Iran Crypto Miner Earnings Calculator

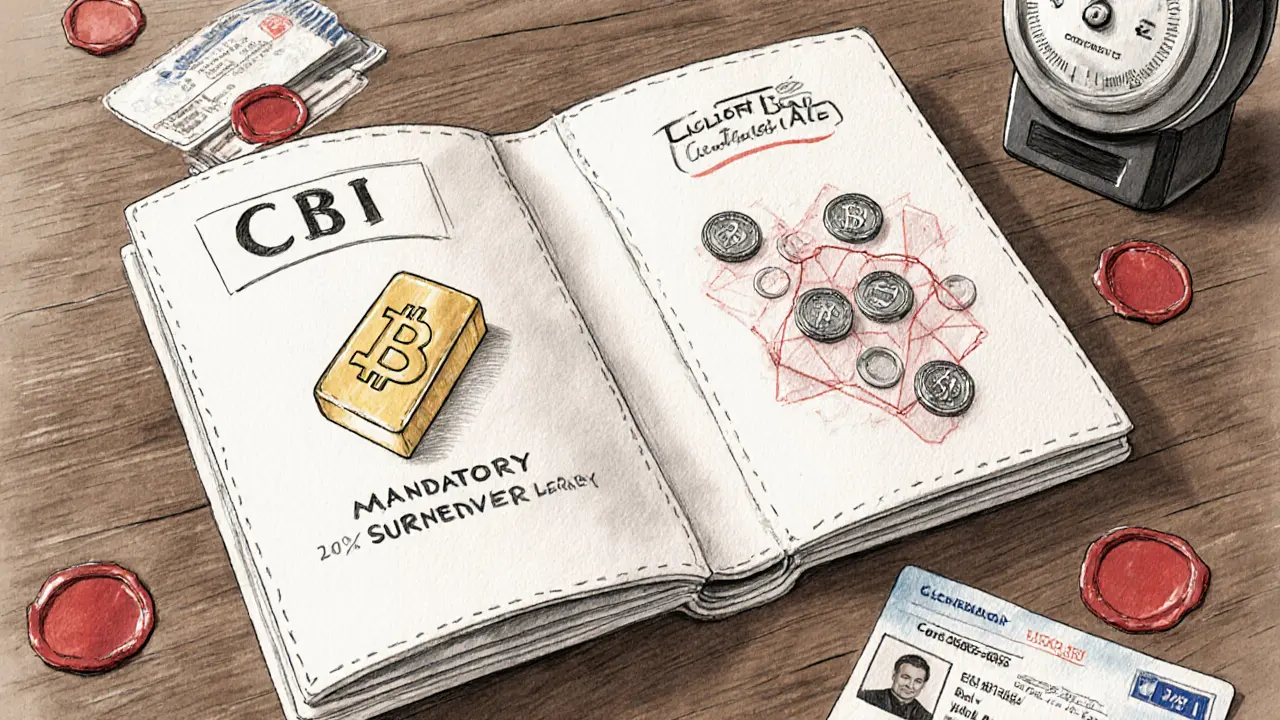

Calculate your actual earnings after Iran's mandatory 30% crypto sale requirement to the Central Bank. The CBI pays miners at a discounted rate tied to black-market dollar prices.

CBI Payment Rate: 71.4% of international price

(28% discount from market price)

Important Note: This calculator uses a 28% discount rate (71.4% of market price) based on the article's example. Actual rates may vary. Your earnings represent the total value after mandatory sale to the Central Bank of Iran.

Disclaimer: This tool is for educational purposes only. It simulates the financial impact of Iran's mandatory crypto sales policy as described in the article. Actual earnings may differ based on regulatory changes, market conditions, and other factors not modeled here.

Iran’s cryptocurrency miners don’t just mine Bitcoin anymore-they’re now required to sell a portion of their output directly to the Central Bank of Iran. This isn’t a suggestion. It’s a legal requirement, enforced since January 2025, as part of a sweeping overhaul of the country’s digital asset rules. If you’re mining crypto in Iran, you’re no longer free to hold or trade it privately. The state now controls the flow of every coin produced on Iranian soil.

