Rollup Finality Calculator

Finality Timeline

When we talk about transaction finality the point at which a transaction becomes irreversible and permanently recorded on a blockchain, the stakes are high for any Layer2 solution. Rollups promise cheaper, faster transactions while still leaning on Ethereum’s security, but the way they reach finality differs dramatically between designs. If you’re building a DeFi app, a game, or even a bridge, you need to know exactly when you can consider a move “settled” and when you should keep a guard‑rail in place.

What "finality" actually means

Finality is more than a buzzword-it’s the guarantee that once a transaction is marked final, nobody can roll it back without breaking the underlying consensus rules. On Ethereum’s proof‑of‑stake chain, finality arrives after two consecutive supermajority votes on a block’s ancestor, typically around 12 minutes after the block first appears. That window gives the network time to detect and reject any forks.

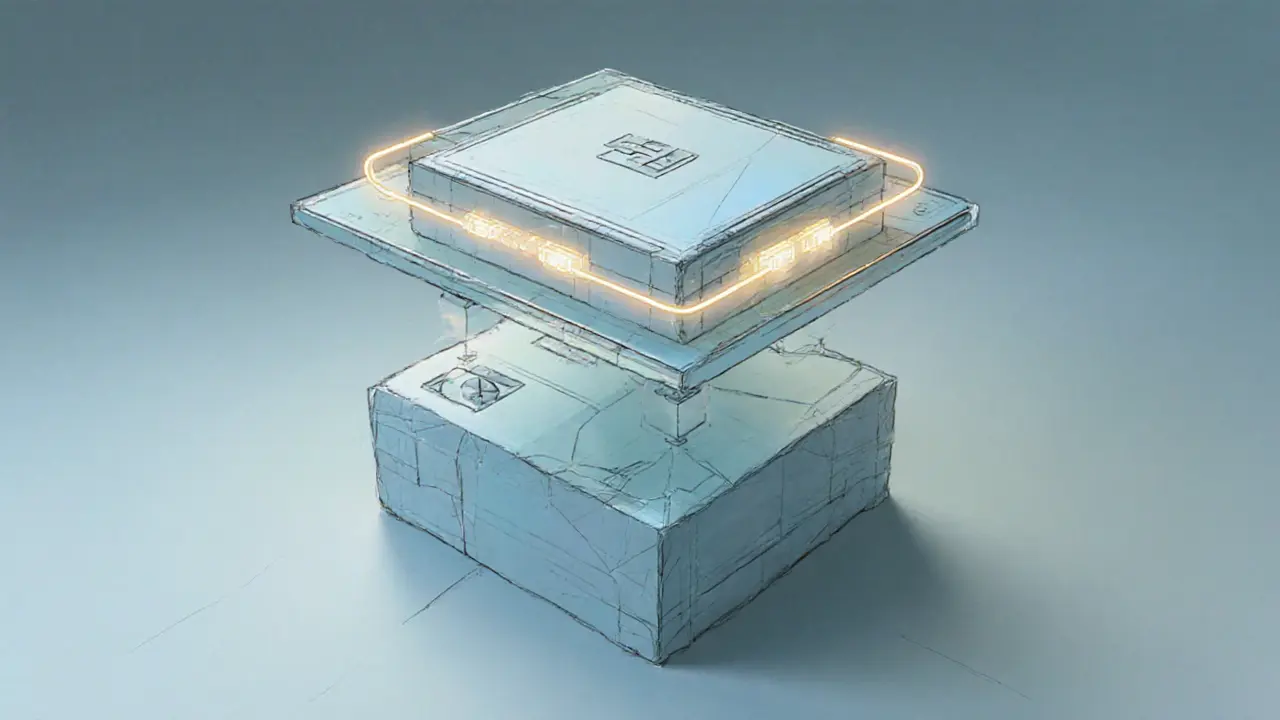

Rollups in a nutshell

Rollups Layer2 scaling solutions that batch many transactions off‑chain, post a succinct proof or data package to Ethereum, and let the main chain enforce final settlement work by separating ordering from execution. Sequencers order transactions, generate a batch, and then hand the batch to Ethereum. The Ethereum block that finally includes that batch gives the rollup its security, but the timing of when a user can act on the transaction varies.

