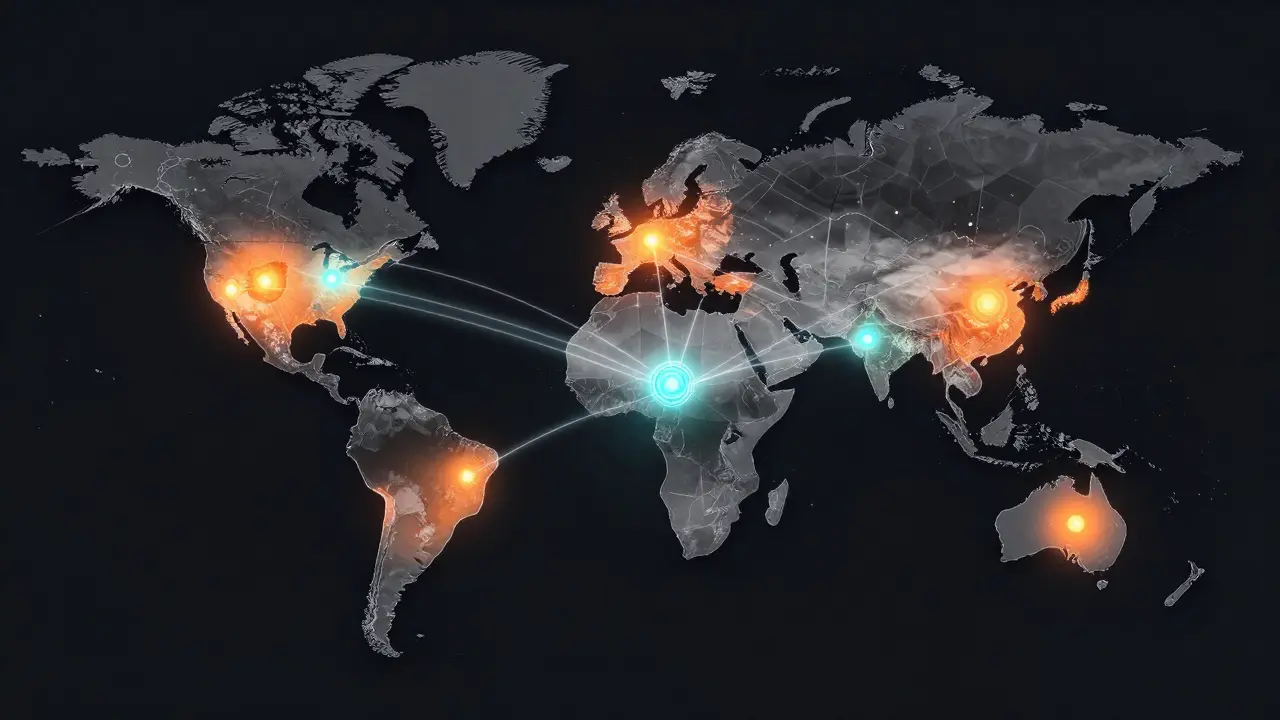

When you're looking for a crypto exchange that feels fast, simple, and gives you cashback just for trading, Cryptomus sounds like a dream. It offers negative maker fees-yes, you read that right-where you get paid to place buy orders. It supports over 110 coins, has a 24/7 Telegram support team, and lets you trade crypto with cash in more than 200 countries. But here’s the catch: in 2023, the Canadian government fined Cryptomus $176 million for helping cybercriminals launder money. That’s not a typo. That’s a massive red flag. So is Cryptomus still worth using? Or is it a ticking time bomb? Let’s cut through the marketing and look at what really matters: security, fees, regulation, and real user experiences.

