Crypto Exchange Review: Security, Fees & Features Explained

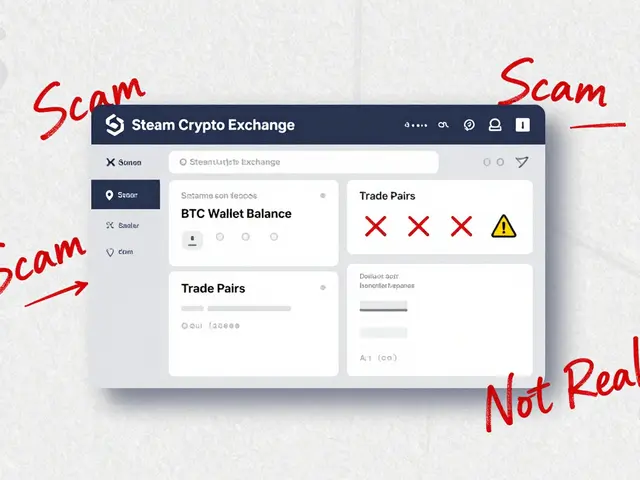

When diving into crypto exchange review, a systematic assessment of a digital asset platform’s safety, cost structure, and user experience. Also known as exchange analysis, it helps traders gauge whether an exchange meets their risk tolerance and trading goals. A solid security assessment examines encryption methods, custody solutions, and past breach history, while a thorough fee breakdown reveals maker‑taker spreads, withdrawal costs, and hidden charges.

Beyond safety and cost, a crypto exchange review must look at trading features, such as order types, margin options, and liquidity depth. API availability is another critical factor; developers and algorithmic traders rely on robust API integration to execute strategies without latency. Finally, regulation shapes an exchange’s compliance posture, affecting user verification, reporting obligations, and regional access. In short, crypto exchange reviews encompass security assessments, require fee analysis, and consider regulatory impact—each element shaping the overall suitability of a platform.

Below you’ll find a curated collection of deep‑dive reviews that break down each of these pillars. From security checklists to fee comparisons, API performance tests to regulatory overviews, the articles are organized to give you actionable insights right away. Ready to see how the top exchanges stack up? Explore the posts and find the exchange that ticks all the boxes for your trading style.

MM Finance (Polygon) Crypto Exchange Review: Is MMF a Legitimate Token or a Scam?

MM Finance (Polygon) token MMF is a scam with zero supply and no trading volume. The real MM Finance DEX exists without a token. Avoid MMF - it's worthless and dangerous.

View MoreTrustdex Crypto Exchange Review: Why It's Dead and What to Use Instead

Trustdex was a crypto exchange that shut down in 2019 with no warning. Learn why it failed, what made it unique, and which exchanges you should use instead in 2026.

View MoreValue DeFi Protocol Crypto Exchange Review: What You Need to Know in 2026

Value DeFi Protocol is not a real crypto exchange. This review exposes the scam, explains how fake DeFi projects operate, and lists trusted alternatives like Uniswap, AAVE, and Lido to keep your funds safe in 2026.

View MoreSterling Finance Crypto Exchange Review: A High-Risk DeFi Protocol with Near-Zero Activity

Sterling Finance crypto exchange is a dead DeFi protocol with zero liquidity, broken tokenomics, and no team. Avoid it completely - it's not worth the risk.

View MoreAryana Crypto Exchange Review: What We Know and What You Should Be Careful About

Aryana crypto exchange has no verifiable details-no audits, no licenses, no user reviews. Don't risk your crypto on a platform that won't prove it's real. Stick to trusted exchanges like Kraken or Bitstamp instead.

View MoreOnBlock Exchange Review: Is This Crypto Exchange Legit or a Scam?

A thorough look at OnBlock Exchange, its missing credentials, red flags, and how to verify any crypto platform before you trust your funds.

View MoreSushiSwap V3 on Arbitrum: In‑Depth Review of the Decentralized Crypto Exchange

A thorough review of SushiSwap V3 on Arbitrum covering fees, liquidity, rewards, risks, and how it stacks up against Uniswap for crypto traders.

View More