Crypto Banking Bans: What They Mean for the Crypto World

When dealing with crypto banking bans, government orders that stop banks from providing services to cryptocurrency businesses. Also known as banking restrictions on crypto, they force traders, exchanges and miners to find new ways to move money. In the same arena, crypto regulations, the legal frameworks that define how digital assets can be created, traded and taxed set the rules of the game, while crypto mining bans, regional prohibitions on setting up new mining farms limit where hash power can grow. Exchange licensing, the process by which crypto platforms obtain official permission to operate becomes tougher when banks pull their support. Together these elements create a web of constraints that affect everything from user onboarding to tax reporting. crypto banking bans are the linchpin that connects all these pieces.

The ripple effect is clear: crypto banking bans encompass the loss of fiat on‑ramps, forcing exchanges to rely on peer‑to‑peer bridges or third‑party processors. They require stronger compliance measures, pushing platforms to acquire exchange licensing to prove legitimacy. Meanwhile, crypto regulations influence how banks interpret risk, often tightening anti‑money‑laundering (AML) checks that spill over into higher fees for users. When a country imposes a mining ban, the local hash rate drops, which can tighten supply and push Bitcoin prices up—an indirect boost for traders who still have banking access. The interdependence means that a single regulatory move can shift market dynamics across multiple fronts, from liquidity crunches on decentralized exchanges to spikes in DeFi activity as users hunt for alternative yield sources. Understanding this ecosystem helps you anticipate where new opportunities or obstacles might appear.

What to Expect Next

Below you’ll find a curated set of guides, exchange reviews, and regulatory deep‑dives that break down each facet of this complex landscape. From the latest crypto banking ban announcements to practical steps for navigating licensing hurdles and mining restrictions, the collection gives you actionable insight to stay ahead of the curve.

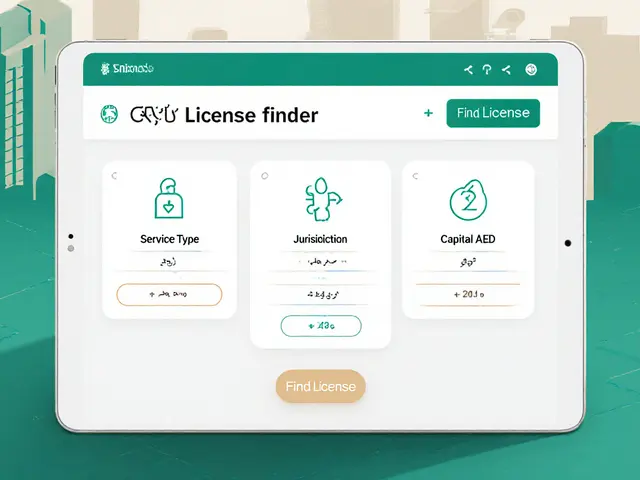

Middle Eastern Crypto Banking Bans: Full 2025 Regulatory Overview

A 2025 guide to Middle Eastern crypto banking bans, covering GCC policies, country‑specific rules, CBDC pilots, and future liberalisation prospects.

View More