Spot Trading Tax Calculator

Tax Calculation Result

When you click on a headline about spot trading tax you expect a clear roadmap for filing your returns without a nightmare of paperwork. Whether you’re swapping euros for dollars on a forex platform or flipping Bitcoin for Ethereum on an exchange, the tax rules differ dramatically. This guide walks you through the two major asset classes, the IRS forms you’ll need, and practical steps to stay compliant in 2025.

Key Takeaways

- Forex spot gains are taxed as ordinary income under IRCSection988; crypto spot gains are taxed as capital gains under IRS Notice2014‑21.

- Ordinary‑income treatment means no $3,000 cap on loss deductions for forex, while crypto losses are limited to $3,000 per year.

- Starting 2025, custodial crypto exchanges must issue Form1099‑DA for gross proceeds; cost‑basis reporting begins in 2026.

- Section1256 contracts (regulated futures) enjoy a blended 60/40 capital‑gain rate, offering a tax advantage over spot crypto.

- Accurate record‑keeping and the right software can cut your annual tax prep time by half.

What is Spot Trading Tax Treatment?

Spot Trading Tax Treatment refers to the way the IRS taxes the immediate purchase and sale of assets such as foreign currencies or digital tokens, as opposed to futures or options contracts. The tax code draws a line between assets that are treated like currency and those that are treated as property. That line determines whether you pay ordinary‑income rates or potentially lower capital‑gain rates.

Forex Spot Trading: Ordinary‑Income Rules (IRCSection988)

Forex Spot Trading is the buying or selling of foreign currency for immediate delivery, typically settled within two business days. Under Internal Revenue Code Section 988 any foreign‑currency gain or loss attributable to a Section988 transaction is treated as ordinary income or loss. That means:

- All gains are added to your regular taxable income and taxed at rates ranging from 10% to 37% for 2025.

- Losses can offset other ordinary income without the $3,000 capital‑loss ceiling that applies to stocks or crypto.

- The treatment is the same whether you trade on a retail platform or a broker‑dealer, as long as the transaction is a spot trade.

For a single filer earning $120,000, a $10,000 forex profit would be taxed at the 24% marginal rate, resulting in $2,400 tax. If the same trader incurred a $5,000 loss, the loss would reduce ordinary income dollar‑for‑dollar, saving $1,200.

Cryptocurrency Spot Trading: Capital‑Gain Rules (IRS Notice2014‑21)

Cryptocurrency Spot Trading involves buying, selling, or swapping digital assets for other crypto or fiat, with the transaction settled immediately. The IRS treats each digital token as property per IRS Notice 2014‑21 which classifies cryptocurrencies as taxable property rather than currency. Consequences include:

- Short‑term gains (held < 1year) are taxed at ordinary‑income rates, up to 37%.

- Long‑term gains (held >1year) qualify for 0%, 15%, or 20% rates based on taxable income thresholds (e.g., 0% up to $47,025 for single filers in 2025).

- Each crypto‑to‑crypto swap triggers a taxable event, requiring cost‑basis calculation for both the asset sold and the asset acquired.

- Losses are subject to the $3,000 annual limit against ordinary income, with any excess carried forward.

Imagine you bought 2BTC at $28,000 each in January 2024 and sold them for $64,000 each in March 2025. Your $72,000 short‑term gain would be taxed at your marginal rate (say 24%), costing $17,280. If you held the same BTC until March 2026, the gain would be long‑term and, given a $120,000 income, taxed at 15%, costing $10,800-a $6,480 saving.

Reporting Forms You Must File

Both asset classes require specific IRS forms:

- Form 8949 is used to list each capital‑gain or capital‑loss transaction, including crypto sales, swaps, and conversions. Totals flow to ScheduleD.

- Forex gains are reported directly on the standard 1040 line for ordinary income (Schedule1, Line8).

- Starting 2025, custodial crypto exchanges must send you Form 1099‑DA which reports gross proceeds from digital‑asset sales, similar to Form1099‑B for securities.. The form does NOT yet include cost basis; that arrives in 2026.

- For Section1256 contracts (e.g., CME Bitcoin futures), you file Form6781, which applies a 60% long‑term/40% short‑term blended rate.

Comparison at a Glance

| Asset | Tax Code Reference | Tax Type | Short‑Term Rate | Long‑Term Rate | Loss Deduction | Reporting Form |

|---|---|---|---|---|---|---|

| Forex Spot | IRCSection988 | Ordinary Income | 10‑37% (marginal) | N/A (treated as ordinary) | Unlimited offset against ordinary income | Schedule1 (Form1040) |

| Crypto Spot | IRS Notice2014‑21 | Capital Gains | 10‑37% (ordinary) | 0‑20% (based on income) | $3,000 annual cap, carry‑forward allowed | Form8949 → ScheduleD |

| Regulated Futures (e.g., CME BTC) | Section1256 | 60/40 blended | 60% long‑term, 40% short‑term | Same blended rates | Same unlimited offset as ordinary income | Form6781 |

Practical Tax‑Planning Tips

- Know Your Holding Period. If a crypto position will cross the 1‑year threshold before you need cash, wait to sell and lock in the lower long‑term rate.