What Cryptomus Actually Offers

Cryptomus isn’t just a trading platform. It’s a full crypto ecosystem. You can:- Trade spot pairs (100+ trading pairs like BTC/USDT, ETH/USDC)

- Buy and sell crypto peer-to-peer (P2P) with local currencies

- Accept crypto payments as a merchant

- Earn rewards with their native token, CRMS (worth $1 and withdrawable as USDT)

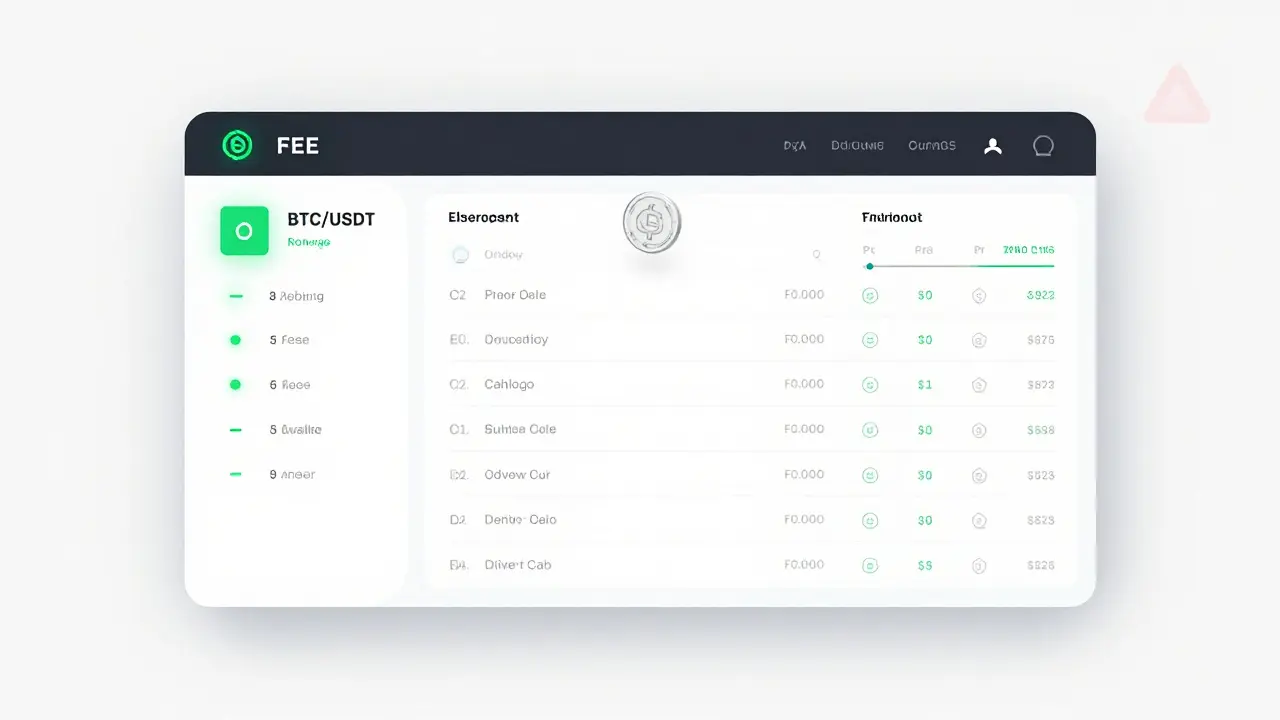

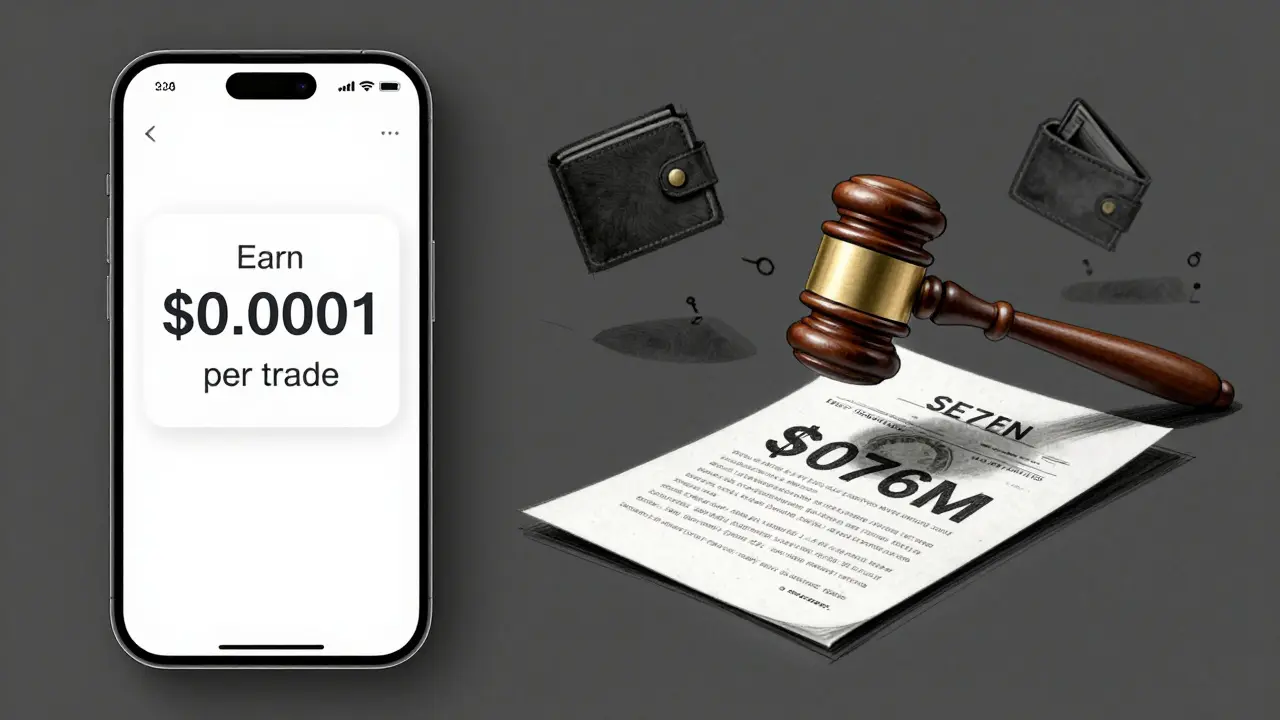

Fees: The Only Exchange That Pays You to Trade

Most exchanges charge you to trade. Cryptomus flips that. Their maker fees range from -0.01% to 0.08%. That means if you place a limit order that doesn’t immediately fill (a "maker" order), you might actually get paid a tiny amount. Taker fees are 0.04% to 0.1%, which is competitive. Compare that to Binance (0.1% maker, 0.1% taker) or Kraken (0.16% maker, 0.26% taker). Cryptomus wins on cost-for liquidity providers, anyway. But here’s the catch: you need to trade a lot to really benefit. If you’re just buying $100 of Bitcoin once a month, the fee difference is negligible. The real value is for traders who move volume-especially those using P2P. Their P2P platform charges a flat 0.1% fee per trade. That’s half of what LocalBitcoins charges. And users report trades clearing in under 5 minutes. That’s faster than most bank transfers.Security: Strong on Paper, Questionable in Practice

Cryptomus boasts serious security features:- SSL encryption

