Cryptocurrency Regulations in Iran: What’s Banned, What’s Forced, and Who Controls It

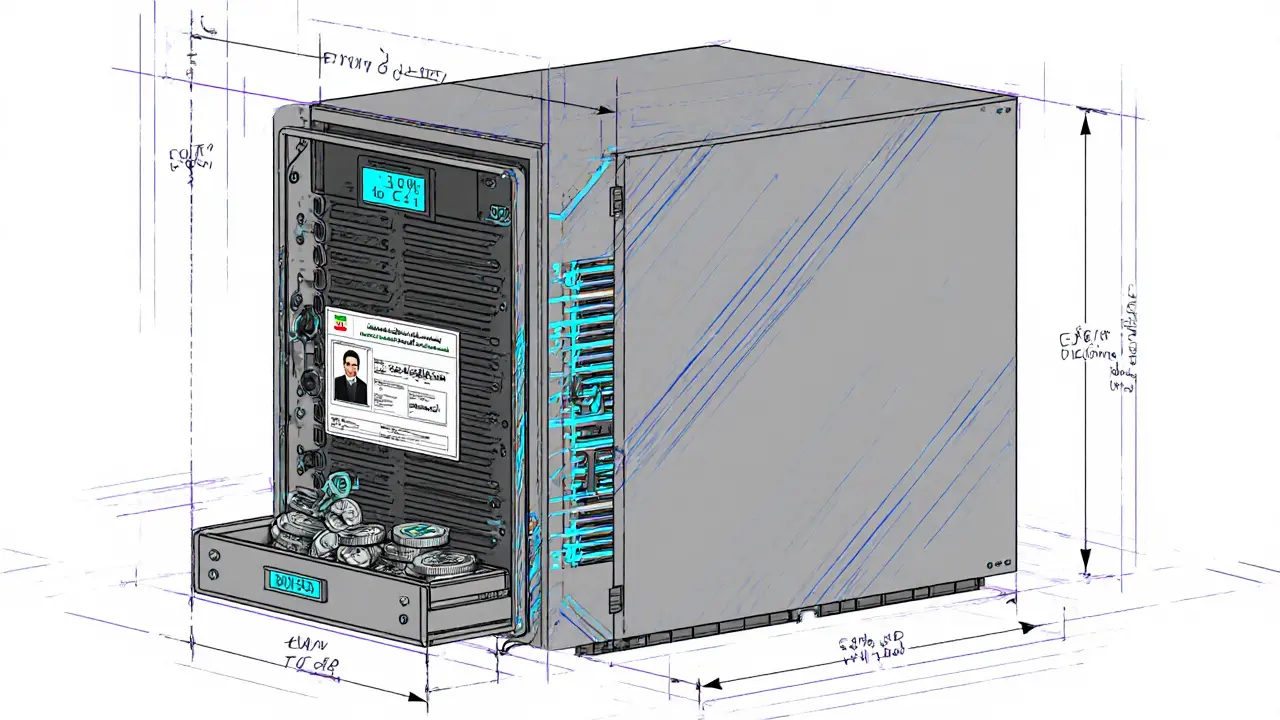

When it comes to cryptocurrency regulations in Iran, a unique blend of state control, energy management, and sanctions evasion. Also known as Iranian crypto policy, it’s not about banning Bitcoin—it’s about owning it. Unlike countries that try to stop crypto, Iran’s government turned mining into a state-run resource. The Central Bank Iran crypto, the country’s financial authority overseeing digital asset flows now requires every miner to sell 30% of their output directly to the state. This isn’t a suggestion. It’s a law, enforced since 2025.

Why? Because Iran needs dollars, and crypto mining gives them a way to bypass international sanctions. The state buys Bitcoin and other coins at low local electricity rates, then sells them abroad for hard currency. At the same time, they’re using this system to control energy use—miners used to drain the grid, so now they’re tied to government quotas. The mandatory crypto sales, a policy forcing miners to hand over a fixed portion of their output turned Iran into the world’s only country where mining is legally a state partnership. And while private traders can still hold crypto, they can’t legally export it. All movement flows through government-approved channels.

What’s left for regular users? Not much. You can mine if you’re licensed, but you can’t freely trade or convert your coins. The government even launched its own digital currency, the Digital Rial, to compete with Bitcoin. Meanwhile, foreign exchanges like ZoomEx or SwapSpace are blocked. If you want to trade, you’re stuck with local platforms—many of which are unregulated, risky, or outright scams. The Iran cryptocurrency regulation, a tightly controlled framework designed to extract value while limiting freedom isn’t about innovation. It’s about extraction.

What you’ll find below are real stories from inside this system. One post breaks down how miners are forced to hand over their coins. Another reveals how the Central Bank tracks every mining rig. There’s also a warning about fake exchanges pretending to serve Iranian users. No fluff. No theory. Just what’s happening on the ground, in the data, and in the code.

Iranian Central Bank Mandates Crypto Sales from Miners Under New 2025 Regulations

Iran's Central Bank now requires crypto miners to sell 30% of their output to the state under new 2025 regulations. This move controls energy use, funds imports, and suppresses private crypto markets.

View More