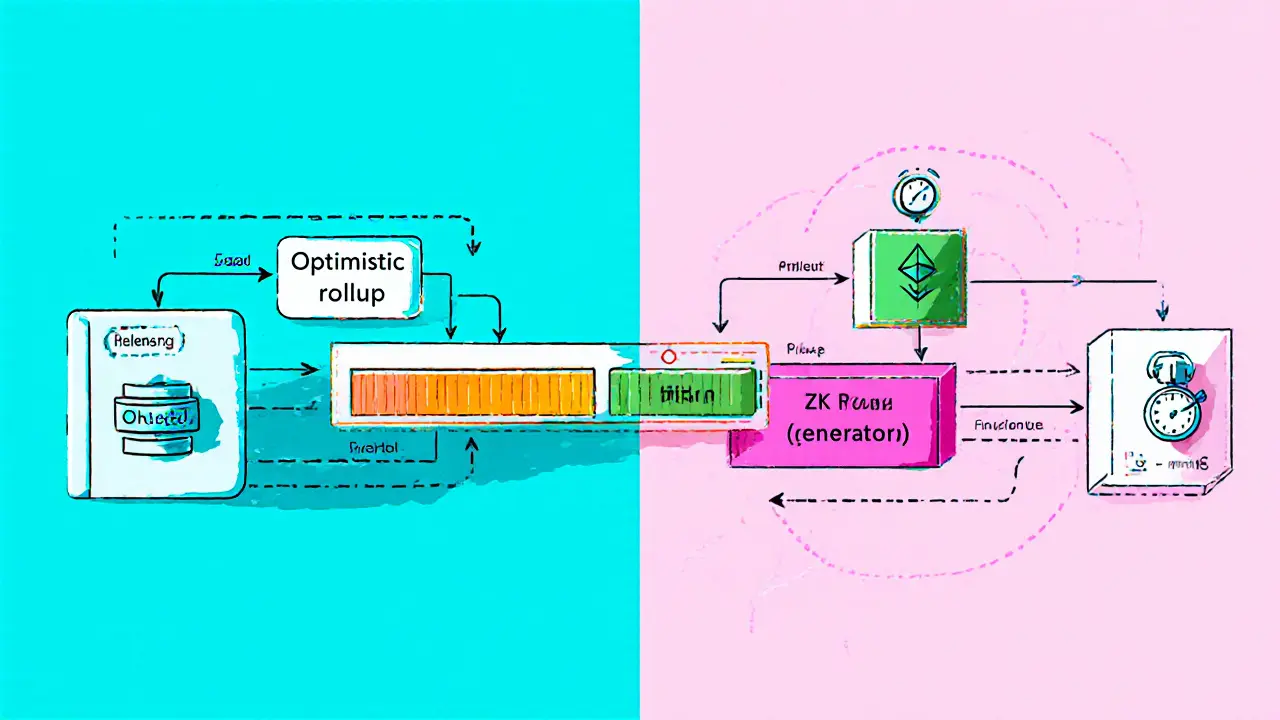

Two families: Optimistic vs. ZK rollups

Optimistic rollups (e.g., Optimism an OP‑Stack based rollup that assumes transactions are valid unless proven otherwise and Arbitrum another optimistic rollup that relies on fraud proofs for dispute resolution) trust the sequencer by default. They open a challenge period-up to seven days-for anyone to submit a fraud proof. If nobody challenges, the batch is considered settled.

ZK‑rollups (e.g., StarkNet a zk‑Rollup that posts succinct validity proofs to Ethereum and zkSync Era a zk‑Rollup that offers near‑instant finality via zero‑knowledge proofs) generate cryptographic proofs that the batch is correct before it ever reaches Ethereum. No challenge window is needed; finality arrives as soon as the proof is posted and accepted.

