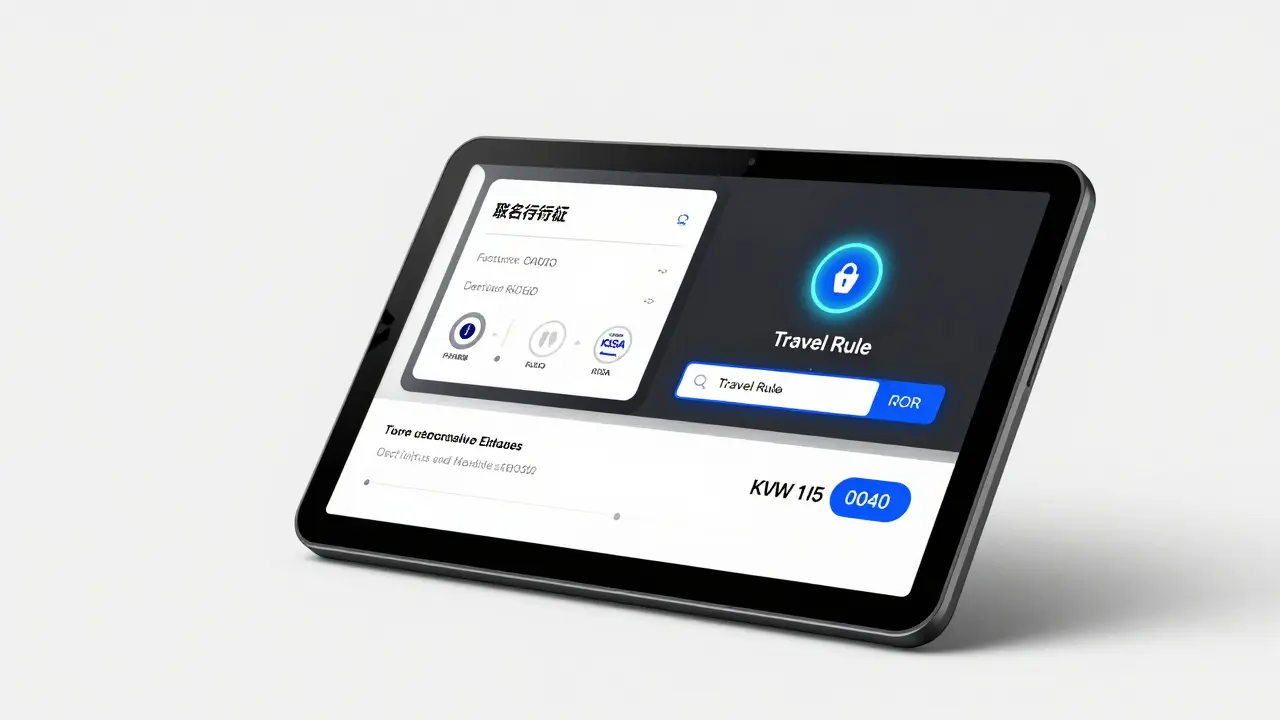

South Korea VASP Registration Eligibility Tool

Determine if you need to register as a VASP

The Financial Services Commission (FSC) requires all Virtual Asset Service Providers (VASPs) operating in South Korea to register and comply with strict regulations.

Do you offer any of these services to Korean users?

The FSC requires real-name banking for all users, even for foreign companies serving Korean customers.

Do you accept deposits from or send transactions to users in South Korea?

The FSC requires exchanges to have a dedicated real-name bank account at a licensed Korean bank.

Do you operate a crypto exchange in South Korea?

All exchanges must pass KISA security certification and maintain continuous compliance.

Does your platform have:

The FATF Travel Rule requires sending exchanges to collect and transmit recipient information for transactions over KRW 1 million.

Do you handle transactions above KRW 1 million (approximately $750)?

By 2025, the Virtual Asset Basic Law will establish penalties for market manipulation and require licensing for DeFi platforms.

Do you offer any of these services?

Your VASP Registration Status

The Financial Services Commission requires all Virtual Asset Service Providers operating in South Korea to register and comply with strict regulations. Failure to register can result in access being blocked by internet service providers.

If you need to register:

- Apply for registration with the FSC

- Pass KISA security certification and annual audits

- Implement real-name banking for all users

- Comply with the FATF Travel Rule for transactions over KRW 1 million

South Korea doesn’t just allow cryptocurrency trading-it controls it. Unlike countries where crypto operates in a gray zone, South Korea’s Financial Services Commission (FSC) has built one of the strictest, most detailed regulatory systems in Asia. By 2025, these rules aren’t just about stopping fraud-they’re about bringing crypto into the mainstream financial system. If you’re trading, investing, or running a business in crypto in Korea, you need to understand exactly what’s required.

