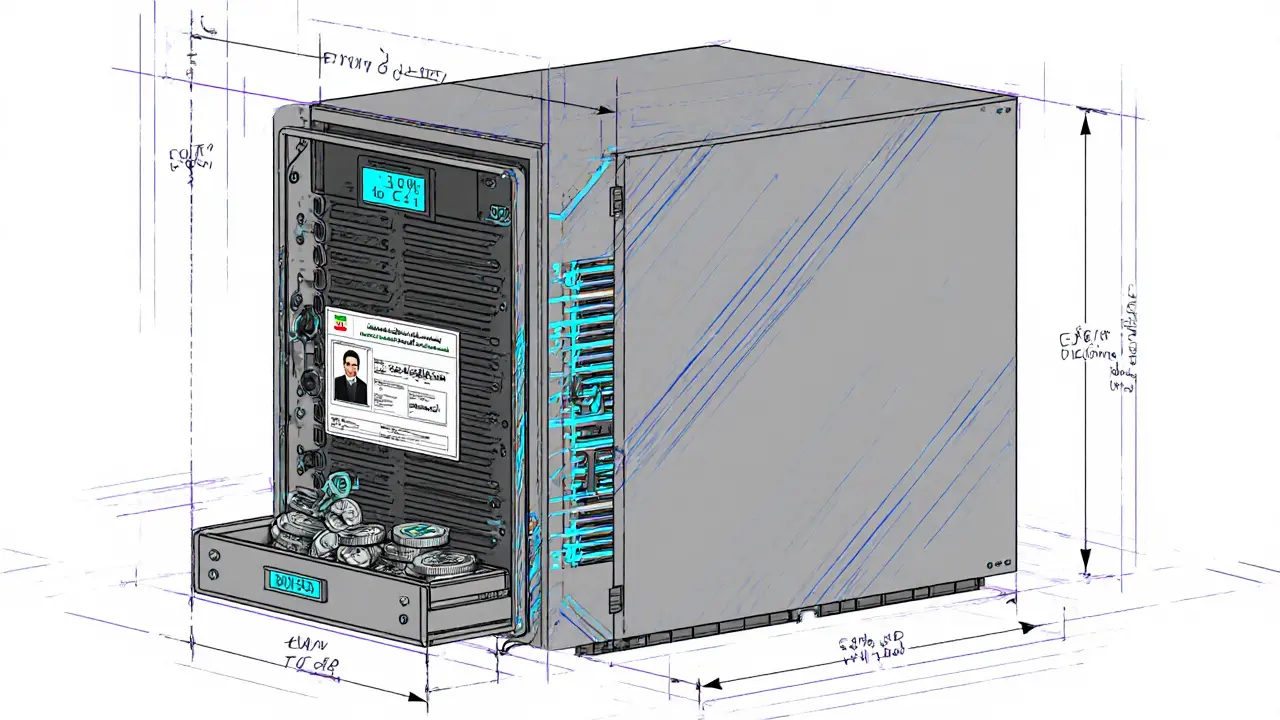

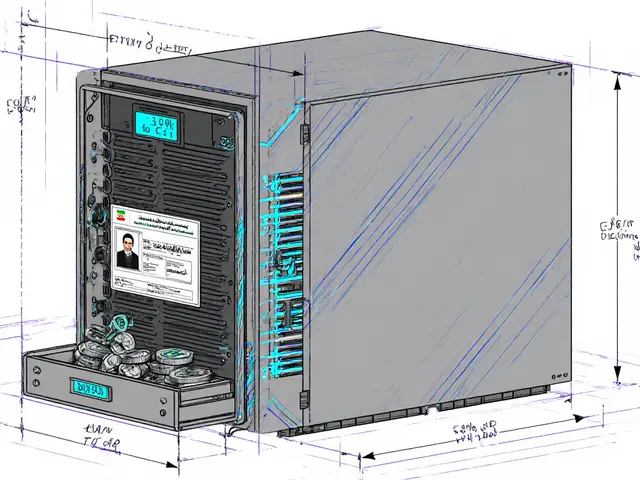

Iran Crypto Sales Calculator

Calculate Your Actual Mining Earnings

Based on Iran's Central Bank regulations requiring 30% of mined coins to be sold to the state at official exchange rates (20-30% lower than black market rates).

Your Earnings Breakdown

Iran’s cryptocurrency mining industry isn’t just operating under rules-it’s operating under a microscope. As of early 2025, the Central Bank of Iran (CBI) has tightened its grip on every aspect of digital asset production, requiring miners to sell a portion of their output directly to state-controlled entities. This isn’t a suggestion. It’s a legal requirement. And it’s reshaping how mining happens in the country.

