Decentralized Autonomous Organizations (DAOs) don’t have CEOs or boardrooms. Instead, they run on code and collective decisions. If you want to change how a DAO spends its money, hires a developer, or updates its rules, you don’t ask a manager. You submit a proposal - and then the community votes on it. This system sounds simple, but behind it lies a complex dance of incentives, technology, and human behavior. Understanding how proposals are made and voted on is key to participating in any DAO - whether you’re a small holder or a whale with millions in tokens.

How Proposals Start: From Idea to On-Chain Action

Every DAO proposal begins as an idea. Maybe someone wants to fund a new marketing campaign. Or maybe they think the treasury should buy ETH instead of USDC. But ideas alone don’t do anything. In a DAO, an idea only becomes a proposal when it’s written down, formatted correctly, and submitted through the DAO’s governance system. Most DAOs use tools like Aragon is a governance platform that lets communities create and manage proposals with customizable voting rules, Snapshot is a non-custodial voting tool that allows DAOs to conduct off-chain polls using token balances, or Colony is a framework for DAOs that separates transactional proposals from simple decisions using reputation and staking. These platforms guide users through a checklist: write a title, explain the proposal, set a voting period, and sometimes link to supporting documents. Not all proposals are equal. Some DAOs require you to stake tokens just to submit one. For example, in MolochDAO is a grant-focused DAO that requires proposals to be sponsored by at least three members before they go to vote, three members must back your idea before it even appears on the ballot. This stops spam. Imagine if anyone could flood a DAO with 50 proposals a day - no one would have time to read them. Sponsorship acts like a filter. Other DAOs, like those using DAOhaus is a no-code platform that simplifies proposal creation for non-technical users, make it easier. Their drag-and-drop interface lets you pick from templates: "Fund a grant," "Change treasury allocation," or "Update governance rules." Still, even with simple tools, bad proposals fail. A Reddit user in the r/DAO community said they spent three hours just reading one proposal because it lacked structure. Clear writing matters. A good proposal answers: What? Why? How much? What happens if it passes or fails?How Voting Works: More Than Just Token Counts