What the FSC Actually Controls

The FSC doesn’t just oversee banks and stocks. Since 2020, it has been the sole regulator for all Virtual Asset Service Providers (VASPs) in South Korea. That means every crypto exchange, wallet provider, or trading platform operating in the country must answer to them. The FSC defines a VASP as any entity that:- Sells or buys cryptocurrencies

- Exchanges one crypto for another

- Transfers crypto between users

- Stores or manages virtual assets

Real-Name Banking: No Anonymity Allowed

One of the most unique-and strict-rules in Korea is the real-name bank account system. Every user must link their crypto exchange account to a real-name bank account at the same bank as the exchange’s authorized account. You can’t use an anonymous account, a friend’s account, or a foreign bank. The exchange itself must have a dedicated real-name account at a licensed Korean bank. Why? To stop money laundering. If someone deposits KRW 5 million from a fake account, the system flags it immediately. The FSC requires exchanges to verify identity at signup and match every deposit and withdrawal to a verified bank account. This isn’t just a formality-it’s built into the exchange’s core infrastructure.Security Certification Is Non-Negotiable

You can’t just set up a website and start taking crypto deposits. Every exchange must pass a security audit from the Korea Internet & Security Agency (KISA). They need certification under the Information Security Management System (ISMS) standard. This isn’t a one-time check. Exchanges must maintain continuous compliance, undergo annual audits, and report any breaches within 24 hours. The FSC doesn’t tolerate weak security. In 2023, a smaller exchange lost access to its cold wallets after failing to update its encryption protocols. The FSC shut it down within days. No warnings. No second chances.The Travel Rule: You Can’t Send Crypto in Secret

South Korea enforces the FATF Travel Rule with a KRW 1 million (about $750) threshold. That means if you send more than that in crypto-whether Bitcoin, Ethereum, or a stablecoin-you must provide the recipient’s full name, wallet address, and account number. The sending exchange must send this data to the receiving exchange. This rule applies to both crypto-to-fiat and crypto-to-crypto trades. It doesn’t matter if the transaction is between two Korean users or if one side is overseas. If the amount crosses KRW 1 million, the data must be exchanged. Most exchanges automate this. When you send a large transfer, you’ll see a pop-up asking for the recipient’s real name and bank details-even if you’re sending to another Korean user. It’s not optional. And if you try to bypass it by splitting transfers into smaller amounts? That’s considered structuring, and it’s a criminal offense.

Only Four Major Exchanges-But All Must Follow the Rules

In 2020, only Bithumb, Upbit, Coinone, and Korbit had fully complied with FSC rules. That’s why they were the only ones allowed to operate legally. But since then, the FSC has cracked down on all others. By 2025, every single crypto exchange serving Korean users must be registered and certified. There are no exceptions. Even if a platform claims to be “overseas” or “decentralized,” if Korean users can access it, the FSC can block it. In early 2025, the FSC ordered internet service providers to block access to 17 unregistered platforms. Users trying to access them got a warning page-no login, no trade, no access.Corporate Crypto Holdings Are Changing

Since 2017, Korean companies were banned from holding cryptocurrency. The idea was to protect businesses from volatility and fraud. But in early 2025, the FSC announced a major shift. A new pilot program allows corporations to hold crypto-under strict conditions. Companies must:- Register with the FSC as a corporate VASP

- Use only licensed Korean exchanges

- Limit holdings to 5% of total assets

- Report all transactions weekly

Spot Crypto ETFs Are Coming-Late 2025

One of the biggest changes coming in late 2025 is the launch of spot cryptocurrency exchange-traded funds (ETFs). Unlike futures ETFs (which are based on price predictions), spot ETFs track the actual price of Bitcoin or Ethereum. The Korea Exchange will list these ETFs. They’ll be available through regular brokerage accounts, meaning pension funds, mutual funds, and even retail investors can buy them without touching crypto wallets. To get approved, ETF sponsors must:- Use only FSC-licensed custodians

- Report net asset value in real time

- Undergo quarterly audits by certified auditors

- Disclose all underlying assets and storage methods

What’s Still Banned?

Not everything is changing. Two major restrictions remain:- Initial Coin Offerings (ICOs) are still illegal. The FSC banned them in 2017 and hasn’t lifted the ban. Even if a project is based overseas, if Korean investors participate, it’s considered illegal.

- NFTs are treated case by case. If an NFT is sold as an investment-like a share in a future movie or a royalty stream-it’s regulated as a virtual asset. But if it’s just a digital collectible, like a profile picture or art piece, it’s mostly ignored by regulators.

