Solana Meme Coin: Trends, Tokenomics & What to Watch

When talking about Solana meme coin, a community‑driven token built on Solana that aims for viral popularity. Also known as Solana meme token, it leverages Solana’s low fees to spread quickly. The broader category of meme coin, cryptocurrencies that rely on internet jokes and hype rather than heavy tech follows a similar playbook, but the Solana network adds a speed advantage. Solana meme coin enthusiasts often chase the next viral wave, watching community memes, token launches, and social media buzz.

Why Solana’s blockchain matters for meme tokens

The Solana blockchain, a high‑throughput, low‑cost layer‑1 protocol known for sub‑second finality gives meme creators the freedom to mint and trade without the fee pain seen on Ethereum. This technical edge translates into more frequent airdrops, rapid price swings, and a lower barrier for newcomers to mint their own joke token. Because transactions settle in milliseconds, community‑driven events like meme contests or flash sales can execute smoothly, fueling the viral loop that meme coins thrive on.

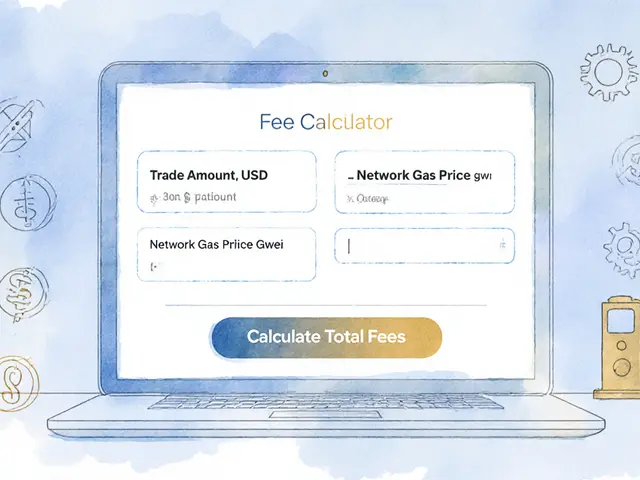

Understanding tokenomics, the supply schedule, distribution model, and incentive structures behind a cryptocurrency is the next step. Most Solana meme coins adopt a fixed or deflationary supply, with a large portion reserved for community rewards, liquidity pools, and early‑adopter airdrops. When a token’s supply is capped at, say, 1 billion units and 30% is earmarked for a launch airdrop, the initial hype can push the price up sharply—but the same design can also trigger rapid sell‑offs once the hype fades. Comparing different tokenomics lets you spot which projects balance fun with sustainable incentives.

Airdrops are practically a rite of passage in the meme space. Projects on Solana often sprinkle free tokens to early users, encouraging wallet creation on the network and seeding a loyal follower base. These drops usually require simple tasks: joining a Discord, retweeting a meme, or staking a small amount of SOL. While many airdrops deliver negligible value, some have sparked multi‑million‑dollar rallies when the underlying token caught traders’ attention. Tracking airdrop calendars and eligibility rules helps you join the fun without falling for scams.

Risk, however, is baked into every meme coin launch. Volatility can eclipse 100% in a single day, liquidity may evaporate after the hype wave, and regulatory scrutiny can hit meme projects unexpectedly. Checking whether a token is listed on reputable crypto exchanges, platforms that enable buying, selling, and trading of digital assets gives you an extra safety net. Exchanges that enforce KYC and monitor for pump‑and‑dump activity tend to attract more serious investors, which can temper price swings over time.

Below you’ll find a hand‑picked collection of articles that dive deeper into each of these angles. From detailed tokenomics breakdowns to step‑by‑step airdrop guides and exchange reviews, the posts are organized to help you assess the next big Solana meme coin, avoid common pitfalls, and make smarter, faster decisions in this high‑energy corner of crypto.

What is DOLLY (DOLLY) crypto coin? The truth about the meme coin and its risks

DOLLY (DOLLY) is a Solana-based meme coin with no utility, zero trading volume, and a market cap under $13,000. It's a high-risk gamble, not an investment. Learn why most experts say avoid it.

View MoreWhat is TORSY (TORSY) Crypto Coin? Real Facts About This Solana Meme Token

TORSY is a Solana-based meme coin with no utility, no team, and minimal liquidity. Learn its real price, supply, risks, and why most experts say it's a high-risk gamble - not an investment.

View MoreWhat is Daddy Tate (DADDY) crypto coin? The full story behind the meme coin tied to Andrew Tate

Daddy Tate (DADDY) is a Solana-based meme coin tied to Andrew Tate, launched in June 2024. It spiked to $300M market cap, then crashed 83%. No utility, no team - just hype and controversy.

View MorePowsche (POWSCHE) Explained: Solana Meme Coin Basics, Price, and Risks

Learn what Powsche (POWSCHE) is, its Solana‑based tokenomics, price history, risks, and how to trade this Porsche‑themed meme coin.

View MoreWhat Is XDOG? A Full Guide to the XDOG Crypto Coin

A concise guide that explains what XDOG is, its Solana foundation, market data, trading options, storage methods, risk factors, and how to buy the token.

View More