Why the Central Bank Took Control

Iran’s economy has been under heavy sanctions for years. The U.S. and European Union have blocked access to global banking systems, making it nearly impossible for Iranian businesses to receive dollars or euros. In response, the government turned to Bitcoin. Mining became a way to generate foreign currency without touching traditional banks. But by 2024, things got messy. Unregulated mining farms were sucking up massive amounts of electricity. Rolling blackouts hit cities like Tehran, Isfahan, and Shiraz. At the same time, miners were selling Bitcoin on peer-to-peer markets, bypassing the rial entirely. The government couldn’t track the money. It couldn’t control the flow. And the rial kept falling. In January 2025, President Masoud Pezeshkian gave the Central Bank of Iran full authority over crypto. No more gray areas. No more underground farms. Every miner-individual or corporate-must now be licensed. And they must hand over a portion of their mined coins to the state.How the Mandatory Sales System Works

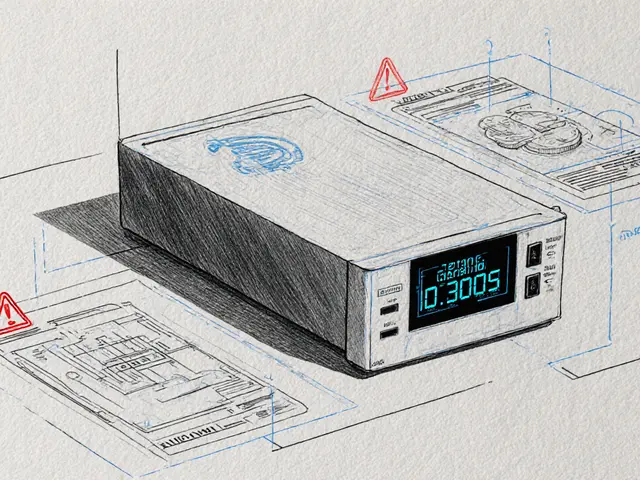

The rule is simple: miners must sell 30% of their monthly Bitcoin and Ethereum output to the CBI at the official exchange rate. That rate is set weekly and is typically 20-30% lower than the black market price. The rest can be sold on approved domestic exchanges, but only after passing strict KYC checks. The CBI doesn’t just take coins. It takes data. Every mining rig must be registered with a unique ID. Power consumption is monitored in real time through government-linked smart meters. If a farm uses more than its licensed allotment, it’s shut down. Repeat offenders face fines or jail time. This isn’t about stopping mining. It’s about controlling it. Iran still wants to be one of the top five global miners. It just wants to make sure the profits go to the state, not to private hands.Who’s Affected?

There are two types of miners in Iran now: licensed and unlicensed. Licensed miners are mostly large operations tied to the Islamic Revolutionary Guard Corps (IRGC) or state-owned enterprises. These farms, like the 175-megawatt facility in Rafsanjan, get priority power access and are exempt from some of the stricter reporting rules. They still have to sell 30% to the CBI-but they’re allowed to keep the rest and trade it on approved platforms. Smaller miners-individuals running rigs in garages or warehouses-are now in a tight spot. Many used to sell Bitcoin directly to buyers in Turkey or the UAE. Now, those transactions are blocked. The CBI has shut down over 200 unlicensed crypto-to-rial exchange websites since February 2025. If you’re mining without a license, you’re breaking the law. And if you try to sell on the black market, your wallet can be traced.What Happens to the Coins the CBI Buys?

The Central Bank doesn’t hold Bitcoin to speculate. It uses the coins as a foreign currency reserve. When it needs dollars, it sells Bitcoin to foreign intermediaries-often through shell companies in Oman, Qatar, or Armenia. These intermediaries then convert the Bitcoin into cash and transfer it to Iranian importers who need to pay for medicine, food, or machinery. It’s a workaround. A clever one. Instead of relying on SWIFT, Iran is using blockchain. And it’s working. In 2024, Iran’s Bitcoin mining output was estimated at $950 million. The CBI claims it collected $285 million in coins from miners that year. That’s enough to cover 15% of Iran’s essential imports.