Taxes Are on Hold-For Now

South Korea planned to start taxing crypto profits in 2025. The tax would have been 20% on gains over KRW 2.5 million per year. But in April 2025, the government announced a one-year delay. Why? The FSC said they needed more time to build a system that could accurately track cross-exchange trades and wallet transfers. They’re working with exchanges to integrate reporting tools. Until then, crypto gains are untaxed. But don’t get comfortable. The delay isn’t a cancellation. The tax is coming, and when it does, losses can offset gains in the same year. If you lost KRW 10 million in January and made KRW 12 million in November, you’ll only pay tax on KRW 2 million.Regional Experiments: Busan, Jeju, Incheon

While the FSC sets national rules, local governments are testing new ideas. Busan, a major port city, launched the Busan Digital Asset Nexus-a sandbox for Security Token Offerings (STOs). Companies can test tokenized real estate or equity under FSC supervision without full regulatory approval. Jeju Island is watching closely. It’s considering allowing foreign investors to trade crypto through local exchanges without needing a Korean bank account. Incheon is exploring blockchain-based land registries. These aren’t loopholes. They’re controlled experiments. The FSC uses them to test how new technologies behave before rolling out nationwide rules.Why This Matters Outside Korea

South Korea isn’t just regulating its own market. It’s setting a global example. The combination of strict KYC, mandatory security audits, real-name banking, and now ETFs and corporate crypto access is a blueprint other countries are studying. Japan and Singapore are watching how Korea balances innovation with control. The U.S. SEC is analyzing the ETF model. Even the European Union is comparing its MiCA rules to Korea’s. The message is clear: if you want to operate in Korea, you play by their rules. And if you want to reach Korean investors, you need to meet their standards.What’s Next? The Virtual Asset Basic Law

The biggest change is still coming. By September 2025, the FSC plans to pass the Virtual Asset Basic Law. This isn’t just another regulation-it’s a new legal framework that defines crypto as a financial asset, not just a commodity. It will:- Formally recognize crypto as a tradable asset under financial law

- Establish penalties for market manipulation, insider trading, and fake trading volume

- Create a licensing system for DeFi platforms

- Set standards for NFTs with financial functions

Are crypto exchanges legal in South Korea?

Yes, but only if they’re registered and certified by the Financial Services Commission (FSC). All exchanges must comply with real-name banking, KISA security certification, and the FATF Travel Rule. Unregistered platforms are blocked by internet providers.

Can I trade crypto without a Korean bank account?

No. All users must link their exchange account to a real-name bank account in Korea. The exchange must also hold its own real-name account at the same bank. This rule prevents anonymous trading and money laundering.

Is crypto taxed in South Korea in 2025?

Not yet. The planned 20% tax on crypto gains above KRW 2.5 million has been delayed until at least 2026. The FSC is building a reporting system to track trades across exchanges. When it launches, losses can offset gains in the same tax year.

Can Korean companies hold Bitcoin or other crypto?

Yes, but only under strict conditions. Since early 2025, corporations can hold crypto if they register with the FSC, use licensed exchanges, limit holdings to 5% of total assets, and report all transactions weekly. This is part of a pilot program to test institutional adoption.

What’s the difference between NFTs and regular crypto in Korea?

If an NFT is sold as an investment-like a share in future revenue or a royalty stream-it’s treated as a virtual asset and regulated by the FSC. If it’s purely a collectible, like a digital artwork or profile picture, it’s generally not regulated. The FSC looks at function, not format.

Will South Korea allow crypto ETFs in 2025?

Yes. Spot crypto ETFs are expected to launch on the Korea Exchange in late 2025 or early 2026. These ETFs will track the actual price of Bitcoin or Ethereum and be available through regular brokerage accounts. Sponsors must meet strict audit and transparency rules.

Are ICOs still banned in South Korea?

Yes. Initial Coin Offerings (ICOs) have been banned since 2017 and remain illegal. Even foreign projects that accept Korean investors are subject to enforcement. The FSC has no plans to lift this ban, though regulated token offerings (STOs) are being tested in Busan.

Sammy Tam

16 December, 2025 . 13:19 PM

Korea’s crypto rules are wild but actually kinda brilliant. Real-name banking? Mandatory security certs? No more shady exchanges? I’m sold. This is how you build trust without killing innovation. Other countries are still arguing about whether crypto is money or not, and Korea’s already building ETFs and corporate treasury programs. Respect.

Madhavi Shyam

18 December, 2025 . 09:56 AM

VASP compliance framework under FATF Travel Rule with KISA ISMS certification is non-negotiable for regulatory arbitrage avoidance.