Why the Central Bank Took Control

Iran has been using crypto mining as a workaround for U.S. sanctions for years. With banks cut off from the global financial system, Bitcoin and other digital assets became a way to earn foreign currency without using dollars. But by late 2024, things got out of hand. Thousands of unlicensed mining rigs popped up across the country, sucking up electricity during rolling blackouts. In some cities, power outages lasted up to 12 hours a day-not because of drought or poor infrastructure, but because miners were running 24/7 rigs on subsidized grid power. The government couldn’t ignore it anymore. So in January 2025, President Masoud Pezeshkian handed full control of crypto to the Central Bank of Iran (CBI). No more underground farms. No more private sales. Every mining operation, big or small, now needs a license. And as part of that license, miners must surrender 30% of their daily output to the CBI at a fixed rate in rials. The rest can be sold on licensed exchanges-but only after passing strict KYC checks.How the Mandatory Sales System Works

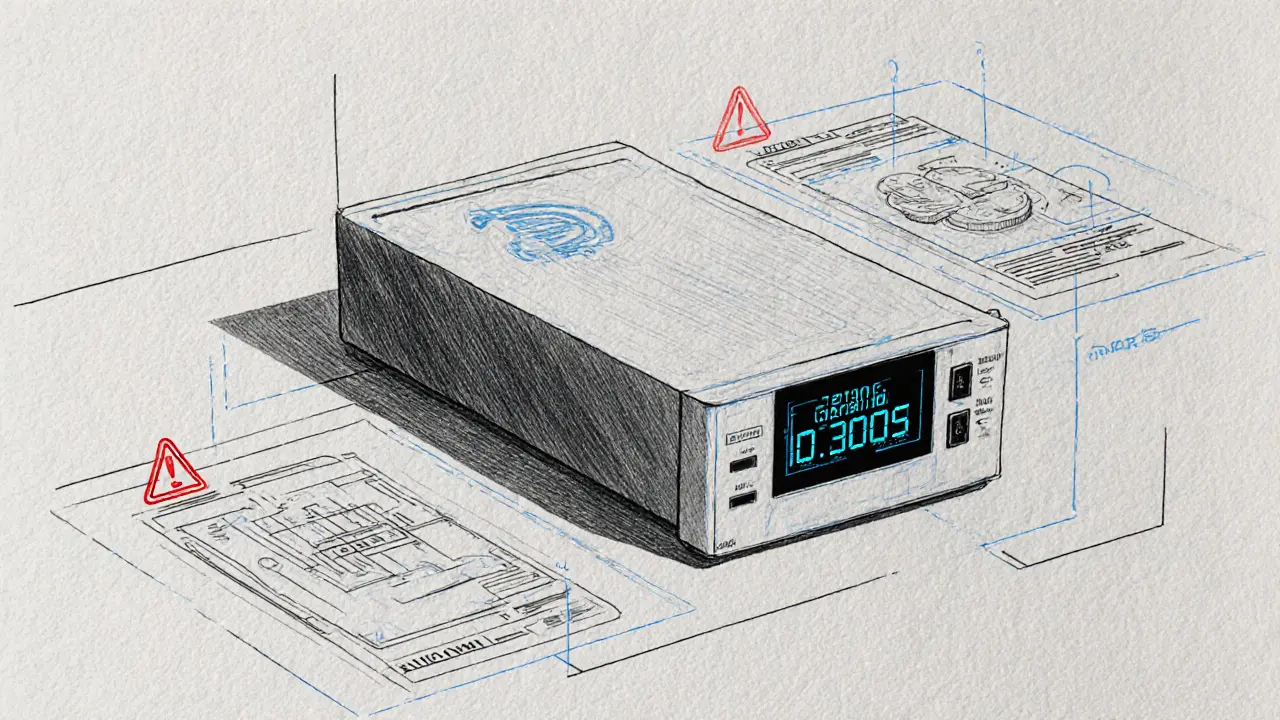

Here’s how it actually plays out on the ground:- Miners register with the CBI and install government-approved monitoring software on their mining rigs.

- The software tracks every hash rate, power draw, and coin mined in real time.

- Every 24 hours, 30% of mined Bitcoin (or other approved coins) is automatically transferred to a CBI-controlled wallet.

- The remaining 70% can be sold on approved domestic exchanges, but only after the miner submits their transaction history for audit.

- Failure to comply results in immediate shutdown of equipment, fines up to 10 million rials (about $200), and possible criminal charges.

Who’s Running the Mines Now?