Resistance and Loopholes

Not everyone is playing along. The Iran Fintech Association has publicly refused to comply with data-sharing demands, calling them a violation of privacy. Some miners are switching to Monero or other privacy coins, hoping to avoid tracking. Others are using mesh networks to bypass internet censorship and sell directly to foreign buyers. There’s also a growing trend of miners exporting hardware. Instead of mining in Iran, they’re shipping ASIC rigs to Turkey, Georgia, or Kazakhstan-where electricity is cheaper and regulations are looser. The rigs are still owned by Iranians, but the mining happens abroad. The profits come back via hawala networks or crypto-to-crypto swaps. The CBI is aware of these moves. In March 2025, it announced plans to ban the export of mining equipment without a special permit. Violators could face asset seizures.Energy and the Real Cost

Iran has some of the cheapest electricity in the world. That’s why miners flooded in. But the grid can’t handle it. In December 2024, power outages lasted up to 12 hours in some provinces. The government blamed unauthorized mining for 30% of the strain. To fix this, the CBI introduced a tiered power pricing system. Miners using more than 100 kW/month pay triple the rate. Those under 10 kW pay a subsidized rate-but only if they’re licensed and compliant. Still, many small miners can’t afford the upgrade to energy-efficient rigs. A 2024 study by Tehran University found that 68% of home miners still use outdated Antminer S9s, which consume 1,375 watts per terahash. Newer models like the Antminer S21 use less than half that. But they cost $5,000-$8,000. Most Iranian miners can’t afford that.The Digital Rial and the Future

The CBI isn’t just controlling Bitcoin. It’s preparing for the digital rial. A pilot program on Kish Island is testing a state-backed digital currency that can be used for domestic payments. The goal? Replace Bitcoin as the people’s store of value. But here’s the catch: the digital rial is fully traceable. Every transaction is logged. There’s no anonymity. That’s the opposite of what Bitcoin offers. If the digital rial succeeds, demand for Bitcoin could drop. Miners might leave. But if it fails-and the rial keeps falling-people will keep turning to crypto. And the CBI will keep demanding their coins.

What This Means for Miners

If you’re mining in Iran in 2025, you have three choices:- Get licensed, sell 30% to the CBI, and keep the rest on approved exchanges.

- Go underground, risk fines or arrest, and sell on black markets with no protection.

- Ship your rigs abroad and mine elsewhere, keeping profits but losing control over your hardware.

Joel Christian

29 November, 2025 . 04:18 AM

this is wild lol i didnt even know iran was still mining crypto

Brian Bernfeld

30 November, 2025 . 18:17 PM

The state is basically turning miners into tax collectors with ASICs. Brilliant in a dystopian way. They're using blockchain to bypass SWIFT while pretending they're cracking down on it. Classic Iranian workaround. The 30% mandate? That's not regulation-that's nationalization with a crypto twist.

Tina Detelj

1 December, 2025 . 09:11 AM

Oh my god, this is like a cyberpunk novel written by a central banker who just watched The Matrix for the first time... I mean, they're not banning crypto-they're *domesticating* it. Turning Bitcoin into a state-controlled currency proxy while pretending it's about energy conservation. The hypocrisy is almost poetic. And the fact that they're using Monero users as scapegoats? 😂😂😂

Vijay Kumar

3 December, 2025 . 01:44 AM

This is exactly what happens when you mix religion with technology. The state wants control. Always. Bitcoin was freedom. Now it's a state asset. Sad.

Felicia Sue Lynn

4 December, 2025 . 09:23 AM

It's fascinating how economic isolation breeds innovation. While the West obsesses over crypto regulation as a threat, Iran has turned it into a lifeline. Not ideal, certainly not ethical in its enforcement-but undeniably resourceful. The digital rial may fail, but this experiment reveals how resilient decentralized systems can be under pressure.

priyanka subbaraj

5 December, 2025 . 08:52 AM

I can't believe people still mine in Iran. The electricity crisis is real. And now they're jail time? What a disaster.

Evelyn Gu

6 December, 2025 . 23:49 PM

I mean, I get it, right? The rial is trash, the banks are blocked, people need to eat, and Bitcoin is the only thing that doesn’t require a visa to trade. But the government turning every miner into a state employee? The smart meters? The ID tags on rigs? It’s like they’ve built a crypto surveillance state and called it ‘economic reform.’ I just... I don’t know if I’m more horrified or impressed. My heart goes out to those garage miners with S9s trying to survive. And the export of hardware? That’s the real rebellion. They’re not fighting the state-they’re just leaving it behind. And honestly? I don’t blame them.

Wilma Inmenzo

7 December, 2025 . 14:17 PM

This is all a CIA psyop. The U.S. knew Iran would turn to crypto. They let it grow so they could monitor every transaction. The 'black market' wallets? Tracked. The 'private miners'? Under surveillance. The digital rial? A backdoor to global financial control. They want to kill anonymity so they can track *everyone*. This isn't about Iran-it's about the global surveillance grid. They're testing it here first. I told you all this would happen. 😎

Mark Adelmann

8 December, 2025 . 09:37 AM

Honestly, I think Iran’s doing what any country would do if it got cut off from the global system. If your currency is collapsing and you can’t import medicine, you find a way. Bitcoin isn’t perfect, but it’s liquid. And if the state takes 30% to keep the lights on and the hospitals running? I’d take that trade. The real tragedy is the small miners getting crushed. Not the policy.