Terrance Alan

19 December, 2025 . 12:59 PM

They shut down exchanges for weak encryption and call it justice but let banks run wild with derivatives and insider trading. This isn’t regulation it’s theater. They’re not protecting users they’re protecting the status quo. Crypto’s supposed to be free and they turn it into a bureaucratic nightmare with bank account linking and weekly reports. What’s next mandatory crypto prayer sessions?

Mark Cook

20 December, 2025 . 01:30 AM

I mean… I get it but like… why not just let people be dumb? 😅

Jonny Cena

21 December, 2025 . 01:13 AM

This is actually a masterclass in how to regulate crypto without crushing it. Most countries either ban it or ignore it. Korea’s doing the hard work: real names, security audits, transparency. The corporate pilot program? Genius. If big companies can hold crypto safely, it legitimates the whole space. This isn’t control it’s integration.

Timothy Slazyk

21 December, 2025 . 08:28 AM

You think this is strict? Wait till the Virtual Asset Basic Law drops. It’s not just regulation-it’s constitutionalizing crypto as a financial asset. That’s a seismic shift. Most countries treat crypto like a glitch in the system. Korea’s rewriting the system. The fact they’re allowing spot ETFs under the same oversight as equities means they’re not just tolerating crypto-they’re elevating it. This isn’t about control. It’s about legitimacy.

Bradley Cassidy

23 December, 2025 . 07:40 AM

i love how korea just kinda went full on and made crypto actually work instead of letting it be a wild west. real name bank accounts? yeah it sucks a little but at least you dont get rug pulled by some dude in a basement with a fake website. also the 5% corp limit is smart-keeps it from turning into a casino for ceos. also why is no one talking about how the busan st0 sandbox is gonna change everything? this is the future

Jack Daniels

24 December, 2025 . 12:05 PM

They’re just trying to control everything. It’s not safety. It’s control. I used to trade on Upbit. Now I can’t even think about crypto without thinking about forms and audits and bank links. It’s suffocating. I don’t need them to protect me from myself.

Heather Turnbow

25 December, 2025 . 04:53 AM

The institutional adoption pathway outlined here is exceptionally well-structured. The combination of mandatory custodianship, real-time NAV reporting, and quarterly audits creates a fiduciary-grade framework previously unseen in digital asset markets. This is not merely regulatory compliance-it is the institutionalization of trust.

Cheyenne Cotter

25 December, 2025 . 12:28 PM

Honestly, the tax delay makes sense. Tracking cross-exchange trades across dozens of wallets and platforms isn’t something you can just slap a spreadsheet on. The FSC’s being smart by waiting. If they tax too early, people will just move to offshore exchanges and the whole system becomes useless. Plus, letting losses offset gains? That’s actually fair. Most governments just want to take your money without understanding the risk. Korea’s trying to do it right.

Sean Kerr

26 December, 2025 . 21:10 PM

this is so cool!!! 🤩 real name banking? yes please!! no more anonymous rug pulls!! and corporate crypto?? like… a company holding btc?? as a treasury reserve?? mind blown!! 🤯 and the busan st0 thing?? that’s like… the future right there!! i wish the us would just copy this and stop arguing about whether crypto is a commodity or a security lol

Jesse Messiah

27 December, 2025 . 22:32 PM

The NFT distinction is actually really smart. If it’s art? Cool. If it’s a share? Regulate it. That’s not overreach-that’s common sense. Most countries treat all NFTs like securities and scare off artists. Korea’s finding the middle ground. Also, the fact they’re letting companies hold crypto but cap it at 5%? That’s the perfect balance between innovation and risk control. This is leadership.

Rebecca Kotnik

28 December, 2025 . 06:56 AM

The regulatory architecture described here represents one of the most sophisticated attempts globally to harmonize financial stability with technological innovation. The phased rollout-starting with exchange certification, progressing to corporate holdings, and culminating in spot ETFs-demonstrates not only technical competence but institutional patience. The decision to delay taxation until reporting infrastructure is robust indicates a prioritization of systemic integrity over short-term revenue. This is not authoritarianism; it is governance with foresight.

Samantha West

29 December, 2025 . 17:22 PM

I find it profoundly disturbing that a government would mandate the linkage of financial identity to digital asset transactions. This is not regulation-it is surveillance under the guise of security. The real-name banking requirement, while ostensibly anti-money laundering, effectively erases the foundational principle of financial privacy that crypto was designed to restore. The FSC’s vision of a fully traceable, monitored, and audited crypto ecosystem is not a future I wish to inhabit.