- Harvest Losses Strategically. With crypto, you can only offset $3,000 of ordinary income each year. Plan loss‑selling in years where your regular income is high to maximize the benefit.

- Consider Section1256 Futures. For high‑frequency traders, swapping spot cryptos for regulated futures can cut the effective tax rate from 37% to roughly 27%.

- Use the Mark‑to‑Market Election Wisely. Only securities and commodities qualify. Crypto spot traders cannot elect Section475, so they miss out on the unlimited loss deduction that forex traders enjoy.

- Leverage Tax Software. Platforms like TaxBit, Koinly, and CoinTracker now ingest Form1099‑DA data and auto‑populate Form8949, saving you up to 10hours a year.

- Document Every Trade. Keep CSV exports, screenshots of exchange‑rate conversions, and notes on any hard‑fork events. The IRS can audit crypto transactions aggressively.

Tools, Resources, and Professional Help

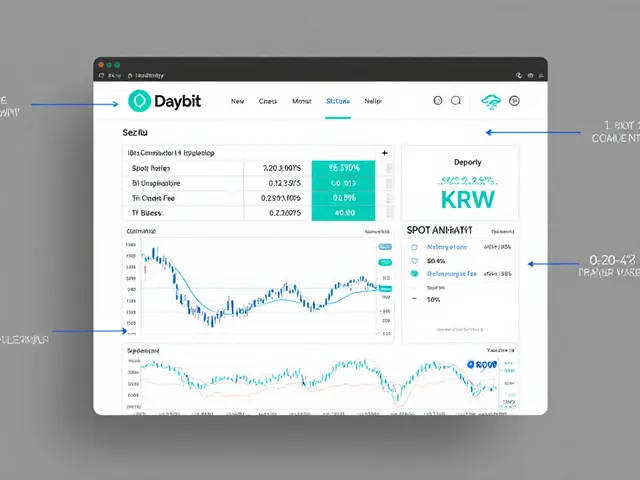

Below are the most reliable solutions for the 2025 tax year:

- TaxBit - Offers a free tier for up to 100 transactions; premium tier adds audit‑ready PDFs.

- Koinly - Handles DeFi staking and NFT sales; price starts at $59/year.

- CoinTracker - Integrates directly with major exchanges; includes a CPA‑review service.

- Green Trader Tax - Specialized CPA firm focusing on forex and crypto traders; typical fees $800‑$1,500 for ≤5,000 trades.

- IRS Publication 550 - Core reference for investment income and taxes; sections on foreign currency and property.

Next Steps for the Busy Trader

- Gather all 2025 statements: broker‑issued Form1099‑DA, forex broker statements, and any self‑generated CSV files.

- Import the data into a tax‑software platform that supports both Form8949 and Schedule1.

- Review each transaction’s holding period; re‑classify any that qualify for long‑term rates.

- Calculate total ordinary‑income from forex and add it to your W‑2 wages on Schedule1.

- File Form8949 and ScheduleD for crypto; attach Form6781 if you hold regulated futures.

- Consider a brief consult with a CPA who knows both Section988 and crypto property rules - it can save you thousands.

Frequently Asked Questions

Do I need to pay tax on crypto‑to‑crypto trades?

Yes. Every time you exchange one cryptocurrency for another, the IRS treats it as a sale of the first asset and a purchase of the second. You must calculate the gain or loss based on the fair market value at the time of the swap and report it on Form8949.

Can I claim forex losses against my crypto gains?

Absolutely. Forex losses are ordinary‑income losses, which can offset any type of ordinary income, including crypto short‑term gains. Because there is no $3,000 cap, you can fully wipe out those gains.

What if I trade on a decentralized exchange (DEX)?

DEX trades are still taxable, but the exchange does not issue Form1099‑DA. You must self‑track every swap, capture the price at the moment of execution, and report the data manually or via tax software that supports API imports from wallets.

When will cost‑basis reporting start for crypto?

The IRS requires custodial exchanges to include cost basis on Form1099‑DA beginning January12026. Until then, you must calculate the basis yourself.

Is the Section475 mark‑to‑market election available for crypto?

No. Section475 applies only to securities and commodities, not to digital assets classified as property. Crypto spot traders cannot use this election to treat gains as ordinary income or to write off unlimited losses.