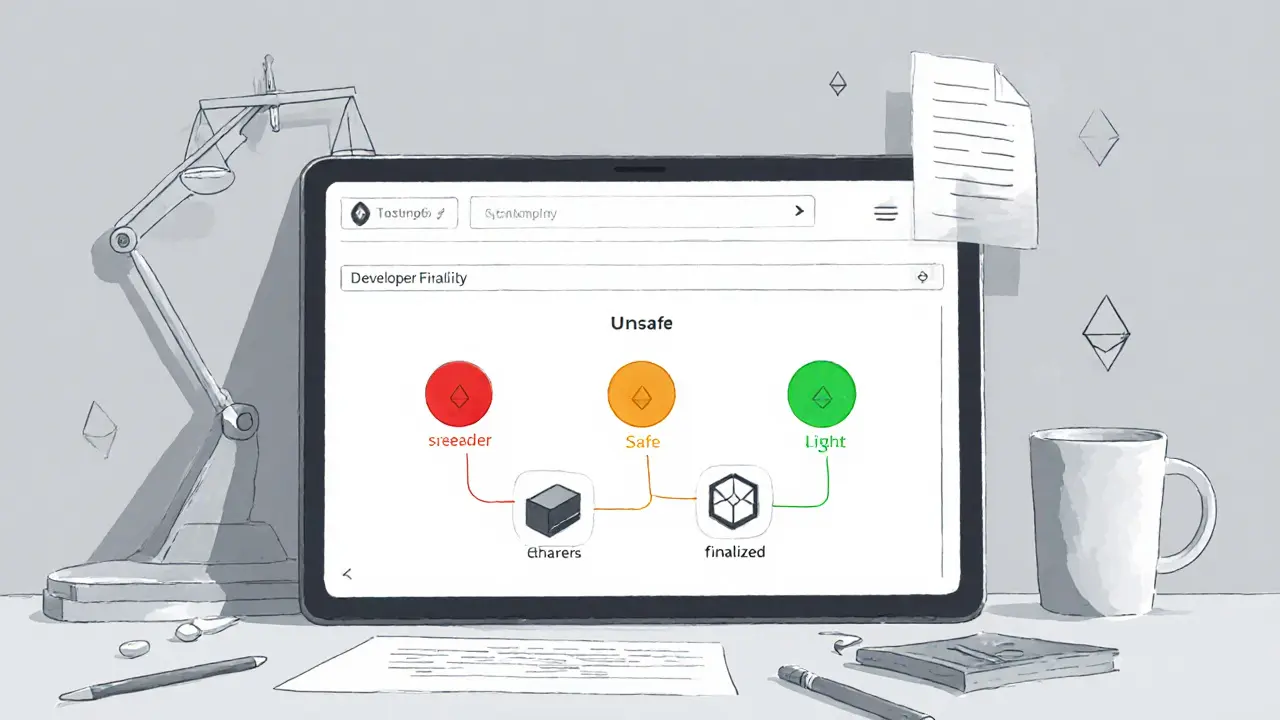

Multi‑stage finality on optimistic rollups

Optimistic rollups layer three states on top of Ethereum’s own finality:

- Unsafe: The sequencer includes your transaction in a batch and posts it to its own chain. At this point the transaction can be re‑ordered or even censored.

- Safe: The batch data lands in an Ethereum block. Most developers treat this as “good enough” for UI updates because the data is now on‑chain. This typically happens 5-10 minutes after submission.

- Finalized: Ethereum’s consensus marks the containing block as final (about 12.8 minutes under normal conditions). Only after this point can you claim Ethereum‑level security.

ZK‑rollup finality timeline

Because validity is proved mathematically, ZK‑rollups skip the unsafe/safe distinction. The sequence looks like:

- Proof generation: The rollup computes a zk‑SNARK or STARK that attests to the correctness of the batch. This can take a few seconds to a couple of minutes depending on load.

- Proof submission: The proof is posted to Ethereum. Once the block containing the proof is mined, the batch is considered final.

Why finality matters for developers

Missing the finality nuance can lead to costly bugs. A common mistake is treating the “safe” state on Optimism as final. If a reorganization happens before Ethereum finalizes the block, a bridge could release funds that later get slashed, creating a double‑spend scenario. Trail of Bits documented several L2 clients that relied only on a simple block‑height delay, exposing bridges to exactly this risk.

Best‑practice checklist:

- Listen to the

forkchoiceUpdatedevent from an Ethereum node to confirm true finality. - On Optimism, call the SDK’s

isFinalized()method instead of using block numbers. - On ZK‑rollups, verify that the proof inclusion receipt is mined and has ≥ 2 confirmations.

- Implement a fallback timeout (e.g., 30 minutes) that alerts users if finality takes longer than expected.

Performance trade‑offs

Optimistic rollups win on computational simplicity-sequencers don’t need to generate heavy proofs, so batch sizes can be larger and fees lower. The downside is the long challenge window, which can stretch to a week in the worst case. ZK‑rollups deliver fast finality and stronger security guarantees, but proof generation can spike gas costs and requires more powerful hardware.

