Central Bank of Iran and Its Impact on Crypto Mining and Regulations

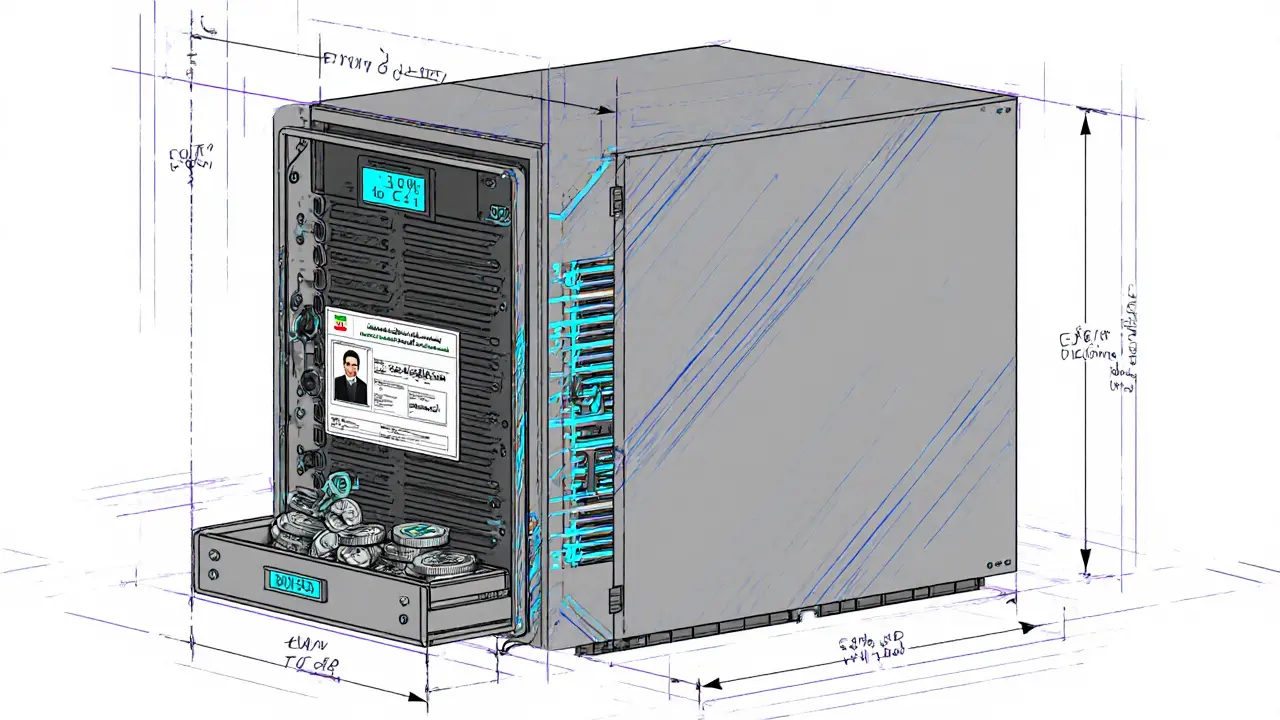

When you hear Central Bank of Iran, the government’s financial authority that controls Iran’s national currency and monetary policy. Also known as Bank Markazi, it has taken one of the most aggressive stances globally on cryptocurrency. Unlike most central banks that either ignore crypto or slowly experiment with digital currencies, the Central Bank of Iran has turned crypto mining from a gray-area activity into a state-regulated industry. In 2025, it mandated that all crypto miners sell 30% of their output directly to the bank — a move designed to bypass U.S. sanctions, control energy use, and generate hard currency reserves. This isn’t just a policy shift; it’s a full redefinition of who owns digital assets in Iran.

What makes this even more unusual is how it connects to cryptocurrency regulation Iran, the set of laws and enforcement actions by Iran’s government to control crypto trading, mining, and ownership. While countries like the U.S. or Switzerland focus on investor protection or tax reporting, Iran’s approach is about survival. By forcing miners to sell to the state, the bank effectively turns every mining rig into a digital gold mine for the treasury. Miners keep 70%, but the state gets the rest — and it’s not just Bitcoin. Ethereum, Monero, and other proof-of-work coins are all caught in this net. This policy also ties into the rise of CBDC Iran, a potential central bank digital currency that could replace or compete with crypto in daily transactions. If the Central Bank of Iran can control crypto supply, it’s likely building the infrastructure to launch its own digital rial — one that can’t be mined, can’t be exported, and can’t be used to evade sanctions.

The ripple effects are real. Miners in Iran now face a choice: comply and earn less, or risk fines and equipment seizures. Some have gone underground. Others have shifted to less traceable coins. Meanwhile, international exchanges that once accepted Iranian miners’ output are now avoiding the country entirely, fearing legal exposure. The Central Bank of Iran didn’t just create a rule — it changed the entire incentive structure of crypto mining in the region. And it’s not alone in this. Countries like Russia and Venezuela have tried similar tactics, but Iran’s execution is among the most systematic. What you’ll find in the posts below are real cases, not speculation. You’ll see how these rules play out on the ground, how miners adapt, and how scams like fake exchanges or fake airdrops thrive in the chaos. This isn’t about theory. It’s about what’s happening now — and what’s coming next.

Iranian Central Bank Mandates Crypto Sales from Miners Under New 2025 Regulations

Iran's Central Bank now requires crypto miners to sell 30% of their output to the state under new 2025 regulations. This move controls energy use, funds imports, and suppresses private crypto markets.

View More