Crypto Service Providers: Your Hub for Exchanges, Airdrops, Mining & More

When navigating the world of crypto service providers, it's helpful to know exactly what the term covers. Crypto Service Providers, entities that deliver trading, lending, staking, mining, or token‑distribution services within the cryptocurrency ecosystem. Also known as digital asset service providers, they form the backbone of modern crypto activity.

One of the most visible types of providers are crypto exchanges, platforms where users can buy, sell, and swap digital assets. Exchanges demand strong security protocols, low latency order books, and clear fee structures to stay competitive. Another key player is the airdrop, a promotional token distribution that helps projects attract users and build communities. Airdrops often rely on exchanges and wallets to reach participants quickly. Finally, mining pools, collective groups of miners who share hashing power to increase block discovery odds, link directly to both exchanges (for payouts) and DeFi platforms (for staking the earned coins).

Why These Entities Matter Together

Crypto service providers encompass a network of interdependent services. Crypto exchanges require robust security measures to protect user funds, while airdrops influence user acquisition strategies for those same exchanges. Mining pools, on the other hand, supply the fresh coins that fuel trading volume on exchanges and often feed DeFi lending protocols. This web of relationships means that changes in one area—like tighter regulation of exchanges—can ripple through airdrop eligibility rules or mining pool profitability.

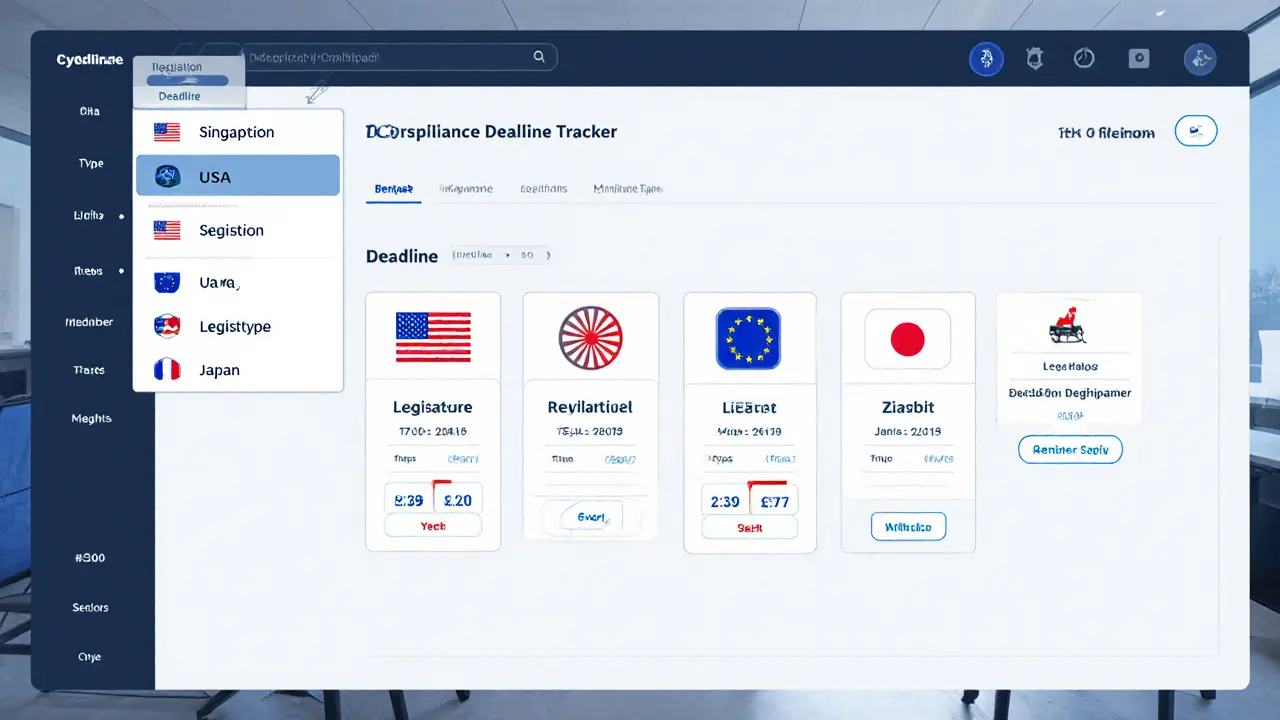

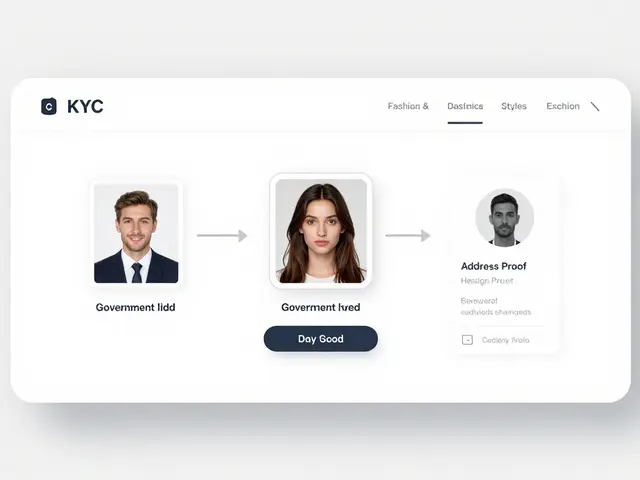

Regulatory bodies also play a pivotal role. Entities such as national financial authorities set licensing standards that affect how exchanges operate, which in turn shapes the legal landscape for airdrops and mining activities. Understanding these links helps traders and investors anticipate market shifts before they happen.

Our collection below reflects these connections. You’ll find detailed reviews of crypto exchanges, step‑by‑step airdrop guides, deep dives into mining pool economics, and analysis of DeFi platforms that integrate all three services. Whether you’re scouting a new exchange, trying to claim a lucrative airdrop, or evaluating a mining pool’s fee structure, the articles are organized to give you quick, actionable insights.

Ready to explore? Below you’ll discover practical breakdowns, risk assessments, and real‑world examples that tie together the core entities of crypto service providers. Dive in and arm yourself with the knowledge needed to make smarter decisions in this fast‑moving space.

Payment Services Act Crypto Rules: Key Requirements for 2025

A clear guide to the Payment Services Act crypto provisions across Singapore, the US, EU, and Japan, covering key deadlines, licensing, technical duties, and a practical compliance checklist.

View More