Table below summarizes the core differences.

| Aspect | Optimistic Rollups | ZK‑Rollups |

|---|---|---|

| Typical finality time | ~12minutes (finalized) + up to 7days challenge window | 5-15minutes (proof inclusion) |

| Security model | Fraud‑proof based; assumes validity unless challenged | Validity proofs; mathematically guaranteed correctness |

| Computational load | Low for sequencer, low for verifier | High proof generation, modest verifier cost |

| Typical gas fee (per transaction) | ~$0.10-$0.30 (depending on batch size) | ~$0.20-$0.50 (proof overhead) |

| Best use‑case | Gaming, NFTs, social dApps where latency is tolerable | DeFi, high‑value settlements, cross‑chain bridges |

Regulatory and market impact

Finality isn’t just a technical detail; it ties into compliance. The European MiCA regulation demands settlement finality within 24hours for certain assets. Optimistic rollups’ seven‑day window can clash with that requirement, pushing exchanges to adopt longer withdrawal hold periods for those L2s. By contrast, zkSync withdrawals often appear on user dashboards within minutes, aligning better with regulator expectations.

Market data shows developers gravitate toward faster finality for DeFi. DappRadar reported a 227% YoY growth of DeFi projects on ZK‑rollups versus 142% on optimistic rollups in Q22023. The speed advantage translates into better arbitrage opportunities and lower risk of price slippage.

Future directions

The rollup ecosystem is already iterating on finality. Optimism’s Retro‑PGF funding aims to shrink the challenge period to 1-2days by improving fraud‑proof aggregation. StarkWare’s proof‑aggregation roadmap promises sub‑5‑minute finality for StarkNet by early 2024. Academic research from the Ethereum Foundation explores “asynchronous finality,” letting dApps pick their own risk tolerance-fast “soft” finality for UI updates, and delayed “hard” finality for settlement.

Analysts predict a convergence toward a 5-10minute sweet spot by 2025, with ZK‑rollups likely setting the standard because they already deliver near‑instant guarantees. However, the computational cost of generating proofs at massive scale could re‑ignite interest in hybrid models that combine optimistic batching with occasional zk‑proof checkpoints.

Quick checklist for developers

- Identify the rollup type you’re on (optimistic vs. ZK).

- Map out the three safety states if you’re on Optimism or Arbitrum.

- Integrate SDK calls that explicitly check

isFinalized()(Optimism) or proof receipt confirmations (ZK). - Monitor Ethereum’s

forkchoiceUpdatedevents to avoid reorg surprises. - Plan UI flows that hide “finalized” status until the appropriate window passes.

Frequently Asked Questions

When does a transaction become truly final on Optimism?

True Ethereum‑level finality arrives when the Ethereum block that contains the Optimism batch is finalized by the proof‑of‑stake consensus, usually around 12‑15 minutes after the batch is posted. The intermediate “safe” state (5‑10 minutes) is not enough for high‑value settlement.

Can I rely on a ZK‑rollup’s proof without waiting for Ethereum confirmations?

The proof itself guarantees correctness, but most wallets still wait for at least one Ethereum confirmation to protect against rare reorgs. After that, the transaction is considered final.

What’s the biggest security risk if I ignore finality checks?

Skipping finality checks can let a bridge release funds before the underlying L2 transaction is immutable. An attacker could trigger a reorg, causing the bridge to lose those assets and potentially lead to a systemic exploit.

Do all rollups inherit Ethereum’s finality schedule?

Optimistic rollups inherit Ethereum’s finality because they rely on the main chain for dispute resolution. ZK‑rollups post validity proofs to Ethereum, so they also depend on Ethereum’s block finality, but the user‑visible finality is much faster.

How can I reduce the optimistic rollup challenge period for my app?

You can’t change the protocol‑level window, but you can design your UI to only consider the “safe” state for non‑critical actions and wait for the “finalized” state for high‑value moves. Some projects also use “fraud‑proof accelerators” that allow validators to submit proofs faster, cutting the effective challenge time.

David Moss

17 October, 2025 . 08:31 AM

If you think rollups are safe you’re living in a delusion!!!

Kaitlyn Zimmerman

18 October, 2025 . 01:11 AM

Developers often skip the nuance between “safe” and “finalized”. The safe state appears when the batch lands on Ethereum but it can still be reverted. A bridge that releases funds at this point is exposing users to a re‑org risk. Make sure your UI only shows final status after Ethereum finality is reached. This practice saves you from costly bugs.

DeAnna Brown

18 October, 2025 . 17:51 PM

Listen up folks, the rollup saga is not some bedtime story you can skim over! Optimistic rollups masquerade as final when they’re merely “safe”, and that distinction is the difference between a secure transaction and a spectacular disaster. ZK‑rollups, on the other hand, flash their proofs like a superhero cape, delivering near‑instant finality. Ignoring these details is akin to marching into battle without armor – you’ll get burned. Trust me, I’ve seen projects crumble because they treated “safe” as the final word.

