July 2025 Archive – Crypto, Blockchain & Stock Market Insights

When you dive into July 2025, the month‑long archive of crypto, blockchain, and market content on PoolMega, you’re stepping into a snapshot of fast‑moving finance. This period captures the pulse of digital assets, the tweaks in protocol design, and the way those shifts ripple into traditional equities. Think of it as a time‑capsule that lets you see where the market headed and why.

One of the biggest threads woven through the month is cryptocurrency, digital assets that use cryptography to secure transactions. From Bitcoin’s price wobble after a major policy announcement to Ethereum’s upgrade rollout, each story needed the backbone of blockchain, decentralized ledger technology that records crypto activity. The month also highlighted DeFi, decentralized finance services that run on blockchain projects launching new yield farms and a wave of liquidity mining incentives that caught traders’ eyes. Meanwhile, the stock market, public exchanges where shares of companies are traded felt the echo of crypto sentiment, especially as tech stocks tied to blockchain infrastructure saw earnings beat expectations.

What made July stand out? Airdrops surged after several layer‑2 solutions announced token distributions – a clear sign that developers keep using giveaways to bootstrap network effects. Mining pools grew in size too, with new consortiums forming to balance hash power across regions, which in turn steadied block times during spikes in transaction volume. Liquidity pools on decentralized exchanges swelled as traders chased high APY rates, prompting a handful of protocols to adjust fee structures to protect against impermanent loss. All these pieces illustrate how July 2025 crypto trends aren’t isolated; they intertwine with broader finance, tech adoption, and regulatory chatter.

What’s Inside the July 2025 Collection

Below you’ll find a curated mix of deep‑dives, quick market snapshots, and how‑to guides that reflect the month’s energy. Expect detailed coin profiles that break down price drivers, step‑by‑step tutorials on staking and pool participation, and unbiased reviews of emerging exchanges that launched this summer. If you’re looking for the data that shaped trading decisions or want to peek at the next big DeFi wave, the posts in this archive give you the facts without the fluff.

Ready to see how the themes fit together? Browse the list and uncover the specific analyses, tool recommendations, and actionable tips that powered July’s discussion. Each entry builds on the ideas introduced here, so you can piece together a full picture of the crypto‑stock crossover that defined the month.

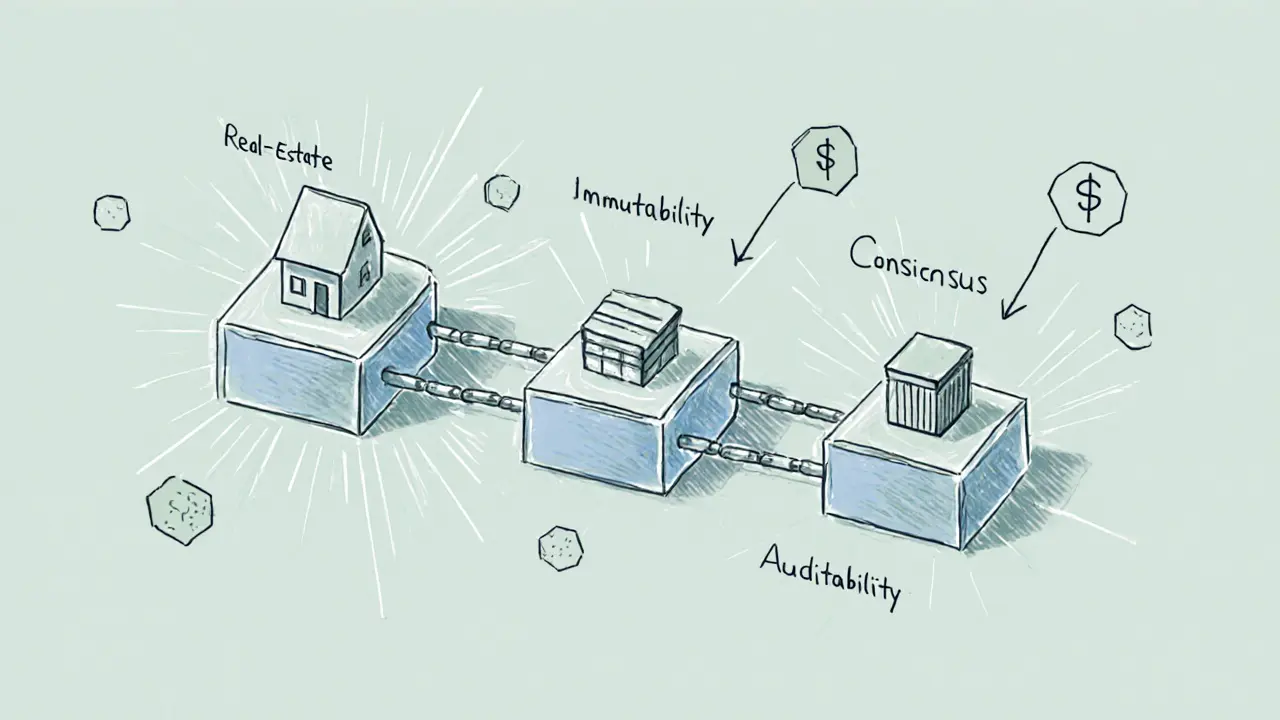

How Blockchain Transparency Stops Fraud

Explore how blockchain's transparent, immutable ledger stops fraud across real estate, supply chains, finance, and crypto, with real‑world examples and implementation tips.

View MorePandaSwap (PND) Airdrop Details: Claim Guide, Eligibility Tasks, and Token Distribution

Learn the full details of the PandaSwap (PND) airdrop: token allocation, eligibility steps, contract info, and how to claim your free tokens.

View MoreMOO DENG (MOODENG) Explained: Meme Token, Blockchain Platforms, Price & How to Trade

Learn what MOO DENG (MOODENG) crypto is, its blockchain confusion, market data, how to buy it, community role, risks, and price outlook-all in a clear, practical guide.

View MoreSphynx Labs DeFi Platform Review: Token, App & Risks

A deep dive into Sphynx Labs, covering its DeFi app, native SPHYNX token, market data, user experience, risks and price outlook for investors.

View MoreCantoSwap Review: Deep Dive into the Canto DEX

An in‑depth CantoSwap review covering how the DEX works, fees, security, liquidity, wallet setup, and a side‑by‑side comparison with major AMM platforms.

View MoreHow Argentine Peso Instability Fuels Rapid Cryptocurrency Adoption

Explore how Argentina's hyperinflation and strict capital controls are driving massive cryptocurrency and stablecoin adoption, reshaping everyday finance and future prospects.

View MoreLC SHIB (LC) Crypto Coin Explained: What It Is, How It Works, and Risks

LC SHIB (LC) is a meme‑coin with unclear blockchain, unverified tokenomics, and high volatility. Learn its basics, risks, and how to assess it before investing.

View More