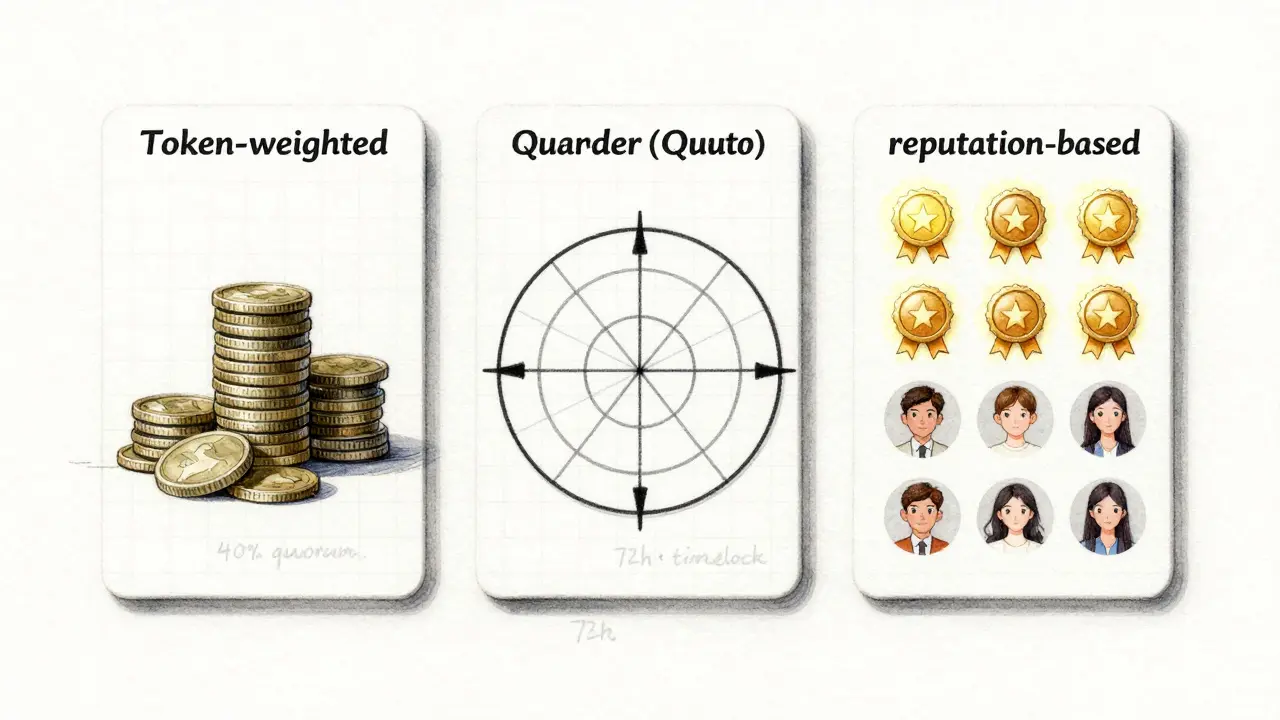

Once a proposal is live, members vote. But not all votes are created equal. The most common method is token-weighted voting. Each token you hold equals one vote. If you own 10,000 DAO tokens, you get 10,000 votes. Simple. Efficient. But deeply flawed. Take Uniswap is a decentralized exchange governed by its token holders, where the top 10 wallets controlled over 50% of voting power in 2022. In September 2022, Proposal #108 passed with 97.3% approval. Sounds great - until you learn only 15.2% of token holders voted. The rest didn’t bother. And the top 10 wallets held 50% of the voting power. That’s not democracy. That’s oligarchy. That’s why some DAOs use quadratic voting. This system, first proposed by economist Vitalik Buterin in 2018, makes voting power grow slower than token holdings. To cast 2 votes, you need 4 tokens. To cast 3 votes, you need 9 tokens. To cast 10 votes, you need 100 tokens. This means a holder with 10,000 tokens can’t just drown out 100 small holders. Their power is capped. Gitcoin is a funding platform that uses quadratic voting to distribute grants fairly among small projects adopted this in 2021. Their results? Voter turnout dropped by 37% because the math confused people. But those who did vote said they felt heard. Smaller contributors got more influence. It’s not perfect, but it’s fairer. Then there’s reputation-based voting. Some DAOs, like Colony, let members earn reputation points for contributing work - not just holding tokens. A developer who ships code gets more voting weight than someone who bought tokens on the open market. This rewards participation, not speculation.

Timelocks, Quorums, and the Hidden Rules

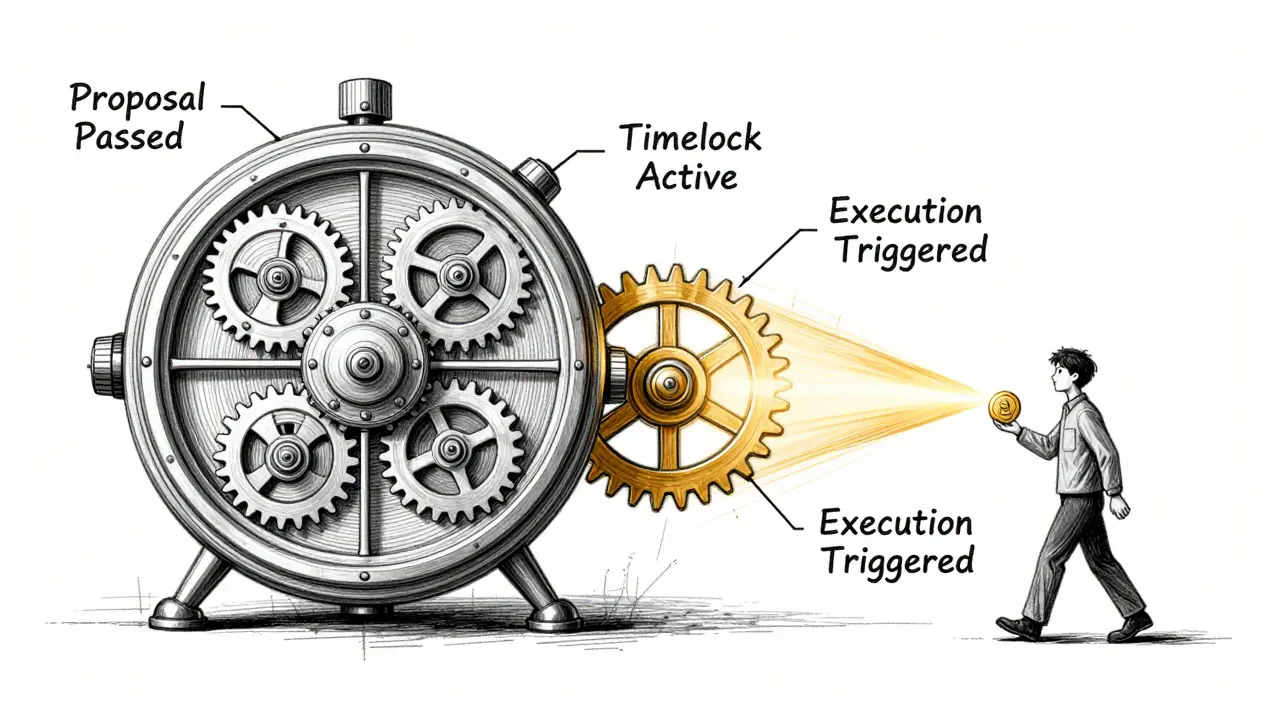

Even if a proposal passes, it doesn’t always execute immediately. Most DAOs use timelocks - delays between approval and execution. These are usually 48 to 168 hours. Why? To give people time to exit if they disagree. Imagine a proposal that drains the treasury. If it executed instantly, there’d be no way to stop it. A timelock gives the community a safety net. Another rule is the quorum. This is the minimum number of votes needed for a proposal to be valid. If a DAO sets a 40% quorum, and only 30% of tokens vote, the proposal fails - even if 90% of those who voted said yes. Some DAOs use 30%, others 50%. Compound is a DeFi protocol that requires 400,000 votes (about 40% of total supply) to pass any governance proposal. This ensures broad support before major changes happen. There’s also super-majority voting. For critical actions - like minting new tokens or changing the core rules - a simple majority isn’t enough. You need 67% or even 80%. MakerDAO is a decentralized stablecoin system that requires 75% approval for high-risk governance changes. This prevents rash decisions. But it also slows things down. A 2023 analysis found DAOs with super-majority rules had 41% fewer approved proposals.Why People Don’t Vote - And How DAOs Are Fixing It