Ikenna Okonkwo

19 October, 2025 . 10:31 AM

When we contemplate the nature of finality on rollups, we must first acknowledge the duality of certainty and uncertainty that underpins any distributed system. On one hand, the Ethereum base layer offers a mathem‑matically provable finality through its proof‑of‑stake consensus, yet even that is subject to a brief window of reorganization before the supermajority votes lock the block. On the other hand, layer‑2 solutions inherit this temporal tension, each adding its own layer of assumptions. Optimistic rollups, for instance, place trust in the honesty of the sequencer until a fraud proof surfaces, creating an “unsafe” period that is invisible to most users. The subsequent “safe” period, marked by the batch’s inclusion in an Ethereum block, feels final but remains vulnerable until the block itself is finalized. ZK‑rollups sidestep this by emitting a cryptographic proof that mathematically guarantees correctness before the batch ever reaches the base chain. This proof, however, still depends on the Ethereum block that records it, because the network must agree on the block’s inclusion. Consequently, users often experience a perceived finality as soon as the proof transaction is mined, even though a single block reorg could theoretically alter history. The practical lesson for developers is to align UI states with the appropriate confidence level: show a provisional “pending” status during the unsafe phase, a “confirmed” badge after safe inclusion, and a “final” label only after Ethereum finality. Moreover, the design of fallback timers, such as a 30‑minute grace period, can mitigate edge cases where network congestion delays finality. From a philosophical standpoint, this layered approach mirrors the human experience of trust – we begin with provisional belief, then seek corroboration, and finally accept an outcome as immutable. By internalizing these stages, developers can build resilient applications that respect both the technical and ergonomic aspects of finality. Remember, the security of your users hinges on the rigor with which you respect these nuances. In short, treat each stage with the caution it deserves, and your protocol will stand the test of time. Thus, the journey from unsafe to finality is not just a technical path but a trust journey for every participant.

Jessica Cadis

20 October, 2025 . 03:11 AM

Rollups are reshaping the blockchain landscape, but not all rollups are created equal. Optimistic solutions trade speed for a lengthy challenge window, while ZK‑rollups sacrifice some computational efficiency for rapid finality. Developers need to match their use case with the appropriate model, especially when dealing with high‑value DeFi contracts. Ignoring these differences can lead to costly security oversights.

Sara Stewart

20 October, 2025 . 19:51 PM

Exactly, the gas economics you mentioned are pivotal – on Optimistic layers you benefit from lower calldata costs, yet you pay the price of a potential 7‑day dispute. ZK‑rollups mitigate that risk by publishing succinct SNARK proofs, which, despite higher verification gas, provide near‑instant settlement guarantees. When you architect a bridge, embed the isFinalized() call for Optimistic chains and verify proof receipts on ZK chains. This dual‑approach ensures both cost efficiency and robust security across the stack.

Devi Jaga

21 October, 2025 . 12:31 PM

Wow, thanks for the masterclass in basic rollup mechanics – truly groundbreaking insights. I guess next you'll tell us that water is wet. Anyway, if you already know the difference, maybe stop littering the thread with obvious statements.

Schuyler Whetstone

22 October, 2025 . 05:11 AM

Yo, hear me out – if you’re still using Optimism without checking the challenge period you’re basically handing over your cash to strangers. It’s a moral failure to ignore the finality gap. Get your act together and read the docs before you ship sh*t.

Pierce O'Donnell

22 October, 2025 . 21:51 PM

Sure, but many projects rely on the “safe” state for UX reasons, and the risk is minimal if they monitor Ethereum finality. Still, better safe than sorry.

Bobby Lind

23 October, 2025 . 14:31 PM

Wow, this discussion really brings out the best and worst of rollup tech, huh?.,,, I love how the community dives deep into finality nuances, and it shows just how complex scaling can be,,,. Keep the insights coming!

Katharine Sipio

24 October, 2025 . 07:11 AM

Indeed, the distinction between safe and finalized states is crucial for developers. Maintaining a clear separation in user interfaces helps prevent accidental fund releases. Thank you for summarizing the importance of this practice.

Shikhar Shukla

24 October, 2025 . 23:51 PM

It is incumbent upon practitioners to recognize that neglecting Ethereum’s finality criteria constitutes a breach of best‑practice standards. The oversight not only jeopardizes asset security but also undermines the credibility of the protocol. A rigorous adherence to the finalized state is non‑negotiable for any serious deployment.

Carolyn Pritchett

25 October, 2025 . 16:31 PM

Oh, look who’s preaching compliance – the same folks who ignore the very same rules they champion. If you’re so worried about standards, maybe start by checking your own code before throwing stones.