- Two-factor authentication (2FA)

- PIN code protection

- Session reset and device whitelisting

- Cold storage for 95% of funds

- Hardware wallet integration recommended

Regulatory Trouble: The 6 Million Bomb

This is the most important part. Cryptomus is headquartered in Vancouver, Canada. That means they’re under Canadian law. And in 2023, Canada’s Financial Transactions and Reports Analysis Centre (FINTRAC) slapped them with a $176 million penalty for:- Failing to assess money laundering risks

- Failing to report large virtual currency transactions

- Operating with outdated registration information

- Not implementing proper AML (Anti-Money Laundering) controls

How Cryptomus Compares to the Big Players

| Feature | Cryptomus | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Maker Fees | -0.01% to 0.08% | 0.10% | 0.40% | 0.16% |

| Taker Fees | 0.04% to 0.1% | 0.10% | 0.60% | 0.26% |

| Coins Supported | 110+ | 350+ | 200+ | 200+ |

| Futures Trading | No | Yes | Yes | Yes |

| Fiat On-Ramps | Limited (bank transfers, cards) | Many (bank, card, PayPal) | Excellent (bank, ACH, wire) | Strong (bank, wire) |

| Regulatory Status | Fined $176M (2023) | Global compliance | Fully licensed (US, EU) | Compliant with US, EU, Canada |

| P2P Fee | 0.1% | 0.1% | 0.5% | 0.1% |

| Available in US? | No | No (US users restricted) | Yes | Yes |

Who Should Use Cryptomus? Who Should Avoid It?