Elmer Detres

2 November, 2024 . 16:54 PM

💡 Think of spot trades like a daily jog – you’re moving money, so the tax man watches every step. Stay consistent, track your gains, and the IRS will only take what it’s owed. 🚀

Tony Young

5 November, 2024 . 00:54 AM

If you’re diving into spot trading this year, remember that every profit is a potential tax event. The IRS treats forex spot gains as ordinary income, which means they’re taxed at your marginal rate. Cryptocurrency spot gains, unless held for more than a year, are also taxed as short‑term capital gains. That puts them squarely in your highest tax bracket for the year. Regulated futures, on the other hand, enjoy the 60/40 blended rate – 60% long‑term, 40% short‑term. This can lower your overall tax hit if you’re trading futures contracts. However, the $3,000 loss cap still applies to crypto, so you can’t deduct unlimited losses. It’s crucial to keep meticulous records of each transaction date, amount, and asset class. Many traders use dedicated software to automate this tracking. Don’t forget to report crypto losses correctly to avoid an audit trigger. If your income pushes you into a higher marginal bracket, the tax on your spot gains will rise accordingly. Consider timing your trades to stay under threshold levels where possible. Loss carryovers can be a lifesaver, but only up to the $3,000 limit for crypto spot. For forex, the loss deduction isn’t capped, so you can offset more of your ordinary income. Always double‑check the latest IRS tax tables for 2025 – they’re updated annually. In short, know your asset, know your rate, and keep clean books. :)

Fiona Padrutt

7 November, 2024 . 08:54 AM

The US never gave up on taxing its own traders – and we’ll keep it that way. Nobody should try to dodge the rules.

Briana Holtsnider

9 November, 2024 . 16:54 PM

Really? Still using the old calculator? It’s 2025, get a proper software that handles 1256 correctly.

Holly Harrar

12 November, 2024 . 00:54 AM

Hey folks, just a heads up – the crypto loss cap is still $3K per year, so don’t think you can write off everything. Also, watch out for the marginal rate, it changes fast!

Vijay Kumar

14 November, 2024 . 08:54 AM

Keep your spreadsheets tidy, and you’ll avoid nasty surprises in April. A clean record also makes it easier to carry forward any excess losses. You’ve got this!

Edgardo Rodriguez

16 November, 2024 . 16:54 PM

When considering the tax implications of spot trading, one must, not merely, look at the headline rates, but also, the underlying marginal brackets, the interaction with other income sources, and the potential for loss harvesting; this holistic view, indeed, provides a clearer financial picture.

mudassir khan

19 November, 2024 . 00:54 AM

Indeed, the preceding analysis, while articulate, overlooks the statutory nuance that Section 1256 assets are subject to a 60/40 split, irrespective of the taxpayer's marginal bracket; this statutory provision, therefore, supersedes the marginal rate argument presented.

Bianca Giagante

21 November, 2024 . 08:54 AM

I appreciate the clarification; however, it remains essential to note that the 60/40 rule applies only to regulated futures, not to forex or crypto spot positions, which continue to be taxed at ordinary rates.

Danielle Thompson

23 November, 2024 . 16:54 PM

Track each trade, file the right forms – you’ll be fine 🙂

Eric Levesque

26 November, 2024 . 00:54 AM

Taxes are the price of freedom.

alex demaisip

28 November, 2024 . 08:54 AM

It is imperative to recognize that the interaction between Section 1256 treatment and the netting rules under IRC 1.1212-1 may yield unexpected tax consequences, particularly when amalgamating short-term capital gains derived from crypto spot transactions with the blended 60/40 rates of regulated futures contracts.

Corrie Moxon

30 November, 2024 . 16:54 PM

Good point about tracking, and remember that the IRS also allows you to amend previous returns if you discover a missed loss carryover, which can be a nice little boost.

Jeff Carson

3 December, 2024 . 00:54 AM

Sounds solid! 😊 Just make sure your software updates the tax tables each year – the rates do shift.

Anne Zaya

5 December, 2024 . 08:54 AM

Nice summary, cheers!

Emma Szabo

7 December, 2024 . 16:54 PM

What a dazzling dive into the tax maze – bright as fireworks! Keep those calculators humming.

Fiona Lam

10 December, 2024 . 00:54 AM

Yo, if you’re not using the 1256 split for futures, you’re leaving money on the table – get with the program!

OLAOLUWAPO SANDA

12 December, 2024 . 08:54 AM

America’s traders should pay their dues, no excuses.

Alex Yepes

14 December, 2024 . 16:54 PM

In conclusion, the prudent trader must integrate a comprehensive tax strategy that accounts for marginal rates, the particular treatment of each asset class, and the strategic utilization of loss limitations, thereby optimizing post‑tax returns whilst remaining fully compliant with prevailing IRS regulations.

Sumedha Nag

17 December, 2024 . 00:54 AM

Honestly, I think most people overthink this – just use a good app.

Andrew Else

19 December, 2024 . 08:54 AM

Oh great, another tax calculator, just what the world needed.

Susan Brindle Kerr

21 December, 2024 . 16:54 PM

Behold! The epic saga of spot trading taxation, where every dollar dances with destiny and the IRS watches with bated breath.