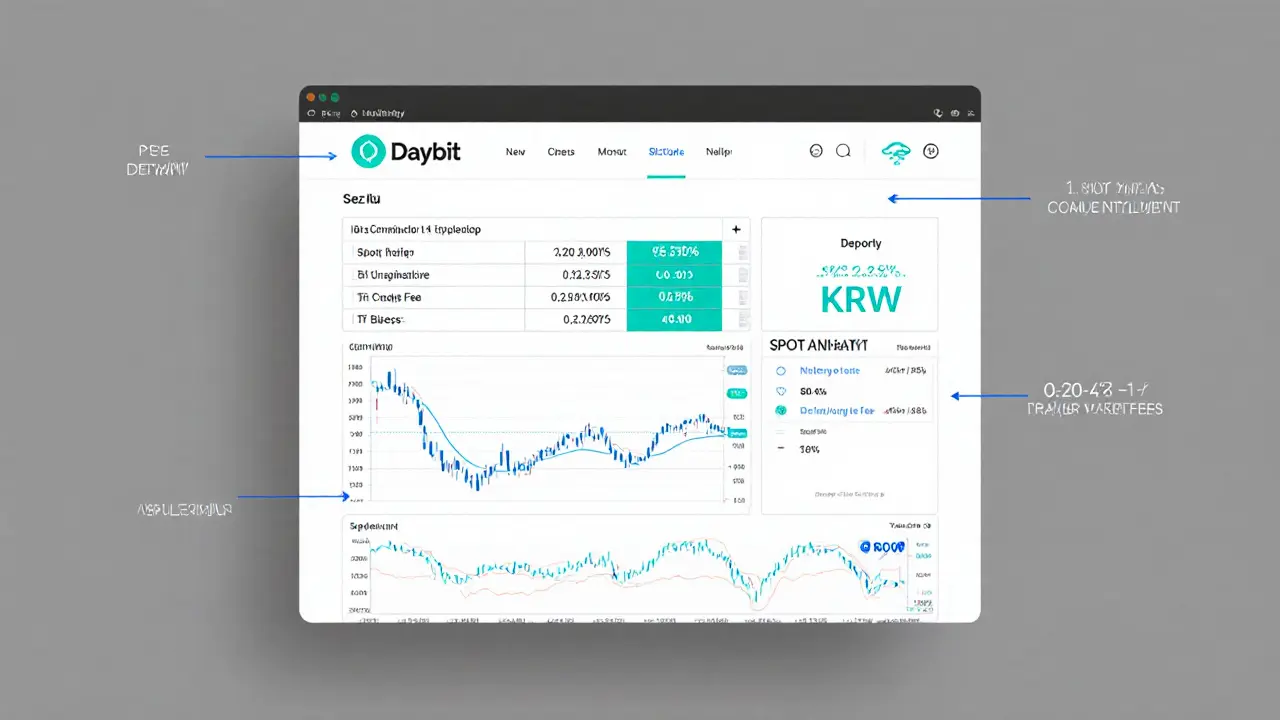

Daybit Exchange Review - Fees, Features, and Safety in 2025

A thorough 2025 review of Daybit Exchange covering fees, features, safety, and how it stacks up against Binance, Bybit, KuCoin, and Bitpanda.

View More