Central Bank Iran crypto: How Iran's State Controls Crypto Mining and Trading

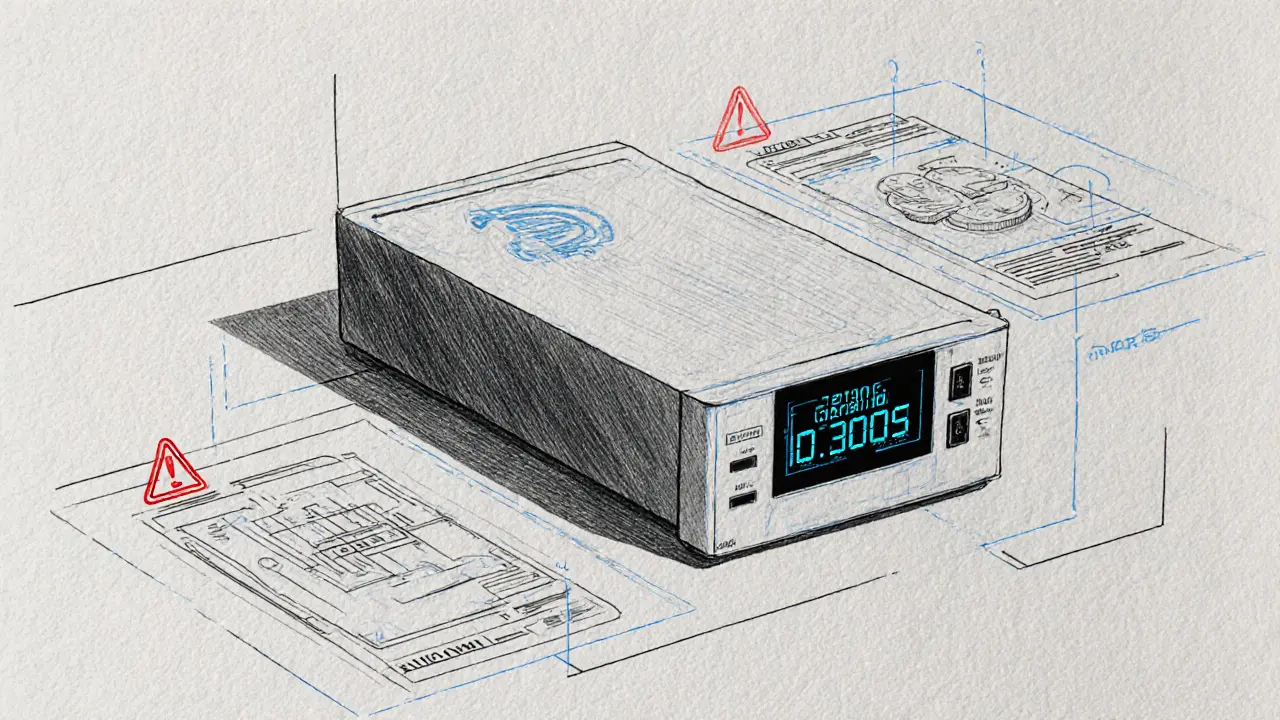

When you hear Central Bank Iran crypto, the official monetary authority of Iran regulating digital assets under state control. Also known as Central Bank of Iran, it has become one of the most aggressive state actors in the global crypto space. Unlike most countries that ban or ignore crypto, Iran doesn’t try to stop it — it owns it. Since 2025, the Central Bank of Iran has forced every licensed crypto miner to sell 30% of their mined Bitcoin and other coins directly to the state at fixed prices. This isn’t a tax. It’s a mandatory seizure.

This move ties directly to Iran crypto mining, a massive industry fueled by cheap electricity and government tolerance. Iran has some of the lowest power rates in the world, making it a magnet for crypto miners from Russia, Turkey, and even the U.S. But the government didn’t want foreign investors keeping the profits. So they turned mining into a state-run resource extraction program. Miners get to keep 70% — but only if they register, use approved hardware, and report every hash. Unregistered miners? They get shut down, fined, or worse.

The real goal? Fund imports and weaken the private crypto market. Iran’s economy is under heavy sanctions, and the rial keeps crashing. By forcing miners to sell Bitcoin to the Central Bank, the state gets hard currency to buy food, medicine, and fuel from abroad. At the same time, it suppresses local crypto trading by flooding the market with state-controlled coins at low prices. This makes it harder for Iranians to use crypto as a savings tool — because the government controls the supply.

And it’s working. Since the 2025 rules kicked in, peer-to-peer crypto trading in Iran dropped by nearly 60%. People still use it — but mostly through unofficial channels, Telegram groups, and black-market exchanges. Meanwhile, the Central Bank of Iran quietly built its own digital wallet infrastructure to track every transaction. They’re not just regulating crypto — they’re turning it into a tool of economic warfare.

What you’ll find below are real posts that dig into these policies, the miners caught in the middle, the scams that popped up because of the chaos, and how this model might spread to other sanctioned nations. No fluff. No theory. Just what’s actually happening on the ground in Iran — and what it means for anyone holding crypto in a country where the state says, "This belongs to us now."

Iranian Central Bank Mandates Crypto Sales from Miners Under New 2025 Regulations

Iran's Central Bank now requires all crypto miners to sell 30% of their output directly to the state under new 2025 regulations. This mandatory sales policy is part of a broader effort to control digital assets, bypass sanctions, and manage energy use.

View More