Imagine building a house using LEGO bricks instead of pouring concrete. You don’t need to design every brick from scratch. You just pick the ones you need, snap them together, and create something new - maybe a tower, a bridge, or a whole city. That’s composability in DeFi. It’s not just a buzzword. It’s the reason DeFi has exploded faster than any financial system in history.

What Exactly Is Composability?

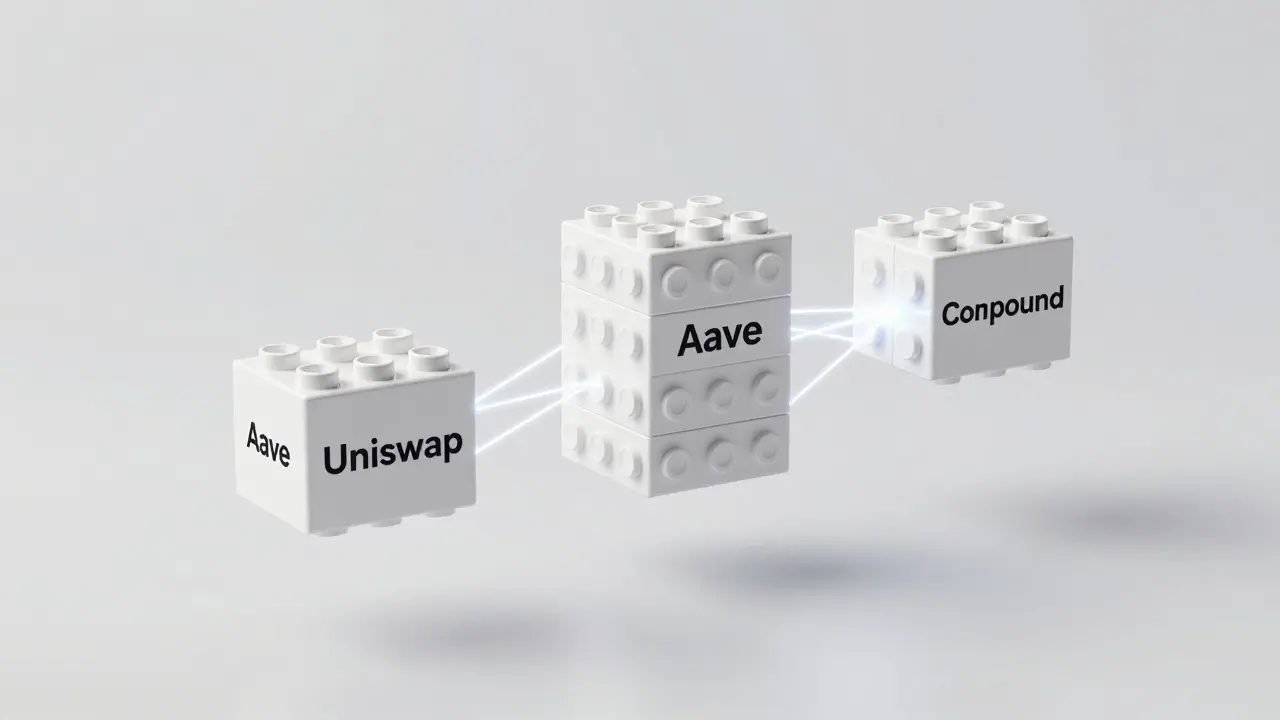

Composability means that DeFi protocols can plug into each other like software modules. Each one does one thing well - lending, trading, borrowing, insuring - and then lets others use its output as input. No permission needed. No contracts to sign. Just code talking to code on the blockchain.This is why people call DeFi "Money Legos." Think of Aave as a lending brick. Uniswap as a trading brick. Compound as a yield brick. Now, someone can take your loan from Aave, use it as collateral on dYdX to trade, and automatically deposit the profits back into Compound to earn more interest - all in one transaction. No bank. No paperwork. Just smart contracts working together.

How Does It Actually Work?

It all starts with smart contracts. These are self-executing programs stored on the blockchain. They don’t rely on humans to trigger actions. If conditions are met, they run automatically. That’s what makes them perfect building blocks.Then there are token standards - especially ERC-20 and ERC-721. These are like universal connectors. An ERC-20 token (like DAI or USDC) can be used in any DeFi app that accepts it. You don’t need a special version for each platform. One token, 100 uses. That’s interoperability in action.

Protocols also expose APIs and SDKs. These are like instruction manuals for other developers. Want to let users borrow against their crypto? Just call the Aave API. Want to let users swap tokens? Integrate Uniswap’s router. No need to rebuild the wheel. Just plug in.

And because everything is open-source, anyone can look at the code. You don’t need to ask for access. You don’t need approval from a CEO. You just clone, modify, and deploy. That’s permissionless innovation.

Real-World Examples of Composability

You don’t have to imagine this. It’s happening every minute.

- Yield aggregators like Yearn Finance automatically move your funds between Aave, Compound, and Curve to find the highest interest rate. They’re not banks - they’re bots that shop for you.

- Flash loans let you borrow millions without collateral - as long as you pay it back in the same transaction. People use them to exploit price differences across exchanges. One swap. One loan. One profit. All in seconds.

- Derivatives platforms like Synthetix combine price oracles, collateral systems, and synthetic token generators to let you trade gold, stocks, or even Bitcoin - without owning any of them.