Use Cryptomus if:- You’re in a country where banks won’t let you trade crypto (Nigeria, Philippines, Argentina, etc.)

- You trade P2P often and want the lowest fees

- You’re comfortable with high risk because you’re only holding small amounts

- You’re okay with the possibility that withdrawals could be frozen again

- You’re in the US, Japan, Russia, or any country that follows strict financial regulations

- You’re holding more than $1,000 in crypto

- You want long-term stability

- You care about regulatory compliance

Real User Experiences

On Trustpilot, Cryptomus has a 4.2/5 rating based on 1,250 reviews. Most positive reviews mention:- Fast P2P settlements

- Easy-to-use app

- Responsive Telegram support

- "My withdrawal got stuck for 11 days after the fine. No explanation."

- "I lost $800 in a P2P scam because their dispute system was useless."

- "I trusted them until I saw the news. Now I’m on Kraken."

The Bottom Line

Cryptomus isn’t a scam. It’s not a Ponzi. It’s a platform that got too big, too fast, and ignored the rules. It offers features no other exchange does: paying you to trade, blazing-fast P2P, and access in regions where crypto is otherwise locked out. For many, that’s worth the risk. But if you’re looking for a safe, long-term place to store or trade crypto, Cryptomus is not it. The $176 million fine isn’t just a number-it’s a warning. Regulators are watching. Other countries might follow Canada’s lead. For now, use Cryptomus only if you’re okay with gambling on its survival. Keep your funds low. Withdraw often. Don’t get attached. Because in crypto, the best security isn’t encryption. It’s choosing a platform that doesn’t need to be fined to prove it’s broken.Is Cryptomus safe to use in 2026?

Cryptomus has improved its compliance systems since the 2023 $176M fine, but it’s still under regulatory scrutiny. If you’re in the US, Japan, or Russia, you can’t use it at all. For others, it’s risky. Only use it for small amounts, and never store large holdings there. Withdraw regularly. Treat it like a temporary tool, not a long-term wallet.

Why was Cryptomus fined $176 million?

Canada’s financial watchdog, FINTRAC, fined Cryptomus for failing to prevent money laundering. They processed over 1,000 transactions linked to darknet marketplaces, didn’t report 7,557 transactions from Iran (a sanctioned country), and had outdated registration records. They didn’t have proper AML checks in place, which is a serious violation for any financial platform.

Can I withdraw my crypto from Cryptomus right now?

Yes, withdrawals are open, but they’re still monitored closely. High-volume users may face temporary limits or delays. If you’re withdrawing large amounts, expect possible holds while they review the transaction. It’s not as smooth as it was before the fine, but it’s not blocked.

Does Cryptomus support fiat deposits?

Limited. You can deposit via bank transfer or card in select countries, but not everywhere. Unlike Coinbase or Kraken, Cryptomus doesn’t integrate with major banking systems. That’s why most users rely on P2P trading-buying crypto directly from other users with cash or local payment methods.

What happens if Cryptomus shuts down?

If Cryptomus shuts down, you could lose access to your funds. Unlike regulated exchanges that hold user assets in segregated accounts, Cryptomus doesn’t guarantee protection. There’s no insurance fund. No bankruptcy protection. If they collapse, your crypto is at risk. That’s why experts advise against storing more than you’re willing to lose.

What to Do Next

If you’re already using Cryptomus:- Withdraw any funds you don’t need immediately

- Move your holdings to a hardware wallet (Ledger or Trezor)

- Watch for official announcements from their Telegram channel

- Consider switching to Kraken or Binance if you’re eligible

- Try a regulated exchange first

- Use Cryptomus only for small P2P trades if you’re in a restricted region

- Never deposit more than you can afford to lose