Decentralized Exchange: The Essentials You Need to Know

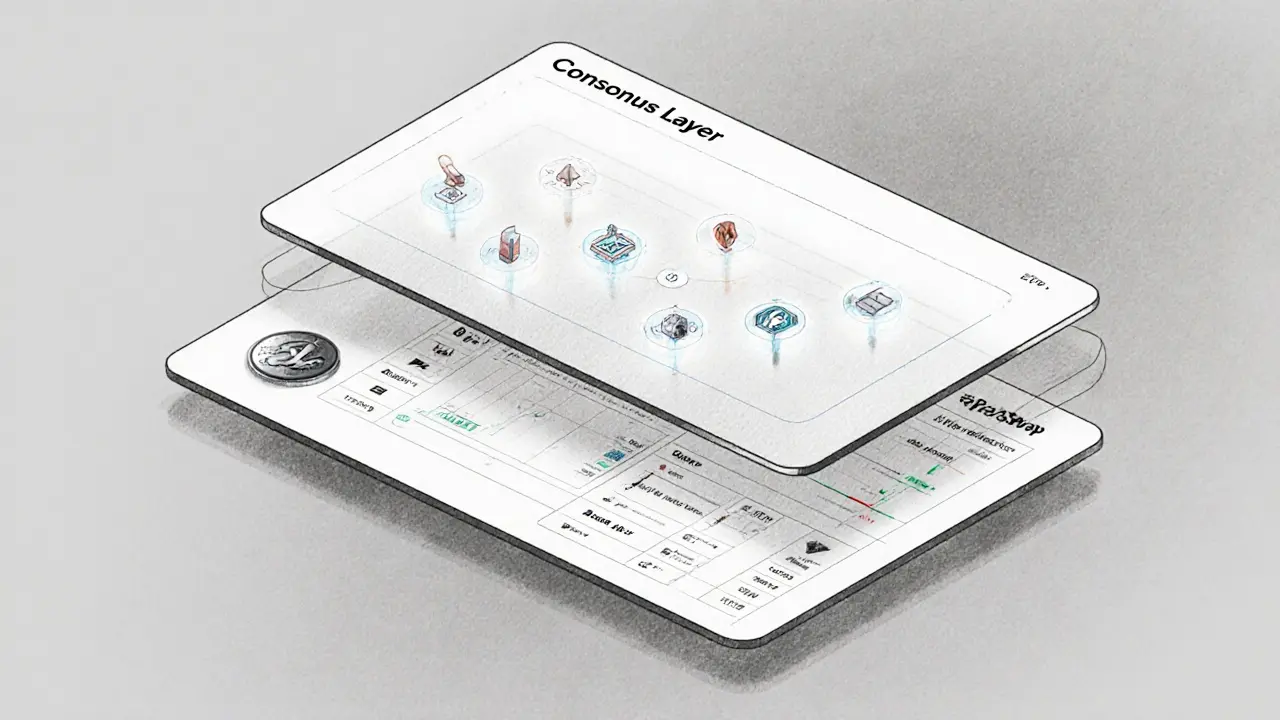

When working with Decentralized Exchange, a peer‑to‑peer platform that lets users trade crypto assets directly from their wallets without a central broker. Also known as DEX, it relies on smart contracts to match orders and manage custody. In contrast, a Crypto Exchange, a more traditional platform where a company holds users' funds and processes trades on its own order book often charges higher fees and requires KYC. A key building block for many DEXs is the Liquidity Pool, a collection of token reserves that enables instant swaps via automated market maker algorithms. Decentralized exchange encompasses automated market making, requires robust smart contracts, and lets liquidity pools influence price slippage. Understanding how a decentralized exchange works can save you time and fees.

Why do traders gravitate toward DEXs? First, you keep full control of your private keys, which means no single point of failure and lower custody risk. Second, DEXs list emerging tokens faster because they don’t need a centralized listing process; this fuels innovation in DeFi, NFTs, and cross‑chain bridges. Third, many DEXs run on automated market makers (AMMs) that replace traditional order books, allowing anyone to provide liquidity and earn fees. However, AMMs bring challenges like impermanent loss and price impact during large trades. Smart contracts also introduce code‑level vulnerabilities, so audits matter. By weighing security, fee structures, and available liquidity, you can decide if a DEX fits your strategy.

Choosing the right DEX involves looking at several factors: overall liquidity depth, gas costs, governance token incentives, and the availability of cross‑chain bridges. Some platforms offer hybrid models that blend order‑book depth with AMM pools, giving traders more options for slippage control. Others focus on privacy or layer‑2 scaling to cut transaction fees. Below, you’ll find in‑depth reviews of specific exchanges, step‑by‑step airdrop guides, token analyses, and regulatory insights—all curated to help you navigate the decentralized trading landscape with confidence.

AmpleSwap Crypto Exchange Review: Is This DEX Still Active in 2026?

AmpleSwap was once promoted as a top BSC DEX, but in 2026, it has zero trading volume, no user reviews, and no active development. This review shows why you should avoid it and where to trade safely instead.

View MoreMerchant Moe Crypto Exchange Review: Zero Fees, Tiny Liquidity, and the Mantle Network Bet

Merchant Moe is a zero-fee decentralized exchange on the Mantle Network. It offers futures, fiat on-ramps, and low gas fees-but only 9 tokens and thin liquidity. For Mantle believers only.

View MoreSithSwap Crypto Exchange Review: Speed, Slippage, and StarkNet's Best AMM?

SithSwap is StarkNet's fastest and lowest-slippage DEX for stablecoin and volatile asset swaps. With near-zero fees, 98.7% settlement success, and a unique dual-mode AMM, it leads the L2 exchange space-but has limited token support and a steep learning curve.

View MoreOasis Crypto Exchange Review: What You Need to Know About ROSE, YuzuSwap, and Privacy-First DeFi

Oasis isn't a crypto exchange - it's a privacy-first blockchain powering DeFi apps like YuzuSwap. Learn how ROSE staking, confidential smart contracts, and Tokenized Data are reshaping finance in 2025.

View MoreFerro Protocol Crypto Exchange Review: Niche DEX for Cronos Stablecoin Swaps

Ferro Protocol is a niche DEX on Cronos optimized for low-slippage stablecoin swaps. It's simple and cheap but lacks trading pairs, liquidity, and features. Only useful for a small group of Cronos users.

View MoreCantoSwap Review: Deep Dive into the Canto DEX

An in‑depth CantoSwap review covering how the DEX works, fees, security, liquidity, wallet setup, and a side‑by‑side comparison with major AMM platforms.

View More