The biggest players aren’t individual hobbyists. They’re state-backed entities. Since 2020, the Islamic Revolutionary Guard Corps (IRGC) has quietly taken over the mining sector. They operate massive farms in places like Rafsanjan and Kerman, using dedicated power lines that never get cut during blackouts. One 175-megawatt facility in Kerman province, built with Chinese hardware, reportedly mines over 200 Bitcoin per month. These state-run operations don’t just mine-they launder. The CBI takes the coins, sells them overseas through intermediaries in Turkey, UAE, and Russia, and converts them into euros or yuan. That money then flows back into Iran’s economy, bypassing sanctions and funding everything from military projects to state subsidies. Regular miners? They’re stuck in the middle. Many used to sell directly to traders on Telegram or local exchanges. Now, those channels are blocked. The CBI shut down 87 unlicensed exchanges in the first quarter of 2025. If you’re caught selling outside the system, your equipment is seized. Your home might be raided. Your bank account freezes.

Energy Crisis and Public Backlash

The government claims this system helps stabilize the grid. But the numbers don’t add up. Iran’s total mining power draw is still estimated at 2,500 megawatts-roughly 10% of the country’s total electricity production. That’s more than the entire city of Tehran uses. In February 2025, power cuts hit 18 provinces. People blamed miners. The CBI blamed illegal operations. But here’s the truth: even licensed miners are using the same grid. The state farms get priority, but the rest? They’re still drawing power that could go to hospitals, schools, or homes. Public anger is growing. The Iran Fintech Association, which represents digital asset startups, publicly refused to hand over user data to the CBI. They called it a violation of privacy and a death sentence for innovation. The government responded by banning all crypto advertising-online, on billboards, even on bus stops. You can’t promote a crypto exchange anymore. Not even if you’re just trying to help people hedge against inflation.What This Means for Miners and Users

If you’re a miner in Iran, you have three choices:- Register with the CBI, surrender 30% of your output, and accept the fixed payment.

- Go underground-risk fines, arrest, and equipment confiscation.

- Stop mining entirely.

The Bigger Picture: Sanctions, Sovereignty, and Control

Iran isn’t trying to be crypto-friendly. It’s trying to survive. The state doesn’t care about decentralization. It doesn’t care about financial freedom. It cares about one thing: keeping the economy running under sanctions. Crypto mining is now a tool of economic warfare. The coins mined in Iran become foreign currency. That foreign currency buys food, medicine, and weapons. The CBI doesn’t just regulate mining-it uses it as a revenue stream. And the mandatory sales? They’re not a tax. They’re a forced export. The digital rial pilot on Kish Island? That’s the next phase. The government wants to replace Bitcoin with its own state-controlled digital currency. But until that’s ready, Bitcoin is the backup plan. And miners? They’re just the fuel.What’s Next?

The CBI is already testing a blockchain-based ledger to track every mined coin from rig to wallet. They’re talking about linking mining licenses to national ID numbers. They’re considering mandatory reporting of all crypto-related internet traffic. One thing’s clear: Iran’s crypto experiment is no longer about technology. It’s about control. And if you’re mining in Iran, you’re not building the future. You’re feeding the state.There’s no way out. No loophole. No gray area. The Central Bank owns the coins. And if you want to keep your rig running, you’ll sell what it makes.

Komal Choudhary

28 November, 2025 . 20:30 PM

So now the state owns your Bitcoin? That’s wild. I mean, I get why they’re doing it, but it’s like they turned every miner into a forced laborer for the economy. And the power cuts? Yeah, that’s on them. They knew this was coming.

Tina Detelj

29 November, 2025 . 23:06 PM

This isn’t regulation-it’s digital feudalism. You mine, you sweat, you overclock your rigs until your motherboard screams… and then the state swoops in like a velvet-gloved vulture, takes 30% of your digital blood, and pays you in rials that lose value faster than your GPU’s hash rate. Welcome to the new dystopia, where decentralization is a crime and your rig is a tax collector’s best friend.

Wilma Inmenzo

30 November, 2025 . 00:36 AM

CBI is just the front for the IRGC. You think they’re buying Bitcoin? Nah. They’re using it to buy drone parts, missile fuel, and maybe a few luxury yachts in Dubai. And that monitoring software? It’s not tracking your mining-it’s tracking YOU. Your IP. Your router. Your Netflix history. They’re building a crypto surveillance state and calling it ‘economic sovereignty’.

priyanka subbaraj

1 December, 2025 . 03:21 AM

They shut down 87 exchanges. People lost everything. And now? No way to save. No way out. Just surrender or suffer. This isn’t policy. It’s persecution.