- Margin trading on dYdX lets you borrow to trade, using your Uniswap LP tokens as collateral. That’s a lending protocol talking to a trading protocol, and both talking to your wallet.

These aren’t rare experiments. They’re daily use cases. And they’re only possible because each protocol was built to work with others - not in isolation.

Why This Changes Everything

Traditional finance is like a castle with moats. Banks, brokers, and clearinghouses all guard their own systems. To connect them, you need lawyers, compliance teams, and months of negotiations.

DeFi throws that model out. Composability turns finance into an open sandbox. A developer in Nairobi can build a new insurance product using Aave, Chainlink, and Uniswap - and launch it in a weekend. No VC funding. No regulatory forms. Just code.

This creates two huge advantages:

- Captial efficiency - Your money doesn’t sit idle. It moves between protocols to earn yield, provide liquidity, or hedge risk - all at once.

- Network effects - Every new protocol makes the whole system stronger. More users on Aave mean more collateral for dYdX. More liquidity on Uniswap means better prices for Curve. The whole ecosystem grows faster than any single app could alone.

The Hidden Risks

But here’s the catch: with great power comes great risk.

Because everything is connected, a bug in one protocol can ripple through dozens. Remember the 2022 Euler Finance exploit? A vulnerability in their lending pool let attackers drain over $200 million. But because Euler was integrated into several yield farms and aggregators, the damage spread. That’s systemic risk.

Another problem? Complexity. When you stack five protocols together, you’re not just trusting one codebase - you’re trusting five. A flaw in one’s oracle, one’s price feed, or one’s withdrawal logic can collapse the whole chain.

That’s why security audits aren’t optional anymore. Projects like CertiK and OpenZeppelin now offer tools specifically for composable systems. Developers are learning to test for edge cases: What if a token’s price crashes mid-transaction? What if a contract gets upgraded while you’re in the middle of a multi-step trade?

There’s no safety net. No FDIC. No bank backing you up. You’re responsible for the whole stack.

The Future: Cross-Chain and Beyond

Right now, most composability happens on Ethereum. But that’s changing fast.

Bridge protocols like LayerZero and Wormhole let assets and data flow between Ethereum, Solana, Polygon, and even Bitcoin-based chains. That means a DeFi app on Arbitrum can now use a liquidity pool on Solana. Or a synthetic asset on Base can be collateralized by a token from Cosmos.

Layer 2 solutions like Optimism and zkSync are making this cheaper and faster. Gas fees used to kill multi-protocol trades. Now, you can do five transactions in one for under $0.10.

And the next wave? Real-world assets. Imagine a DeFi protocol that lets you tokenize a piece of real estate, then use it as collateral to borrow stablecoins - all while automatically paying property taxes via smart contract. That’s not sci-fi. It’s being built right now.

What This Means for You

If you’re a user: You have more control than ever. You can earn yield, trade, borrow, and hedge - all in one wallet. But you also need to understand what you’re connecting. Don’t just click "Deposit" on a yield farm. Ask: What protocols is this using? Are they audited? Is the code public?

If you’re a developer: The tools are here. The code is open. The market is hungry. But you’re not just building an app - you’re building a component in a much larger system. Your code will be used by others. Your bugs will affect them. Design with safety, not speed.

If you’re just watching: Understand this - DeFi isn’t about apps. It’s about ecosystems. The most valuable projects aren’t the ones with the prettiest interfaces. They’re the ones that let others build on top of them.

Is composability the same as interoperability?

They’re related, but not the same. Interoperability means two systems can exchange data - like two apps sharing a login. Composability goes further: it means systems can actively use each other’s functionality as part of their own logic. For example, a lending protocol can automatically use a price feed from a decentralized oracle to adjust loan limits. That’s composability.

Can I use DeFi protocols without understanding smart contracts?

Yes - most users do. Wallets like MetaMask and interfaces like Aave or Uniswap hide the complexity. But if you’re using yield farms, leveraged positions, or automated strategies, you’re interacting with multiple contracts behind the scenes. You don’t need to read the code, but you should understand the risks. A high APY often means higher complexity - and higher risk.

Why hasn’t traditional finance adopted composability?

Because it’s built on legacy systems that weren’t designed to talk to each other. Banks use proprietary software, closed APIs, and manual reconciliation. Adding a new service requires legal contracts, compliance checks, and months of integration. DeFi’s open, code-based model doesn’t need any of that. It’s a fundamentally different architecture - one that prioritizes speed and openness over control and hierarchy.

What’s the biggest danger in composable DeFi?

The biggest danger isn’t one protocol failing - it’s the chain reaction. A small bug in a popular oracle, or a flash loan attack on a widely used collateral token, can cascade across dozens of apps. That’s why audits, bug bounties, and simple designs are critical. The more protocols you stack, the more you rely on every single one being flawless.

Are there any standards making composability safer?

Yes. The Ethereum community has developed standards like ERC-20, ERC-4626 (for standardized yield-bearing tokens), and EIP-1193 (for wallet interfaces). These reduce friction and create predictable behavior. New tools like Slither and Foundry help developers scan for vulnerabilities in multi-contract systems. But standards alone aren’t enough - you still need to test, audit, and assume something will break.