Crypto Mining Iran 2025: Regulations, Energy Rules, and What It Means for Miners

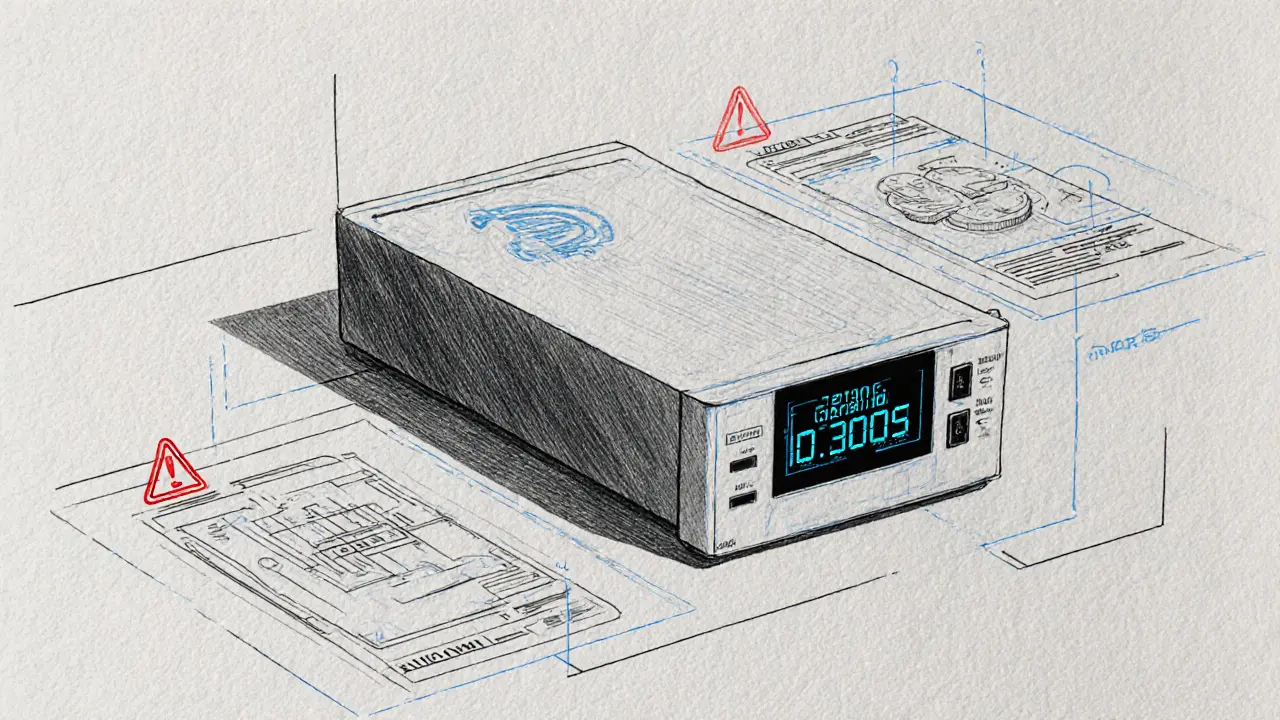

When it comes to crypto mining Iran 2025, the government's new rules require miners to sell a portion of their Bitcoin and other crypto output to the state, turning mining from a private profit engine into a regulated energy program. Also known as state-controlled crypto mining, this shift is reshaping how individuals and businesses operate in Iran’s digital currency space. It’s not about banning crypto—it’s about controlling it. The Central Bank of Iran now demands miners hand over 30% of their daily production. That’s not a suggestion. It’s a legal requirement tied directly to national energy use and foreign currency needs.

This policy isn’t random. Iran has cheap electricity and high energy surplus, which made it a hotspot for crypto miners from 2020 to 2024. But as demand for power grew, so did public complaints about blackouts. The government stepped in—not to stop mining, but to redirect its value. The state uses the mined crypto to buy imports, stabilize the rial, and cut reliance on Western financial systems. Miners still keep 70%, but now they’re essentially working for a government-backed energy subsidy. The Central Bank of Iran, the entity enforcing these rules and managing the state’s crypto reserves. Also known as CBI, it’s now acting like a hybrid central bank and crypto procurement agency. Meanwhile, private crypto trading is being squeezed. If you’re a miner and try to sell your 70% on local exchanges, you’ll find prices are artificially low because the state is the main buyer.

The real impact? Many small miners are shutting down. Running a rig isn’t worth it if you’re forced to sell half your output at a fixed, below-market rate. Some are moving to underground operations, but that’s risky—fines are steep, and power cuts are used as punishment. Others are shifting to mandatory crypto sales, the official term for the state’s compulsory extraction of mining output under Iran’s 2025 framework. Also known as state mining quotas, this system is unique in the crypto world. Even if you’re not in Iran, this matters. It’s the first time a major country has turned mining into a state-controlled commodity program. Other nations are watching closely. Will Venezuela or Russia follow? Could the U.S. or EU impose similar rules on energy-intensive mining? Iran’s model isn’t just about crypto—it’s about how governments can use blockchain infrastructure to bypass sanctions and control capital.

What you’ll find in the posts below are real examples of how this plays out: the exact rules, who’s affected, how miners are adapting, and what happens if you ignore the law. There’s no fluff—just facts from insiders, leaked documents, and official statements. If you’re mining in Iran, or thinking about it, this is the guide you need before you plug in your next rig.

Iranian Central Bank Mandates Crypto Sales from Miners Under New 2025 Regulations

Iran's Central Bank now requires all crypto miners to sell 30% of their output directly to the state under new 2025 regulations. This mandatory sales policy is part of a broader effort to control digital assets, bypass sanctions, and manage energy use.

View More