George Kakosouris

1 December, 2025 . 08:14 AM

The 30% mandatory take is essentially a 28% effective tax on mining profitability, which collapses the marginal utility curve for small-scale operators. Add in the KYC overhead and the CBI’s fixed-rate arbitrage, and you’ve got a classic rent-seeking mechanism disguised as monetary policy. The real crypto innovation here? State capture via algorithmic extraction.

Tony spart

1 December, 2025 . 16:03 PM

Iranians think they can just mine Bitcoin and laugh at the US? Nah. You’re just a bunch of power-hungry thieves stealing electricity while your kids freeze. If you want to be rich, go get a job. Not everyone needs to be a crypto bro. The state’s doing the right thing-take your rigs and go.

Ben Costlee

2 December, 2025 . 16:39 PM

I can’t imagine living in a place where your only way to protect your savings is to risk your home, your freedom, or your electricity. There’s no winning here. The miners aren’t villains-they’re desperate people trying to survive. The real villain is a system that turns technology into a weapon against its own citizens. This breaks my heart.

Mark Adelmann

3 December, 2025 . 22:27 PM

Honestly, this feels like the world’s most messed-up version of a pyramid scheme. You mine, you give up most of your profit, and the state turns it into cash to fund… well, who knows what. But at least the miners still get paid, right? Kinda. It’s not freedom, but it’s not total ruin either. Still, I feel for them.

ola frank

5 December, 2025 . 06:13 AM

The CBI’s blockchain ledger initiative represents a paradigmatic shift from decentralized consensus to centralized provenance. By binding mining licenses to national IDs and monitoring internet traffic, they’re effectively creating a permissioned blockchain infrastructure-antithetical to the ethos of Bitcoin yet perfectly aligned with authoritarian governance models. The irony is not lost: a decentralized asset is being weaponized to enable total control.

imoleayo adebiyi

5 December, 2025 . 12:23 PM

This is tragic. People just want to survive. I come from a country where the internet is slow and the power is unreliable too. But we don’t punish people for trying to make a better life. The state should be helping, not taking. Maybe they could use the Bitcoin to fund renewable energy instead of weapons? That would be a real win.

Angel RYAN

6 December, 2025 . 07:57 AM

They’re not banning crypto. They’re just making it a state-run utility. Like water or electricity. You don’t own the pipe-you just pay for the flow. Kinda cold. But maybe it’s the only way to keep the lights on.

stephen bullard

6 December, 2025 . 10:32 AM

I know it sounds harsh, but think about it-without this, Iran’s economy would’ve collapsed years ago. The miners are the unsung heroes here. They’re not just mining coins-they’re keeping the country alive. Maybe the system’s unfair, but what’s the alternative? Let the power grids burn? I’m not defending the 30%, but I get why it exists.

SHASHI SHEKHAR

7 December, 2025 . 03:43 AM

Okay, let’s break this down 🧠. So Iran’s using crypto as a sanctions workaround since 2018, right? Then they hit 2,500 MW of mining power-like, that’s more than some European countries. So they clamp down. Mandatory 30% to CBI? Fine. But here’s the kicker-they pay in rials at black-market rates, not official. That’s actually smart. It keeps miners compliant because they’re not getting ripped off by the government’s fake exchange rate. Also, IRGC running 175MW farms? No surprise. They’ve been doing this since 2020. What’s wild is the monitoring software. Real-time hash tracking? That’s next-level surveillance. But honestly? If you’re mining in Iran, you signed up for this. The real tragedy? The average person can’t even buy BTC to hedge inflation anymore. That’s the real loss. 🥲

Vaibhav Jaiswal

8 December, 2025 . 20:19 PM

The whole thing feels like watching someone burn their house to stay warm. You get the heat, but you lose everything else. Iran’s not building a future. It’s just buying time.

Abby cant tell ya

10 December, 2025 . 00:04 AM

You miners thought you were rebels? Nah. You were just pawns in a game you didn’t even know you were playing. Now you’re begging the state for permission to run your own machines. Pathetic.