DeFi Composability: Building Blocks for Next‑Gen Finance

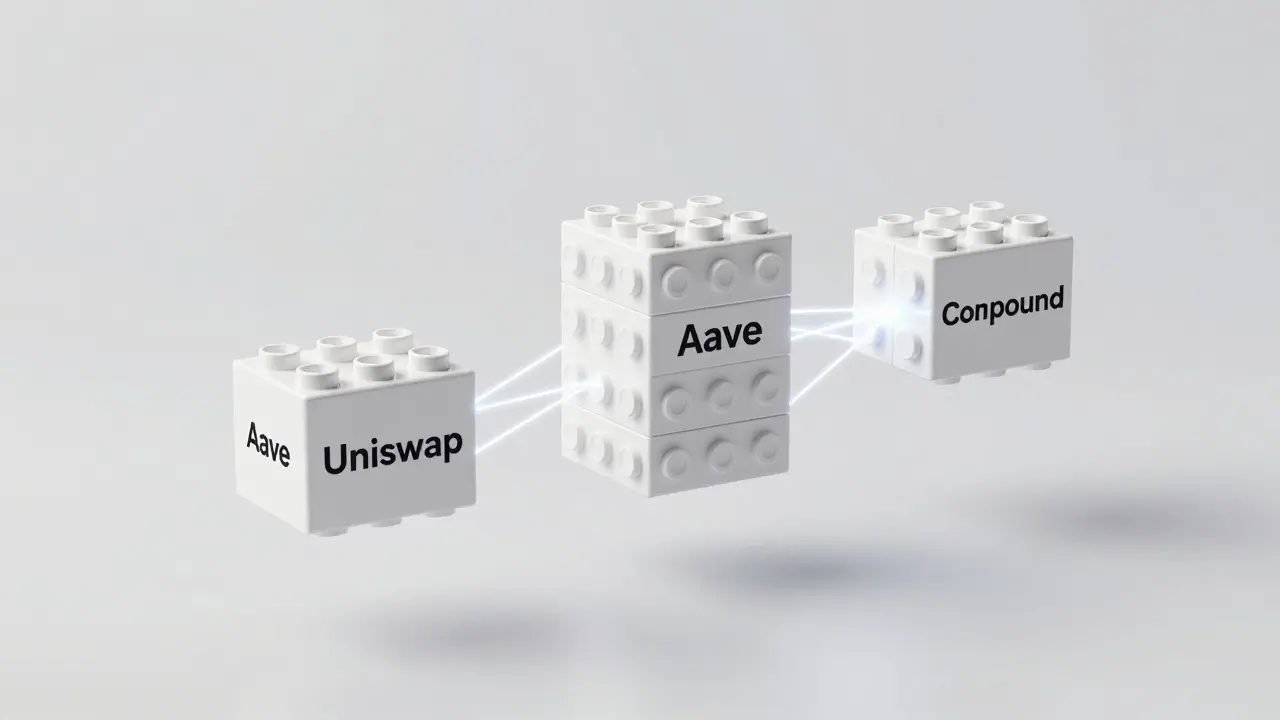

When working with DeFi composability, the ability of decentralized finance components to integrate and share functionality without friction. Also known as DeFi interoperability, it lets developers stack lending, swapping, and yield tools without rebuilding each piece from scratch.

At the heart of this integration are smart contracts, self‑executing code that enforces agreements on blockchain. Smart contracts act as the Lego bricks of DeFi, and when they connect to liquidity pools, shared reserves that enable instant token swaps and lending, they create reusable financial primitives. Add cross‑chain bridges, protocols that move assets between separate blockchains, and you have a network where a tokenized asset can travel, earn yield, and be used as collateral across many platforms. In simple terms, DeFi composability means a borrowing app can pull price data from one oracle, swap collateral on an AMM, and hand the result to a yield farm, all in a single transaction. This triple—smart contracts, liquidity pools, and bridges—forms the backbone of modern DeFi ecosystems.

Why composability matters for users and creators

For developers, composability reduces code duplication and speeds up innovation. Instead of writing a new lending engine, a team can integrate an existing protocol’s contract and focus on the user interface. For traders, it means faster, cheaper routes to profit: a single transaction can borrow, swap, and repay, cutting the need for multiple steps and lowering exposure to price swings. Tokenized assets—anything from stablecoins to real‑world collateral—benefit because they can be reused across protocols without being locked in one place. However, each link in the chain adds risk: a bug in one contract can cascade, and bridges may introduce vulnerabilities when moving assets across chains. Understanding these trade‑offs is key to leveraging composability safely. Below you’ll find a curated set of articles that break down each piece of the puzzle. We cover everything from AI‑driven coins that rely on composable finance, to privacy‑focused tokens, exchange reviews, and real‑world use cases like mining bans and regulatory shifts. Whether you’re a beginner trying to grasp the basics or an experienced trader looking for the latest yield opportunities, the posts ahead give practical insight into how DeFi composability shapes today’s crypto landscape.

What Is Composability in DeFi and Why It Matters

Composability in DeFi lets financial protocols work together like LEGO bricks, creating powerful new apps without central control. It's the engine behind yield farming, flash loans, and automated finance - but also introduces new risks.

View MoreLiquid Staking & DeFi Composability: Unlock Liquidity and Yield Across Chains

Learn how liquid staking creates tradeable tokens, boosts DeFi composability, and offers new yield opportunities while staying secure and compliant.

View More