Here’s the uncomfortable truth: most DAOs have terrible voter turnout. According to BlockScience is a research firm that analyzes DAO governance patterns and found average turnout below 20%, only 15-20% of token holders vote on most proposals. ConstitutionDAO is a short-lived DAO formed to buy a copy of the U.S. Constitution, which saw only 9.3% voter turnout during its campaign had just 9.3% turnout. Why? Two reasons: information overload and perceived lack of impact. People don’t vote because they don’t understand the proposal. Or they think their vote won’t matter. A 2023 survey found 68% of DAO members said they felt overwhelmed by the volume of proposals. Another 52% thought their vote wouldn’t change anything. DAOs are trying to fix this. Aragon added delegated voting in 2023. Now you can assign your vote to someone you trust - like a community leader or expert. In Aave is a DeFi lending protocol that saw a 12% increase in participation after implementing delegated voting, this boosted turnout by 12%. Colony introduced voting power decay - if you don’t vote for six months, your voting weight slowly drops. This discourages passive holders from dominating. Gitcoin tried gamification. They gave members badges for voting consistently. It worked. Participation rose. People liked the sense of contribution.

What Happens After a Proposal Passes?

Once a proposal passes and the timelock ends, the magic happens: smart contracts execute automatically. No human needs to click "approve." The code does it. This is one of DAOs’ biggest advantages. MakerDAO members say this eliminated 14 days of manual paperwork previously needed to move treasury funds. But automation isn’t foolproof. If the proposal had a bug - say, it was supposed to send 100 ETH but accidentally sent 1,000 - the code still executes. That’s why timelocks and quorums matter. They’re not just delays. They’re safety checks. Some DAOs also use rage quitting. If you vote yes and then realize the proposal is dangerous, you can withdraw your tokens and leave the DAO. This doesn’t stop the proposal - but it lets you cut your losses. It’s a way to protect yourself without needing to convince everyone else.What’s Next for DAO Voting?

The future of DAO governance is hybrid. No one expects every DAO to run on pure on-chain voting forever. Experts like Vitalik Buterin are pushing for conviction voting, where your vote grows stronger the longer you hold your position. In Gitcoin’s 2023 trial, this boosted small-holder participation by 31%. Others are combining on-chain votes with off-chain reputation. Imagine if your voting power came from your contributions - not your wallet balance. That’s what Colony and DAOStack are testing. Regulators are watching too. The SEC’s 2023 action against Nexus Mutual is a decentralized insurance DAO that faced legal scrutiny over its governance structure showed that DAOs aren’t immune to law. Future systems may need to prove they’re not securities. That could mean stricter rules on who can vote or how proposals are structured. One thing is clear: DAOs won’t survive if only a few people control them. The goal isn’t just to make decisions. It’s to make them fairly. That means fixing voter apathy, reducing whale power, and making participation meaningful - not just a checkbox.Can anyone create a proposal in a DAO?

Not always. Some DAOs allow anyone to submit a proposal, but many require sponsorship, staking, or reputation. For example, MolochDAO requires three members to back a proposal before it goes live. This prevents spam and ensures only serious ideas get voted on.

Why do some DAOs use timelocks?

Timelocks are safety delays between proposal approval and execution. They give members time to exit if they disagree with a decision. For example, if a proposal tries to drain the treasury, a 72-hour timelock lets people sell their tokens or organize opposition before funds are moved.

Is token-weighted voting fair?

It’s efficient but not fair. The more tokens you hold, the more votes you have. In Uniswap, the top 10 wallets controlled over 50% of voting power in 2022. This leads to whale dominance. Many DAOs now use quadratic voting or reputation systems to balance power.

How can I increase my voting influence in a DAO?

Hold more tokens, contribute to the DAO’s work, or delegate your vote to someone trusted. Some DAOs, like Colony, award reputation for contributions - not just token ownership. Others, like Aragon, let you assign your vote to a representative. Active participation often matters more than holding.

What happens if a proposal passes but people regret it?

If it’s already executed, reversing it is hard. That’s why timelocks and quorums exist - to prevent mistakes. Some DAOs allow rage quitting, letting voters leave and take their tokens out. Others rely on future proposals to undo bad decisions. There’s no undo button in code.

DAO governance is still experimental. It’s messy, slow, and sometimes unfair. But it’s also the closest thing we have to true digital democracy. The systems we build today - how we vote, who gets to propose, how we protect against abuse - will define whether DAOs grow into lasting institutions or fade into another crypto fad.