Michael Fitzgibbon

10 December, 2025 . 03:58 AM

There’s something deeply human here. People in garages, running S9s on stolen power, just trying to feed their families. The state doesn’t care about their ethics-it cares about their hash rate. But you can’t outlaw desperation. That’s why the hardware exports are booming. They’re not running from the law-they’re running from a system that sees them as a resource, not a person. And honestly? I think history will remember this as the moment crypto stopped being a tech revolution and became a survival tactic.

Ben Costlee

11 December, 2025 . 12:28 PM

I’ve lived in three countries that faced hyperinflation. Venezuela, Lebanon, Argentina. What Iran’s doing isn’t unique-it’s just the next evolution. When the state controls the money, it controls the people. But crypto? It doesn’t care about borders. Even if you force miners to sell 30%, the rest still moves. The black markets adapt. The mesh networks grow. The hawala networks get smarter. You can’t stop this. You can only delay it. And in the end, the people always find a way.

ola frank

11 December, 2025 . 12:28 PM

The economic logic here is sound: extract value from an unregulated asset class to stabilize a collapsing fiat. The energy pricing tiering? Smart. The KYC on domestic exchanges? Necessary. The real flaw is the assumption that centralized monitoring of mining rigs is scalable. ASICs are modular, decentralized, and easily reconfigured. The CBI’s data infrastructure is a house of cards. They’ll catch the big farms. But the distributed, low-power, mobile miners? They’ll vanish into the urban grid. The state thinks it’s controlling the supply chain. It’s actually creating a black-market innovation incubator.

jeff aza

12 December, 2025 . 07:26 AM

The 30% mandate is just a tax. But they're calling it 'mandatory sales' to sound like they're not taxing. Classic. Also, 'approved exchanges'? More like state-approved gambling dens. And the fact they're using Oman as a shell? Please. That's not clever-it's pathetic. They're not innovating, they're laundering. And the S9s? Those things are energy hogs. If they're still using them, they're not miners-they're digital hoarders with a death wish.

imoleayo adebiyi

13 December, 2025 . 02:10 AM

This reminds me of Nigeria’s CBDC struggles. The state wants control, but the people want freedom. The energy crisis is real, but punishing small miners won’t fix it. The real solution? Invest in renewables. Let miners run on solar. But no-better to arrest them and call it policy. The digital rial will fail. People won’t trade in something that tracks every penny. They’ll still use Bitcoin. Even if they have to hide it.

George Kakosouris

13 December, 2025 . 12:49 PM

Let’s be real: Iran is using crypto as a weapon against the West. The CBI isn’t regulating-it’s weaponizing. The 285 million in coins? That’s not revenue-that’s geopolitical leverage. And the fact they’re selling through Armenia and Qatar? That’s not a loophole-it’s a military operation. This isn’t about mining. It’s about asymmetric economic warfare. And honestly? I’m impressed. They turned a sanction into a strategy.

Vance Ashby

14 December, 2025 . 12:23 PM

so they're forcing miners to sell to the state at a discount... and then selling it abroad for real money? that's like stealing from the poor to pay the rich. and the digital rial? lol. no one trusts it. people will still use btc. always. 😒

Ian Esche

15 December, 2025 . 05:32 AM

Iran thinks it’s clever? It’s just a third-world kleptocracy with GPUs. The U.S. and EU should slap even more sanctions on their mining rigs. Let them fry in their own blackouts. This isn’t innovation-it’s theft. And if they’re exporting hardware? Ban those shipments. Shut it all down. We don’t fund terrorist economies with Bitcoin.

Komal Choudhary

17 December, 2025 . 03:55 AM

I’m from India and I’ve seen how governments treat tech. But this? This is next level. They’re not just controlling crypto-they’re redefining what it means to be a citizen. If you mine, you’re a state servant. If you don’t, you’re a criminal. And the digital rial? It’s not money. It’s a prison. I feel bad for the miners. But I also feel bad for the people who just want to buy medicine. This whole system is broken.

Tony spart

18 December, 2025 . 12:02 PM

Iranians think they’re so smart with their crypto scams. But let me tell you something-when the West finally cracks down, they’ll be begging for SWIFT again. And guess what? No one will help them. This is all temporary. The state is just delaying the inevitable collapse. And those miners? They’re pawns. Useless pawns.