Blockchain Transparency: Why It Matters and How to Spot It

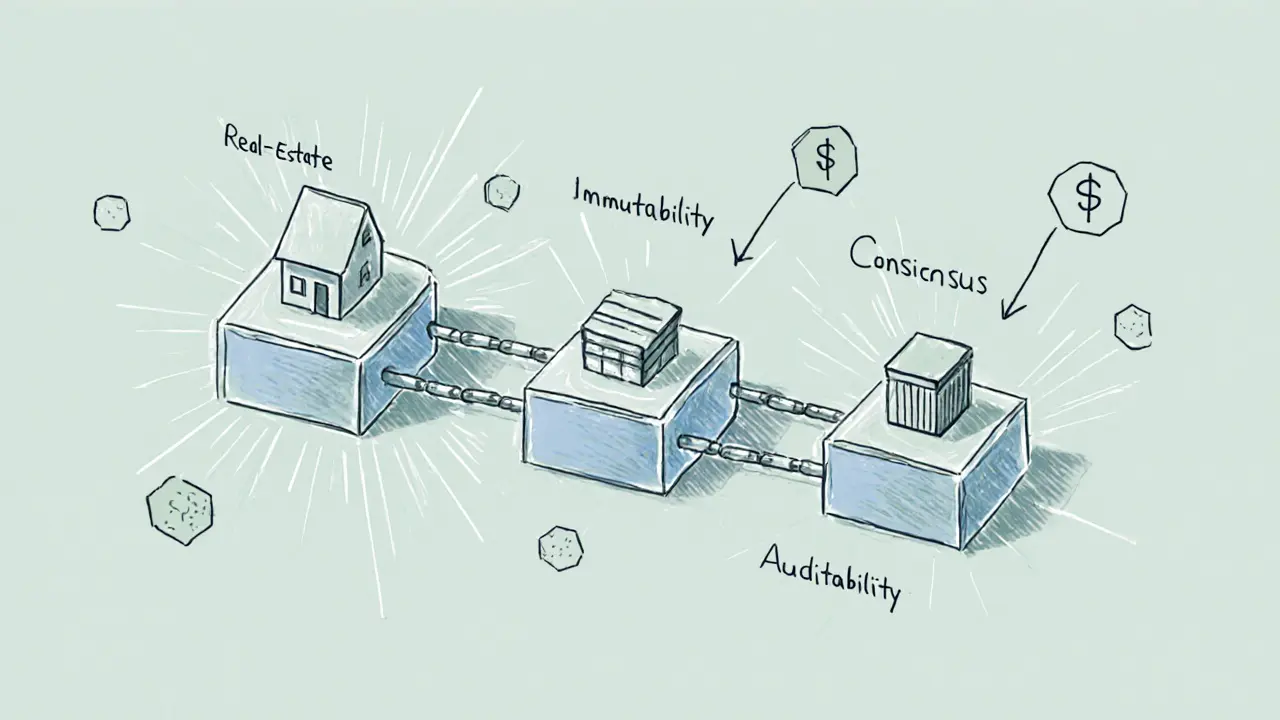

When talking about blockchain transparency, the ability for anyone to verify transactions, token supplies, and protocol rules on a public ledger. Also known as open ledger, it lets users see where money moves and how rules change without a middleman. Blockchain transparency builds trust, reduces fraud, and makes it easier for regulators and investors to evaluate projects.

Key Aspects of Blockchain Transparency

One major driver is crypto regulation, government rules that require clear reporting, anti‑money‑laundering checks, and public disclosure of token metrics. When regulators demand audit‑ready data, chains become more open, and users can directly compare compliance. Another core piece is tokenomics, the design of token supply, distribution, and inflation mechanisms. Transparent tokenomics let you verify that a coin’s total supply matches what the project claims, which is crucial for assessing long‑term value.

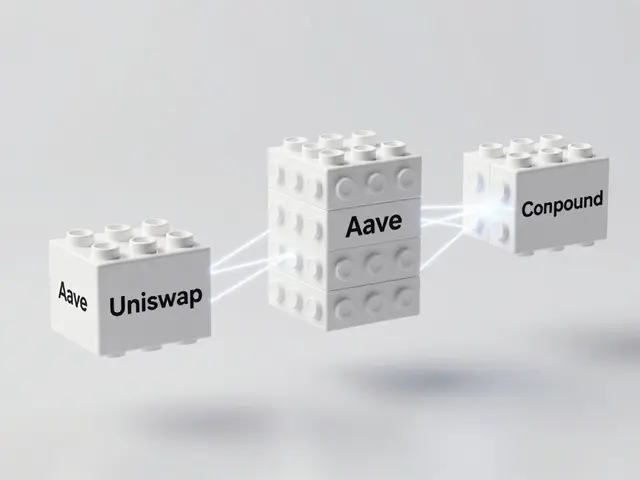

In the world of decentralized finance, financial services built on smart contracts without a central authority, transparency isn’t optional—it's the foundation of trust. Users need to see pool sizes, fee structures, and liquidation triggers before they lock up capital. Likewise, mining transparency, the public reporting of hash rate, electricity use, and miner rewards helps the community gauge the health of proof‑of‑work networks and spot potential centralization risks.

Beyond the technical layer, blockchain governance, the processes by which protocol upgrades and policy changes are decided ties everything together. Transparent voting records, on‑chain proposals, and clear stakeholder incentives let anyone follow how a network evolves. When governance is open, projects can adapt to new regulations, improve tokenomics, or introduce DeFi features without losing user confidence.

The articles below pull together real‑world examples of these concepts. You’ll find deep dives into AI‑driven coins, privacy tokens, exchange security reviews, mining bans, and the latest airdrop mechanics—all framed through the lens of transparency. Whether you’re hunting for a trustworthy DeFi yield, checking a token’s supply math, or comparing exchange fee structures, this collection gives you the facts you need to make informed decisions.

How Blockchain Transparency Stops Fraud

Explore how blockchain's transparent, immutable ledger stops fraud across real estate, supply chains, finance, and crypto, with real‑world examples and implementation tips.

View More